Roll Over An Ira To A : The Pros And Cons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

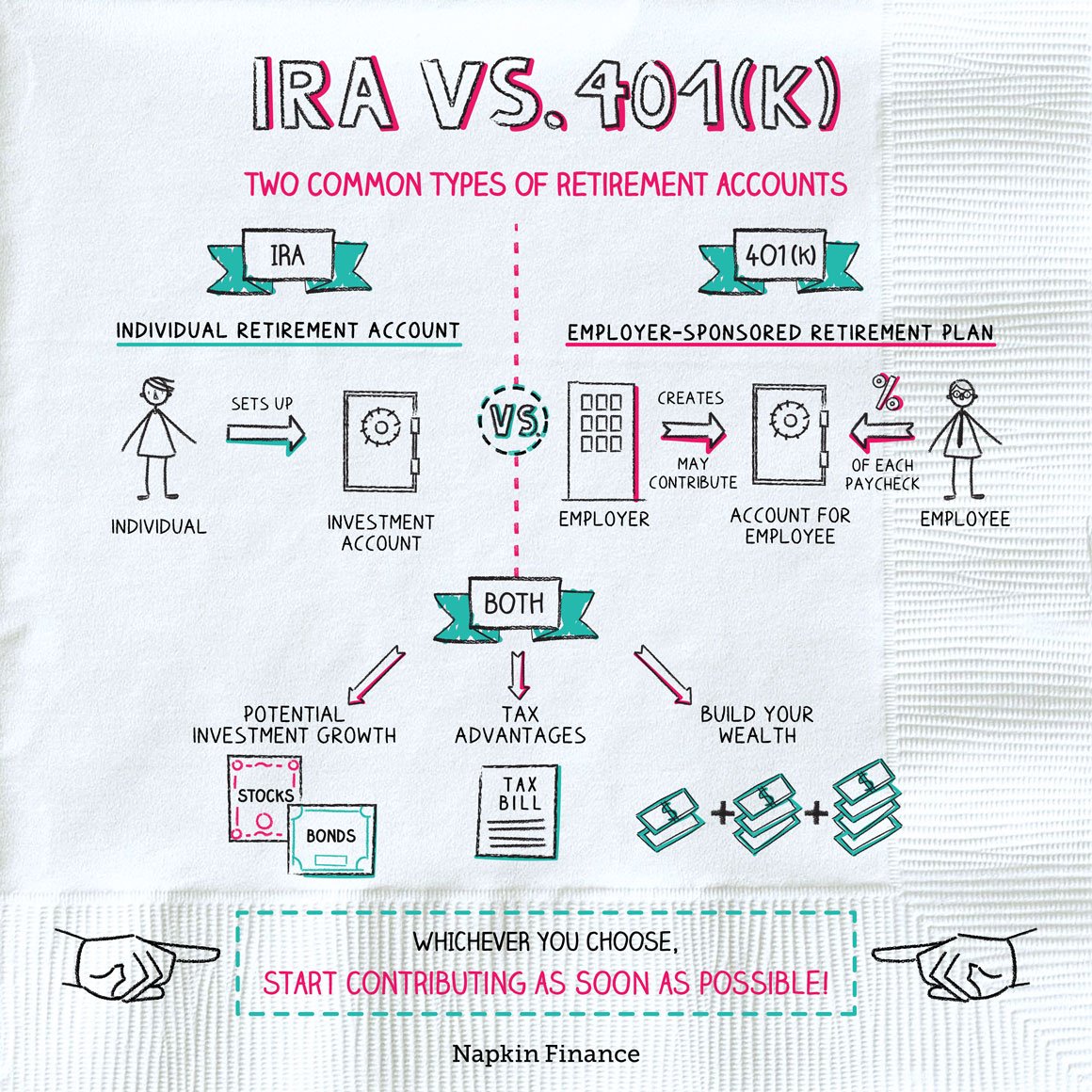

In the world of retirement account rollovers, theres one type that doesnt get much love: the IRA-to-401 maneuver, which allows you to roll pretax traditional IRA assets into a 401. Its frequently overshadowed by rollovers in the other direction 401 to a rollover IRA because theyre more common. But in some cases, this less common move is also worth considering.

