Rolling Over Your 401 Into An Ira Account Comes With Many Benefits

When you change jobs, you generally have four options for your 401 plan. One of the best options is doing a 401 rollover to an individual retirement account . The other options include cashing it outand pay taxes and a withdrawal penalty, leave it where it isif your ex-employer allows this, or transfer it into your new employer’s 401 planif one exists. For most people, rolling over a 401 for those in the public or nonprofit sector) is the best choice. This article explains why and how to go about it.

How To Roll Over An Ira To A 401

Rolling over your 401 to an individual retirement account is common practice when starting a new job. But what about doing the opposite: moving IRA assets into a 401 plan? While not nearly as common, these reverse rollovers do exist and may be an option if youre an investor looking to merge multiple retirement accounts. When considering a rollover of any variety, it may help to work with a financial advisor who can guide you on your path to retirement.

K Rollover To An Ira Why You Should Think Twice About It

Written byAdamonOctober 29, 20182018-10-29.UpdatedFebruary 11, 2021.

When I was 26 I left my first job. It had a 401k that I had been contributing to since I started. Being the responsible investor I was at the time, I immediately decided to rollover that 401k into an IRA at my bank Bank of America at the time. The total amount of the account wasnt anything huge maybe $20,000 or so. This seemingly innocent action ended up costing me thousands of dollars in taxes over the next decade. Let me explain how.

Also Check: Where To Open A 401k Account

What Are The Rules For Putting Money In A Roth Individual Retirement Account

Most people who earn income will qualify for the maximum contribution of $6,000 in 2022, or $7,000 for those ages 50 and older. If your income falls within the Roth individual retirement account phaseout range, you can make a partial contribution. You cant contribute at all if your modified adjusted gross income exceeds the limits.

You May Like: How Do You Move Your 401k When You Change Jobs

Tips For Retirement Investing

- Consider finding a financial advisor to steer you in the right direction in terms of savings and investments. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre starting to plan for retirement, you should consider the tax laws of the state you live in. Some have retirement tax laws that are very friendly for retirees, but others dont. Knowing what the laws apply to your state, or to a state you hope to move to, is key to getting ahead on retirement planning.

Don’t Miss: Should I Move My 401k To Bonds 2020

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Choosing An Ira Provider For Your 401k Transfer

Once you have determined that you want to transfer your 401k, you will need to find a provider that offers IRAs. The type of provider you choose will determine the type of investments that you have available to you. There are three basic types of providers.

Traditional Investment FirmsA traditional investment firm will allow you to open an IRA. You have the option of choosing between different types of stocks, mutual funds, and CDs, depending on the amount of risk that you are willing to take.

Pros:

- Easy to make the investment

- Wide variety of investment options

- Good option for someone who does not understand or study the markets closely

Cons:

- Little control over your investments

- Annual fees may be high

Banks and Credit UnionsBanks and credit unions will allow you to invest in Certificates of Deposit , when you open an IRA with them. The investments are guaranteed up to $250,000. This offers more security, but it does limit the type of investments you are allowed.

Pros:

- Good option if you are nearing retirement age

Cons:

- Ability to really diversify your investments

- More control over your account

Cons:

Read Also: What Age Can You Take Out 401k

You May Like: How To Pull Money From 401k Without Penalty

Con: Delayed Access To Funds

401 accounts impose a 10% penalty for withdrawals made before you turn 59 ½. However, there is an exemption to this rule: if you retire at 55 years, you can take a penalty-free withdrawal from your 401 account. This exemption does not apply to IRA accounts, and you will have to wait until you are 59 ½ to make withdrawals without paying a penalty.

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but here are just a few examples of when I suggest that clients might want to leave funds with their employer.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Some Government Workers

If you worked for a federal, state, or local government, be sure to explore your options. Those with 457 plans can potentially avoid the early-withdrawal penalty thats commonly associated with 401 and similar plans. Plus, some public safety workers can avoid early withdrawal penalties from a retirement planincluding the TSPas early as age 50.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

NUA Opportunities

Also Check: Should I Have An Ira And A 401k

Why Move 401k To Ira

Investors should be wary of transaction expenses when purchasing specific investments, as well as expense ratios, 12b-1 fees, and loads on mutual funds. All of these items can easily account for more than 1% of total assets each year, says Mark Hebner, founder and president of Irvine-based Index Fund Advisors.

To be sure, the inverse can also be true. Institutional-class funds, which have lower fees than retail funds, are available to larger 401 plans with millions to invest. Of course, there will be expenses associated with your IRA. However, you will have more options and control over how you invest, where you invest, and how much you pay.

Read Also: How To Grow Your 401k Faster

Heres Exactly How To Roll Over A 401 To An Ira

Last updated Aug. 25, 2022| By Matt Miczulski

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

If youve recently left your job where you had a 401, you may be wondering what to do with that account. You may be questioning if you should take a different approach to managing your 401 during a recession, or if rolling it over should be on your list of things to do after being laid off. This article will discuss how to roll over your 401 to an IRA and some reasons it might be a good financial move for you.

Generally, 401 participants have multiple options when it comes to what they can do with their account: leave the money where it is roll it over into a new employers 401 plan roll it over to an individual retirement account or cash it out. Rolling over your 401 to an IRA helps you save for retirement and has a number of benefits, but there are also a few reasons it might not be the right move for some people.

Recommended Reading: How Do I Track My 401k

Can I Transfer My 403b To Another Broker

You can transfer or roll over your 401 funds to a self-directed IRA if you separate from your employer due to retirement, termination, or simply quitting your job. You can transfer the funds just like you would to another 401 or a traditional IRA. The difference is, you use a specialized IRA, which allows you to invest in instruments other than stocks, bonds and mutual funds.

