What Is A 401 Early Withdrawal

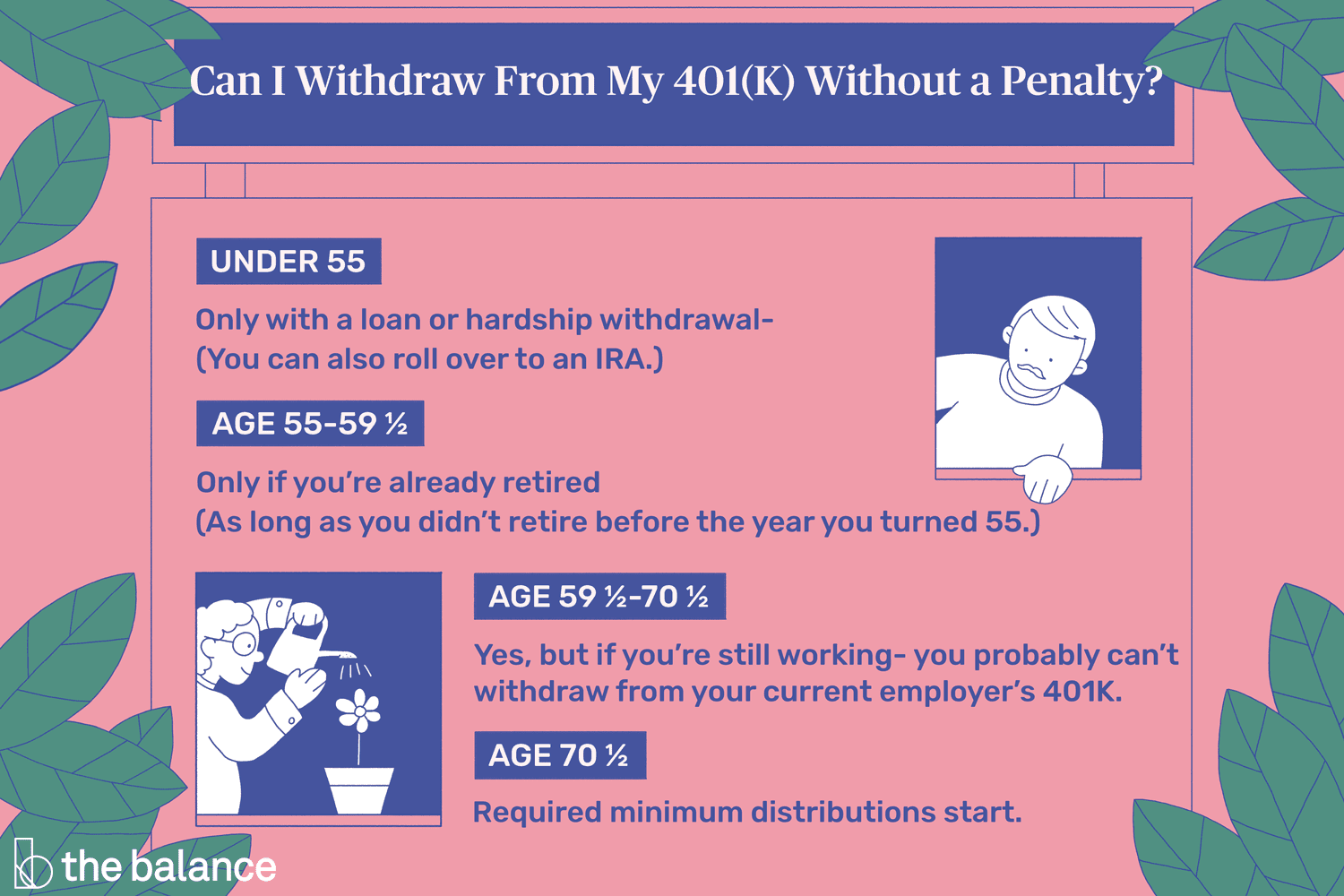

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% penalty by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the penalty is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

Consider Converting Your 401 To An Ira

Individual retirement accounts have slightly different withdrawal rules from 401s. So, you might be able to avoid that 10% 401 early withdrawal penalty by converting your 401 to an IRA first. s and IRAs, of course.) For example:

-

Theres no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You still have to pay the tax when you file your return, though. So if youre in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds.

Did You Take Money Out From Your Retirement Account Because Of Covid

Its important that you let your tax preparer know if in 2020 you took money out of a retirement account because of COVID-19, especially if you took the money out before you turned 59 ½ years old.