Choose Your 401 Rollover Destination

Consider whether a traditional IRA or Roth IRA makes the most sense for your 401 rollover.

401 Rollover to Traditional IRA: If you want to maintain the same tax treatment, this can be a good choice, Henderson says. You avoid extra hassle, and you just see the same RMD and tax treatment as you would with your current 401.

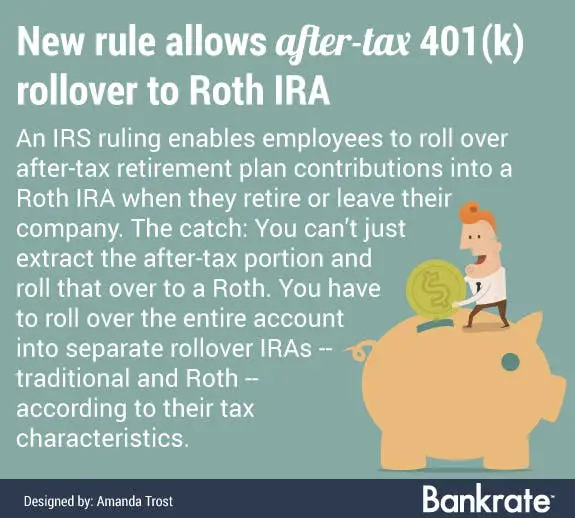

401 Rollover to Roth IRA: For those with high incomes, the 401 rollover to a Roth IRA can serve as a backdoor into a Roth tax treatment. But dont forget about the taxes, Henderson says. In addition, remember the five-year rule when it comes to Roth accounts: Even at 59 ½, you cannot take tax-free withdrawals of earnings unless your first contribution to a Roth account was at least five years before. Those close to retirement, therefore, may not benefit from this type of conversion. Talk to a tax professional if youre rolling into an account with different treatment, says Henderson.

Be Sure To Understand The Tax Consequences Before Making The Change

If you are considering leaving a job and have a 401 plan, then you need to stay on top of the various rollover options for your workplace retirement account. One of those options is rolling over a traditional 401 into a Roth individual retirement account . This can be a very attractive option, especially if your future earnings will be high enough to knock into the ceiling placed on Roth account contributions by the Internal Revenue Service .

Regardless of the size of your earnings, you need to do the rollover strictly by the rules to avoid an unexpected tax burden. Since you havent paid income taxes on that money in your traditional 401 account, you will owe taxes on the money for the year when you roll it over into a Roth IRA. Read on to see how it works and how you can minimize the tax bite.

You May Like: What Age Is Retirement For 401k

What Happens If I Cash Out My 401

If you simply cash out your 401 account, you’ll owe income tax on the money. In addition, you’ll generally owe a 10% early withdrawal penalty if you’re under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

Keeping The Current 401 Plan

If your former employer allows you to keep your funds in its 401 after you leave, this may be a good option, but only in certain situations. The primary one is if your new employer doesn’t offer a 401 or offers one that’s less substantially less advantageous. For example, if the old plan has investment options you cant get through a new plan.

Additional advantages to keeping your 401 with your former employer include:

- Maintaining performance:If your 401 plan account has done well for you, substantially outperforming the markets over time, then stick with a winner. The funds are obviously doing something right.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think you’ll start withdrawing funds before turning 59½ the withdrawals will be penalty-free.

- Legal protection: In case of bankruptcy or lawsuits, 401s are subject to protection from creditors by federal law. IRAs are less well-shielded it depends on state laws.

