The Costs Of Early 401k Withdrawals

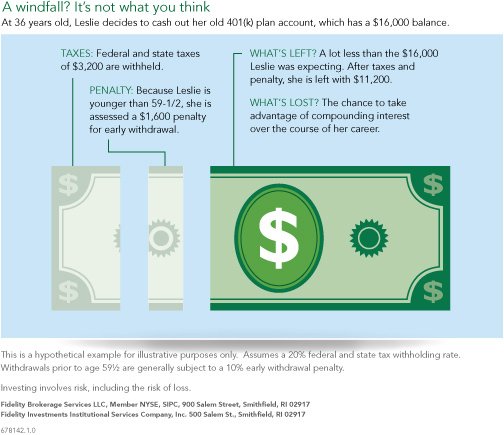

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Tapping Your 401 Early

If you need money but are trying to avoid high-interest credit cards or loans, an early withdrawal from your 401 plan is a possibility. However, before you consider this option, be forewarned that there are often tax consequences for doing so.

If you understand the impact it will have on your finances and would like to continue with an early withdrawal, there are two ways to go about it cashing out or taking a loan. But how do you know which is right for you? And what are the tax consequences you should be expecting?

Dont Miss: What Is The Minimum 401k Distribution

Retirement Funds Don’t Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Also Check: How To Roll Over 403b To 401k

You Can Only Withdraw From Your Current 401

Penalty-free early withdrawals are limited to funds held in your most recent companys 401 or 403 under the rule of 55.

Even if youre 55 or older, you cant reach back to old 401s and use that money, says Luber. Additionally, this rule doesnt apply to individual retirement accounts , so you need to leave your IRA alone if you want to avoid the penalty.

If youre actively planning how to retire early, Roger Whitney, certified financial planner and host of the Retirement Answer Man Show, suggests rolling retirement funds from old jobs and other retirement accounts into your current 401 before you leave. This way, you can get access to they money with the rule of 55.

Purchasing Your First Home

You can use your 401 money to buy a house. But you will pay a 10% penalty.

You can take money from your IRA without a penalty. You do not have to be a first-time home buyer, but you cannot buy another house if youve owned a home in the last two years. You can take more than one withdrawal for a home, but there is a $10,000 limit over a lifetime.

You May Like: Can I Start A 401k For My Child

Roth 401 Or Roth Ira Conversion

Since you can withdraw from your Roth account without a penalty at any time, you might consider converting your Traditional 401 to a Roth account. You might even have the option to rollover to a Roth IRA, but there are some differences between an IRA and 401. You should check with your plan administrator to make sure this is allowed. Also note that you will be required to pay income taxes when you make the conversion. Since you contribute to a traditional plan with pre-tax dollars and contributions to a Roth plan are with after-tax dollars, you will have to go ahead and pay taxes on those dollars when you perform the conversion. Make sure you have enough cash on hand to cover those taxes. Once the conversion is complete, you will be free to make a withdrawal from your Roth account without any associated penalties.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Read Also: Can I Open A 401k On My Own

Do You Get Taxed On 401k After 65

Your tax depends on how much you withdraw and how much other income you have. … The amount of a 401k or IRA distribution tax will depend on your marginal tax rate for the tax year, as set forth below the tax rate on a 401k at age 65 or any other age above 59 1/2 is the same as your regular income tax rate.

Avoid The 401 Early Withdrawal Penalty

While the age for avoiding the penalty is normally 59 1/2, there is an exception to the age rule. If you leave a job or are terminated at age 55 or later, then you can make withdrawals from your account with that employer without paying the penalty. Make sure that you do not make withdrawals from any other plans you might have as those will still be subject to the penalty.

Likewise, remember that there are even heavier penalties for missing required minimum distributions . Upon reaching age 72, you are required to withdraw certain amounts from your account. If you fail to make the withdrawal, then you will receive a penalty of 50% of the amount of the required distribution. Suppose you were required to withdraw $8,000 from your 401. If you miss that distribution, then you will owe $4,000 in the penalty alone!