Normally, people have to report all of their retirement withdrawals on their tax return, even if they already had tax taken out. And if they took the money out before they turned 59 ½, then its called an early distribution and there is a penalty of an additional 10% tax.

But, if you took the money out because of COVID-19, you dont have to pay tax on all of it this year. Instead you can spread it out evenly over 3 years. For example, if you took out $9,000 because of COVID-19 in 2020, you could report $3,000 in income on your federal income tax return for each of 2020, 2021, and 2022. Or, you can also simply report all of it on your 2020 return.

You need to discuss this with your tax preparer before filing the return, so that you can figure out if it is better for you to report all the retirement income on your 2020 return or to spread it out. Your choice could affect things like the amount of Earned Income Tax Credit you qualify for, and whether or not you have to pay back Advance Premium Tax Credits you got from the Marketplace to help cover your health insurance premiums.

And, if you took the retirement money out because of COVID-19, and you were under 59 ½ years old, you can avoid the extra 10% penalty for the early distribution.

More Resources

Read Also: Does Fidelity Offer A Solo 401k

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

What Is The Rule Of 55

The rule of 55 is an IRS regulation that allows certain older Americans to withdraw money from their 401s without incurring the customary 10% penalty for early withdrawals made before age 59 1/2. The rule of 55 applies to you if:

- You leave your job in the calendar year that you will turn 55 or later . You can leave for any reason, including because you were fired, you were laid off, or you quit.

- You are withdrawing funds only from a 401 account offered by your most recent employer. You cannot withdraw money penalty-free from accounts with other past employers, nor can you make penalty-free withdrawals from an IRA, even if you rolled over your 401 into one upon leaving your most recent job.

One common misconception is that you can leave your job before the calendar year you turn 55 and the rule will still apply to you. This is not the case. If you are turning 55 in 2022 and left your job on Dec. 31, 2021, the rule does not apply to you.

Don’t Miss: How To Find Old Employer 401k

How Can I Avoid Paying Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Case : You Have An Outstanding 401 Loan

There are many reasons why it doesnt make sense to take a loan from your 401. Heres one more: You cant deduct the interest payments that you make on your 401 loan. This means you wont receive an interest statement like the one you receive when paying mortgage interest .

As long as you keep up with your agreed payment schedule and you pay your loan in full within five years , you wont have to do anything special on your taxes. However, defaulting on your loan turns the remaining unpaid balance into a taxable distribution and triggers the same rules described under case 2b above. Even worse, you are no longer eligible to do an indirect rollover and are likely to trigger additional penalties from your plan and state government.

Also Check: How To Pull Out 401k Without Penalty

Different Definitions Of Disability

To receive Social Security disability benefits, you must have a medical condition that keeps you from taking part in substantial gainful activity and that is expected to last at least one year or end in death. Substantial gainful activity is work that brings in more than a specified amount of income for 2022, the cap is $1,350 a month for most disabled beneficiaries.

Social Security further classifies disabilities based on your prospects for recovery, with the following designations: medical improvement expected, medical improvement possible and medical improvement not expected. These categories determine how frequently the SSA will review your condition to see if you still qualify for benefits.

To qualify for penalty-free early withdrawals from a traditional IRA or 401, your disability must be total and permanent, as defined by the IRS meaning that your physical or mental condition leaves you unable to do any substantial work and will be fatal or, in the tax agencys terms, of long, continued and indefinite duration.

That means not everyone collecting SSDI or SSI benefits is eligible for penalty-free withdrawals from a retirement account. For example, someone with the SSA classification medical improvement expected would be less likely to fit the IRS definition than someone classified as medical improvement not expected.

To claim a disability exemption to the early-withdrawal penalty, complete IRS Form 5329 and file it with your federal taxes.

Keep in mind

Check Your State Pension Age

Your State Pension age is the earliest age you can start receiving your State Pension. It may be different to the age you can get a workplace or personal pension.

The State Pension age is under review and may change in the future.

Use this tool to check:

- when youll reach State Pension age

- your Pension Credit qualifying age

- when youll be eligible for free bus travel

Don’t Miss: How Do You Take Out 401k Money

What Are Military Retirement Benefits

Your military retirement benefits refer to the assistance you receive after you leave the military service. Benefits can include pension, medical care, education, and more. You can find out more about your benefits by visiting the United States Department of Veterans Affairs website.

For a free legal consultation, call

How The 401 Tax Deduction Works

First of all, its important to understand that this is NOT a true tax deduction, but in a way, its better, because its easier for you. Unless youre a business owner, you wont claim your 401 contributions as tax deductible when you fill out your 1040. Instead, the money is taken out of your paycheck before federal taxes on your income are figured. This is how you save on taxes today. Your 401 pretax contribution comes out of your paycheck first thing, lowering your taxable income. Then, your taxes are taken out of your paycheck based on the smaller income number.