You might want to stick to the old plan, too, if you’re self-employed. It’s certainly the path of least resistance. But bear in mind, your investment options with the 401 are more limited than in an IRA, cumbersome as it might be to set one up.

Some things to consider when leaving a 401 at a previous employer:

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 does protect up to $1.25 million in traditional or Roth IRA assets against bankruptcy. But protection against other types of judgments varies.

Don’t Miss: Can You Pull Money Out Of 401k

Transfer Of A 401 To An Ira To An Rrsp

If your 401 plan isnt eligible for a rollover directly to an RRSP , it can be rolled into an IRA that qualifies for a transfer to an RRSP. Subsequent to this, the new IRA can be transferred to an RRSP on a tax-deferred basis provided the conditions required for a transfer from an IRA to an RRSP, as outlined above, are satisfied.

Select An Ira Partner Institution

The first step is to decide where you wish to invest the money. Since this will be a long-term partnership likely lasting through your golden years, you must consider several factors, including:

- Ease of transfer: Your new IRA partner institution must make the rollover process simple, easy and transparent.

- Depth and breadth of investment options: Check out the list of investment vehicles offered by the institution. Look for a partner that offers a wide variety of investments, including mutual funds, ETFs, stocks, bonds, foreign investments, options and futures.

- Fees and commissions: These levies can substantially drag down the performance of your IRA investments, especially if you opt for a self-directed account. Higher commissions can even undermine savings from a no or low-fee account.

- Trading platform: Evaluate each partners trading platform carefully, before making a rollover decision. User-friendly, helpful tools and analytics and knowledgeable and available help staff are key things to consider.

TD Ameritrade, Ally Invest and E-Trade, all have discount brokerage platforms that support IRA accounts. You can get additional information on the best individual retirement accounts. You can compare them below:

You May Like: Should I Convert My 401k To A Roth Ira Calculator

Benefits Of Converting A 401 To A Roth Ira

- Youll lock in a zero future tax liability. By voluntarily converting your 401 to a Roth IRA now, youll pay taxes now, but youll also give your money an opportunity to grow completely unrestrained by taxes for the rest of your life.

- IRAs tend to be more flexible. Since an IRA is an independent retirement account, you dont necessarily have to be in any sort of formal employment relationship to open one Money in an IRA is free of the common restraints that typically come with the standard 401 plan youll find at your employer.

- Youll be free to invest in what you want. Most 401 plans have set investment menus that youll need to choose from with IRAs, youll have significantly more choice in terms of how you can invest your money.

There are also some major costs involved with converting your 401 to a Roth IRA.

Pros Of A Tsp Rollover

You May Like: How To Start A 401k For Employees

Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

We Tell You When It Makes Sense To Move Your 401 Account To An Ira And When Its Smart To Stay Put

www.peopleimages.com

When you leave a job, you pack up your family photos, the spare pair of dress shoes stashed under your desk, your I Love My Corgi coffee mug and all your other personal items. But what do you do with your 401 plan?

Most people roll the money over to an IRA because they gain access to more investment options and have more control over the account. Some brokerage firms sweeten the deal with cash incentives. TD Ameritrade, for example, offers bonuses ranging from $100 to $2,500 when you roll over your 401 to one of its IRAs, depending on the amount. Plus, moving your money to an IRA could help you streamline your investments. Amy Thomas, a 43-year-old clinical trial coordinator in Lakewood, Colo., has rolled over 401 plans from three former employers into one place, which makes everything a lot easier, she says. Now she doesnt worry that shell lose track of an account that might have been left behind.

Also Check: Can You Start Your Own 401k

Also Check: How Much Can You Put Into 401k Per Year

Transferring Money From A Roth 401 To A Bank Account

If you are taking a qualified distribution from a Roth 401, the IRS requires that participants must have contributed to the plan for at least five years, and have attained age 59 ý. To make a withdrawal, send a request to the 401 plan custodian, and choose to be paid via check or direct deposit. Roth 401 withdrawals can take seven to 10 days.

