How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways well need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, its okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially free money so you dont want to leave any sitting on the table.

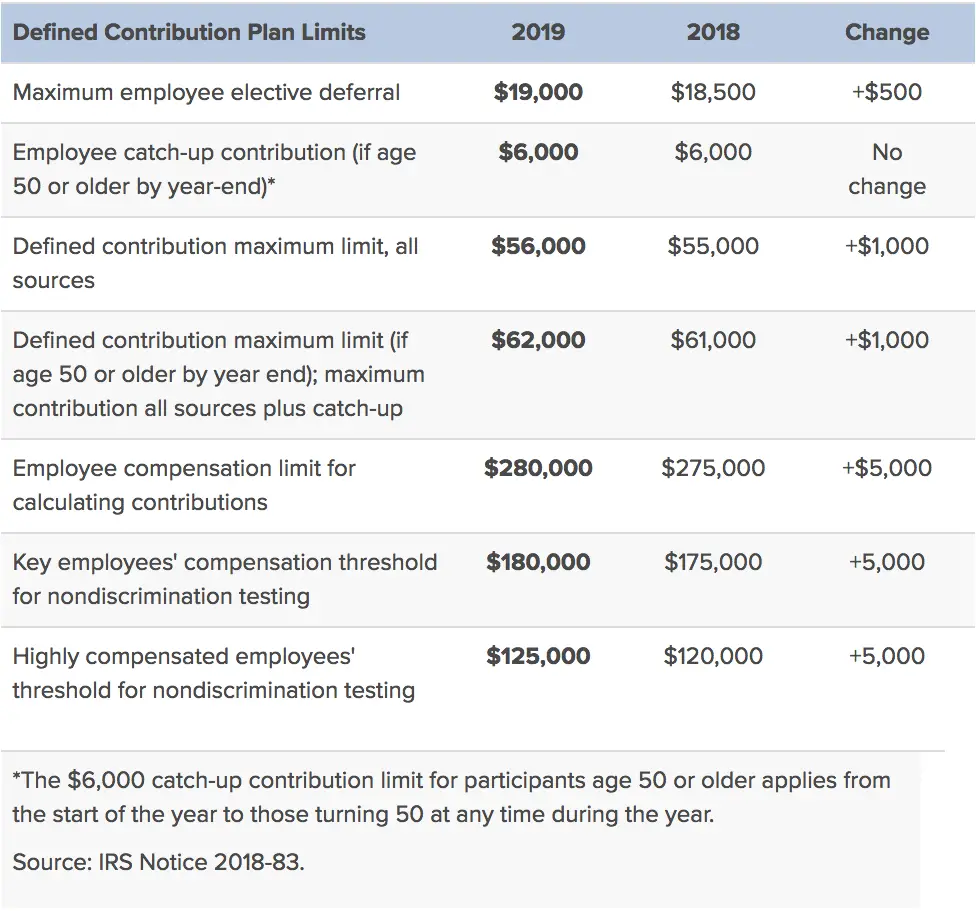

Contribution Limits For Highly Compensated Employees

Some 401 plans have extra contribution limits on employees who are highly compensated. plan and you are a high earner, these limits may not apply to you.)

Highly compensated employees can contribute no more than 2% more of their salary to their 401 than the average non-highly compensated employee contribution. That means if the average non-HCE employee is contributing 5% of their salary, an HCE can contribute a maximum of 7% of their salary. In addition to the federal limit, your company may have specific caps established to remain compliant.

The IRS determines you are a HCE if:

Either you owned 5% or more of a company last year and are participating in its 401 plan this year.

Or you earned $130,000 or more in 2020 from a company with a 401 plan youre participating in this year.

Unlike most other 401 limit guidelines, HCE classifications are based on your status from the previous year. For the 2022 plan year, the employee compensation threshold is $135,000.

If HCE contribution rates exceed non-HCE contribution rates by more than 2%, companies workplace retirement plans may lose their tax-advantaged status. As a HCE, you may be prevented from contributing to your 401 to the employee contribution max due to low 401 participation rates. You should still be able to make catch-up contributions on top of your HCE cap if you are eligible, though.

Related:Find A Financial Advisor In 3 minutes

Contribute The Maximum Amount Your Employer Matches

Robert Johnson, Ph.d., CFA, CAIA, and Professor of Finance at Creighton University

Perhaps the worst financial mistake anyone can make is turning down free money. If one doesnt contribute enough in a 401 plan that has a company match to earn that match, one is basically turning down free money. Contributing the max to your 401 also reduces your tax bill. Investors should do whatever it takes to participate in your companys 401 plan to the level to get your full employer match.

Company matching requirements vary considerably by company. For instance, some firms will match contributions dollar for dollar up to a certain maximum. On the other hand, some plans require the employee to invest a certain minimum percentage of salary before the firm will contribute any employer match.

You May Like: How Much Can You Rollover From 401k To Ira

Contributing To Your 401 Plan

As part of enrolling in a 401, you must decide how much you are going to contribute to the plan each year. There are some limits on the upper end, and your employer may require a minimum contribution if you want to join the plan.

But you may find that the critical question is what percentage of your earnings you are willing to commit to retirement savings. Many experts in the retirement field believe a ballpark amount is somewhere around 10 percent of your earnings. But it can be more or less, depending on your personal circumstances. If your company offers a match, you should contribute at least enough to get the full benefit of the match, otherwise you are leaving money on the table. And keep in mind that even if you are automatically enrolled at a certain level , this is often a minimum amount to save for a secure retirement. Consider increasing this amount, perhaps significantly, to give yourself a better shot at accumulating a robust retirement nest egg.

