If You Really Cant Stand It Boost Your Comfort Cash

So hes heard from people across the spectrum who express concerns that they cant afford to lose what they have. Even many educated investors wanted out during the downturn early in the pandemic, he said.

While Struthers will counsel them not to panic and explain that downturns are the price investors pay for the big returns they get during bull markets, he knows fear can get the better of people. You cant just say dont sell because youll lose some people and theyll be worse off.

And its been especially discouraging to investors to see that bonds, which are supposed to reduce their portfolios overall risk, are down too. People lose faith,Struthers said.

So instead he will try to get them to do those things that can assuage their short-term concerns but do the least long-term damage to their nest egg.

Dont Panic When Your 401 Loses Value

Itâs natural to freak out when your 401 loses value. Checking your 401 balance and seeing youâve lost hundreds or thousands of dollars in a few months is never fun.

However, what you donât want to do is panic and make any changes in the moment.

It may seem counterintuitive, but during a stock market crash, the last thing you want to do is take money out of your 401. The reason is that you paid a price for the stocks, mutual funds, and index funds youâre invested in. If they lose value and you sell, you sold your investments for a loss. In fact, the best strategy is to invest even more money into the funds youâre invested in because youâll be paying a discount for the same funds because theyâre lower in value. And because time is on your side, the funds will recover long before youâll need to start taking distributions during retirement.

How Much Monthly Income Could An Annuity Give You

Lets be clear about what not running out of money actually looks like. Depending on the state where he lives, if the 65-year-old male buys a $100,000 single premium immediate annuity with payments beginning in January 2022, his monthly income for life is estimated at only $486, according to Schwabs Income Annuity Estimator. That payment will never be adjusted for inflation, and his heirs wont receive anything when he dies, even if he dies long before he breaks even.

He can make sure his annuity pays out for at least 10 years, even if he dies during that period, in exchange for reducing his monthly payment by $3. These 10 years are called a period certain. This way, his heirs get something if he dies prematurely, and the annuity will pay out at least $57,960. Another option is to make sure his heirs receive a refund of his unused premium by reducing his monthly payment to $443.

Many retirees have spouses to consider. This man could also buy a joint-life-only annuity with his $100,000. It would pay $405 per month for life as long as either he or his wife were alive.

| Annuity Payouts |

|---|

| $2,406 | $4,813 |

Source: MyCalculators.com. Table assumes average annual growth of 6%, an inflation rate of 3%, and a drawdown to zero after 30 years. Monthly income is based on annual withdrawals at the beginning of each year.

Read Also: How To Rollover 401k To Ira Td Ameritrade

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Protecting Your 401 From A Stock Market Crash

Any time you put your money in the stock market or other investments, you always run the risk of losses. While you can make largely educated decisions, things dont always go to plan. Also, because youre talking about something as important as your retirement, emotional decision-making can come into play.

Despite the above, there are many strategies, simple and complex, you can use to mitigate risk. For instance, spreading your assets across multiple types of investments and areas of the market can allow you to avoid the volatility that comes with stock-picking and concentrated investment positions.

Everyone has short-term expenses that periodically arise. For example, you might need to repair your car, replace a broken household appliance or pay for a medical procedure. Long-term expenses are even more prevalent, including student loans and mortgages. However, the best thing you can do is treat your retirement savings just as important as all of your other needs. This will ensure your pool of retirement funds will continue to grow over time.

Below are some of the most influential strategies you can use to minimize losses in your portfolio, even if a stock market crash comes around. Just remember that you can never eliminate risk entirely, though.

You May Like: Can You Roll Over 401k To Roth Ira

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

How Much Should You Contribute To Your 401

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401 each year. The most you can contribute in 2022 is $20,500 or $27,000 if you are 50 or older. In 2023, the maximum contribution limit for individuals jumps to $22,500 or $30,000 if you are 50 or older. For 2022, those age 50 and older can contribute an extra amount of $6,500, though the IRS is increasing the 2023 limit to $7,500. Consider working with a financial advisor to determine a contribution rate.

Don’t Miss: How Do I Pull Money Out Of My 401k

How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the new financial institution with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your plan administrator is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Understand What A 401 Is

While you sign up for your 401 through the company you work for, it is typically managed by a separate financial firm, such as Vanguard, Fidelity, Principal, Schwab, etc. This is the company you will receive important information and disclosures from about your account and investments.

If you leave your employer, in most cases your account will remain at the financial firm that originally managed it, unless you roll it over to a new company .

You can begin withdrawing money penalty-free at 59 ½ in most cases. If you withdraw money before that age, you will be hit with a 10% early withdrawal penalty and pay income taxes on the distributions. You can also take a 401 loan, which needs to be repaid, including interest. Learn more about that here.

Not every employer offers employees a 401. If that’s the case, you can open an IRA, which also offers tax advantages for those investing for retirement, on your own through a brokerage firm.

