A Plan For Stabilizing Your 401 Retirement Savings

To do well and endure the economic storm that has apparently been unleashed on the markets and funds that 401 savings are invested in, you must make some decisions about how your funds will be invested in both the short- and long-term. It would be prudent to develop a strategy for overcoming the time-consuming challenges linked with analyzing and changing your savings rate or method.

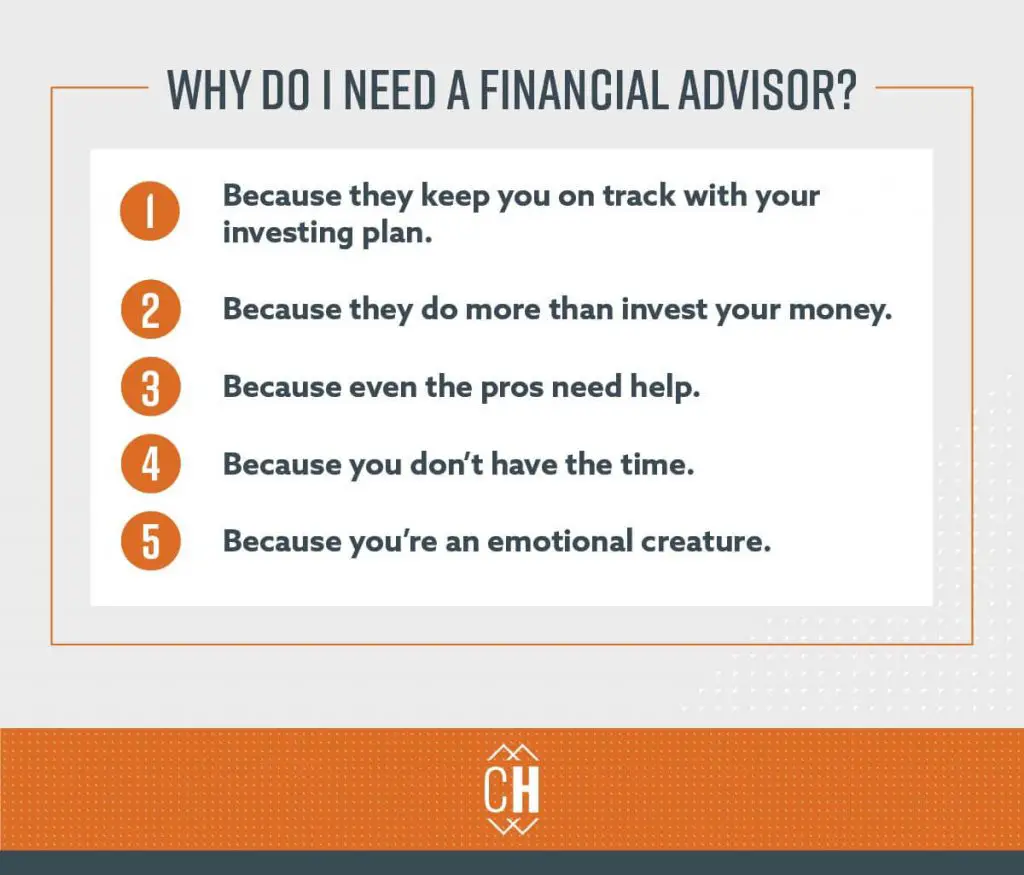

Do I Need A Financial Advisor For My 401k

A 401 is a retirement plan that allows employees to set aside a portion of their pre-tax earnings . This payroll deferral money can be invested in a variety of investment funds within the 401k plan, and the earnings on the investments are not taxed until the employee withdraws their money . Employers may also match employee contributions to the plan up to a certain amount. For example, an employer may contribute 50 cents for every dollar an employee contributes up to the first 6% of the employees salary. This would mean if the employee contributed 6%, then the employer would add 3%, for a total annual contribution of 9% of pay toward the employees retirement account.

401 accounts are for retirement savings and need to have risks managed appropriately. These accounts generally need to be invested in broadly diversified investments to reduce the risk of a substantial loss . Broad categories such as large US stocks or fixed income are offered through well diversified investment choices in a 401k plan. For this reason, many 401 accounts are managed and run by large, well-known financial services advisory companies such as Fidelity Investments, the Vanguard Group, or other large mutual fund complexes.

This is when we ask an important question:

Should I use a financial advisor or choose my 401k plan investments by myself?