Read Also: How To Keep Your 401k In A Divorce

Penalties For Withdrawing Money From Your 401 Early

A 401 plan can play a key role in your retirement income, especially if you resist the urge to withdraw from it early . However, you may need a lump sum of cash at some point in your life – such as to cover a medical emergency or the down payment on a house.

While an early 401 withdrawal can help in those situations, it often comes with a hefty cost. Make sure you know the consequences first.

It’s never too early to start planning for retirement. Get started today by creating a free online dashboard to track your progress.

If you’re still considering withdrawing from your 401 early, here’s what you should know about the penalty tax.

Do You Pay State Taxes On 401k Withdrawals

Because payments received from your 401 account are considered income and taxed at the federal level, you must also pay state income taxes on the funds. The only exception occurs in states without an income tax. Your 401 plan may offer you the opportunity to have taxes automatically withheld from a withdrawal.

Also Check: Can I Create My Own 401k Plan

Don’t Withdraw Money From Your 401 Without Reading This

A 401 is a tax-advantaged retirement account you can contribute to with pre-tax money. Contributions are usually deducted directly from your paycheck.

Because investing for retirement via a 401 plan confers tax advantages, some restrictions are associated with 401 withdrawals. If you withdraw funds before reaching age 59 1/2, then you may face early withdrawal penalties.

Here’s what you need to know about how withdrawing money from a 401 works — including how much early withdrawals can cost you and which circumstances qualify you for a penalty exemption.

How To Use Rule Of 55 To Fund An Early Retirement

If youre thinking about early retirement then chances are that youll need to take early withdrawals from your retirement account in order to fund your life. Retiring early means you wont have access to Social Security benefits so youll need to not only pay for your living expenses but also some added expenses like more expensive health insurance. Unless you have a lot of money sitting around in savings and checking accounts, you may want to consider using the rule of 55 to take early withdrawals.

There are a few rules that you need to comply with in order to qualify for these withdrawals. Those rules are:

- Age of Retirement: You must leave your job after turning 55, or the calendar year of. This reduces to the age of 50 if youre a public service employee. You cannot retire earlier and then take withdrawals or the rule of 55 doesnt work.

- Work: You must leave your job to start taking withdrawals but you can return to work later. You arent locked into retiring forever.

- Retirement Account: You can only withdraw funds from your most recent 401 or 403 account for the rule of 55 to work.

If you meet the requirements for all of these rules then the rule of 55 might be a good fit for you in order to avoid paying the early withdrawal penalty. In order to start taking these withdrawals, youll just have to prove that you qualify for the plan administrator. Its important, though, that you plan the timing of those withdrawals effectively.

Recommended Reading: How To Get Your 401k From Walmart

What Happens To My 401k If I Quit My Job

If you leave a job, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. … If you decide to roll over your money to an IRA, you can use any financial institution you choose you are not required to keep the money with the company that was holding your 401.

Its Better Than Falling Behind On Your Bills

Sometimes, you just dont have a better option. If a 401 withdrawal is the only way that you can pay your bills without taking on costly credit card debt, do it. Leaving your retirement savings alone isnt worth it if it threatens your current financial security and your ability to save more for retirement in the future.

Only withdraw as much as you need and keep seeking out alternative sources of funding. Look for a new job if youve lost yours, start a side hustle, or consider applying for a personal loan with a reasonable interest rate.

Read Also: How To Check 401k Balance Fidelity

You May Like: Does Max 401k Contribution Include Employer Match

Roth Ira Hardship Withdrawals

If turning to your retirement savings is your last resort and you have a Roth IRA, this is the account you may want to consider tapping into first. The contributions you make into these accounts are taxed before they go in. So the IRS cant tax your contributions twice.

