Things To Know Before Opening A 401 Brokerage Account

If you’re considering a 401 brokerage account, the first thing you must decide is what percentage of your retirement savings you’d like to put there. You can put all of it there if you’d like, but it may be better to leave part of it in a mutual fund chosen by your employer, just to be safe.

You should also note that some 401s only allow you to transfer funds to a brokerage account during a certain window each year. If this is the case for your plan, make a note of this time frame so you don’t miss it.

Next, look into the account maintenance fees and any other fees associated with the investment products you’re considering. Ideally, you can keep these at or below 1% of your assets. That means you’ll pay $1,000 or less per year for every $100,000 you have in the account. If you plan to employ a financial adviser to help manage or offer suggestions for your 401 brokerage account, don’t forget to factor in those fees as well.

If a 401 brokerage account isn’t a good fit for you, go with one of your employer’s investment selections instead. This is the safer bet if you don’t have the time or interest to learn more about investing. These are your retirement savings at stake, so you don’t want to take unnecessary risks.

The Motley Fool has a disclosure policy.

A Quick Review Of The 401 Rules

A 401 account is earmarked to save for retirementthats why account holders get the tax breaks. In return for giving a deduction on the money contributed to the plan and for letting that money grow tax-free, the government severely limits account holders access to the funds.

Not until you turn 59½ are you supposed to withdraw fundsor age 55, if youve left or lost your job. If neither is the case, and you do take money out, you incur a 10% early withdrawal penalty on the sum withdrawn. To add insult to injury, account holders also owe regular income tax on the amount .

Still, it is your money, and youve got a right to it. If you want to use the funds to buy a house, you have two options: borrow from your 401 or withdraw the money from your 401.

Should I Hold Company Stock In My 401k

Should you hold your own employers stock in your 401K? The conventional answer, and my default response, is no. However that is a topic that is worth some discussion.

While I wouldnt encourage you to buy your employers stock in your 401k plan it doesnt necessarily follow that you should immediately sell it if you already own it. This is especially true if you have held it for a long time and are VERY near retirement and getting ready to start taking distributions or roll it into an IRA.

The reality is, many people DO own stock in their own employer and you may be one of them. What are the pros and cons and why should you not necessarily sell employer stock that you currently own?

Also Check: Can I Invest My 401k In Gold

Read Also: How To Use Your 401k To Invest In Real Estate

Move Money To New Employers 401

Although theres no penalty for keeping your plan with your old employer, you do lose some perks. Money left in the former companys plan cannot be used as the basis for loans. More importantly, investors may easily lose track of investments left in previous plans. I have counseled employees who have two, three, or even four 401 accounts accumulated at jobs going back 20 years or longer, Ford said. These folks have little or no idea how well their investments are doing.

For accounts between $1,000 and $5,000, your company is required to roll the money into an IRA on your behalf if it forces you out of the plan.

If you have at least $5,000 in your account, most companies allow you to roll it over. But accounts of less than $5,000 can be rolled out of the plan by the company if a former employee does not respond to a notification letter within 30 days.

For amounts under $1,000, federal regulations now allow companies to send you a check, triggering federal taxes and state taxes if applicable, and a 10% early withdrawal penalty if you are under age 59½. In either scenario, taxes and a potential penalty can be avoided if you roll over the funds into another retirement plan within 60 days.

Tips For Saving For Retirement

- In any retirement conversation, its important to be mindful of the retirement tax laws in the state you live in. Taking your states laws into account can make a significant difference as you plan for retirement.

- If you already have some money to spare, you could save even more by finding a financial advisor. A financial advisor can take a comprehensive look at your finances and determine where you can save more. With SmartAssets financial advisor matching tool, you answer a series of simple questions about your financial goals and situation. Then the tool will pair you with up to three qualified financial advisors in your area.

Recommended Reading: Can You Convert Your 401k To A Roth Ira

Also Check: How Do You Access Your 401k

Borrow Against Your 401

A better option may be to borrow against your 401 by taking out a 401 loan. Not all 401 plans allow 401 loans, so you will have to contact your plan provider to ask if this option is available to you.

