Who Can Have A Solo 401 Plan

According to Allec, there are three categories of people who can have solo 401 plans:

Solo 401k Contribution Deadline 2021

You need to establish your plan and formally elect your contributions before December 31. Do this by filling out the contribution form in the Solo 401k dashboard. You do not have to actually make the contribution until you file your taxes. This depends on what your business structure is. For S Corp, C Corp and Partnership this is March 15, or September 15 if you file an extension. For Sole Proprietorship and Single Member LLC this is April 15 or October 15 if you file an extension. There are many important dates to remember for the Solo 401k. Rather than memorize them, here is a handy article which goes over some of the most important Solo 401k dates to remember.

You May Like: How Much To Invest In 401k To Be A Millionaire

Exchange Promissory Note Investment Question:

Such investment would result in a prohibited transaction. You cannot assign an investment that you personally own to your own solo 401k plan.

Sale, exchange, or leasing of property between a plan and a disqualified person.

- Your Spouse

- Your natural children and/or your adopted children

- The spouses of your natural children

- Any fiduciary of your Solo 401k

- Any people providing services to your Solo 401ksuch as your stockbrokeras well as his employees and both his and his employees blood relatives

- Your Solo 401k trust document provider or administrator

Also Check: How To Make More Money With My 401k

You May Like: What To Do With 401k When You Quit

How A Keogh Works

Keogh plans usually can take the form of a defined-contribution plan, in which a fixed sum or percentage is contributed every pay period. In 2021, these plans cap total contributions in a year at $58,000. Another option, though, allows them to be structured as defined-benefit plans. In 2021, the maximum annual benefit was set at $230,000 or 100% of the employees compensation, whichever is lower it rises to $245,000 in 2022.

A business must be unincorporated and set up as a sole proprietorship, limited liability company , or partnership to use a Keogh plan. Although all contributions are made on a pretax basis, there may be a vesting requirement. These plans benefit high earners, especially the defined-benefit version, which allows greater contributions than any other plan.

