Youll Have More Investment Options To Choose From In An Ira

The more investment options you have, the more likely you are to make better decisions. Thats why Dave likes to say if you have two bad options in front of you, go look for better ones!

Like we mentioned before, rolling your old 401 funds into an IRA means you have thousands of mutual funds to choose from instead of the handful of options you had in your old workplace plan.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

Don’t Miss: Should I Move Money From 401k To Roth Ira

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How To Roll Over Your Old 401

8 Min Read | Sep 8, 2022

Forty-seven million. Thats how many people left their jobs in 2021 at the height of the Great Resignation. And millions more are planning to quit this year.1

While theres nothing wrong with blazing new career paths, many of those folks are leaving a trail of forgotten 401s, sometimes with thousands of dollars in retirement savings left behind. Maybe youre one of them!

If youve got money gathering dust in a long-forgotten retirement account, its time to find it a new home. Thats where a 401 rollover comes in.

Recommended Reading: How To Convert 401k Into Roth Ira

How Often Can You Roll Over An Ira Or 401

When it comes to retirement, there are a number of different investing options to choose from. Even the most financially literate individuals can get lost in the weeds when trying to set up retirement accounts that are likely to be long lived and effective. Some of the most familiar sounding terms, like an IRA account or a 401, might seem natural to include in a portfolio, but not all retirement plans encompass them. Whats more, few individuals take the time to understand the nuances of these accounts including rollovers, fees, and income tax implications.

An individual retirement account, or IRA, is a popular tax-advantaged option that many people choose as a part of their financial planning strategy. Traditional IRAs, Roth IRAs, SIMPLE IRAs, SEP IRAs, and 401s are all options available to investors depending on individual financial goals. Investors may decide moving or rolling over an IRA or 401 into another IRA or self-directed IRA. This could be as a strategy to diversify an investment or for reasons such as higher returns, lower fees, or different investment options.

It’s important to understand that the IRS regulates how often funds can be moved from one IRA to another without paying taxes and penalties. To avoid finding yourself in a distribution disaster, we’ll help break down the timeframe of rolling over your 401 or IRA by answering the top 5 most frequently asked questions.

Can I Contribute to a Rollover IRA Once Its Established?

A New 401 Or Other Employer

Doing a direct rollover of your 401 into another 401 probably seems like the easiest option for employees, but thats not always the case. For one, the retirement plan at your new job may not accept rollovers from a previous plan. Even if they do accept rollovers, that doesnt necessarily mean youll be getting the most bang for your buck.

Look at how the new 401 plan is set up, what investing options you have and if there are any minimums you need to meet before you can invest in certain funds, says Andrew Meadows, senior vice president at Ubiquity Retirement + Savings.

It may be the case that while you should certainly take advantage of your new employer-sponsored plan with your new salary, holding onto your old 401 or rolling it into an IRA could give you access to more investment choices.

A direct rollover into a 401 does still have distinct advantages. Namely, that you can avoid paying unexpected taxes and penalties.

Read Also: How To Use My 401k To Start A Business

Fund Selection And Fees

Ideally, you want low-cost fund options with no administrative fees. Consider the choices available with different brokerages to minimize the administrative or brokerage fees you may pay.

When it comes to fund selection, the sheer volume of choices can feel overwhelming. Beginner or hands-off investors may benefit from target date funds or robo-advisors that manage retirement funds for you based on your risk profile.

If you prefer to manage investment choices on your own, most advisors recommend beginners start with a simple portfolio of a broad U.S. stock index fund, a broad international stock fund and a U.S. bond fund. For more on how to invest for retirement, check out our guide.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: How Do I Find My 401k Plan

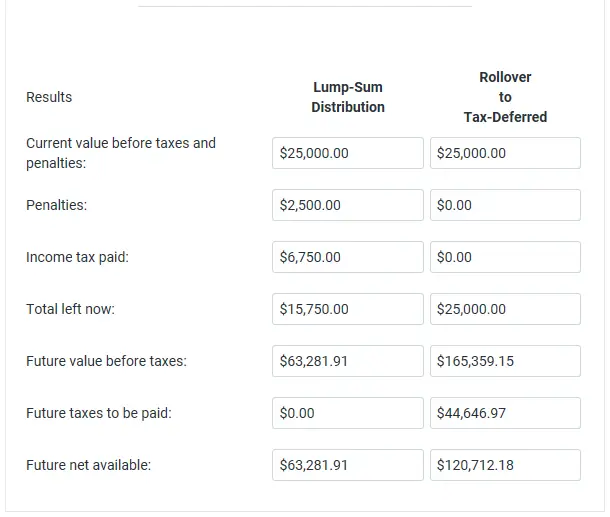

Do I Have To Pay Taxes When I Roll Over A 401

It depends on whether or not youre changing account types with the rollover. For example, if you move funds from a traditional 401 to a Roth IRAthats called a Roth conversionthen you will owe taxes on the money after the transfer. And that could create a hefty tax bill!