How 401 Plan Advisors Get Paid

401 plan advisors get paid one of two ways:

- Direct payment from the employer

- Direct or indirect payments out of plan assets

When employers pay for financial advisors, they typically write a check annually or quarterly. The fee may be based on services provided, or it may be calculated as a percentage of investment assets.

When employees pay for financial advisors, the fee may be paid as either a flat fee for services or an asset based fee. With flat fees, employees see a fee deducted from their account periodically .

Asset based fees come out of employee investments, and they may or may not be visible to employees as transactions in their accounts. Depending on the financial advisor, recordkeeper, and other vendors, payments may transparently appear as a line-item transaction. Other payments go to the advisor indirectly through the investment provider or recordkeeper. Indirect fees are baked into investment expenses .

Also Check: How To Buy A House With 401k

When Is It Time To Fire Or Replace Your 401 Advisor

Basically, if you currently have a 401 advisor and you get help with none or a minimal aspect of what we discussed today, its time to break up!

If your participation rate has not improved since your 401 advisor started working with your plan, its time to break up!

If your 401 is never available for you, its time to break up!

Lastly, if your 401 advisor refuses to review your plans metrics on a regular basis, especially if it has to do with the fees being too high, its definitely time to break up.

What Is A 401

A 401 is a workplace retirement account that allows workers to save automatically through payroll deductions. Annual contributions are limited to $20,500 with an extra $6,500 allowed for workers age 50 and over. Traditional 401 plan contributions are pre-tax, but the introduction of Roth 401 plans enable post-tax contributions as well.

One of the primary benefits of a 401 is the potential for employer matching contributions. The company contributes a matching contribution based on how much you contribute each pay period. An example of a matching contribution is 50% up to 6%, which means that a company will contribute $0.50 for every dollar that you contribute up to 6% of your eligible compensation. In other words, if you contribute 6%, the company will contribute 3%.

Also Check: What To Do With 401k When You Quit Your Job

Does The Company You Work For Sell Investment Products/funds

Sometimes, an advisor selling you their companys branded products/funds can be the best option for you and your situation. However, an advisor who works for a bank, brokerage firm, or insurance company is typically first and foremost required to sell you their employers products/funds whether they are the best choice for you or not.

Florida Financial Advisors is an independent advisory firm that does not manufacture or sell any Florida Financial Advisors branded products or funds.

Roth 401 is one of the 401K investment options that put you in control of your retirement plan contributions. Learn more about Roth 401K plan and determine if it is right for you with our FREE Guide to Your Roth 401.

Is It Worth Having A Financial Advisor

A financial advisor can be a great resource to have in your corner. They can help you navigate the complex world of investing, and help you plan for your future. However, the financial advisor is not a necessity. If you are interested in investing, and commit enough energy to your plans, you can do it yourself. The basics of investing are not hard to understand.

- Risk-reward relationship: You need to understand that the risk-reward relationship is directly proportional. Generally, the higher the risks, the higher the rewards. And, of course, the lower the risks, the lower the rewards. And there are always exceptions!

- Risk appetite: You need to know/understand your own risk appetite. Are you risk averse or a risk seeker? Risk averse investors usually adopt a low-risk strategy whereas risk seeking investors go for a higher risk approach.

- Time horizon: Investments should always be bound by time. You should know whether your investments are short term or for the long term . These different time horizons should have different investment strategies.

Read Also: How Can I Find My 401k

Registered Investment Advisers: Fiduciary Services With Employer And Employee Support

Fisher Investments 401 Solutions fits into the final category of 401 adviser: National registered investment advisers who focus strictly on 401. We specialize only in providing 401 services to small to mid-sized employers and their employees, which means we have no other financial products to upsell. Because were independent, our plans are not sold by brokers or other advisers, which means registered investment advisers like Fisher may not have been included in any adviser reviews youve performed in the past.

Level of Service

Registered investment advisers who specialize in 401 support build their entire business around helping companies manage 401 plans. Our Retirement Counselors and 401 Service Team are fully dedicated to serving 401 plan managers, offering a direct approach to everything from customizing plans to investment selection and monitoring.

401 flexibility: Our first priority is helping you and your employees meet your retirement goals. That means we offer a wide variety of plan types and options to help fit to your exact needs rather than offering standardized options.