If your plan does allow you to borrow against your 401, you are permitted to borrow half of the amount in your 401 up to $50,000. This is usually a more favorable option because loans are not subject to the 10% penalty fee, nor are they subject to income taxes.

It is important to remember that you will have to repay the loan plus interest. Usually, 401 loans must be repaid in five years. If you do not repay the loan in the five-year period, it will be considered a taxable withdrawal, which means it will then be subject to income tax plus the 10% early withdrawal fee. Many plans do not allow you to make any contributions to your 401 until the loan is fully repaid, so this may be a factor to consider if you plan to continue to contribute to your 401 after purchasing your business.

Solo 401k Brokerage Account Tips

Alongside alternative investments, many Solo 401k plan owners also invest in stocks and derivatives. For instance, there can be time between alternative investments when cash is sitting in your Solo 401k that you could invest in highly liquid stock assets. Or maybe you want to invest idle reserve funds where there is a potential for a higher rate of return compared to a savings account. Although stock market investing may not be your preferred assets class, there are times when traditional equities investing make sense while you are waiting to invest your money elsewhere.

Because, you are not opening a new 401k account with the stock brokerage , the brokerage is NOT the custodian/trustee of your 401k plan you are. The only thing the brokerage is doing is providing brokerage services to your existing Solo 401k you can still control all of your stock market transactions.

Recommended Reading: When Can I Start Drawing From My 401k

Recommended Reading: How To Find Out How Much Is In My 401k

The Pros Of Buying Property With A 401k

The primary benefit of buying investment property via a 401k is that youre able to do so by taking a loan that is both tax-free and penalty-free.

There are other tax benefits worth consideration. For instance, when purchasing a property with a 401k, any income generated from that property will not be taxed. Instead, the income is put directly into the 401k plan. This means that the owner never actually receives the income, but theyll have this income available in their 401k upon retirement.

However, there is one important exception to this rule: loans against a 401k need not be the only investment in a rental property. Lets say you take out the maximum loan amount and then use the proceeds to invest in a property that requires a $200,000 down payment. The property then generates $2,000 per month in rental income. The 401k would be entitled to $500 of that income each month. The remaining funds would be dispersed to other investors accordingly, even if the person investing is the only investor in the deal. In the latter case, the remaining 75% of rental income each month would flow back to him for use as he pleases.

Recommended Reading: How Much Can You Put In Your 401k A Year

No Interest No Collateral No Credit Score

401 business financing is an ideal method if you dont want to go into debt, dont qualify for a loan, or just dont have the cash on hand to start or purchase a business. Unlike other types of funding methods, your credit score, past experience, or on hand collateral play no role in eligibility. Instead, the main factors are the type of retirement account or IRA) and the amount of money you have in it .

Recommended Reading: How Do I Collect My 401k

Is Using A 401 To Buy A Business A Good Idea

Weve all heard the advice from financial planners: Diversify your portfolio. In other words, dont put all your eggs in one basket. But if youre talking about building serious wealth, that age-old advice may be leaving something out.

I once heard a financial planner who worked exclusively with high net worth clients many of them successful business owners say the following:

You get rich by owning a lot of one thing. You stay rich by owning a little of many things.

Most successful entrepreneurs get wealthy by initially bending the rules, taking risks, and doubling down on one investment: their own business. No matter how you end up funding the purchase of a business, work with experienced advisors to understand the pros and cons of all available financing options.

Barbara Taylor is the co-founder of Allan Taylor & Co. You can connect with her on Twitter and .

Read Also: How Old Do You Have To Be To Start 401k

Can I Use Robs To Start A Business

If youre looking into starting a new business, a ROBS might be an attractive option.

ROBS are unique 401 rollovers for an employee who has left their employer and would like to start a business, says Ryan Shuchman, Investment Advisor Representative and Partner at Cornerstone Financial Services in Southfield, Michigan. Effectively, the 401 funds can be used as the startup capital for a new business or to acquire an existing business.

There are specific rules you must follow if youre going to apply the ROBS strategy to your situation. This is where you may be entering uncharted territory.