If I Offer A 401 To My Employees Are There Compliance Regulations I Must Follow Or Can The Retirement Plan Provider Help With These

Certain employers who offer 401 and other retirement plans must abide by the Employee Retirement Income Security Act of 1974, as amended, which helps ensure that plans are operated correctly and participants rights are protected. In addition, a 401 plan must pass non-discrimination tests to prevent the plan from disproportionately favoring highly compensated employees over others. The plan fiduciary is usually responsible for helping comply with these measures.

This information is intended to be used as a starting point in analyzing employer-sponsored 401 plans and is not a comprehensive resource of all requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. For specific details about any 401 they may be considering, employers should consult a financial advisor or tax consultant.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

You May Like: How To Open 401k For Small Business

Deferrals Limited By Compensation

Although plans may set lower deferral limits, the most you can contribute to a plan under tax law rules is the lesser of:

- the allowed amount for that plan type for the year, or

- 100% of your eligible compensation defined by plan terms and 457 plans).

If youre self-employed, generally your compensation is your net earnings from self-employment .

ExampleYou are 52 years old and participate in a 401 plan with Company #1 and a SIMPLE IRA plan with an unrelated employer Company #2. You receive $10,000 in compensation in 2020 from Company #1 and another $10,000 from Company #2. You cant defer more than $10,000 to either plan plan and $8,000 to the SIMPLE IRA plan) because your deferrals to each employers plan cant exceed 100% of your compensation from that employer.

Contribution Limits For Roth Iras

For most households, the Roth IRA contribution limits in 2021 and 2022 will be the smaller of $6,000 or your taxable income. If you’re age 50 or older, you can make an additional $1,000 catch-up contribution.

Some may see a reduced contribution limit based on their modified AGI. If you make within $10,000 or $15,000 of the maximum modified AGI, you’ll have to do a little math.

- Take the maximum limit for your filing status and subtract your modified AGI.

- If you’re married filing jointly or separately and you lived with your spouse, take that number and divide by $10,000.

- Otherwise divide by $15,000.

- Multiply the resulting percentage by $6,000 . That’s your contribution limit for a Roth IRA.

For example, if you’re a married couple and you have a combined AGI of $200,000 in 2021, you’d:

- Subtract that amount from $206,000, the maximum AGI allowed to make any contribution. The result is $8,000.

- That number divided by $10,000 is 80%.

- 80% multiplied by $6,000 is $4,800. That’s the maximum amount you and your partner can each contribute to your Roth IRAs.

Importantly, the $6,000 contribution limit applies to all IRAs. The income limits for the Roth IRA apply only to Roth IRA contributions, so you could still contribute to a traditional IRA up to the $6,000 limit. Those contributions won’t be tax deductible, though, if your Roth contributions are limited by your income and you have a 401 at work.

Don’t Miss: How To Borrow From 401k

Maximum 401 Company Match Limits

The employee and employer match limits for 401s fluctuate each year to account for inflation. Since inflation is projected to rise, the 401 max contribution is increasing as well.

According to the IRS, the employee contribution amount 401 limits per year include:

Therefore, in 2022, an employee can contribute up to $20,500 toward their 401. The employer can match the employee contribution, as long as it doesnt exceed the separate $61,000 employer-employee matching limit.

Since matching $20,500 in full would only total $41,000, most employees dont have to worry about this dilemma. This problem typically arises for individuals who are contributing to more than one employer-matched 401 plan or have switched or are switching to a new employer within the year. Employers should continue to communicate limits with employees each year to avoid misunderstandings.

If you have employees who are aged 50 or older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2021 and 2022.

The key employees compensation threshold increased from 2021 to 2022, from $185,000 to $200,000. Known as the nondiscrimination testingthreshold, these limits apply to specific individuals within a company to ensure they remain within specific 401 contribution limits.

Key employees are defined as any employee who:

Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.

Recommended Reading: Can You Borrow From Your 401k To Buy A House

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021-2022 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $26,000 including catch-ups.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, PA. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

How Much Should I Save For Retirement

We get that question a lot.

A good rule of thumb is to try to save 1015% of your income toward retirement, says Stanley Poorman, a financial professional with Principal®, but that also depends on when you get started. That may be fine if youre 25 if youre starting at 50, you may need to save more to retire comfortably. Theres no one-size-fits-all answer.

Another factor is whether you have a matching contribution from your employer, and if so, what percentage the company contributes. Poorman suggests deferring enough of your pay to get that match.

Get a snapshot of how much you may need to save with our Retirement Wellness Planner.

Also Check: What Is The Best Fund To Invest In 401k

Also Check: How To Open 401k For Individuals

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

Should I Buy Stocks In Roth Ira

Given the tax characteristics of the two types of IRAs, it is generally better to hold investments with the greatest growth potential, typically stocks, in Roth, while assets with more moderate returns, usually bonds, in traditional IRAs.

How many shares should I have in my Roth IRA? As a general rule, however, most investors hold 15 to 20 stocks at the very least in their portfolios.

Also Check: Can A 401k Be A Roth

Where To Invest If You Dont Have A 401

Dont worry if your employer doesnt offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $20,500 in 2022 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

Also Check: How To Get Old 401k Money

Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.