Dedicated employee support: Our retirement specialists work with your employees on-site during enrollment, and offer one-on-one meetings with any participants who want help aligning their savings and investment strategies with their unique goals for retirement.

Fiduciary Protection

Fisher takes on full 3 fiduciary liability for selecting and monitoring funds in your plan.

What Are The Duties Of A Financial Advisor

A financial advisor should guide you on six key areas:

1. Analyze cash flow and expenses: No financial plan will work if you lack a healthy balance between your incoming cash flow and your expenses. A financial advisor should review your monthly and annual income and expenses to understand the foundation of your financial life.

2. Craft an investment plan: Your savings and investments need to be appropriate for your situation and aligned with your risk tolerance and your goals.

3. Forecast a retirement plan: A comprehensive retirement plan includes your investments in retirement savings accounts such as 401s and individual retirement accounts , tax planning, and information on when and where you plan to retire.

4. Build a college savings plan: Planning for children’s college educations is frequently part of financial planning for parents and even grandparents due to the rising costs of higher education.

5. Match your insurance needs with your coverage: As part of managing risk, financial planning should include prudent levels of insurance for your real estate and possessions, and life insurance.

6. Quarterback an estate planning process: You should have a plan for your estate assets and choose the beneficiaries you want to receive them. Building a comprehensive estate plan takes specialized knowledge. Many financial advisors aren’t estate plan lawyers. But they can help connect you with one.

Also Check: How To Select 401k Investments

Studying Advisor Fees Within The Context Of A Bundled 401 Arrangement

All 401 plans require three basic administration services asset custody, participant recordkeeping and Third-Party Administration . Employee Fiduciary provides all of them. Financial advisors ally with service providers like Employee Fiduciary to offer a bundled 401 solution to employers.

When evaluating the fees charged by a 401 financial advisor, employers should do so within the context of the total fees charged under the bundled arrangement. By adding financial advisor fees from the prior table to Employee Fiduciary fees, average total plan fees can be determined.

|

Plan Asset Range |

|

0.72% |

*Based on average assets and participants.

These figures do not include investment expense ratios. That said, most of the financial advisors that partner with Employee Fiduciary use low cost investments like index funds and ETFs in their fund menus. The average expense ratio of a menu using these funds can be as low as 0.10% of plan assets.

Downsides Of Having An Advisor For Your 401

While financial advisors can benefit your 401 investing strategy, there may be downsides as well. Here are a few of the concerns to keep in mind when considering hiring an advisor:

- You must implement the strategy. While a financial advisor can provide financial advice, you must be the one to implement the strategy because they do not have access to your 401 account. Plus, youll need to provide copies of your statements so they can monitor progress.

- How do they get paid? Many financial advisors get paid based on a flat fee, as a percentage of assets managed or commissions off products they sell. A 401 plan will not pay your financial advisor for their advice, so how will they get paid? Because they arent paid from the investments, you may need to pay them directly for their services. Some advisors are willing to include your 401 plan into your overall financial planning based on the potential of a future rollover when you leave your current job.

- Investment options are limited. Because your investment options are limited within a 401, the potential benefit of a financial advisor may be limited as well. Their ability to suggest alternative investments or allocations may not change your 401 performance enough to offset fees that they charge.

You May Like: What Is The Average Management Fee For A 401k

Questions To Ask Your Financial Advisor If Their Services Are Fee

You need to understand how your advisor gets paid. Your advisor may be fee-based or fee-only. Fee-only financial advisors are directly paid by clients. The fees may be hourly, yearly or a percentage of assets managed. They do not receive a commission for the financial products they recommend. Fee-based advisors take client fees but also receive payment from other sources like receiving a commission from financial products their client purchases. This can lead to a conflict of interest.

You May Like: How To Find 401k Account Number

The Business Owners Personal Wealth Manager

Youll probably find that most 401 financial advisors on the marketplace fit into the first category: the person who also manages the business owners personal wealth.

These individuals provide very basic 401 advising as a favor or value-added service to the business owner.

Very Basic 401 Advising normally consists of…

1. Picking the Plans Fund Lineup

They do not, however, take any fiduciary liability for their selections. Its also not uncommon for wealth managers to favor mutual funds that provide them with kickbacks – such as the notorious 12b-1 fee fund sales commission and something were not huge fans of).

2. Occasionally Checking In

The quarterly check-in is a classic feature of a personal wealth manager acting as a 401 advisor. This may be in the form of a phone call or on-site visit, but it rarely happens more than a few times a year.

