Plan Sponsor Versus Plan Administrator

Its important to understand your role as a plan sponsor or administrator. A plan sponsor is any company, union or other institution that sets up a retirement plan, such as a 401 or 403, for the benefit of the organizations employees, while more strictly speaking, a plan administrator is responsible for directing and planning the day-to-day operations and the strategic decisions involved with a groups retirement plan. ERISA requires that the plan sponsor formally identify someone as plan administrator or the named fiduciary acting on behalf of the plan sponsor.

In other words, a plan sponsor is the designated employer responsible for all stages of designing, implementing, amending and terminating the group plan, while the plan administrator oversees its functioning. One major difference between a sponsor and administrator is that plan administration is often outsourced to another individual or firm with more specialized investment or management expertise. While the plan sponsor can never eliminate its fiduciary responsibilities, it can outsource them to co-fiduciaries as plan administrator under ERISA Section 3 and investment advisor under 3 or 3 .

However, the same party may serve as both plan administrator and plan sponsor. Under these circumstances, the plan sponsor has additional fiduciary responsibilities, meaning they hold higher professional standards of duty.

Safe Harbor 401 Plans

A safe harbor 401 plan is similar to a traditional 401 plan, but, among other things, it must provide for employer contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees, regardless of whether they make elective deferrals. The safe harbor 401 plan is not subject to the complex annual nondiscrimination tests that apply to traditional 401 plans.

Safe harbor 401 plans that do not provide any additional contributions in a year are exempted from the top-heavy rules of section 416 of the Internal Revenue Code.

Employers sponsoring safe harbor 401 plans must satisfy certain notice requirements. The notice requirements are satisfied if each eligible employee for the plan year is given written notice of the employee’s rights and obligations under the plan and the notice satisfies the content and timing requirements.

In order to satisfy the content requirement, the notice must describe the safe harbor method in use, how eligible employees make elections, any other plans involved, etc. Income Tax Regulations section 1.401-3 , contains information on satisfying the content requirement using electronic media and referencing the plan’s Summary Plan Description.

Both the traditional and safe harbor plans are for employers of any size and can be combined with other retirement plans.

What Is A 401

A 401 is a type of defined contribution plan, which means that employees decide how much to contribute to their account. The unintuitive name 401 comes from the section of the Internal Revenue Code that governs the plans.

Contributions to a traditional 401 plan are taken out of your paycheck before income taxes are calculated. This means that contributions help lower your taxable income immediately.

The contributions are invested in mutual funds and other investments, and grow in value over time. When you take money out of your traditional 401 in retirement, you pay ordinary income tax on the withdrawals.

Also Check: How Are 401k Withdrawals Taxed

Best In Class 401 Plans

PLANSPONSOR is pleased to announce the sixth class of companies being given the Best in Class 401 Plan designation.

PLANSPONSOR is pleased to announce the sixth class of companies winning the Best in Class 401 Plan designation.

Plans were rated by way of a proprietary system that weighted usage/implementation of more than 30 criteria related to plan design, oversight/governance and participant outcomes. This being the sixth year, it was also the year that the first class of plansthose receiving the designation in 2015needed to requalify to keep their Best in Class status.

For more information, read the full story here.

Art by Mar Hernández

Pooled Employer Plan: The 401 Plan Designed For All Business Sizes

The Paychex Pooled Employer Plan makes it easier for businesses of any size to offer one of the most popular retirement plans for employees. While you reap the benefits of offering a retirement plan, we oversee plan setup, implementation, monitoring, enrollment, and other duties for 401 administration. Learn why a PEP could be a retirement game-changer for your small business.

Don’t Miss: Can You Roll Over 401k To Roth Ira

How Do Smaller Businesses Operate A 401

Small employers dont have the resources to staff a competent HR team that understands the complexities of the 401 ecosystem, says Peter Nerone, Compliance Officer at MM Ascend Life Investor Services, LLC in Cincinnati. Small employers also face challenges allowing the key employees to make adequate contributions due to the various coverage and contribution testing protocols.

But the biggest potential issue for small company plans might come from a source you least expect: you.

If youve already demonstrated an aptitude for all things entrepreneurial, that means youre used to flying solo. You may even prefer to work alone. Once you bring on employees, though, your status changes. You need to be aware of and follow rules that are designed to protect employees. This is most true for retirement plans.

