How To Roll Over Your 401 To An Ira

There are many reasons why you may have decided to make a 401-to-IRA rollover. You may have left your job for a position at a new company, you may have been laid off or you may have decided to take your career in a new direction. Regardless, if youve been contributing diligently to your employer-sponsored retirement plan for a number of years, you could have a decent stash of cash in your account. If you want help managing your retirement accounts after your rollover, consider working with a financial advisor.

Take Advantage Of An Investment Option In The 401

Conversely, there may be an investment option available in your 401 that is not available in your IRA account. You may want to leave a portion of the funds in your 401 to take advantage of that opportunity. Remember, diversifying your portfolio is extremely important when it comes to investing and if you have access to something special inside your 401, its worth keeping some money there to take advantage of the investment opportunity.

Dont Miss: Can I Borrow Against My Fidelity 401k

How To Roll Your Roth 401 To A Roth Ira

The process might seem complicated, but its typically straightforward if you know what to expect. In the case of Roth accounts, taxes are no longer part of the equation which makes a rollover even easier. This process wont work if youre still with your employer, but if youve found a new role and are looking to move an old Roth 401, read on.

Recommended Reading: Can I Rollover 401k To Another 401 K

Roll Over Your Money To A New 401 Plan If This Option Is Available

If youre starting a new job, moving your retirement savings to your new employers plan could be an option. A new 401 plan may offer benefits similar to those in your former employers plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, youll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plans features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employers 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employers 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if youre still working.

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

Also Check: How Do I Collect My 401k

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Annuitization Calculator To Determine Taxes

But paying taxes now isnt always a bad thing. In fact, some would argue that you can better afford the taxes now, while youre still working. Claiming the rollover on your taxes when you have a decent salary coming in will likely be easier than paying taxes on the money youre taking out when youre in your 60s or 70s and no longer have a steady paycheck coming.

Another argument for paying the taxes now is that youll probably pay less than you will down the road, assuming tax rates increase over time. This, of course, may be a bigger difference if youre younger rather than just a few years away from retirement. You can find annuitization calculators online that can help you determine just how much youll get each month from your various investments to determine what youll need to live on.

Also Check: Should You Roll Over Your 401k

Are 401ks Traditional Or Roth

Roth 401 is an after-tax retirement savings account. This means that your contributions were already taxed before they were credited to your Roth 401 account. On the other hand, a traditional 401 is a pre-tax savings account.

