Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

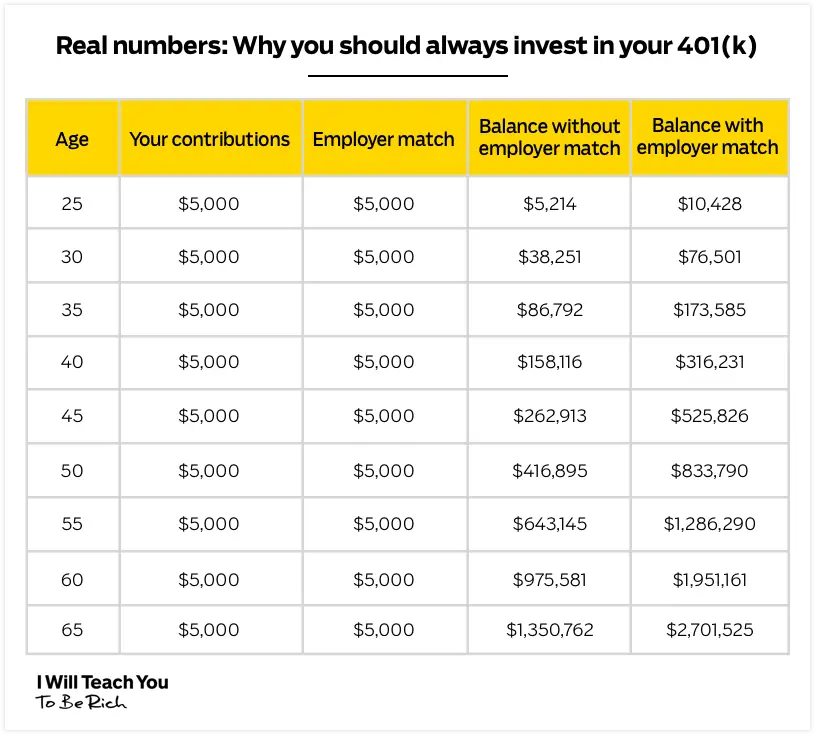

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

How Much Should You Save For Retirement

How much do you need to have saved up before you retire? The answer to that question used to be pretty straightforward. With $1 million in savings, at a 5% interest rate, you could be reasonably assured of having $50,000 in annual income by investing in long-term bonds and simply living off the income. If you saved $2 million, you could expect to have a six-figure yearly income without having to dip into principal.

Unfortunately, interest rates have been on a steady decline for roughly three decades now. Back in 1980, nominal Treasury bill rates were approximately 15%, but as of June 2021, a 30-year Treasury is yielding 1.91%. Lower bond yields have made the investing equation in retirement more difficult. It was only exacerbated by the , which complicated how individuals save enough to live off in retirement.

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Recommended Reading: Should I Invest My 401k

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Your 401 Savings And Your Desired Retirement Lifestyle

How you want to live out your golden years is another huge factor in what your 401 savings will need to look like. Thats because retirement has evolved over time to become a more active time of life. Its now viewed as a new beginning in our lives rather than a beginning of our end. That shift in mindset has driven the need for additional sources of retirement income.

The Employee Benefit Research Institute study on the Expenditure Patterns of Older Americans shows that as we age our expenses decline. Using age 65 as a benchmark, the study found that household expenses drop by 19% by age of 75 and 34% by age 85. The study also found that people over the age of 50 spend 40-45% of their budget on their home and home-related items. The bottom line is that by the time we retire our expenses are down between 20% and 40%. This is why expert opinions differ on how much of our pre-retirement income we need. Guidelines generally vary from 60% to 80%.

If you have a household income of $100,000 when you retire and you use the 80% income benchmark as your goal, you will need $80,000 a year to maintain your lifestyle. Assuming your 401 savings grow at 8%, you should expect to have up to $80,000 a year in interest income so you can avoid having to touch your principal as much as possible.

Don’t Miss: Do Employers Match Roth 401k

How Much Will Your 401 Be Worth

We all have ideas for how wed like to spend our retirement. Whether you hope to travel the world, buy an RV, or just spend more time with your family, the choices you make today will dictate the options available to you when you retire.

Fortunately, you dont have to fly blind. Use Ubiquitys 401 calculator to get a clear picture of how your savings will stack up when you retire and how much you should be saving now to realize your goals.

Improve Your 401 Balance

Improving your 401 balance depends on how well you can handle your finances and how much you can contribute to it. Doing your research for the best interest options for your 401 plan can be a good way to start building compound interest, which will result in a higher balance.

If you think youre at a good place with your finances and making sure your living expenses and debts are being paid off, it might be worth considering maxing out your 401 contributions. According to Vanguard, only 12 percent of 401participants maxed out their contribution limit of $19,500 in 2020, and you could be one of them.

Whether you start small or contribute close to the limit, consistently contributing to your 401 and making sure your plan meets your goals will help you improve your average 401 balance and save more for retirement.

Read Also: Can I Transfer My Roth Ira To My 401k

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Dont Beat Yourself Up If You Cant Save That Much Money In Your 401 By 30

There are a couple of good reasons some twentysomethings dont start putting away for retirement immediately:

- Youre in grad school

- Youre battling big debts

If youre a student, its unlikely youll have extra money to tuck away for retirement. And thats okay, because your education will hopefully increase your lifelong earning potential.

If youve got high-interest credit card debt, your top priority should be to pay that down. Debt interest rates could crush even the best retirement account returns, so its best to use extra funds to dispatch credit card balances quickly.

The one exception? If your employer matches 401 contributions. In this case, contribute the maximum percentage your employer will match, then increase retirement savings after your debt is gone.