This might not strike your fancy, but dont worry. As they say, Theres an app for that.

Plan Administrator Fees And Pricing

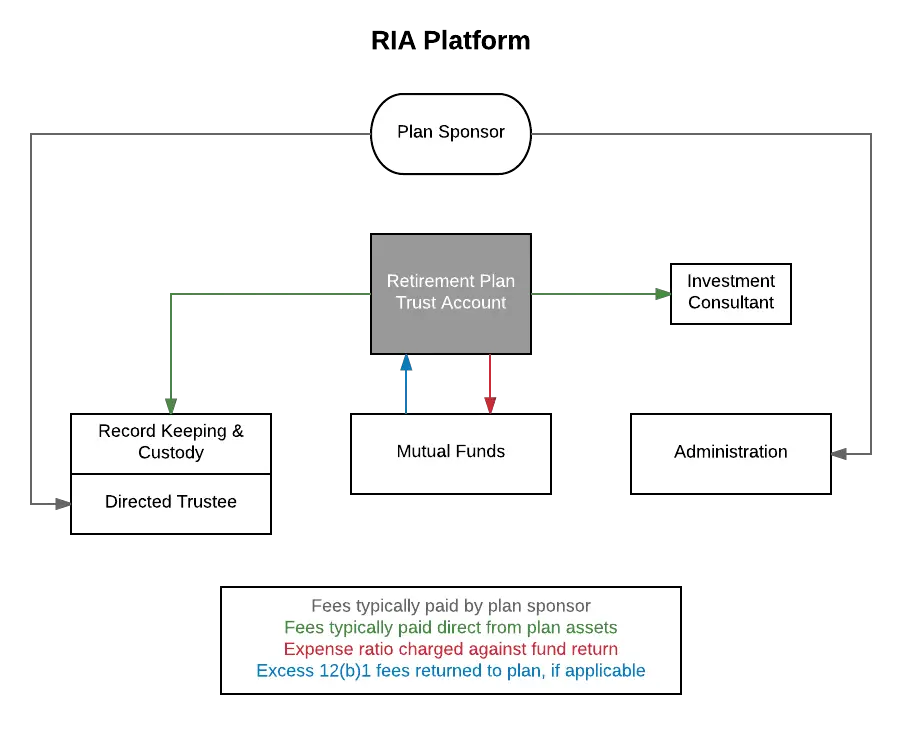

Most plan administrators charge a flat fee to employers and a per-head fee to plan participants. They may also charge additional 401 fees for other services like distributions, 401 loan processing, plan termination, and rollovers.

For example, a plan administrator may charge $2000 annually to the employer for plan management, and an additional 0.05% fee on assets under management to employees. The employer may decide to pay the plan administrator’s fee or pass it to employees. However, most employers opt to bear this cost for the tax benefit if it is a deductible expense and to keep plan investment costs as low as possible.

When the employer passes the cost of plan administration to employees, the cost may be borne by employees as a flat fee or as an asset-based fee. For flat fees, participants will see a recurring cost on the monthly or quarterly account statement. However, asset-based fees may or may not be visible to employees in their account statement, since they may be added as part of the mutual fund expense ratio.

You May Like: How To Get Money From 401k Fidelity

Converting Your Retirement Plan Is Simple

We can work with your current provider to make switching to Paychex simple including handling filing documents, setting up payroll processing, transferring assets, re-enrolling employees into the new plan, and much more. We’ll also work with you to establish your plan’s investment lineup, customize the parameters of the plan, and build new documents.

What Is A Plan Sponsor

A plan sponsor is a designated partyusually a company or employerthat sets up a healthcare or retirement plan, such as a 401, for the benefit of the organization’s employees. The responsibilities of the plan sponsor include determining membership parameters, investment choices, and in some cases, providing contribution payments in the form of cash and/or stock.

Read Also: Can You Use 401k To Buy Stocks

Keep Up With Your Ongoing Plan Maintenance Responsibilities

These tasks will help you keep your plan running smoothly and remain qualified for tax benefits.

- Review your service providers reports, such as:

- the allocation report for possible contribution errors.

- the distribution report to ensure that participants have timely started their required minimum distributions and consented to these payments.