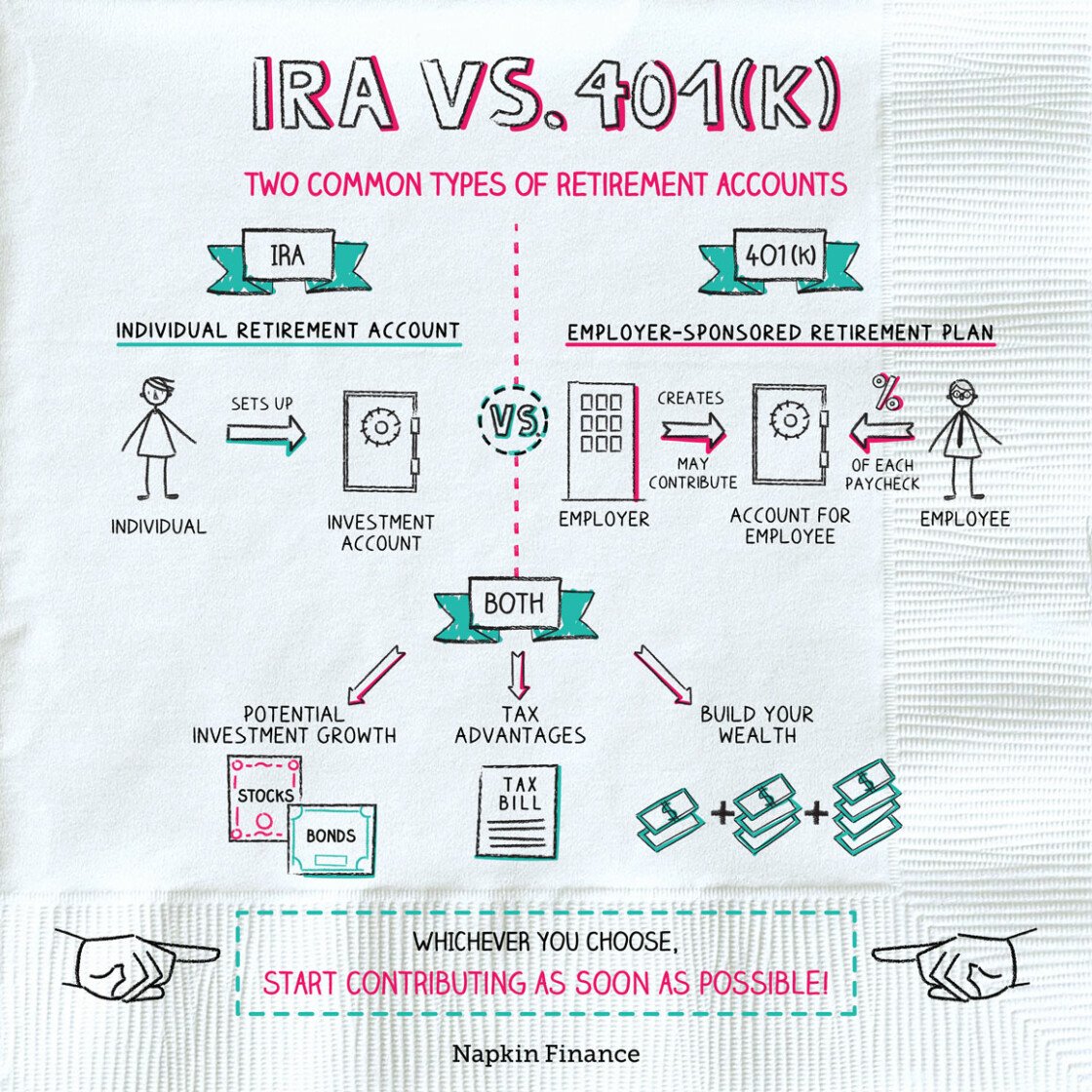

Ira vs 401kWhat is the difference between a 401k and Ira? The main difference between a 401k and an IRA is that a 401k must be created by an employer, while an IRA is a personal retirement account that anyone can create for themselves. The amount that can be saved with deferred tax is also significantly higher: 401 thousand.Is 401k better than IRA?Objectively speaking, 401 is simply better in this category. Wit

Dont Miss: How Much Can You Contribute To 401k Per Year

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

Also Check: How To Roll Your 401k From Previous Employer

When Does A Roth Conversion Make Sense

A Roth conversion, which happens when you roll over money from a traditional 401 into a Roth IRA, comes with good news and bad news.

The good news is that from now on, that money will grow inside your Roth IRA tax-free and you wont pay any taxes on that money when youre ready to withdraw from the account in retirement.

But when you transfer that pretax money from your traditional 401 into a Roth IRA, which is funded with after-tax dollars, youll have to pay taxes on that money now. Thats the bad news.

A Roth conversion might feel like ripping off a Band-Aid now, but itll feel great once you retire. You might want to seriously consider a Roth conversion only if you can afford to pay the tax bill with cash you have saved up. But be careful, because a conversion could add thousands of dollars to your tax bill. If thats just too much for you to stomach, then stick with a traditional IRA rollover.

How To Do An Ira To 401k Reverse Rollover

On to the nitty-gritty. So you’ve decided that it makes sense for you to do an IRA to 401k reverse rollover. So, where do you actually begin? Here is our simple step-by-step guide on how to do the reverse rollover.

Step 1 – Confirm Eligibility

Before you begin anything, you need to confirm that your employer-sponsored 401k accepts IRA rollover funds. While doing this step, you should also get the deposit information from your 401k provider on where to send the check, what account numbers or information is needed, and what forms you might need to fill out .

Step 2 – Request A Distribution

Once you’re 100% positive that your employer 401k accepts a rollover contribution from your IRA, you can request a distribution from your IRA. Each IRA provider has it’s own policies and procedures for doing a distribution, but you should be prepared to fill out a form and select the reason why you’re requesting the distribution.

