How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2021 is $19,500 or $26,000 if you are 50 or older. In 2022, the maximum contribution limit for individuals is $20,500 or $27,000 if you are 50 or older. For both years, those those age 50 and older can contribute an extra amount of $6,500. Consider working with a financial advisor to determine the best contribution rate.

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $58,000 for 2021, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,500 employee contribution to the Roth solo 401k for 2021, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,500 employee contribution on the Roth solo 401k. Note that you can also split up the $19,500 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,500 of catch-up contributions to work with if you are age 50 or older in 2021 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

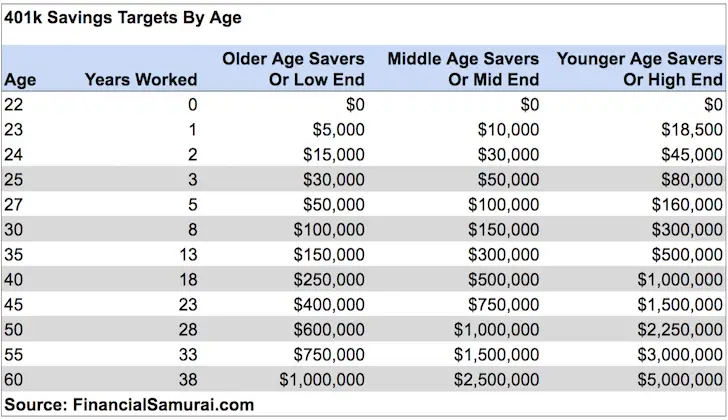

Im 35 What Should I Have Saved

There is a lot of research showing that people tend to rely on approximations or rules of thumb when it comes to financial decisions.

With this in mind, many financial firms publish savings benchmarks that show the ideal levels of savings at different ages relative to an individuals income. A savings benchmark isnt a replacement for comprehensive planning, but it is a quick way to gauge whether youre on track. Its much better than the alternative some people useblindly guessing! More importantly, it can act as a catalyst to take action and start saving more.

However, for the benchmark to be useful, it needs to be realistic. Setting the target too low can lead to a false sense of confidence setting it too high can discourage people from doing anything. Articles on retirement savings goals have generated spirited discussion about the reasonableness of the targets.

So, to answer the question, we believe having one to one-and-a-half times your income saved for retirement by age 35 is a reasonable target. Its an attainable goal for someone who starts saving at age 25.

For example, a 35-year-old earning $60,000 would be on track if shes saved about $60,000 to $90,000.

Savings Benchmarks by AgeAs a Multiple of Income

Recommended Reading: How To Grow Your 401k Faster

How Much You And Your Employer Can Contribute For You In 2022

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

If your employer offers a 401 plan, it can be one of the easiest and most effective ways to save for your retirement. But while a major advantage of 401 plans is that they let you put a portion of your pay automatically into your account, there are some limits on how much you can contribute.

Each year, usually in October or November, the Internal Revenue Service reviews and sometimes adjusts the maximum contribution limits for 401 plans, individual retirement accounts , and other retirement savings vehicles. In November 2021, the IRS made updates for 2022.

Contribution Limits In 2021 And 2022

For 2022, the 401 limit for employee salary deferrals is $20,500, which is above the 401 2021 limit of $19,500. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $61,000 in 2022, up from $58,000 in 2021.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $185,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | +$5,000 |

Also Check: How Much Should I Contribute To My 401k

Can I Contribute 100 Percent Of My Salary To A 401

If your earnings are below $20,500, then the most you can contribute is the amount you earn. It should also be noted that a 401 plan document governs each particular plan and may limit the amount that you can contribute. This applies especially to highly compensated employees, which in 2022 is defined as those earning $135,000 or more or who own more than 5 percent of the business.

Sponsors of large company plans must abide by certain discrimination testing rules to make sure highly compensated employees dont get a lopsided benefit compared to the rank and file. Generally, highly compensated employees cannot contribute higher than 2 percentage points of their pay more than employees who earn less, on average, even though they likely can afford to stash away more. The goal is to encourage everyone to participate in the plan rather than favor one group over another.

There is a way around this for companies that want to avoid discrimination testing rules. They can give everyone 3 percent of pay regardless of how much their employees contribute, or they can give everyone a 4 percent matching contribution.

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Read Also: When Can You Convert 401k To Roth Ira

Why Is There A Maximum Contribution To A 401

The IRS limits the amount that individuals can contribute to a 401 plan as well as other tax-advantaged retirement accounts because of their tax benefits. Depending on the type of contributions you make , a 401 allows you to either defer taxes on your contributions until retirement or pay taxes now.

Having these limits allows people with lower income to have potential access to savings vehicles and greater market share return while limiting the amount that higher-income earners can deduct, said Mindy Yu, the Director of Investing at Betterment at Work.