Also Check: How To Get Money From 401k Before Retirement

If You Have Company Stock

Some retirement savers hold company stock in their 401 alongside other investments. In that situation, if you roll over all those assets to an IRA, you lose the potential to get a more favorable tax treatment on any growth those shares had while in your 401.

It gets a bit confusing, but the idea is that if the company stock has unrealized gains, you transfer it to a brokerage account instead of rolling it over to the IRA along with your other 401 assets. Upon transferring, you are taxed on the cost basis .

However, when you then sell the shares from your brokerage account whether immediately or down the road any growth the stock experienced inside the 401 would be taxed at long-term capital gains rates . This could be less than the ordinary-income tax treatment you’d face if the stock went into a rollover IRA and then were withdrawn.

Here’s an example: If the cost basis of your company stock is $10,000 and the gains on it were $20,000, you would pay ordinary taxes on the $10,000 when you transfer the shares to a brokerage account.

The $20,000 in gains, however, would be taxed at long-term rates once the stock is sold. Any further growth from the point of transfer to sale would be taxed as either short- or long-term gains, depending on how long you held it before selling.

“It’s a complex transaction, and if done incorrectly, the strategy loses its tax advantage,” said CFP Melissa Brennan, a financial planner with ARS Private Wealth in Houston.

You May Like: How To Withdraw From 401k

Disadvantages Of Rolling An Ira Over Into A 401

As with every investment decision, there are also some potential drawbacks to moving your IRA assets into a 401:

Limited investment options. One of the advantages of an IRA is that you can invest in nearly everything. But 401 accounts, in contrast, are often much more limited. Some company 401 accounts only allow you to invest in a few mutual funds, for instance, or encourage you to invest in company stock.

In certain circumstances, it can be easier to access IRA funds than those held in a 401. Though IRAs dont allow you to take out emergency loans, there are some loopholes that allow early distributions without penalty for higher education expenses and a first-time home purchase .

Low-cost investment advice. If your 401 plan doesnt come with investment advice and you want help with that, many IRAs offer help with investment selectionas long as you dont mind working with a robo-advisor. A financial advisor can also help you manage investments in a 401, of course, but this could be of limited use considering the small, curated investment selection thats typical of a 401.

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover, and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Also Check: Can You Move 401k To Roth Ira

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but you’ll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

What Are The Disadvantages Of Rolling Over A 401 To An Ira

Although it could potentially be a good idea to roll over a 401 to an IRA, depending on your situation, there are a couple of drawbacks to keep in mind:

- Loans: You typically cannot take loans from IRAs like you can with 401 plans, so youll likely lose that option when you transfer your account.

- Cost: Because of your employers group buying power, you could potentially have access to lower-cost investment funds with your 401 than your IRA.

You May Like: How To Calculate Roth 401k Contribution

How Do I Transfer From An Active 401k With A Current Employer

- Contact your 401k administrator.

- Transfer part of your 401k to a Qualified Retirement Plan

- Explain that you are not taking a distribution you simply want to transfer part or all of the 401k funds to a qualified plan.

Expect some resistance 401k trustees get paid based on the number of dollars they have under management. Hence, they seek to avoid letting go of money. You may have to ask more than one person and you may need to ask more than one time.

If you get resistance from your current 401k trustee here are a few other points you may want to make when you speak with them.

- Let them know if you are over age 59½.

- Let them know if any of the funds in the 401k are funds you transferred in from another job you had.

- Ask if they would transfer only the funds you contributed to your plan.

If your 401k trustee will allow a transfer we suggest you start your new IRA before you begin the transfer. That will allow the transfer to move directly from the 401k to the new IRA account smoothly.

For information about the Self Directed IRA or Solo 401k, call IRA Club at 312-795-0988

IRA Club offers no investments, products, or planning services. Therefore, please consult your attorney, tax professional, financial planner, and any other qualified person before making any investments.