Is It Better To Roll Over A 401 To An Ira

If you like your former employers 401 plan the investment options and the expense ratios on the investments then it wont necessarily be better to roll it over into an IRA. But you may find that if you roll your 401 into an IRA, you may have more investment options. Compare expense ratios and fees to see which option is best for you.

Kaleb Paddock, a certified financial planner at Ten Talents Financial Planning in Parker, Colorado, says a typical 401 plan only has approximately 20 to 40 mutual funds available. But an IRA could give you access to thousands of exchange-traded funds and mutual funds as well as individual stocks.

Another reason might be, if you want to invest in socially responsible funds or funds that invest according to a certain set of values, those funds may not be available in your 401 or your prior employer 401, Paddock says.

But by rolling it over to one of these large custodians, youll likely be able to access funds that may be socially responsible or fit your values in some fashion and give you more options that way, he says.

Plus, rolling over your 401 to an IRA may result in you earning a brokerage account bonus, depending on the rules and restrictions that the brokerage has in place.

You May Be Charged Lower Fees

Even if your company covers fees charged by your plan now, it may not once youve parted ways. And you have no guarantee your future companys 401 will be fee-free. Make sure you have a handle on potential costs your employer-sponsored retirement plan has just for managing your money.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

Disadvantages Of Rolling Over Your 401

1. You like your current 401

If the funds in your old 401 dont charge high fees, you might want to take advantage of this and remain with that plan. Compare the plans fund fees to the costs of having your money in an IRA.

In many cases the best advice is If it isnt broken, dont fix it. If you like the investment options you currently have, it might make sense to stay in your previous employers 401 plan.

2. A 401 may offer benefits that an IRA doesnt have

If you keep your retirement account in a 401, you may be able to access this money at age 55 without incurring a 10 percent additional early withdrawal tax, as you would with an IRA.

With a 401, you can avoid this penalty if distributions are made to you after you leave your employer and the separation occurred in or after the year you turned age 55.

This loophole does not work in an IRA, where you would generally incur a 10 percent penalty if you withdrew money before age 59 1/2.

3. You cant take a loan from an IRA, as you can with a 401

Many 401 plans allow you to take a loan. While loans from your retirement funds are not advised, it may be good to have this option in an extreme emergency or short-term crunch.

However, if you roll over your funds into an IRA, you will not have the option of a 401 loan. You might consider rolling over your old 401 into your new 401, and preserve the ability to borrow money.

Also Check: Which Is Better A Roth Ira Or A 401k

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Arrow Right Arrow Right Arrow Right Arrow Right

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Move Money Into The Tsp

Whether youre a civilian employee, a member of the uniformed services, or a separated participant, you can roll over money from other eligible plans to your existing TSP account. The money will be invested according to your investment election on file. Rollovers do not count against the Internal Revenue Code limits on contributions.

Recommended Reading: How To Rollover Money From One 401k To Another

Invest Your Newly Deposited Funds

You’ll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

Option : Leave Your Money Where It Is

Usually, if your 401 has more than $5,000 in it, most employers will allow you to leave your money where it is. If youve been happy with your investment options and the plan has low fees, this might be a tempting offer. Before you decide, compare your old plan with any retirement plans offered at your new job or with an IRA of your own.

Your new employer-sponsored plan might have more limitations on it than your previous plan or other available options. Maybe there are fewer investment choices/options. Maybe it doesnt have an employer match or higher management fees. So youll want to look closely.

Also consider how often you tend to stay at jobs. If you change jobs every few years, you could end up with a trail of 401 plans at all the different places youve worked. Consolidating might be easier in the long run.

Read Also: What Is A Self Directed 401k

Pros Of Roth 401 To Roth Ira Rollovers

Something that applies to Roth 401 accounts but not Roth IRAs is that, beginning at age 72, you must take required minimum distributions from your account. This is similar to a traditional 401 or IRA. So if you would rather let your retirement funds grow tax-free until you need them, rolling them into a Roth IRA might be the best move for you since RMDs do not apply to this kind of IRA.

In fact, you can leave rollover funds in a Roth IRA indefinitely if need be. That may be something of interest to you, particularly if youre looking to maximize the assets you leave for your beneficiaries.

Why You Might Not Want To Combine Your Ira With Your 401

On the flip side, there are plenty of areas where a traditional IRA has a leg up on a 401 that is, of course, why so many people roll a 401 into an IRA. Here are the biggest you should know:

-

Wider investment selection: Within an IRA, you can invest in nearly anything under the sun not just the mutual funds, index funds and exchange-traded funds that show up in 401 plans, but also individual stocks and even options . You can also shop around for the absolutely lowest-cost funds, which can save you money. As noted above, you should look closely at your 401 plan and its investments to see if youd save money by leaving your funds in your IRA.

-

More loopholes for early withdrawals: Aside from the aforementioned loans, a 401 may allow hardship withdrawals in certain situations the IRS defines hardship as an immediate and heavy need, which means things like unreimbursed medical expenses, funeral expenses or disability. Those will waive the 10% penalty on early distributions youll still owe income taxes on the withdrawal. But a traditional IRA casts a wider net, allowing early distributions without penalty but with taxes still owed for higher education expenses and a first-time home purchase .