At this step, make sure you select “Rollover”, otherwise your brokerage may attempt to withhold funds from your distribution for taxes. If your brokerage withholds funds from your distribution, you’ll need to come up with that money when you re-deposit it in your 401k.

Step 3 – Deposit The Funds In Your 401k

Step 4 – Report The Rollover Accurately On Your Tax Return

If the amount of your distribution from your IRA and the amount you deposited into your 401k don’t match, that difference is the “taxable amount” and you’ll owe taxes and a 10% penalty on that.

Also Check: How Fast Can I Get My 401k Money

Mistakes To Avoid With Your Roth Ira

Individual retirement accounts are a great option for anyone who wants to save up for retirement, whether you choose a traditional or a Roth version. You may think that the only thing that you need to know about a Roth IRA is that your contributions are limited to $6,000 if you are under age 50 and $7,000 if you are 50 or older. Well, its a little more complicated than that.

Here are 11 common errors that people with Roth IRAs are likely to make, and a few suggestions on how to avoid those mistakes.

Also Check: How Can You Get Money From Your 401k

Can I Roll A 401k Into A Roth Ira

If you have built a nice nest egg, you may consider rolling over your 401 into a Roth IRA. Here are the steps involved when rolling over 401 into a Roth IRA.

If you left your job and you are wondering what to do with your 401, you have several rollover options with the money. The most common rollover option is to rollover from 401 to an IRA, where a taxpayer can continue making tax-deferred contributions to the IRA account. You may also consider rolling over to a Roth IRA. But, is this allowed?

You can rollover your 401 into a Roth IRA if you want to enjoy the benefits of a Roth IRA. Rolling over from 401 to Roth IRA is a taxable event, and you will be required to pay taxes on the contributions, employerâs match, and all investment earnings generated from the account. However, you wonât pay income taxes when you withdraw money from the Roth IRA in retirement.

Don’t Miss: Can You Convert 401k To Roth 401k

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

How Many 401 Rollovers Per Year

The once-per-year rule does not apply to 401 rollovers, and you can rollover multiple 401s in a year. When you transfer money from one 401 to another 401, the check is made payable to the new 401 and not the name of the account holder. Therefore, this transfer is considered a trustee-to-trustee transfer, and hence, it is excluded from the once-per-year rule. Also, this rule does not apply to 401 rollovers to an IRA or Solo 401 account.

Read Also: How To Take Out Loan From 401k

Protection From Stock Market Downturns

In a fixed annuity or fixed index annuity, you will not lose money due to market downturns. If the markets have a down year, you earn zero interest. In exchange for this protection, you are limited on the upside you can get each year, unlike an individual stock through a mutual fund.

A variable annuity will provide unlimited upside potential with no protection from volatile market conditions. However, adding a Guaranteed Lifetime Withdrawal Benefit can protect the annuitant from running out of money due to a stock market crash.

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense not to roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt not to defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell itimmediately or in the futureyour taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.

Read Also: How To Move My 401k To An Ira

Preparing For A Backdoor Roth Ira Conversion

If you’re considering doing a Backdoor Roth IRA Conversion, one of the first things you need to do is eliminate any money you have in a traditional, SIMPLE, or SEP IRA. The reason for this is that you can run into complexities and potential tax consequences if you have pre-tax money in any of these accounts when you convert.

As we previously discussed in our ultimate guide on how to do a mega backdoor Roth IRA conversion, one of the simplest ways to eliminate money in these pre-tax accounts is to roll it into an employer sponsored 401k. Remember, though, that you can only roll over pretax money into a 401k, so any non-deductible contributions you have made to these accounts don’t qualify.

Request A Direct Transfer Rollover From Your Old 401

Remember, you need to ask for a direct transfer rollover from the plan administrator of your old 401this could be your old employer or a third party. Theyll give you a form to fill out that will usually ask you to provide your contact information and account information for the plan youre transferring money from and the account youre transferring the money to.

You May Like: How To Liquidate Your 401k