Whats So Great About 401 Accounts

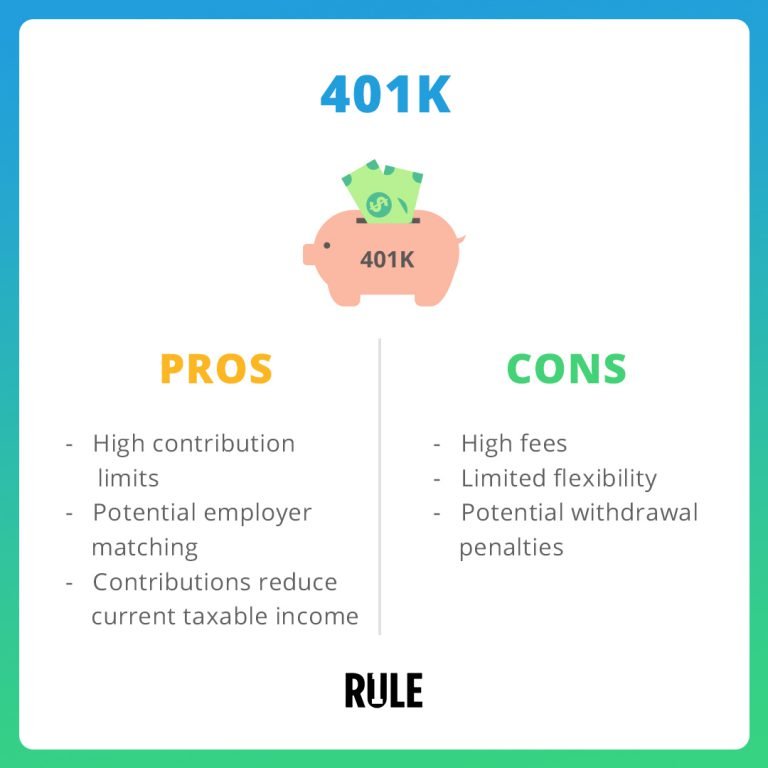

A 401 is a popular type of employer-sponsored retirement plan thats available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they havent met this criterion yet.

In 2021 youre allowed to contribute up to $19,500 to a 401 or up to $26,000 if youre 50 or older. In 2020, those amounts rise to $20,500 and $27,000. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but youll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Benefits Of A Solo 401

Solo 401s provide some advantages over other types of retirement accounts available to you.

One big advantage is the availability of the Roth option as well as the traditional version. Only the traditional option can be used by those who invest using the SEP IRA, a Keogh plan, or a SIMPLE IRA. The plain-vanilla IRA that is available to all who have earned income is available in Roth or traditional versions but the annual contribution limits are far lower.

One of the main advantages of the solo 401 is that it can accept contributions from both an employee and an employer. That is, if you have a solo 401, you wear both hats and can make contributions in both roles.

Also Check: How To Rollover 401k To Ira Td Ameritrade

What Are The Roth Ira Requirements

To be eligible to fully contribute to a Roth IRA, you must:

-

Have an earned income.

-

Have whats called a modified adjusted gross income . But it has to be less than $198,000 for married couples filing jointly or $125,000 for single people.3

Now listen up, married people, because this is important. Even if you or your spouse doesnt have an earned income, you can still have two Roth IRAs between both of you with something called a spousal IRA, if your spouse has an earned income. For most folks, fully funding two Roth IRAs will be enough to reach the goal of investing 15% of their income for retirement.

Dont Miss: Best Way To Raise Capital For Real Estate Investment

Getting It Right With Your Solo 401k Brokerage Sub

Through Nabers Group, you can open a Solo 401k Brokerage Sub-account with almost any major brokerage firm. As an example, we use a Schwab brokerage account to keep the terminology simple. When you explore sub-accounts for different brokerages, youll find variations in the terminology that each uses. For instance, Schwab calls these types of accounts a Company Retirement Plan. This is their account specifically designed to work with your Solo 401k.

Something very important to remember is that you are NOT opening an Schwab 401k account. Rather, your Solo 401k is opening an investment-only account with Schwab. There are a specific process and application for this account.