Just because you may have already rolled over your retirement assets from your former employer doesnt mean youve missed this opportunity. ROBS funding can come from your IRA, too.

The technique here is that a small business establishes a 401 plan and the owner rolls over a sum of money from another qualified source such as an IRA or previous employer plan and that cash, once in the plan, is used to buy stock in that same business, says Jason Grantz, Managing Director at Integrated Pension Services in Highland Park, New Jersey. The plan is now the owner/custodian of the stock certificates and the owner has now gotten out the cash without taxes being applied to them. Youd use them as a form of cheap financing for a small business, and especially for owners who cant find or qualify for quality financing elsewhere.

You May Like: How To Roll Over 401k After Leaving Job

Best Stocks For Your 401k: Amazoncom Inc

Im going to maintain my aggressive posture with my second pick among retirement stocks: Amazon.com, Inc. . Again, the criticisms strike a familiar tone. AMZN shares are up 60% YTD, and since the close of Oct. 26, it has gained 22%. On paper, its price-earnings ratio is a seemingly absurd 300-times trailing earnings. Everything about Amazon screams sell!

If this story was about picking the best stocks for the next six months, I probably wouldnt mention AMZN shares. I believe the critics are correct shares have gone up too high, too fast, and a correction is inevitable. But given a multiple-decade timeframe? I think youre crazy not to consider putting AMZN among a basket of your top 401k stocks.

As Ive mentioned in several articles, e-commerce is taking a greater portion of the total retail pie. Currently, the allocation is 9.1%. Decades from now, e-commerce will at least be a quarter of total retail, but the actual figure could be higher. It wouldnt surprise me if online retail surpassed the traditional brick-and-mortar platform, and that bodes very well for AMZN.

To its credit, Amazon isnt waiting for the disruption to happen. It made an insanely aggressive move acquiring Whole Foods Market, and that wont be the last. Eventually, Amazon will get its hands on virtually anything we buy.

How Do I Avoid Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Recommended Reading: Should I Invest In 401k