The Four Required Players For Defined Contribution Plan Administration

Every 401 plan needs a plan sponsor, a plan administrator, a Named Fiduciary, and a trustee. To review, a plan sponsor, by default, may serve as the 3 Plan Administrator, Named Fiduciary, and trustee. Thats why its important to understand both the overlaps and differences in the responsibilities of the required players.

Also Check: What Age Can You Draw From 401k

Withdrawing Funds From Your 401

Funds saved in a 401 are intended to provide you with income in retirement. IRS rules prevent you from withdrawing funds from a 401 without penalty until you reach age 59 ½.

With a few exceptions , early withdrawals before this age are subject to a tax penalty of 10% of the amount withdrawn, plus a 20% mandatory income tax withholding of the amount withdrawn from a traditional 401.

After you turn 59 ½, you can choose to begin taking distributions from your account. You must begin withdrawing funds from your 401 at age 72 , as required minimum distributions .

Who Is The Plan Administrator

A plan administrator is responsible for administering a 401 plan on behalf of its participants. The administrator has a fiduciary duty of acting in the best interests of the plan participants to safeguard their retirement money. Due to the demanding responsibilities of plan administrators, the role of plan administration is often outsourced to an external third-party administrator. However, small companies may keep the plan administration duties in-house to save costs.

Although the plan administrator does not make investment decisions of the plan, they ensure that participant funds are allocated to investments based on the investor’s preferences. They ensure that employees’ contributions are within the IRS limits and that the individual 401 accounts are properly managed.

Also Check: How To Find Out Whats In Your 401k

What Does A Plan Administrator Do

A plan administrator is responsible for the regular operations of the retirement planâs activities. Some of the functions that a plan administrator is required to perform include:

Plan design– the plan administrator consults with the employer on how the plan should be structured.

Monitor compliance-As regulations change, the plan administrator ensures that the 401 complies with federal regulations and the plan rules.

: If you request a 401 loan or distribution from the 401 plan, the plan administrator must approve these transactions.

Perform tests– the plan administrator must perform routine tests to ensure fairness and equity among participants.

Filings and disclosures: the plan must make periodic statutory filings and disclosures required by regulators. Some of these filings may include Form 5500, Form 1099-R, and Safe Harbor notices.

Making payments to beneficiaries– the plan administrator is required to make scheduled payments to beneficiaries who inherit a participantâs 401 money.

Employee communication– the plan administrator responds to participantsâ questions and concerns. They also send periodic account statements to the planâs participants.

What Is A 401 Plan And How Does It Work

A 401 plan is a tax-deferred retirement savings vehicle offered by employers as a way to help employees save for their retirement. It allows employees to direct a portion of their earnings into the account and defer paying income tax on it until they withdraw it in retirement. Funds that are directed to a 401 can be invested in various securities, including mutual funds, exchange-traded funds , stocks, bonds, options, and more.

Employees are offered a number of different investment options pre-selected by the employer, and any contributions made into the 401 account can then be invested into the funds chosen by the employee. Contributions are automatically deducted from employeesâ paychecks, at whatever rate the employee selects.

With a traditional 401 plan, contributions are made with pretax dollars. Any qualifying funds contributed to a 401 plan throughout the year can be deducted, reducing oneâs total taxable income for that year.

Employers may also choose to match some or all of their employeesâ contributions to their 401, in what is known as an employer match.

When an employee leaves the company, they can choose to rollover their 401 funds into a new employerâs 401 or into an individual retirement account .

Read Also: Which 401k Investment Option Is Best

Should You Use A Third

In order to simplify the management of a 401, many businesses appoint a 3 plan administrator. As the IRS notes, this move does shift some of the fiduciary responsibility away from the sponsor. However, hiring someone to perform fiduciary functions is itself a fiduciary act, and does not absolve your business of fiduciary responsibility.

In other words, a sponsor can never totally abdicate their role as a fiduciary. The ultimate responsibility for the plan lies with the plan sponsor, regardless of whether another fiduciary is appointed. So choose who you work with carefully.

Managing a 401 is a significant responsibility its about the future security and comfort of your loyal employees, after all. But just because its a big responsibility doesnt mean it has to be a big burden. Check out our checklist for 401 providers to see what third party providers can do for you and how to pick one that makes sense for your business .