You May Like: How Much Should You Invest In 401k

Can You Lose Money In A 401

Its possible to lose money in a 401, depending on what youre invested in. The U.S. government does not protect the value of investments in market-based securities such as stocks and bonds. Investments in stock funds, for example, can fluctuate significantly depending on the overall market. But thats the trade-off for the potentially much higher returns available in stocks.

That said, if you invest in a stable value fund, the fund does not really fluctuate much, and your returns or yield are guaranteed by private insurance against loss. The tradeoff is that the returns to stable value funds are much lower, on average, than returns to stock and bond funds over long periods of time.

So its key to understand what youre invested in, and what the potential risks and rewards are.

Potential Risks In 401 Investments

- Being too conservative: Some people may think that the best way to manage risk is not to take any, but being too conservative with your investments can be a risk, too. Many investors dont allocate enough of their retirement portfolios to stocks, which will likely have the highest returns over the long term. Instead, they stick to assets perceived to be low-risk investments such as bonds. While stocks are volatile, they should be an important part of investing for goals like retirement.

- Paying too much in fees: Fund expenses eat into the return you earn as an investor, so pay special attention to the fees associated with the funds you invest in. If a fund has an annual expense ratio above 0.50 percent, its likely you can choose something cheaper. Most index funds cost less than 0.10 percent each year.

- Investment losses: This is what most people think of when it comes to investment risk. Stocks and bonds can decline in value, especially over short periods of time. Stocks tend to rise over the long term, though, making them ideal assets for goals far in the future like retirement.

Also Check: How Is A 401k Different From An Ira

Bonds And The Bear Market

Bear markets are characterized by a 20% or more decline in stock prices. There are different factors that can trigger a bear market, but generally, theyre typically preceded by economic uncertainty or a slowdown in economic activity. For example, the most recent sustained bear market lasted from 2007 to 2009 as the U.S. economy experienced a financial crisis and subsequent recession.

During a bear market environment, bonds are typically viewed as safe investments. Thats because when stock prices fall, bond prices tend to rise. When a bear market goes hand in hand with a recession, its typical to see bond prices increasing and yields falling just before the recession reaches its deepest point. Bond prices also move in relation to interest rates, so if rates fall as they often do in a recession, then bond prices rise.

While bonds and bond funds are not 100% risk-free investments, they can generally offer more stability to investors during periods of market volatility. Shifting more of a portfolios allocation to bonds and cash investments may offer a sense of security for investors who are heavily invested in stocks when a period of extended volatility sets in. That can be a key component of trying to protect your 401 from a stock market crash.

Is 4 Percent 401k Match Good

The maximum possible match remains a median of 3 percent of pay.Most employers require workers to save between 4 and 6 percent of their pay to get the maximum possible match. Immediate eligibility to participate. Only about half of companies offer new employees immediate eligibility for the 401 plan.

Recommended Reading: How Do I Find A Old 401k

Make Sure You Contribute At Least This Much

Deciding how much to save in your 401 shouldnt take an advanced degree in mathematics.

At a minimum, you should contribute as much as your employer will match to your 401. If youre able to put away even more for retirement, you can contribute up to $19,500, or $26,000 if youre older than 50, in 2021 .

There are a few other considerations to take into account before plowing all that money into your 401, but heres all you need to know.