Depending on the brokerage firm you select, the platform may have its own fees and rules associated with trading. The Nabers Group Solo 401k is compatible with any brokerage platform. However, its wise to learn about fees and rules before opening an account or investing.

Recommended Reading: How To Set Up A Self Employed 401k

You Have More Choices And Potential But Greater Risks Of Messing Up

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Participants in 401 plans might feel restricted by the narrow slate of mutual fund offerings available to them. And within individual funds, investors have zero control to choose the underlying stocks, which are selected by the mutual fund managers, who regularly underperform the market.

Fortunately, many company’s offer self-directed or brokerage window functions that give investors the option to seize the reigns over their own financial destinies by managing their 401 plans for themselves. But there are both pros and cons to taking the do-it-yourself route.

Roundabout Transactions Direct Vs Indirect Prohibited Transactions

A roundabout transaction occurs when the Solo 401k participant/trustee structures one or more transactions with the purpose of making a prohibited transaction. A disqualified person may not indirectly do what cannot be done directly.

If a transaction directly violates the prohibited transaction rules, changing the transaction to removethe disqualified person from direct involvement would still deem the transaction prohibited. Put differently, merely insulating that person from the transaction and enlisting a third party does not make a prohibited transaction allowable.

Illustration 1

You loan money from your Solo 401k /self-directed 401k to your friend , and he or she then turns around and loans the same funds to your mother. This is considered a roundabout transaction and viewed by the IRS as not only prohibited but also as an attempt to evade the tax rules because you cant loan money from your Solo 401k to your mother, even if you first loan it to your friend , who then loans it to your mother.

Illustration 2

Don’t Miss: How To Open A Solo 401k Account

Tips For Saving For Retirement

- In any retirement conversation, its important to be mindful of the retirement tax laws in the state you live in. Taking your states laws into account can make a significant difference as you plan for retirement.

- If you already have some money to spare, you could save even more by finding a financial advisor. A financial advisor can take a comprehensive look at your finances and determine where you can save more. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Individual 401 Plan With Traditional And Roth 401 Contributions

Retirement investing for the self-employed

- For self-employed workers and their spouses to maximize retirement savings

- Generous contribution limits and simple administration

- Tax-deferred growth potential

Contribution limits

Maximum total contributions up to $61,000 in 2022 annual contributions, or 100% of compensation, whichever is less, with compensation taken into account capped at $305,000 in 2022

Contribution limits

Maximum total contributions up to $67,500 in 2022 annual contributions, or 100% of compensation, whichever is less, with compensation taken into account capped at $305,000 in 2022

Also Check: Can I Transfer Money From 401k To Ira

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

Dont Miss: How Do I Open A 401k

Be Smart With Your 401

Opening a 401 is a smart step on the road to a comfortable retirement, but itâs not quite as simple as signing some papers and setting aside a percentage of your paycheck. You have to understand the rules, choose your investments wisely, and continue to maintain your plan for as long as you own it. If you do that, you can feel confident that youâre giving yourself the best shot at a secure retirement.

Read Also: How Long Do I Have To Transfer My 401k

Employer Stock Ownership Plan

Choosing to buy company stock with your 401 contributions is different from getting stock from your employer through an employer stock ownership plan . An ESOP, when it has been approved as a retirement plan by the IRS, is a trust to which the company contributes shares of newly issued stock, shares the company has held in reserve, or the cash to buy stock. The shares go into individual accounts set up for employees who meet the plans eligibility requirements generally the same ones that determine eligibility for a 401.

In fact, while an ESOP may be separate from a 401, it may also be part of the same plan. If its linked, your employer may match your contribution by adding shares to your ESOP account rather than adding cash to your investment account. In many cases, matches made through ESOPs are more generous, in part because there are tax advantages to using an ESOP and in part because offering an ESOP can be a good way to attract interest in and contributions to the retirement plan.

If you leave your job, you have the right to sell your shares, on the open market if your employer is a public company or back to the ESOP at fair market value if its not. About 90% of companies offering ESOPs are privately held.

The Truth About Company Stock Investments In Your 401k Plan by Inna Rosputnia

Wishing you a great week!