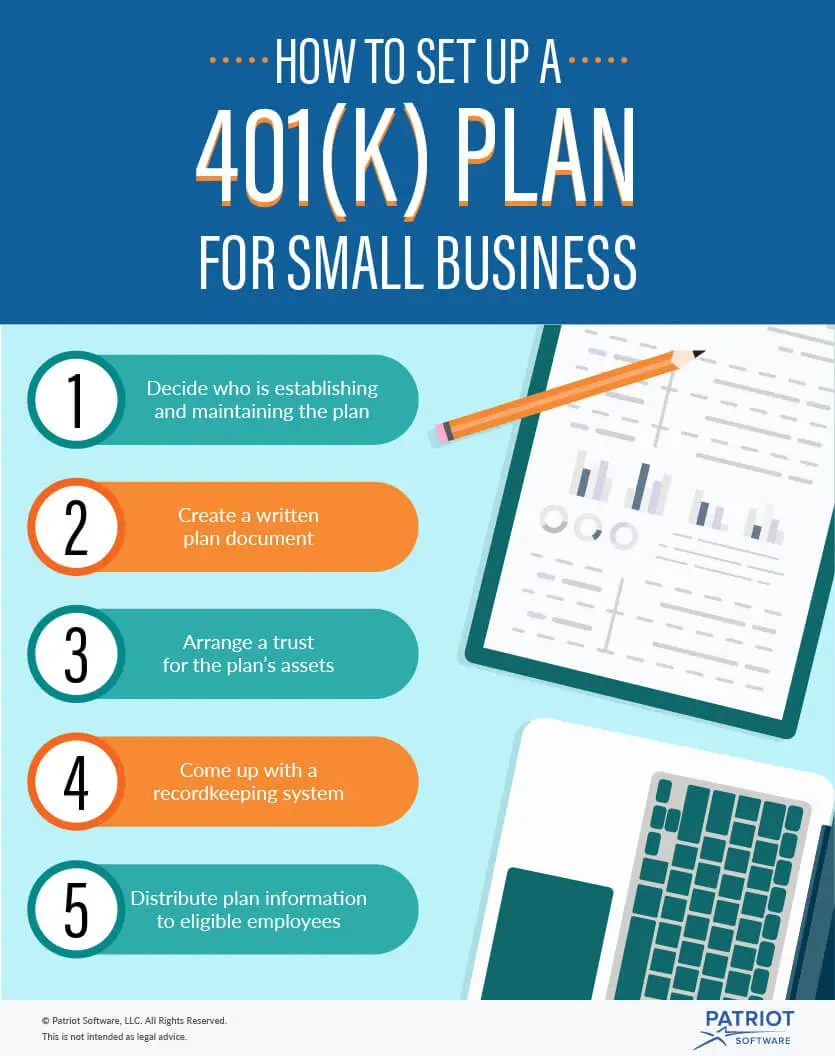

Research Options For Your Business

First, research 401k plan options for your small business employees. Look into different firms that provide book keeping and third-party services for 401k plans. As you list your favorite options, take note of their established mutual funds, insurance companies and brokerage firms. With this information, you can focus on 401k providers that offer the best long-term savings resources and outstanding customer service. In addition, talk to other small businesses about their retirement plans. This way, you can gather insights about their experiences selecting the best 401k packages that will improve your small business. Surely, you should research 401k plan options for your small business employees.

You May Like: Can I Withdraw From My Fidelity 401k

Use Assessed Value Of Property For In

No. The taxes owed on the in-kind distribution of the land will be based on the fair market value of the land. As such, it would not necessarily be appropriate to use the assessed value . The most conservative approach would be to obtain a third party valuation such as an appraisal or at least an assessment from a professional such as an experienced realtor based on comps, etc. Ultimately, the governments concern is the underpayment of taxes especially from the distribution of property owned inside a solo 401k plan or a self-directed IRA.

You Can Fund A Traditional Ira

A traditional IRA, or individual retirement account, allows you to contribute pre-tax dollars . You pay taxes when you withdraw the money once you retire, meaning that its tax-deferred.

If you earn taxable income and are under age 70 ½, you can contribute. Easy-peasy. Plus, since you have no 401k or retirement plan at work, you can put money in and deduct the entire amount from your taxes.

Also Check: What Is The Difference Between Roth 401k And Roth Ira

You May Like: Is Roth Ira Better Than 401k

Withdrawing Funds From A Self

As with traditional 401 plans, the self-employed 401 is intended to help you save money for retirement, and there are regulations in place to encourage you to do so. For example:

- Withdrawals prior to age 59½ may be subject to a 10% early withdrawal penalty, along with any applicable income taxes1

- You must take required minimum distributions from self-employed 401s beginning at age 722

- Plans can be structured to allow loans or hardship distributions3

- Plans can be structured to accept rollovers from other retirement accounts, including SEP IRAs and traditional 401s, into your self-employed 401

- You can roll your self-employed 401 assets into another 401 or an IRA

Because of its high contribution levels, flexible investment options, and relatively easy administration, the self-employed 401 is an attractive option for small-business owners or sole proprietors who want to be able to save aggressively for the future.

If there is the potential that your business might add employees at a later date, however, know that you will either have to convert your self-employed 401 plan to a traditional 401, or else terminate it. But if you’re confident that you will remain a one-person operation, and you want the high savings options that these plans offer, this type of account may be a good fit.

Use The Funds To Operate Your Business

Once the QES transaction is complete, your retirement funds can be used by the corporation to begin operating and paying for business expenses! The retirement plan now owns the corporation, and the corporation is cash-rich from selling QES stock.

While the ROBS structure can be complex, the end result is your ability to buy or start a business without going into debt or collateralizing your home. For a more in-depth explanation of the ROBS structure, check out our Complete Guide to 401 Business Financing.