Rollovers Of Retirement Plan And Ira Distributions

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA. The Rollover Chart PDF summarizes allowable rollover transactions.

Read Also: Can You Do A 401k On Your Own

Roth Ira Income Limits

Anyone can contribute to a traditional IRA, but the IRS imposes an income cap on eligibility for a Roth IRA. Fundamentally, the IRS does not want high earners benefiting from these tax-advantaged accounts. In 2021 and 2022, the annual contribution limit for IRAs is $6,000 or $7,000 if you are age 50 or older.

The income caps are adjusted annually to keep up with inflation. In 2021, the phaseout range for a full annual contribution for single filers is a modified adjusted gross income ranging from $125,000 to $140,000 for a Roth IRA. For , the phaseout begins at $198,000, with an overall limit of $208,000.

In 2022, the income phase-out range for taxpayers making contributions to a Roth IRA increases to $129,000 to $144,000 for singles and heads of households. For married couples filing jointly, the income phase-out range is increased to $204,000 to $214,000.

And this is why, if you have a high income, you have another reason to roll over your 401 to a Roth IRA. Roth income limitations do not apply to this type of conversion. Anyone, regardless of income, is allowed to fund a Roth IRA via a rolloverin fact, it is one of the only ways. The other way is converting a traditional IRA to a Roth IRA, also known as a backdoor conversion.

Each year, investors may choose to divide their funds across traditional and Roth IRAs, as long as their income is below the Roth limits. But the maximum allowable contribution limits remain the same.

Pro #: You May Gain Flexibility

Your new employers plan may have different investment options, loan options, protections against potential creditors, or other benefits that better suit your needs than your former employers plan. If you continue working until and beyond 72 years of age, you may be excused from required minimum distributions if your new employers plan allows it.

Dont Miss: Should I Invest In 401k Or Roth Ira

Read Also: Can I Open My Own 401k Account

Rollover Iras Consider Simplifying Your Retirement Accounts By Combining Into One Ira

If youve worked at several jobs, you may have a few 401k-type plans from previous employers plus your own IRA accounts. Managing all those accounts can be a real challenge. You may want to consider a direct transfer of your account balances under these plans into a single IRA – without paying taxes on the transaction, if done properly. Once in the new IRA, your money has the opportunity to continue to grow federal income tax-deferred.

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

Don’t Miss: How To Split 401k In Divorce

Is It Better To Roll Over A 401 To An Ira

If you like your former employers 401 plan the investment options and the expense ratios on the investments then it wont necessarily be better to roll it over into an IRA. But you may find that if you roll your 401 into an IRA, you may have more investment options. Compare expense ratios and fees to see which option is best for you.

Kaleb Paddock, a certified financial planner at Ten Talents Financial Planning in Parker, Colorado, says a typical 401 plan only has approximately 20 to 40 mutual funds available. But an IRA could give you access to thousands of exchange-traded funds and mutual funds as well as individual stocks.

Another reason might be, if you want to invest in socially responsible funds or funds that invest according to a certain set of values, those funds may not be available in your 401 or your prior employer 401, Paddock says.

But by rolling it over to one of these large custodians, youll likely be able to access funds that may be socially responsible or fit your values in some fashion and give you more options that way, he says.

Plus, rolling over your 401 to an IRA may result in you earning a brokerage account bonus, depending on the rules and restrictions that the brokerage has in place.

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but youll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

Read Also: How Much Can I Rollover From 401k To Ira

Figuring Out The Fees

Another factor in your decision is tough to decipher: How does the cost of investing inside the 401 compare with what youd pay if your money was in an IRA? You may have a hard time figuring that out because the planâs administrative and record-keeping fees are not listed on individual investment statements.

The first step is to check the expense ratio of each fund offered by your company plan. You can find the expense ratio, which is the percentage the fund manager demands to cover its expenses, on the funds Web site or perhaps on your plans Web site. An expense ratio of 1% or less is reasonable. If you invest in an IRA, you can find many funds with low expense ratios.

A new tool can help if you work at one of the 45,000 companies whose plans have been rated, based on administrative costs, investment fees, returns and quality of investment choices, by BrightScope, based in San Diego. Visit www.brightscope.com, enter your company name, and the software kicks out a score between 1 and 100 . People often discover their 401 is more expensive than the fees they would pay in an IRA, says Mike Alfred, chief executive officer of BrightScope. Total plan costs for the largest plans can be as low as 1%, but some small plans charge more than 3%.

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

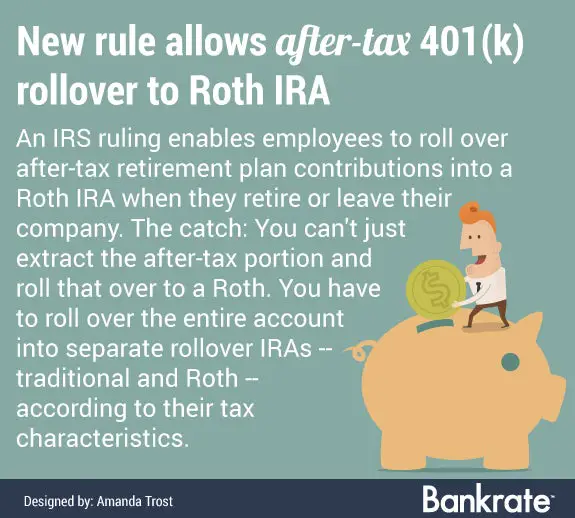

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Also Check: How To Invest 401k After Retirement