Lets say you make $85,000 per year and are married filing jointly. This puts you in the 22% tax bracket. You can get a quick and dirty estimate of how much you could potentially save by multiplying your 401 contributions by your tax bracket. So, if you put aside 10% of your income , you might see a savings of $1,870. This isnt a fool-proof method, and your actual savings could vary based on state and local income taxes and other factors. The good news is most states dont tax pretax employee 401 contributions either, so you save even more on your contributions.

Read Also: What Is A 401a Vs 401k

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Misconceptions About 401 Contributions

The contributions that you make to a 401 plan only reduce your income taxes, not your Social Security and Medicare taxes. These two taxes only apply to your earned income, but you do not get to claim any deductions before these taxes are assessed. For example, if your gross wages for the month are $2,500 and you contribute $400 to your 401 plan from it, there is withholding on the full $2,500 for Social Security and Medicare even though for federal income tax purposes, there is withholding on $2,100.

As you file your 2021 taxes remember you can still contribute up to $6,000 to your IRA by the tax deadline and you may be able to get a tax deduction on your 2021 taxes. Just remember to tell your retirement account administrator that your contribution is for 2021 and not 2022.

Dont worry about knowing these tax laws.TurboTax will ask you simple questions about you and give you the tax deductions and credits youre eligible for based on your answers. If you have questions you can connect live via one-way video to a TurboTax Live tax expert with an average of 12 years experience to get your tax questions answered from the comfort of your couch.TurboTax Live tax experts are available in English and Spanish, year round and can review, sign, and file your tax return or you can fully hand your taxes over to them. All from the comfort of your home.

Don’t Miss: What Happens To 401k When Changing Jobs

Case 2d: You Completed An Indirect Rollover

In an indirect rollover, you received a cashout check from your previous plan but were able to find a new qualifying plan within 60 days. In this case, the IRS will use your 1099-R from your previous employer and the W-2 from your new employer to cross-reference the indirect rollover on your 1040. You would report your 401 on your taxes, but you wont pay a 401 contribution tax.

When doing an indirect rollover, you have two options. Lets go over them, assuming that your employer cashed out a $1,000 balance from your 401.

-

You decide to roll over the $800, but not the mandatory $200 withheld by your employer: Youll claim the $800 as non-taxable income and the $200 as taxes paid. If you were under age 59 1/2, you would need to file form 5329 to calculate the early distribution tax of 10% on the $200, unless youre eligible for an exception.

-

You choose to roll over the entire $1,000 balance: Since your employer withheld $200, youll need to come up out of your own pocket with the $200 to fully fund a non-taxable rollover of $1,000. Youll claim $1,000 as non-taxable income and the $200 as taxes paid.

Here are additional resources on completing rollovers:

If Your Appeal Is Denied

If the plans final decision denies your claim, you may want to seek legal advice regarding your rights to bring an action in court to challenge the denial. You also may want to contact the nearest office of the Department of Labors Employee Benefits Security Administration about your rights if you believe the plan failed to follow any of ERISAs requirements in handling your benefit claim.