Dont Miss: How To Check How Much Is In Your 401k

Read Also: Can I Rollover My 401k To A Money Market Account

Open Your Solo 401k With Nabers Group

Our Solo 401k platform is a dream come true for the modern Self-Directed Investor. Our platform is the only one in the world of its kind that combines the strengths of both 401k and IRA accounts and solves the weaknesses. Your Investments can be self-directed and there is no need to hire, pay, and wait for a custodian to hold your assets. You get Checkbook Access built-in, without the need to register any LLCs. Your Solo 401k is exempt from taxation on debt leveraged real estate investments. You will never have a third party deny you from investing in a legally compliant investment . There are no transaction fees or asset fees, ever.

Your Solo 401k can include additional Unlimited® sub-accounts for your spouse as wellTax deferred and Roth. You can borrow up to $50,000 from your Solo 401k funds tax-free for any reason. Your spouse, if named as a participant, can also have unlimited rollovers received that can be self-directed into alternative investments. Every Solo 401k includes a Roth 401 subaccount for you and one for your spouse, even if you make too much money to be allowed to contribute to a Roth IRA.

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Recommended Reading: How To Open A 401k Plan

How Do They Work

When you set up a Solo 401K, you are both the employee and the employer. In other words, you make both contributions, but one comes from your earnings and the other from your profit-sharing.

Employees can contribute as much as $19,500 per year toward your retirement account. If you make less than $19,500, you may contribute 100% of your earnings and again, if youre over 50-years old, you may contribute the extra $6,500.

You also contribute as the employer. This money comes from your companys profit sharing. Youll need the following equation to determine how much you may contribute as the employer:

- 25% x you earned income ½ of your self-employment tax

- The maximum contribution is $57,000 as an employer.

Also Check: Can I Move My 401k From One Company To Another

What Are The Factors That Differentiate The Solo 401 From An Employer 401

Three main factors distinguish a self-employed 401 plan from an employer 401 including:

-

You are the employer and employee on the plan as the business owner.

-

Solo 401 plans allow you to make far higher contributions to your retirement plan than if you are an employee in an employer 401.

-

Any self-employed person can open a solo 401 plan regardless of the product or service you provide.

You can also run a self-employed 401 account as a self-directed plan. It allows you to invest your contributions on specific assets with an investment broker trustee.

A solo 401 plan is ideal if you want to set up a retirement plan as a self-employed person. It has the highest contribution restrictions, which allows you to grow your retirement savings faster and you can also enjoy solo 401 tax benefits. It is also easy to set up and administer.

Self-employed 401 plans give you complete control of your investment choices if you open them in a self-directed brokerage account. If your business hires employees at a later date, you only need to convert the solo 401 account into a standard employer 401 plan.

Recommended Reading: Can You Roll Over 401k From One Company To Another

Appoint A Plan Administrator

Many providers also require investors to appoint plan administrators for their private 401k plans. A plan administrator is responsible for the functionality of the plan. If you choose to appoint yourself as the plan administrator, it is your duty to ensure that you operate your account according to your written plan. With a good provider, this task is not difficult. However, it is essential to start your own solo 401k plan.

Financial Advisors And Consultants

These are individuals or firms that provide advice to employers and even employees or participants of retirement plans. For an additional fee, these financial advisors can help you decide what type of plan is best for you, how to set it up, and which individual investments you can choose within your plan.

Are you considering the Earnest Student Loan? See this Earnest Student Loan Refinancing Review: Is Earnest Student Loan Legit or Scam

Read Also: How To Locate Lost 401k

How A Health Savings Account Works

HSAs are funded with pretax dollars, and the money within them grows tax-deferred as with an IRA or a 401. While the funds are meant to be withdrawn for out-of-pocket medical costs, they dont have to be, so you can let them accumulate year after year. Once you reach age 65, you can withdraw them for any reason. If its a medical one , its still tax-free. If its a non-medical expense, you are taxed at your current rate.

To open an HSA, you have to be covered by a high-deductible health insurance plan . For 2021 and 2022, the Internal Revenue Service defines a high deductible as $1,400 per individual and $2,800 per family.

Also, the annual out-of-pocket expenses, including deductibles, co-payments, but not premiums, must not exceed $7,000 for self-only coverage or $14,000 for family coverage for 2021, but for 2022, not exceed $7,050 for self-only coverage or $14,100 for family coverage.