Want Your Money To Grow?

Learn More About:

Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

You May Like: What Is Max Amount To Contribute To 401k

Roll Over Your Old 401 Into An Ira

Leaving a job to start your own business or freelance work? Its possible to take your old 401 with you! This is called a 401 rollover. You can use a direct 401 rollover to move a traditional 401 into a traditional IRA account or a Roth 401 into a Roth IRA account tax-free. A rollover also does not count toward your contribution limit. This allows you to open an IRA, create a nice foundation, and continue investing.

Now, you can potentially roll over your traditional 401 into a Roth IRA , but there are big tax implications to considermeaning it might not be the right choice for everyone. And you should never ever withdraw the money yourself to roll overdon’t even touch it! Thats considered an early withdrawal and youll get slapped with a 10% early withdrawal penalty plus a big tax bill. No thank you!

Dealing With Poor Choices

If your 401 has investment choices that do not allow you to diversify or invest the way you like, you can partially overcome this by putting money into your own IRA, and invest that IRA in the missing asset classes. If your spouse’s 401 offers what is missing from yours, you also can allocate more money into her account to do the same. In addition, you can speak with your 401 plan administrator or trustee about your investment needs. Over time, you may see your own plan’s offerings improve.

References

Also Check: Should I Rollover My 401k When I Retire

How To Start A Private 401k Plan Without An Employer

Many investors have trouble opening a 401k for their retirement because they are not familiar with private 401k plans. As an investor struggling to open a 401k, you are worried that you will not have the necessary finances for retirement. Fortunately, you can open a 401k in a non-traditional way. The private 401k functions similarly to traditional plans that many employers offer employees. You can invest in your future even when the traditional route is out of reach. There are also safe investments for seniors that retired investors can benefit from. If you are not yet retired and want to save for retirement, continue reading to learn how to start a private 401k plan.

Read Also: Where Can You Invest In Penny Stocks

Ira Or Solo 401k Question:

They both allow for investing in alternative investments including real estate, but the solo 401k is generally more advantageous. For example, the contributions limits are higher for a solo 4o1k plan, you can borrow from a solo 4o1k plan, and the ongoing fees are also generally much less. See the following link for more on this.

Recommended Reading: Can You Contribute To 401k And Ira

Investing In Your 401

The variety of investments available in your 401 will depend on who your plan provider is and the choices your plan sponsor makes. Getting to know the different types of investments will help you create a portfolio that best suits your long-term financial needs.

Among the most importantand perhaps intimidatingdecisions you must make when you participate in a 401 plan is how to invest the money you’re contributing to your account. The investment portfolio you choose determines the rate at which your account has the potential to grow, and the income that you’ll be able to withdraw after you retire.

Is Maxing Out Your Match Enough

That depends on many factors, but maybe not. The company match limit shouldnt be taken as advice on how much to invest. What should your average 401 plan contribution be? It depends on your own unique retirement goals and other sources of savings. You might want to aim for your annual contribution from all sources your own contribution plus the employer match to be between 10% and 20% of your salary to help best prepare for retirement.

You May Like: Can I Borrow From My 401k Without Penalty

You Can Fund A Traditional Ira

A traditional IRA, or individual retirement account, allows you to contribute pre-tax dollars . You pay taxes when you withdraw the money once you retire, meaning that its tax-deferred.

If you earn taxable income and are under age 70 ý, you can contribute. Easy-peasy. Plus, since you have no 401k or retirement plan at work, you can put money in and deduct the entire amount from your taxes.

Recommended Reading: When Can I Get Money From 401k

Do I Need A 401 Solo Plan

For sole proprietorship businesses, solo 401 plans are very effective ways to set aside and grow a large amount of money for retirement. If youre a small business owner and dont yet have a retirement plan set up, a solo 401 is an excellent way to save for retirement.

If you happen to need to hire employees at some time during your businesss lifetime, youll need to be sure to adjust the plan to include them equally or create criteria to define benefit-eligible employees and create retirement plans for them.

Read Also: Jp Morgan 401k Investment Options

Read Also: How Do You Get Money From 401k