You can withdraw your contributions from a Roth IRA at any time without penalty. So if your Roth IRA contributions have been large enough to cover your financial burden, it might make sense to withdraw these first. Again, not the best financial decision. But as a last resort, youd at least avoid taxes and penalties.

However, its important to keep in mind were talking about contributions here.

This is the money you put into these accounts via automatic paycheck deduction or a bank transfer you initiated. This is separate from the earnings your contributions make from investment funds, interest, dividends or any other source.

The IRS doesnt permit you to withdraw any investment earnings on your contributions tax-free unless you meet two requirements. First, you have to be at least 59.5-years-old. Second, your account must have been open for at least five years. You must meet both stipulations before you can make tax-free qualified withdrawals from a Roth IRA.

Its also important to note that while you can withdraw your own contributions from a Roth IRA at any time, this is not the case with a Roth 401.

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer.

You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal, but you can only do this from a current 401 account that’s held by your employer. You can’t take loans out on older 401 accounts.

You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company, but these plans must accept these types of rollovers.

Read Also: How To Set Up A Solo Roth 401k

Age 72 And Over: Required Minimum Withdrawals Are Mandatory

Once you turn 72, you must start taking annual Required Minimum Distributions from your Traditional IRA. Your first RMD must be taken by April 1 of the year following the year you reach age 72. Every year thereafter you must take an RMD by December 31. The amount of your RMD is calculated by dividing the value of your Traditional IRA by a life expectancy factor, as determined by the IRS. You can always withdraw more than the RMD, but remember that all distributions are taxed as income. If you dont make withdrawals, youll have to pay a 50% penalty on the amount you shouldve withdrawn. Learn more about RMDs.

Can You Take Money Out Of Your 401k Without Being Penalized

The CARES Act allows individuals to withdraw up to $ 100,000 from a 401k or IRA account without penalty. Early withdrawals are added to the participants taxable income and taxed at ordinary income tax rates.

Can you withdraw from 401k without being taxed?

Withdrawals of contributions and earnings are not taxed until the distribution is deemed qualified by the IRS: The account is held for five years or more and the distribution is: Cause of disability or death. At the age of 59½ or later

Also Check: How To Get The Money From Your 401k

What States Do Not Tax 401k Withdrawals

Nine of those states that don’t tax retirement plan income simply have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. The remaining three Illinois, Mississippi and Pennsylvania don’t tax distributions from 401 plans, IRAs or pensions.

Reasons You Can Withdraw From 401k Without A Penalty Include

Recommended Reading: How To Find Missing 401k Money

Do You Pay Taxes On 401k After Age 65

Tax on a 401k Withdrawal after 65 Miscellaneous Whatever you take from your 401k account is a taxable income, as would a regular regular payment when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on retirees.

How old can you get your 401k without paying taxes? After you turn 59, you can withdraw your money without having to pay an early retirement penalty. You can choose a traditional plan or Roth 401 . The traditional 401 offers deferred tax savings, but you still have to pay taxes when you take the money.

Which Is Right For You

For many, 401 loans are a better option than early withdrawals. After all, as long as you pay the money back during the required time period, you won’t have to pay taxes on the amount withdrawn. Plus, the interest you’ll pay is added to your own retirement account balance.

However, there are several reasons to think twice before taking out a 401 loan.

For example, if you left your job in December of 2022 and had a $2,000 outstanding balance on your loan, you would have until to repay $2,000 in full.

- If you’re not able to repay the loan, your employer will treat the unpaid balance as a distribution.

- Typically, it will be considered taxable income and subject to the 10% early withdrawal penalty.

Ideally, you want to leave your 401 alone until retirement. However, if you find yourself in a really tough spot, borrowing from your 401 might be a better option than simply cashing out your balance. Just make sure you understand the potential consequences and do what you can to repay the balance quickly so you can start rebuilding your retirement nest egg.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Read Also: How To Transfer A 401k Account