-

Low-cost options for investment management: If your 401 plan doesnt come with anything in the way of investment advice, and you want that sort of thing, youll have more options for getting it on the cheap within an IRA if youre open to a robo-advisor. .)

Recommended Reading: Does The Maximum Contribution To 401k Include Employer Match

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense notto roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt notto defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell it , your taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment. The usual more-than-one-year holding period requirement for capital gain treatment does not apply if you dont defer tax on the NUA when the stock is distributed to you.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

Recommended Reading: How Much Can A 50 Year Old Contribute To 401k

What Is A Simple 401 Plan

The SIMPLE 401 plan offers a cost-effective way for small businesses to offer retirement benefits to employees. It is a qualified plan and must follow the rules for required distributions. However, SIMPLE 401 plans are not subject to annual nondiscrimination testing. Contributions are immediately vested , which means that an employee who meets the requirements to receive distributions from the plan may withdraw their entire account balance at any time. Also, the annual contribution limits are lower for a SIMPLE 401 plan than for a traditional 401 plan.

SIMPLE 401 plans have a few stipulations that employers and employees must follow:

- Eligible employers must have no more than 100 employees.

- Employees must have received at least $5,000 in compensation from the employer for the previous year.

- Employers cannot maintain any other qualified retirement plan for employees who are eligible to participate in the SIMPLE 401. A second plan may be offered to employees who are not eligible.

- Employers must make either a matching contribution of up to 3 percent of an employees pay or a 2 percent non-elective contribution based on employees pay.

How To Pick An Ira To Roll Over To

The most important question you need to ask is whether you want to start a traditional IRA or a Roth IRA. Traditional IRAs work much like traditional 401 plans. You contribute money before you pay taxes. The 2023 maximum contribution limit for traditional and Roth IRAs is $7,500.

With a traditional IRA, the money you contribute is deducted from your taxable income for the year. When you reach retirement, the money is taxable as you withdraw it. A Roth IRA, however, works differently. You contribute money post-taxes. The money is then not taxable when you withdraw it in retirement. If you think you might want to keep contributing to your new IRA after the rollover is complete, its important to decide which type of IRA you want.

Its also important to consider the tax implications. If you have a traditional 401 plan, that means you didnt pay taxes on the money when you contributed it to your account. If you want to move that money into a Roth IRA, youll have to pay taxes on it. You can roll over from a traditional 401 into a traditional IRA tax-free. Same goes for a Roth 401-to-Roth IRA rollover. You cant roll a Roth 401 into a traditional IRA.

Don’t Miss: How To Access 401k From Old Job

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Option : Roll It Into Your New 401

If your new employer offers a 401, you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount of time before youre eligible to participate in their plan.

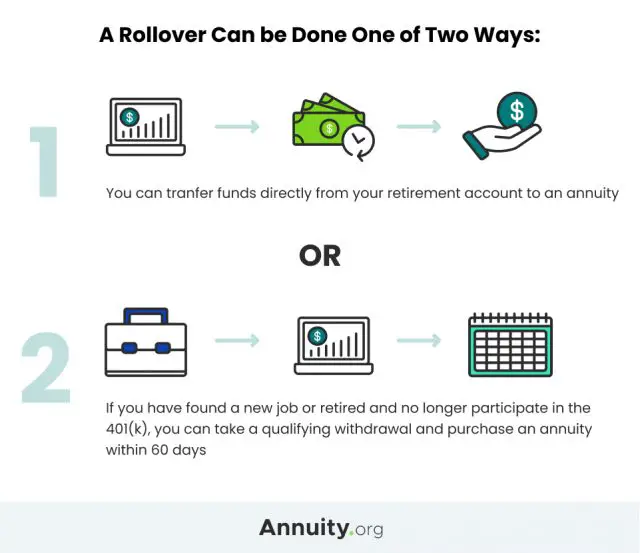

You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires some paperwork.

Or, you can choose an Indirect Rollover. With this option, 20% of your account balance is withheld by the IRS as federal income tax in addition to any applicable state taxes. The balance of your old account is given to you as a check to deposit into your new 401 within 60 days. There is one catch, though. Youll need to deposit the entire amount of your old account into your new account, even the amount withheld for taxes. That means using personal cash to cover the difference and waiting until tax season to be reimbursed by the government.

Also Check: How Do I Take A Loan Against My 401k

Transfers To Simple Iras

Previously, a SIMPLE IRA could only accept transfers from another SIMPLE IRA plan. A new law in 2015 now allows a SIMPLE IRA to also accept transfers from traditional and SEP IRAs, as well as from employer-sponsored retirement plans, such as a 401, 403, or 457 plan. However, the following restrictions apply:

- SIMPLE IRAs may not accept rollovers from Roth IRAs or designated Roth accounts of employer-sponsored plans.

- The change applies only to rollovers made after the two-year period beginning on the date the participant first participated in their employers SIMPLE IRA plan.

- The new law only applies to transfers to SIMPLE IRAs made after December 18, 2015, the date of enactment.

- The one-per-year limitation that applies to IRA-to-IRA rollovers also applies to rollovers from a traditional IRA, SIMPLE IRA, or SEP IRA into a SIMPLE IRA.

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover, and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

You May Like: How To Borrow From Your 401k Without Penalty