Don’t Miss: How To Borrow Money From 401k Fidelity

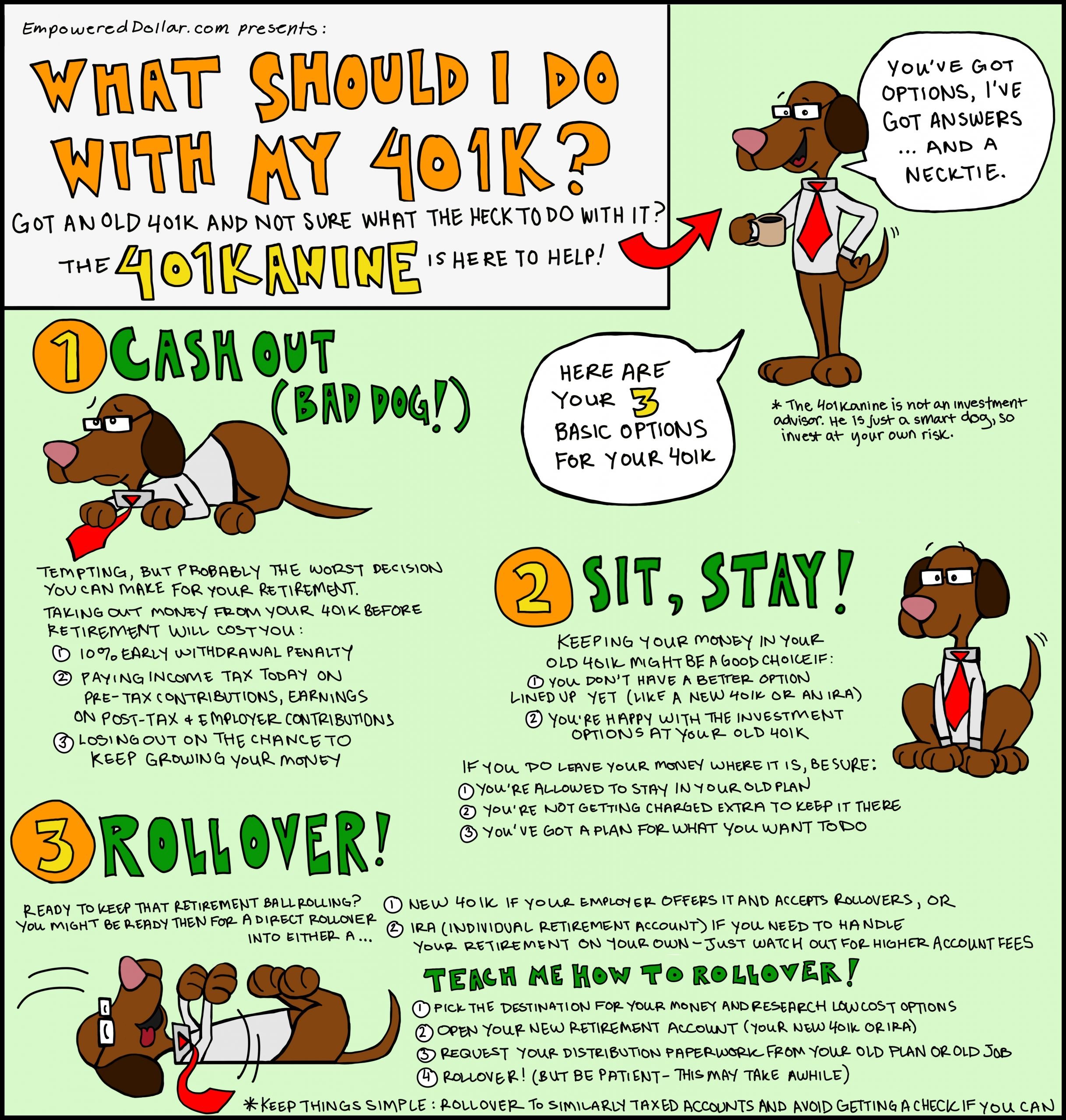

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Roll Your Money To An Ira

Transfer your money into an Individual Retirement Account .

- Your savings stay invested, with similar tax advantages

- You have access to a wide range of investment options

- You can roll in retirement savings from other jobs

- You can keep contributing money to the account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

Recommended Reading: How Often Can I Rollover 401k To Ira

Case : You Separated From An Employer

You may have separated from your employer because you were laid off, let go, or quit. Depending on the rules and features of the employer-sponsored retirement plan from your previous employer, you may have left your contributions untouched, cashed out your account, or completed a direct or indirect rollover. Depending on the option you selected, you may be paying penalties or taxes on the 401 withdrawal, and your 401 is taxable income. Here are the reporting repercussions for each one of these scenarios:

How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. That’s between 10% and 37% depending on your total taxable income.

In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

Don’t Miss: How Can I Get A Loan From My 401k

Are 401k Withdrawals Penalty Free In 2021

Although the initial provision for penalty-free 401 withdrawals expired at the end of 2020, the Consolidated Appropriations Act, 2021 provided a similar withdrawal exemption, allowing eligible individuals to take a qualified disaster distribution of up to $100,000 without being subject to the 10% penalty that would …

What You Need To Know To Avoid Costly Mistakes

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

Don’t Miss: Can You Transfer 401k To Another Company

Consider How You Make Charitable Gifts

If you are taking the standard deduction and you make charitable gifts, you might not be recognizing any income tax credit for those charitable gifts. There are a couple of ways that you can still give to your favorite charity while still receiving some tax benefit.

If you are over age 70½ you could consider a qualified charitable distribution QCDs are a direct transfer of money from an IRA to an eligible charitable organization. This is more commonly known as “IRA to charity.” To take advantage of this strategy, you must be 70½ and direct money from your IRA a qualified charitable organization. Talk with a TIAA financial professional or tax advisor to see if this might be a good strategy for you.