The annual contribution limit for 2021 is $3,600 for individuals and $7,200 for families the 2022 contribution limit is $3,650 for individuals and $7,300 for families. People age 55 and older are allowed a $1,000 catch-up contribution.

Maximize Your Employers 401 Match

Some employers will match their employees contributions at either 50 or 100 percent up to a certain amount, sometimes 3 to 5 percent of an employees salary. Thats free money that you should take advantage of, if you can.

Some plans will also require a vesting period before employees are entitled to fully own company matches, often for a year or longer. Vesting schedules vary by company, but they mean that if you leave your job before a certain time period, you will not be able to keep the money your employer contributed on your behalf. Your own contributions, though, are always fully vested and available to you.

After fully meeting your companys vesting schedule, you will have 100 percent ownership of any matching contributions.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Read Also: Can I Rollover A 401k To A 403b

Can You Contribute A Lump Sum To A Self

According to Bergman, a self-employed individual can usually make an employee deferral lump-sum contribution to a plan so long as he or she has sufficient earned income. However, in the case of a W-2 owner/employee, the employee deferral contribution should not be more than the income earned for that income period. In the case of employer profit-sharing contributions, those can be made by the employer in a lump sum.

Alternatives To A Solo 401

There are basically two options in addition to the solo 401 for freelancers and independent contractors who want to save for retirement and get the tax advantages that go with these IRS-approved choices:

- The , for Simplified Employee Pension, is designed to be an easy, flexible option for small businesses with employees. It works much like a traditional IRA but has higher contribution limits. The limits are the same as for the Solo 401: $58,000 for 2021 and $61,000 for 2022. However, your contribution cannot exceed 25% of your net adjusted income. You may not find that adequate for your goals. No catch-up contribution is allowed for those age 50 and older. No Roth option is available. A SEP IRA can be opened through any brokerage or bank.

- The Keogh Plan is open to sole proprietors, partnerships, and limited liability companies and is often used as a profit-sharing vehicle for professional practices such as doctors’ and lawyers’ groups. It has the same contribution limits as the SEP IRA and the Simple 401 but poses a greater administrative burden. There is no Roth option.

Another option, the SIMPLE IRA, is designed for businesses with 100 or fewer employees. It is open to sole proprietors but has a lower contribution limit than the Solo 401 or the SEP IRA. The maximum contribution is up to 3% of salary plus $14,000 in 2022. There is no Roth option.

Don’t Miss: How To Find Out Whats In Your 401k

Save In Taxable Accounts:

One option available for you as a student who cant start a 401k account is to save in Annual Individual Retirement Account . But annual IRA limits restrict you from making a substantial contributions toward a comfortable retirement. So, if youve reached the IRA limit and you want to save more, you can always save in a normal taxable accounts.

Although these non-retirement accounts wont provide you enough tax benefits, they are better than not saving at all. And the plus is that at some point, you may be able to shift funds from these accounts into retirement accounts. That is to say that if you are done with college and start working and your employer decides to sets up a 401k plan, you can move these savings to your account. It is the same if you decide to start your own business.

From the above, it is clear that as a college student with a side job, you can actually set up a Solo 401k account, especially if you are 21 years of age or above. Now, lets explore the eligibility requirements for setting up a Solo 401k account as a student.

Everyday 401 By Jp Morgan

Everyday 401 by J.P. Morgan is not an offering of JPMorgan Chase Bank, NA clients will be directed to J.P. Morgan Asset Management, an affiliate.

INVESTMENT AND INSURANCE PRODUCTS ARE:· NOT FDIC INSURED · NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY · NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES· SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

This is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan Asset Management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. JPMorgan Chase & Co. and its affiliates do not provide tax, legal or accounting advice. This material is not intended to provide, and should not be relied on, for tax, legal or accounting advice. The client should consult its own tax, legal and accounting advisors for advice before engaging in any transaction.

Don’t Miss: What Is The Maximum I Can Contribute To My 401k