Why You Should Recover Your Old 401k

Theres a simple reason why you should attempt to recover a lost 401k account: Its your money. Whether your old 401k plan holds a lot of money or a little, every penny counts when staying on track with your retirement savings.

Another important point to consider: If youve changed jobs multiple times, its possible that you could have more than one lost 401k and taken together, that money could make a surprising difference to your nest egg.

Last, if you were lucky to have an employer that offered a matching 401 contribution, your missing account may have more money in them than you think. For example, a common employer match is 50%, up to the first 6% of your salary. If you dont make an effort to find old 401k accounts, youre missing out on that free money as well.

Dont Miss: Can I Borrow From My 401k To Start A Business

Checking With The Department Of Labor

Different types of retirement plans, including 401k plans, are required to keep certain information on file with the IRS and the Department of Labor . One key piece of information is DOL Form 5500. This form is used to collect data for employee benefit plans that are subject to federal ERISA guidelines.

So how does that help me find my 401k? The Department of Labor offers a Form 5500 search tool online that you can use to locate lost 401k plans. You can search by plan name or plan sponsor. If you know either one, you can look up the plans Form 5500, which should include contact information. From there, you can reach out to the plan sponsor to track down your lost 401k.

How To Save For Retirement

The key to saving for retirement is focusing on the elements you can control. Develop a discipline of saving at your target savings rate, and then use cost-effective and diversified investment strategies to help those savings grow.

The best place to start saving for retirement is often your employer-sponsored retirement plan because it offers a streamlined way to save and often provides lower-cost options than you can get elsewhere.

With a 401 account, you set up automatic contributions that ensure a portion of every paycheck goes into your retirement savings.

Both Shamrell and Stinett say to save around 15% of your salary each year. If thats too much, at the very least, contribute enough to get your full employer matching contribution, if you have one. Otherwise, you could be leaving free money on the table.

You can increase your savings rate by 1% to 2% each year until you reach the target of 12% to 15% per year, Shamrell says.

And you neednt stop at 15%. If you can save more, do it. The more you put away for retirement today. The faster retirement can come.

Recommended Reading: Is It Smart To Roll Over 401k To Ira

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

Reading And Understanding The Summary Annual Report

The first thing you should do is discover exactly what is going on. You should have statements and contracts relating to the agreements you signed, as well as prior-year tax returns. To figure out where your money is going, use a computer program or a pen and paper.

As of 2009, the amount of information on your 401 report summary will be greater, including a more detailed account of the costs you pay to maintain it. Inquire about any line items that are unclear and double-check with your own research.

Request for Updated Materials

You may occasionally wait months for your fund reports to arrive. Even if you are charged an additional fee to receive a new statement, you are entitled to one. To make an informed decision about whether your fund sub-components are suitable candidates for weathering a bear market, you will need up-to-date information on your funds performance and diversification.

Investment funds can change rapidly, especially in a volatile market. Be sure your reports include historical data and some sort of standard to compare performance against that makes sense. This will help you understand how the fund is performing over time and make more informed decisions about investing.

Historical Performance Analysis

Don’t Miss: Where To Put My 401k

How To Check My Social Security Retirement Or Disability

How to check my social security retirement or disability? You can check the status of your application online using your personal my Social Security account. If you are unable to check your status online, you can call us 1-800-772-1213 from 8:00 a.m. to 7:00 p.m., Monday through Friday.

How can I find out my Social Security benefits amount? Most people can receive an estimate of their benefit based on their actual Social Security earnings record by going to www.socialsecurity.gov/estimator. You also can calculate future retirement benefits by using the Social Security Benefit Calculators at www.socialsecurity.gov.

Is Social Security retirement the same as disability? your disability benefits automatically convert to retirement benefits, but the amount remains the same. If you also receive a reduced widows benefit, be sure to contact Social Security when you reach full retirement age, so that we can make any necessary adjustment in your benefits.

How do I know if I get SSI or SSDI? The major difference is that SSI determination is based on age/disability and limited income and resources, whereas SSDI determination is based on disability and work credits. In addition, in most states, an SSI recipient will automatically qualify for health care coverage through Medicaid.

Read Also: Does Maximum 401k Include Employer Match

How To Find Your 401 With Your Social Security Number

Knowing how to find your old 401s with your social security number can save a lot of time and headache. There are tools you can use to find your 401 and roll them over.

If youre like most, youve changed jobs quite a bit during your career. According to a Department of Labor study, the average American will have had about 12 jobs during their career. All of that moving around is bound to cause some things to get lost in the shuffle. And if youve participated in any company-sponsored 401 plan, your retirement money may have been left behind. Luckily, there are ways to find your 401s using your social security number.

The sad fact is billions in retirement funds are left behind in 401 plans where the participant no longer works for that company.

401s that have been left behind with former employers can be cumbersome at best to find. However, its vital in building your retirement to locate your old funds and bring them back into your active portfolio.

The first step would be to contact your former employers human resources department. If you can get in touch with them, they should have the best route to getting a hold of your old 401s.

Next would be to reference your old 401s summary plan description. In that, you should be able to find your plan administrators contact information and what they do with former employees 401s.