Oftentimes theres a fairly close personal relationship between the business owner and their wealth manager, and much of the information and decision-making happens in this context. This might be good for trust with the business owner, but its pretty poor for transparency.

You May Like: When To Convert 401k To Roth Ira

What Is The Difference Between A Wealth Manager And A Financial Advisor

The key difference is that a wealth manager is largely tasked with preserving and growing existing assets and wealth, while a financial advisor is concerned with managing day-to-day finances and investments, as well as achieving long-term goals. Sometimes, the same professional may be able to provide both wealth management and financial advisory services. Other times, a specialist will focus on just one aspect.

What Has Your 401 Plan Advisor Done For You Lately

Shutterstock

In the world of corporate retirement plans, change can be difficult for plan sponsors. Once a 401 is in place, its common for it to remain untouched for five or even 10 years. Plan advisors will check in once a quarter and, if everything seems fine, they assume there is no need for review.

However, as a Certified 401 Professional and co-founder at Twelve Points Retirement Advisors in Boston, Massachusetts, Ive noticed that when I ask plan sponsors a couple of key questions, they start to see things may not be going as well as they thought.

For every 10 plan sponsors we talk to, only one says they are extremely satisfied with their plan and everything is running smoothly. The other nine all have some sort of issue.

Plan sponsors tell me things like:

Their current advisor mostly manages personal money but does not have expertise in 401 plans.

Their current advisor is not acting as a fiduciary.

Employees are not receiving the education they need to make informed decisions about the plan.

The lack of thorough service by plan advisors of 401s is not sitting well with plan sponsors. A 2017 article by the National Association of Plan Advisors points out that, in an annual Plan Sponsor Attitudes survey, 38% of sponsors are looking to switch advisors, up from 30% in 2016 and 9% in 2013.

Advisor complacency, coupled with a need for more knowledgeable advisors, is prompting the switch.

Fiduciary Responsibilities

Employee Education

Recommended Reading: How Do I Start A 401k For Myself

Advisor: Your Guide To Hire A 401 Advisor In 2021

June 15, 2021 | General

401 advisor hiring guide

A 401 advisor can be hard to find. As business owners, you want help creating and managing a 401 because you are already extremely busy and you likely dont want to devote additional time to a retirement plan.

Although there are fewer and fewer advisors wanting to handle 401 plans every year because the laws protecting employees continue to get more strict. I personally think this is fantastic!! If the plan is for the benefit of employees, a 401 advisor should be there to help ensure its a good plan for all.

That being said, 401s are a whole other beast. If you are a business owner who has attempted to set up a 401, you know this to be true.

If you are in California, CalSavers new law might have you looking for alternatives and you are just starting to get your feet wet in this world of 401s.

Wherever you are in the spectrum of knowledge or experience, this article will help you have a much better understanding of what a 401 advisor can help you do, where to find one and when it might be time to break up with your current 401 advisor.

Fee Study: How Much Does A Fiduciary

Eric Droblyen

When a business owner needs help picking investments for their 401 plan, my advice to them is always the same hire a fiduciary-grade 401 financial advisor. The reason only advisors bound by a fiduciary standard of care have a legal obligation to give impartial investment advice to their clients. In contrast, its perfectly legal for non-fiduciary advisors who are bound by a lesser suitability standard to give conflicted advice by steering their clients towards high-commission investments when lower-cost alternatives exist. In general, fiduciary-grade 401 advisors include investment advisers, but not brokers and insurance agents.

The irony? Even though fiduciary-grade 401 financial advisors are bound by a higher standard of care than non-fiduciaries, their investment advice often costs less. Dont take my word for it. Check out our latest fee study of fiduciary-grade 401 advisors.

Recommended Reading: How To Move 401k To New Job

Paying Your Financial Advisor

Getting quality advice isnt free, and a professional financial planner will cost you money. Some planners charge by the hour or have a set rate for certain services. This is called fee-based or fee-only planning. Some are compensated by a commission every time they make a transaction or sell you a product. Some get paid in both ways.

Fee-based advisors often claim that their advice is superior because it carries no conflict of interest, as commission-based recommendations might. In response, commission-based advisors argue that their services are less expensive than paying fees that can run as high as $100 per hour or moreand that youre paying for demonstrated services and activities, not just amorphous advice or untraceable work hours.