Don’t Miss: How To Invest Without A 401k

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

How Much Should I Contribute To My 401 With Employer Matching

Of course, how much you can contribute to a 401 and how much you should contribute can be two different calculations. First, youll want to find out what your employer match is to be sure youre maximizing your savings. Then you may need to crunch a few more numbers to determine how much you should put into your retirement account without overburdening yourself now.

You May Like: Is It Good To Have A 401k

Vs 2021 401 Contribution Limits

Like most tax-advantaged retirement plans e.g. 403bs, 457 plans, different types of IRAs 401k plans come with caps on how much you can contribute. The IRS puts restrictions on the amount that you, the employee, can save in your 401k plus there is a cap on total employee-plus-employer contributions.

For 2021 the contribution limit is $19,500, with an additional $6,500 catch-up provision for those 50 and older, for a total of $26,000. The combined employer-plus-employee contribution limit for 2021 is $58,000 .

For 2022, you can save up to $20,500 in your 401k a $1,000 increase. The catch-up amount is unchanged at $6,500, for a total of $27,000 if youre 50 and up. The employer-employee max is $61,000 for 2022 its $67,500 with the catch-up amount.

401 Contribution Limits 2021 vs 2022

| 2021 |

|---|

| $67,500 |

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

Don’t Miss: How To Transfer Rollover Ira To 401k

How Much Should I Have In My 401k At Age 40

Are you wondering how much should I have in my 401k at age 40? Good for you to wonder because age 40 is a big financial milestone.

For the above-average 40 year old, s/he should have somewhere between $200,000 $750,000 in their 401k. The amount range depends on when you started investing, how much youve been contributing each year, and your returns.

If you are only 25 years old reading this, you should have closer to $750,000 in your 401k in 15 years. If youre 40 years old reading this post, then you may likely have closers to only $200,000. When you were contributing, the 401k limits were lower. For 2022, an employee can now contribute $20,500 to their 401k.

If you are a Financial Samurai, then you should have closer to $500,000+ in your 401k by age 40. Since 2009, Financial Samurai has ben producing the best content on how to help readers achieve financial freedom sooner, rather than later.

Make Savings A Priority

Keep your eye on your dreams. Do the best you can to get to at least 15%. Of course, it may not be possible to hit that target every year. You may have more pressing financial demandschildren, parents, a leaky roof, a lost job, or other needs. But try not to forget about your futuremake your retirement a priority too.

Also Check: How Do You Max Out Your 401k

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

Is Your Plan Working For You

If your work retirement plan is burdened by high fees and lackluster investment lineup, it may not be worth hitting the maximum contribution. Read over a copy of your summary plan description and annual report before considering your next move. Other tax-advantaged retirement options like Traditional or Roth IRAs may let you contribute up to $6,000 or $7,000 a year with more control over your investment options.

If youre an employer looking out for your workers, you can always contact Ubiquity to discuss starting a new plan or switching plan providers to take advantage of our administrative services without paying AUM fees, per-participant fees, or other unnecessary costs.

Recommended Reading: Can You Transfer 401k To Ira While Still Employed

Contribution Limits For 401 403 And Most 457 Plans

| 2020 | |

| $63,500 | $64,500 |

1. If you have contributed to more than one qualified retirement plan during the calendar year, it is your responsibility to ensure that you have not exceeded these limits.

2. Company contributions include any employer matching, profit-sharing, and non-elective contributions.

3. Amount typically not to exceed the lesser 100% of your compensation or this number. Your employers retirement plan might limit the compensation to something less than 100% please refer to your plans Summary Plan Description or plan document for other applicable limits.

The annual compensation limit is $290,000. You can make contributions up to the IRS contribution limits noted above up to $290,000.

Investing Matters Because Inflation Matters

Lets say you live for 25 years after retiring at 60. You only get to live on $40,000 $100,000 a year on the low-to-mid end. Sounds feasible in todays dollars, but not so much in future dollars due to inflation.

If goodness forbid you live for 35 years after retiring at 60, then you can only live off of $28,571 $71,000. If we use a 2% inflation rate to calculate what $1,000,000 $5,000,000 is worth today, its only worth about $5500,000 $2,355,000.

We know that due to inflation, a dollar today will not go as far as a dollar 30+ years from now. Private university tuition will probably cost over $100,000 a year in 20 years. That is ridiculous since education is now free thanks to the internet.

Then there is the incredible growth of healthcare costs that is the most worrisome for retirees. For example, Ive been paying $23,000+ a year in healthcare premiums for a platinum plan for my family of three. This is despite us all in good health.

Does that sound affordable for the average American household who makes $68,000 a year? Absolutely not, which is why employees should not underestimate the value of their overall work benefits.

In fact, inflation is the reason why it takes $3 million to be a real millionaire today. Make sure you own assets like stocks, real estate, and more to let inflation work for you!

You May Like: How Much Tax On 401k Withdrawal

Choosing Health Insurance Bills Or Your 401

If you cant afford to pay your monthly bills, you cant afford to make 401 contributions. If there are unexpected expenses or loss of income, you may even need to withdraw retirement money early. If possible, focus on putting in the minimum to get your employers match, then use the additional money to pay off any high-interest debt, like credit cards.

One option, if youre struggling to afford your 401 contributions, is to choose a cheaper health insurance plan. People who overpay for health insurance are 23% more likely to forgo their employers retirement match, a TIAA Institute study found.

A health savings account can help you reduce health costs and save for retirement at the same time. You can only fund one if you have a high-deductible health plan, which often leads to higher out-of-pocket costs. You fund an HSA with pre-tax money. When you spend it on Internal Revenue Service -approved qualified medical expenses, your distributions for those are also tax-free and penalty-free.

An HSA is a good supplement to your 401 contributions because if you have unused money in the account when you turn 65, you can withdraw it without penalty for any purpose, though youll owe income taxes for distributions made for non-qualified medical expenses.