Don’t Miss: How Should I Invest My 401k

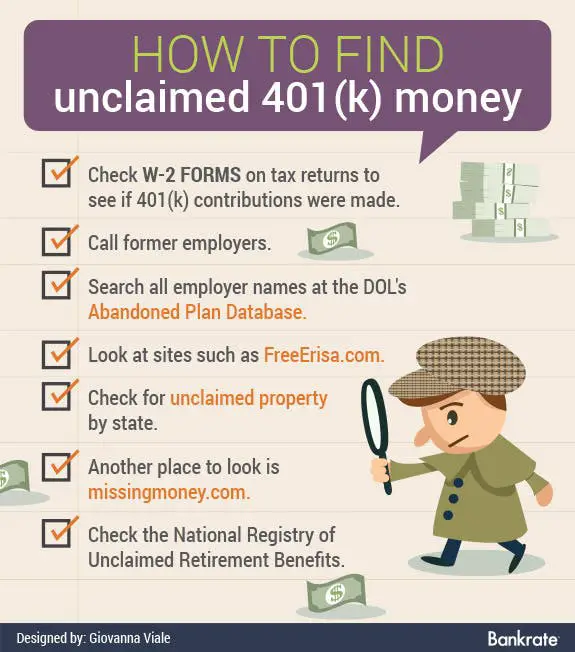

Search Databases For Unclaimed Assets

If you still cant find information on your lost 401 plans, you can also try searching one of the publicly available databases for unclaimed assets. The National Registry of Unclaimed Retirement Benefits is a good place to start. By entering your Social Security number, you can quickly see if there are any unclaimed retirement funds that belong to you. The money may still be held in the employers plan, or the company may have opened a special IRA account in your name to hold the funds.

You can also search using the National Association of Unclaimed Property Administrators site, which will help you track down unclaimed money you may be owed, not limited to retirement assets. Be sure to check in each state you have lived or worked. The site processes tens of millions of requests each year and has helped return more than $3 billion in unclaimed assets annually.

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Don’t Miss: Why Cant I Take A Loan From My 401k

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

Develop Other Sources Of Income

Think about other ways you can secure sources of income in retirement outside of collecting Social Security and withdrawing from your 401k. This will not only prevent you from having all your retirement eggs in one basket, but it is also something to consider if your 401k balance is lower than youd like. Where can you invest and how can you optimize your portfolio for greater returns? Consider other ways you can supplement your retirement income, and speak to your financial advisor about what solutions could work for you.

You May Like: How Do I Set Up A 401k For My Employees

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

How Long Can You Stay On Each Page

For security reasons, there are time limits for viewing each page. You will receive a warning if you dont do anything for 25 minutes, but you will be able to extend your time on the page.

After the third warning on a page, you must move to another page. If you do not, your time will run out and your work on that page will be lost.

Don’t Miss: What Is Better For Retirement 401k Or Ira

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

Also Check: Can I Rollover A 401k To An Existing Ira

Is There A Company Match And If So What Are The Rules

Many employers offer incentives for employees to contribute to their 401 plans by matching contributions up to a certain point. For instance, some companies may match every dollar you contribute with 50 cents of their own, up to a certain percentage of your salary. Thats a nice benefit you dont want to miss out on. But individual plans vary widely, and there may be restrictions on qualifying for the company match or vesting schedules for the match. Ask your plan administrator for the rules that apply to your companys plan.

Recommended Reading: How Much Can I Put In A Solo 401k

Discover Where Your Funds May Have Been Transferred

If your former employer does not have your old 401, you can search on the Department of Labors abandoned plan database. You will be able to search for your plan using the information you already have, including your name, your employers name and more. If you had a traditional pension plan and it no longer exists, you can search the U.S. Pension Guaranty Corp. database to find your unclaimed pension.

Finally, you may want to search the National Registry of Unclaimed Retirement Benefits. This service is available nationwide and has records of account balances unclaimed by former retirement plan participants.

Recommended Reading: What’s My 401k Balance

Average 401 Balances Dont Reflect All Retirement Savings

Theres another key fact to remember when looking at average 401 balances. They do not reflect total retirement savings, says David Stinnett, principal of Vanguard Strategic Retirement Consulting.

Participants may also have other savings accounts, such as individual retirement accounts , retirement accounts at previous employers or spousal accounts, not to mention additional retirement income sources like real estate, pensions and Social Security. All of these assets combined determine a persons retirement readiness.

What Is The 401k Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

- The numbers are more forward-looking vs. backward, since the average 401k contribution limits were lower in the past.

- You start full-time employment at age 22 at a company that provides a 401k, without a company match.

- You contribute $8,000 to your 401k after the first year, then from the second year onward, you contribute the maximum annual amount of $20,500.

- The No Growth column shows what you could potentially have in your 401k after so many years of a constant $20,500-per-year contribution and no growth.

- The 8% Growth* column shows what you could potentially have in your 401k after so many years of a constant $20,500-per year contribution compounded over the next 43 years.

- The difference between the two columns emphasizes the power of growth, compounding over time. By starting early and enjoying a historically average return on 401k, at age 65, an individual could turn $869,000 of contributions into over $6.4M dollars.

Recommended Reading: What Happens To My 401k When I Leave My Job