But if youre transferring money from a traditional 401 to a traditional IRA, then you wont owe any taxes on that rollover. The same goes for a rollover from a Roth 401 to a Roth IRA .

If you have questions about whether your 401 rollover counts as a taxable event,get in touch with a tax advisor.

Direct Rollover Vs Indirect Rollover: Whats The Difference

Okay, once you decide to roll money from one account to another, you have two options on how to do the transfer: a direct rollover or an indirect rollover. Spoiler alert: You always want to do the direct transfer. Heres why.

With a direct rollover, the money in one retirement accountan old 401 you had in a previous job, for exampleis transferred directly to another retirement account, like an IRA. That way, the owner of the account never touches the money, and you wont have to pay any taxes or penalties on the cash being transferred. Once its done, its done!

Indirect rollovers, on the other hand, are a bit more complicatedand needlessly risky. In an indirect rollover, instead of the money going straight into your new account, the cash goes to you first. Heres the problem with that: You have only 60 days to deposit the funds into a new retirement plan. If not, then youll get hit with taxes and penalties.

See why the direct rollover is the only way to go? Theres just no reason to take a chance on an indirect rollover that leaves you open to heavy taxes and penalties. Thats just dumb with a capital D!

About the author

Ramsey Solutions

Read Also: How To Roll 401k Into Roth Ira

Rollover: The Complete Guide

Shawn Plummer

CEO, The Annuity Expert

A 401 rollover is a process by which you can move your retirement savings from one 401 account to another. This can be a great way to consolidate your retirement savings or to move your money into a better investment plan. This guide will discuss how the 401 rollover works and what you need to do to complete it. We will also provide tips on choosing the right investment plan for you!

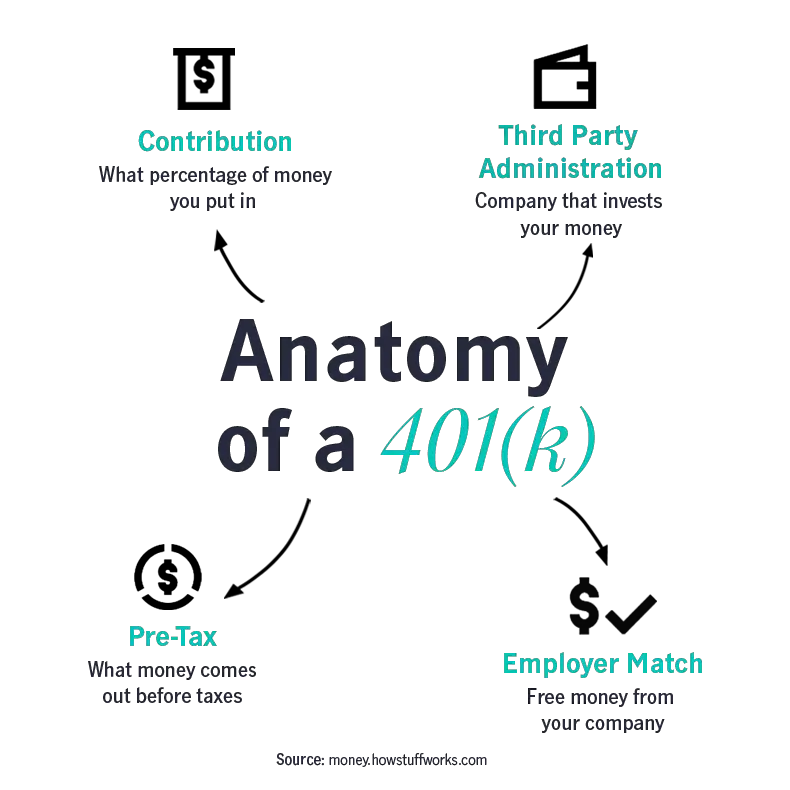

What Is A 401k Rollover

If you lose or leave your job, your 401k retirement savings can come with you. When this happens there are options for your 401k funds and one is to conduct a rollover into an Individual Retirement Account . The IRS allows you to direct the rollover to another plan or IRA. Having a financial advisor to assist you in clarifying your options and in the decision making is sometimes helpful.