What Percentage Should I Be Putting In My 401 Per Week

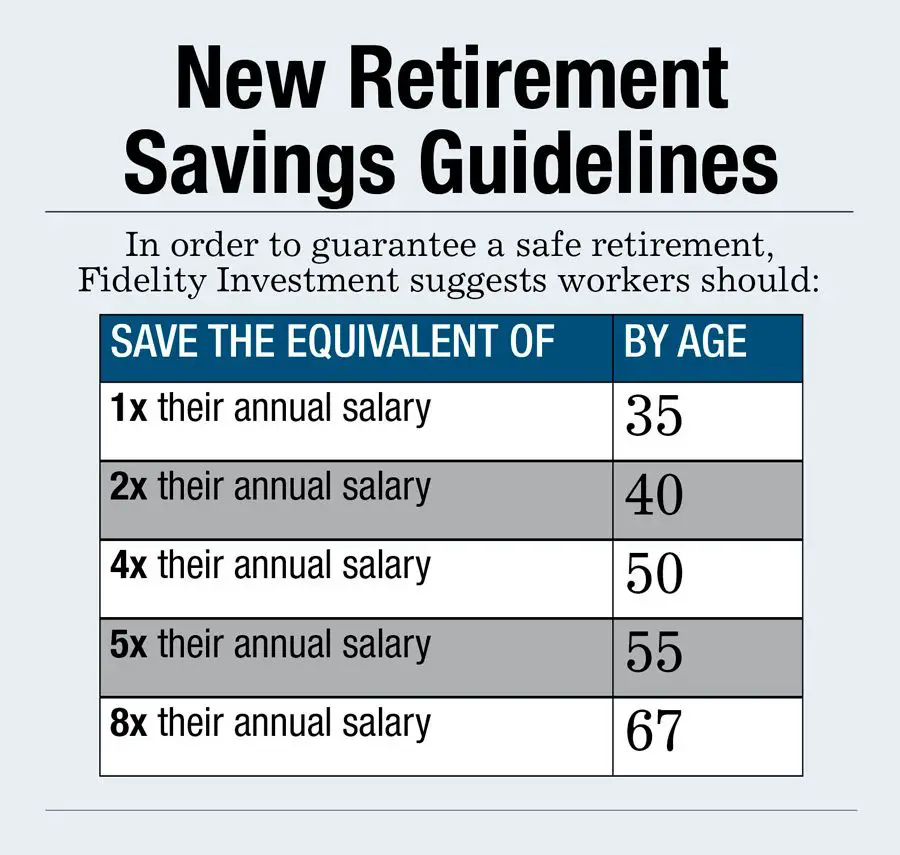

A 401 is an easy, accessible plan that many take advantage of to save for retirement. Your employer deducts your contributions from your pay and very often matches them up to a certain percentage. If the amount you contribute is small enough, you probably wont even miss the money. But if thats your only method of saving for retirement, youll need to consider whether you are adding enough money to your retirement savings account. According to Fidelity, the rule of thumb is that youll need about eight times your annual salary to ensure you dont run out of money in 25 years of retirement.

You May Like: How To Convert 401k To Silver

Spread 401 Money Equally Across Available Options

Most 401 plans offer some version of the choices described above. If they dont, a fourth way to allocate your 401 money is to spread it out equally across all available choices. This will often result in a well-balanced portfolio. For example, if your 401 offers 10 choices, put 10% of your money in each.

Or, pick one fund from each category, such as one fund from the large-cap category, one from the small-cap category, one from international stock, one from bonds, and one that is a money market or stable value fund. In this scenario, youd put 20% of your 401 money in each fund.

This method works if there are a limited set of options, but requires much more time and research if there are an array of options. In addition, it’s not as fail-safe as the first three because the asset mix may not be suitable for your retirement goals, and you have to rebalance the portfolio to maintain a certain percentage of each asset category over time.

Contributing To Your 401

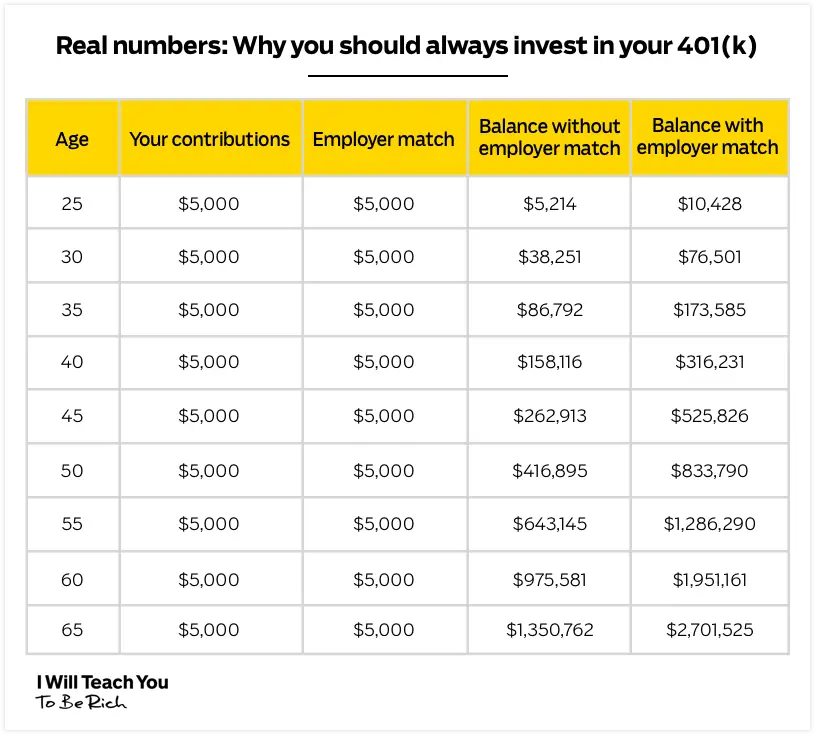

You can contribute a portion of your earnings to a 401 account tax-free each pay period, subject to annual limits set by the Internal Revenue Service . Some employers even offer matching programs, where they contribute an equal amount to help grow your fund. It’s clear to see how it makes sense to put in as much as possible and maximize your 401.

But there may be reasons to hold back. Your financial situation should play a role in how much you decide to put in an employer-sponsored retirement plan. So should the specifics of the plan. Consider whether your company’s 401 is high in quality with solid growth rates and company matching. Make sure your own money base is solid, ensuring that you can afford to put some of your earnings away.

Maxing out your contributions probably isn’t your best choice if you’re struggling to pay bills each month, still working on other aspects of your finances, or if your 401 options aren’t great.

Recommended Reading: When Can I Start Drawing From My 401k

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.