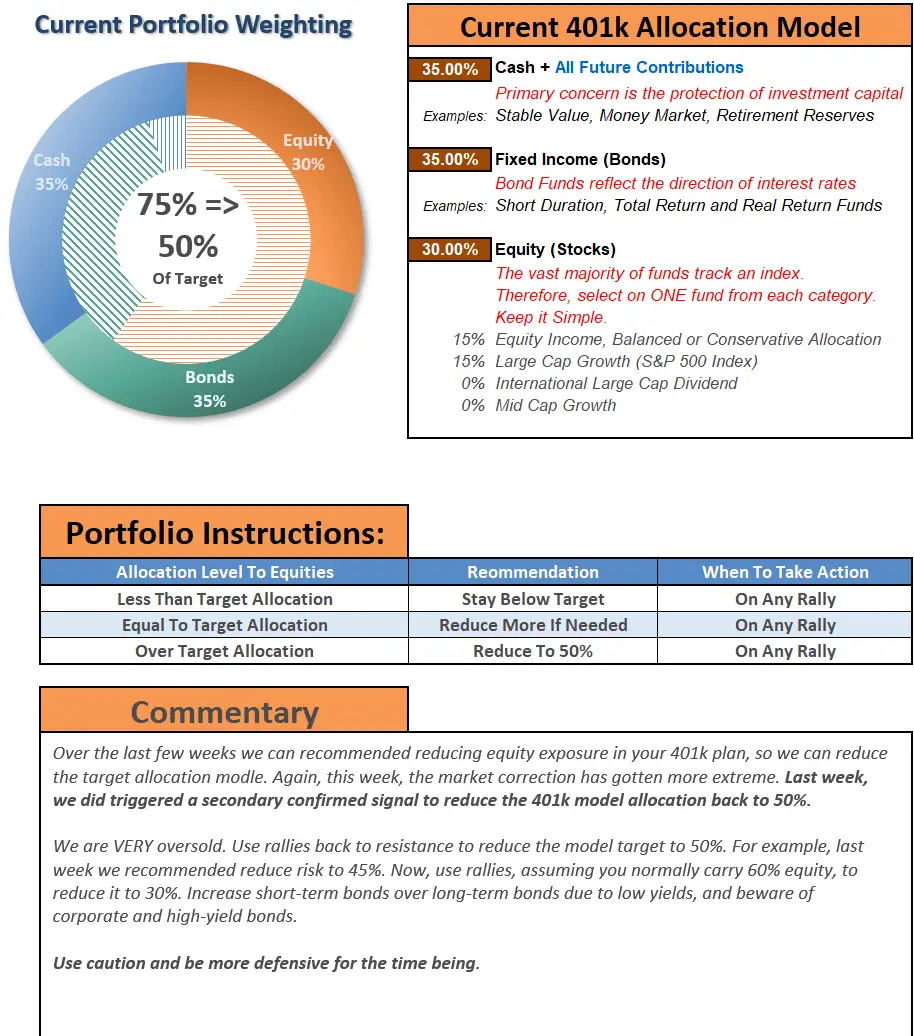

How Long Does A Bear Market Last

Since World War II, bear markets on average have taken 13 months to go from peak to trough and 27 months to return to breakeven. The S& P 500 index plunged an average of 33% during bear markets in that period. The biggest decline occurred in the 2007-2009 slump, when the S& P 500 fell 57%.

Bear markets tend to have three stages, according to Bank of America technical research strategist Stephen Suttmeier, who cited Wall Street legend Bob Farrells 10 Market Rules to Remember for investors anxious about the market downturn.

The first stage is a sharp decline, followed by a rebound, and then a drawn-out fundamental downtrend, he noted.

We are likely in the third stage, with risk to 3800 and even 3500 on the S& P 500, Suttmeier said in a research note.

That means the stock market may not have hit bottom, with the S& P 500 trading at about 3,760 on Monday. But even if markets continue fading, investors should focus on valuations, given that the price-to-earnings ratio on the S& P 500 is now below its 25-year average, advised David Kelly, chief global strategist at JPMorgan Funds.

Whatever short-term cyclical journey the economy takes from here, it should, within a few years, resume a brighter path of moderate growth, low inflation and high profitability, Kelly said in a report.

Using Your 401k To Purchase A Primary Residence

When you are first considering using your 401k or your traditional IRA to purchase real estate, it is a good idea to talk to your plan provider, plan administrator, or custodian.

According to the IRS rules, you are able to use the retirement funds in your 401k to buy a house.

If it is for your first home that will be your principal residence, you can have access to the money in your 401K.

There are two options when it comes to using your 401k to help you purchase a home.

You can either borrow money in the form of a loan or take the money from the 401k as a withdrawal.

The amount of money you are able to borrow from your 401k depends on the number of years you worked at your company and the guidelines of the IRS.

The amount you can borrow is the greater of $10,000 or half of the balance in your account that has been vested, but the loan cannot exceed $50,000.

If your company allows loans from your 401k, you will not be subject to an early withdrawal penalty.

However, you will incur a penalty if you leave your job before paying back your loan within a specific time frame.

Recommended Reading: What Happens To 401k Money When You Quit

Option : Taking Out A 401 Loan

If you have determined the ROBS method might not be for you, you can always buy your business with a loan taken from your 401. In many cases, this can provide a significant advantage over other loan types as you are lending yourself the money while putting up your own collateral. You should discuss the best way to process this loan with your plan administrator.

Taking out a 401 loan is also much easier than pursuing a ROBS strategy. Just like ROBS, you are able to take a 401 loan without incurring penalties from the IRS. You still pay interest on the loan but you pay it back to the lender , so the interest paid will be paid back into your own account. This alone makes it a better option than a private business loan and the resulting business debt.

Working with a qualified accountant can save time and money when dealing with taxes

You are able to take a loan for $50,000 or as much as 50% of your savings, within a 12-month period. The loan itself has an amortization period of five years. If for some reason you fall behind on the loan, it may be reported to credit bureaus, which could lower your credit score. If you truly cant repay the loan, the IRS requires you not only to pay taxes on the defaulted amount, but you incur an early withdrawal penalty of 10% if youre under 59½ years old.