Without limits on tax-advantaged contributions, high earners could easily shelter large portions of their income in a 401, helping them to avoid much of their tax burden. Contribution limits help to prevent that.

Total Annual 401 Contribution Limits

Total contribution limits for 2022 are the lesser of 100% of your compensation or the following:

- $61,000 total annual 401 if you are age 49 or younger

- $67,500 total annual 401 if you are age 50 or older

The amounts listed above are the total maximum amount that can be contributed. This number is a combination of both your own and your employers contributions.

In some cases, you can contribute additional amounts to other types of plans these may include a 457 plan, Roth IRA, or traditional IRA. It all depends on your income and the types of plans available to you.

Recommended Reading: Can You Pull From 401k To Buy A House

Limitation On Elective Deferrals

The maximum amount you can defer into your 401 plan adjusts each year for inflation. As of 2012, the standard limit is $17,000. However, for people age 50 and older, the contribution limit increases by $5,500 because of what is known as a “catch-up” contribution. This extra $5,500 increases the total limit for someone older than 50 to $22,500. The catch-up contribution does not count toward the general 401 plan contribution limits.

Types Of 401 Contributions That The Irs Allows

Many 401 plans allow you to put money into your plan in all of the following ways:

- 401 pretax contributions: Money is put in on a tax-deferred basis. That means that it’s subtracted from your taxable income for the year. Youll pay tax on it when you withdraw it.

- Roth 401 contributions : Money goes in after taxes are paid. All of the gain is tax-free you pay no tax when you withdraw it.

- After-tax 401 contributions: Money goes in after taxes are paid, which means that it won’t reduce your annual taxable income. But you will not pay taxes on the amount when you withdraw it. You might have tax due, at your ordinary income-tax rate, on any interest that’s accumulated tax-deferred on the amount. You can avoid this by rolling over the sum into a Roth IRA.

Don’t Miss: Can I Rollover My 401k To A Mutual Fund

What Is The Maximum 401k Contribution For 2020 For Married Couple Over 50

For taxpayers aged 50 and over, an additional $ 6,500 recovery amount brings the total to $ 27,000. The $ 20,500 limit also applies to 403 plans and most 457 plans. Contributions to the IRA remain limited to $ 6,000. Also unchanged: the recovery limit of $ 6,500 on 401 plan contributions for ages 50 and over.

What is the contribution limit of 401k for married couples? If you and your spouse both work and your employer provides a 401 , you can contribute up to the IRS limits. For 2021, each spouse can contribute up to $ 19,500, which amounts to $ 39,000 annually for both spouses.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Is It Worth Rolling Over A 401k

Final Thoughts On 401k Limits For Highly Compensated Employees

If youre an employee of a large organization, your employer has probably figured out how to avoid the HCE problem. Its more of an issue for smaller employers. If you are the employer, this is a situation youll need to monitor closely. Your plan administrator should be able to help.

There are two of the ways to fix the problem:

But if youre a highly compensated employee in a small company, you wont know its a problem until you get notification from your employer. That will come in the form of a return of what is determined to be your excess contribution and a potential tax bill as a result.

Are you considered to be a highly compensated employee, or have you been in the past? Did you get hit with a refund and a subsequent tax bill? What are you or your employer doing to fix the problem?

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2021, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $104,000 but less than $124,000 for a married couple filing a joint return or a qualifying widow,

- More than $65,000 but less than $75,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

Also Check: How Much Can You Put In 401k Annually

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2022 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

What Happens If I Exceed The Roth 401 Limit

If your 401 contributions exceed the annual limit, you risk being taxed twice on your excess contributions. Its advisable to contact your HR, payroll department, or plan administrator as soon as you notice an overcontribution. If you inform them before the tax-filing deadline, you may be able to fix the issue in time.

Recommended Reading: How To Save For Retirement Without A 401k

How To Stay On Track

The point of benchmarks isnt to make you feel superior or inadequate. Its to prompt action, coupled with a guidepost to inform those actions, even if that means staying the course. If youre not on track, dont despair. Focus less on the shortfall and more on the incremental steps you can take to rectify the situation:

-

Make sure you are taking advantage of the full company match in your workplace retirement plan.

-

If you can increase your savings rate right away, thats ideal. If not, gradually save more over time.

-

If you have a company retirement plan that enables automatic increases, sign up.

-

If you are struggling to save, many employers offer financial wellness programs or other tools that can help with budgeting and basic finances.

Use these savings benchmarks to get more comfortable with planning for retirement. Then go beyond the rule of thumb to fully understand your potential retirement expenses and income sources. Beyond your savings, think about what you are saving for and how you envision spending your time after years of hard work. After all, thats the reason why you are saving in the first place.

Past performance cannot guarantee future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA’s BrokerCheck.

202204-2128727