Also Check: How To Check Your 401k Balance Online

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

Move Money To New Employer’s 401

Although there’s no penalty for keeping your plan with your old employer, you do lose some perks. Money left in the former companys plan cannot be used as the basis for loans. More importantly, investors may easily lose track of investments left in previous plans.

For accounts between $1,000 and $5,000, your company is required to roll the money into an IRA on your behalf if it forces you out of the plan.

If you have at least $5,000 in your account, most companies allow you to roll it over. But accounts of less than $5,000 can be rolled out of the plan by the company if a former employee does not respond to a notification letter within 30 days.

For amounts under $1,000, federal regulations now allow companies to send you a check, triggering federal taxes and state taxes if applicable, and a 10% early withdrawal penalty if you are under age 59½. In either scenario, taxes and a potential penalty can be avoided if you roll over the funds into another retirement plan within 60 days.

You May Like: Should I Transfer My 401k To An Annuity

Bank To Bank Transfer

If you own multiple bank accounts, then a bank-to-bank transfer is an excellent idea. You can set up the transfer using either the sending or receiving bank with the funds arriving at its destination within 48 hours to 72 hours.

The time of arrival varies from bank to bank, but its often quicker domestically than internationally. Many banks provide free transfers between linked accounts, but its always good to err on the side of caution, so check to make sure.

Before you consider bank-to-bank transfer, ensure you link both accounts. Doing this can take seven days, so ensure it is done before attempting a transfer.

How to link your bank accounts

- Log into your sender bank account dashboard and find the feature add account or add external account or link account. You might see these options or something similar in your banks transaction menu.

- You need to enter the recipient banks routing number, including your account number at the bank. If the number is inaccessible, you can get it from a check, bank rep, or online account.

- Once you submit the information, youd likely have to verify that the external account is yours. Provide the username and password for that account or by testing a transfer between both banks. The latter is easier if the two bank accounts are in your name. However, transferring money to another person may require the use of third-party apps like PayPal or transfer by wire. Consult your bank for the most viable solution.

Rolling Over A : What Are Your Options

Lets say youre starting a new job and youre wondering what to do with the money in a 401 you had at an old job. You have four options:

- Option 1: Cash out your 401.

- Option 2: Do nothing and leave the money in your old 401.

- Option 3: Roll over the money into your new employers plan.

- Option 4: Roll over the funds into an IRA.

Well walk you through the pros and cons of each one:

Also Check: How To Look Up An Old 401k Account

Roll Over Your 401 Into A New Employers 401 Plan

You may want to move assets from your old 401 to your current employers 401 plan to keep them all in one place. This will make viewing how your assets progress and communicating with your employer about your retirement account much simpler.

If you would like to roll over from one 401 to another, contact the plan administrator at your previous employment and inquire if they can perform a direct rollover. A direct rollover means that your old 401 plan provider makes a payment directly to your new 401 account rather than to you.

They will direct you to complete a rollover request or withdrawal form. Please include the information below on your rollover request to roll your money into your new 401 account with Slavic401k:

- Make the check payable to Depository Services

- Include your 10-Digit Account Number

- Include the name of your current employer

- Please mail the check Attention To: Rollovers

- Mail check to Slavic Integrated Administration, 1075 Broken Sound Parkway NW, Suite 100, Boca Raton, Florida 33487-3540

Once we receive the funds youve mailed to us, please allow 7-10 business days to process your rollover.

Tax penalties do not generally apply to 401 rollovers, as long as the funds are transferred directly from the old account to the new one.

Decide What Kind Of Account You Want

Your first decision is what kind of account youre rolling over your money to, and that decision depends a lot on the options available to you and whether you want to invest yourself.

When youre thinking about a rollover, you have two big options: move it to your current 401 or move it into an IRA. As youre trying to decide, ask yourself the following questions:

- Do you want to invest the money yourself or would you rather have someone do it for you? If you want to do it yourself, an IRA may be a good option. But even if you want someone to do it for you, you may want to check out an IRA at a robo-advisor, which can design a portfolio for your needs. But do-it-for-me investors may also prefer to make a rollover into your current employers 401 plan.

- Does your old 401 have low-cost investment options with potentially attractive returns, and does your current 401 offer similar or better options? If youre thinking about a rollover to your current 401 plan, youll want to ensure its a better fit than your old plan. If its not, then a rollover into an IRA could make a lot of sense, since youll be able to invest in anything that trades in the market. Otherwise, maybe it makes sense to keep your old 401.

- Does your current 401 plan offer access to financial planners to help you invest? If so, it could make sense to roll your old 401 into your new 401. If you move money to an IRA, youll have to manage it completely and pick investments or hire someone to do so.

Recommended Reading: How To Take A Loan Out Of Your 401k