Plan Assets And Average Account Balance

These two items are generally the most significant demographic factors that impact 401 plan pricing because they affect both the costs of providing services and provider revenue.

For example, lets say a plan has $5 million in assets and 200 participants, with an average per participant balance of $25,000. From this cost perspective, the provider will have to keep records of participant files, process phone calls, and provide communication materials for 200 participants.

In the 1980s and 1990s, many 401 provider pricing structures were inversely proportional to the number of plan participants. In an effort to build market share, many providers offered lower pricing to plan sponsors with more employees, regardless of plan size or average account balance.

This led more than 100 providers to exit the 401 recordkeeping business. Recently, providers have begun to consider the costs associated with each 401 plan participant and price accordingly. This change has driven many providers to offer revenue per participant pricing models that are based on plan assets and average account balances.

If plan sponsors pursue this type of pricing model with their current/potential providers, then the providers typically convert the revenue to an asset-based fee once the revenue per participant is negotiated. This asset-based fee may either be built into the investment expense or charged against the assets, in addition to the investment expense.

Also Check: Can I Invest In My Own 401k

Reinvesting In Stable Funds

The word âstableâ is subjective when the market is constantly changing. We can make assumptions about what will remain stable during a recession by observing past performance or current trends.

Many investors consider bonds to be a very safe haven during economic downturns. This does not include certificates of deposits or the enormous amount of âcommercial paperâ that many individuals have become acquainted with for the first time in 2008.

In contrast to stocks, the other type of security, bondholders lend money rather than invest it. As a result, bankruptcy laws favor lenders rather than part-owners . In the event of bankruptcy, you will be able to liquidate your assets before other creditors.

Although some experts believed that dividends in the most stable firms might be secure for 401 investments because of natural economic growth, the severity of the current financial crisis has made this market significantly riskier than it has been in a long time, with few firms capable of generating dividend profits to share in either stock offerings or cash payments.

Your ability to re-invest your 401 savings is, in part, limited by the action of your current or previous employer. There are several different aspects to consider when establishing the appropriate balance of safety and return for one of the most volatile decades-long markets that has ever existed.

Expense Ratios

What Is An Erisa Fiduciary

Before we identify a plans fiduciaries, we must first explain what it means to be an ERISA fiduciary. The Employee Retirement Income Security Act is the federal law that controls most aspects of retirement plans .

ERISA includes a set of standards , often referred to as ERISA fiduciary duties. The primary ERISA fiduciary duty is to run the plan solely in the interest of participants and beneficiaries for the exclusive purpose of providing benefits and paying plan expenses.

This deceptively simple sentence breaks out into many parts and means plan fiduciaries must:

Diversify the plan’s investments to minimize the risk of large losses

Follow the terms of plan documents

Manage plan expenses

Avoid conflicts of interest

When acting in a fiduciary role, plan fiduciaries cannot put their own interests above their plan participants and must always consider whats best for the plans participants. ERISA has specific rules that identify whos wearing a fiduciary hat and when they are wearing it.

Don’t Miss: Can You Cash Out 401k Early

Whos On Your Team For 401 Plan Administration

While keeping track of the whos whos behind 401 plan administration may be overwhelming, know that you dont have to do it alone. Still unsure about who and what you need to set up a 401 plan? Need new players for the 401 plan team you already have? Get in touch with a Human Interest retirement specialist today.

The Art Of Understanding 401 Plan Fees

Understanding 401 plan fees has become a hot topic in recent years. But, in todays volatile economywhere every dollar counts and is counted its not more important than ever to understand, document, and monitor such fees.

In fact, 401 plans are increasingly viewed by many as their primary source of retirement income. This is especially true with the younger generation, who fear that Social Security may not live as long as they will.

Todays 401 industry has grown to more than 60 million participants, $3 trillion in participant assets, and $30 billion in annual fees.

The Employee Retirement Income Securities Act established rules that govern 401 plans and the responsibilities for those offering the plan the plan sponsors and fiduciaries .

This authority over plan assets does not refer to investment managers, but rather to plan sponsors those individuals who decide which funds will be allowed or offered in the 401 plan. If a broker is involved, he or she is usually not considered a fiduciary and will explicitly disclaim and fiduciary responsibility.

Don’t Miss: How To Get 401k For Employees