About 401 Investing In Down Markets

You might naturally feel nervous about continuing to invest while share prices are falling. There are two protective measures investors take during bear markets. They are:

You may already be taking these actions in your 401. If you’re younger than 50, you shouldn’t be withdrawing money for at least five years, or possibly 10. And your investment menu may not even offer speculative fund options.

Still, it’s smart to check in on your investment selections. Make sure most of your contribution is allocated to a large-cap or S& P 500 index fund.

Down Markets Are Efficient For 401 Investors

Since the advent of public stock trading, stock prices have moved up and down in waves. While the stock market goes up more than it goes down, those down cycles can feel more pronounced. Time flies when your 401 balance is growing, but it drags when your balance is shrinking.

Image source: Getty Images.

The thing is, continuing to invest in your 401 gives you a better chance of robust long-term growth. Here are two reasons why:

Do You Want To Be Diversified

Investors can decide whether they want to diversify their 401 savings and how to do it. This means spreading oneâs savings efforts across a number of different types of investment, which can hedge against losses and market downturns, as other investments may grow even if certain industries or sectors see a downward trend.

Don’t Miss: What Is The Phone Number For 401k

Understanding The Different Investing Options

The average 401 plan provides about 19 different investment options to choose from. Unless the plan has a default investment option, your contributions could sit in your 401 as cash without being actually invested in anything.

If your contributions are automatically invested in a particular fund, you can always change what your money is invested in. If your 401 plan has an online portal, then you can research different funds and move your money as you please. If not, youâll have to contact your planâs custodian to facilitate moving your money to other investment options.

Your 401 planâs summary plan description will outline the default investment options, the other available investment options, and how to move your money to various funds. Some of the most common funds provided in 401 plans are target-date funds, mutual funds, index funds, and bond funds.

Read Also: Can You Use Your 401k To Buy Real Estate

How To Invest Your 401k Money

When it comes to retirement, no topic is more important than the 401. Although there are other options that will give you money during your golden years, most likely a large part of the money will come from this account. And if youve already chosen this option, heres how you can invest your 401K money wisely.

The first step will always be to find the money to save in the account. But then you have to think about where to invest it, considering the possible risks that the future will bring, and this is precisely the point where most people have problems. According to a Schwab survey, more than half a million 401 plan holders wish it were easier to choose the right investments.

And with good reason. After all, no one knows what the future holds and it might go well or it might not go as well as you hope. However, there are ways to combat this, which we will show you later.

Now, in order to invest, the most important thing is to understand how the 401 works and what the rules of the game are.

Table of Content

You May Like: Does A 401k Rollover Count As A Contribution

Setting Up Automatic Contributions Makes Saving Easy

Once you’ve opened your IRA, set up a monthly automatic deposit from your checking account to your IRA. A $6,000 yearly contribution comes out to $500 a month. If that’s more than you can manage, contribute as much as you can and try to add to it with any bonuses, raises, or gifts. You actually have until the tax filing date of the following year to make your full IRA contribution.

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Also Check: Can I Rollover My Ira To My 401k

What Plans And Investment Products Are Offered By Your Employer

Each workplace determines the funds and investment products that are offered to employees participating in a sponsored 401 plan. There may be few options or many, but itâs up to the employee to make the investment choices. That may mean researching each fund to assess its performance history, asset allocation, and fees. To that end, investors can ask the following: Are certain sectors or companies of interest? Would they prefer to stay away from specific industries? Does one fund have significantly higher fees?

Investing $100000 For Retirement

Saving for retirement should be a major goal for everyone. If you havent saved much for retirement yet, putting $100,000 toward your retirement accounts can make a big difference. How exactly you save will depend on your individual situation.

If your employer offers access to a tax-deferred account, consider making a maximum contribution. Common examples are 401, 403 and 457 plans. The maximum annual contribution for all of these is $19,500 for 2021. In addition, if youre over 50, the IRS allows for annual catch-up contributions of an extra $6,500 for 2021. At the very least, make sure you contribute enough to max out any matching that your employer offers.

These accounts are useful for retirement savings because you dont have to pay taxes when you contribute, or as your accounts grow. You only pay income tax when you withdraw the money in retirement. Contributing the maximum means smaller paychecks, but if you have $100,000 to spare, then you can likely afford the dent to your monthly income.

Also Check: Investing In Oil And Gas Companies

Read Also: Can I Use My 401k To Purchase A Home

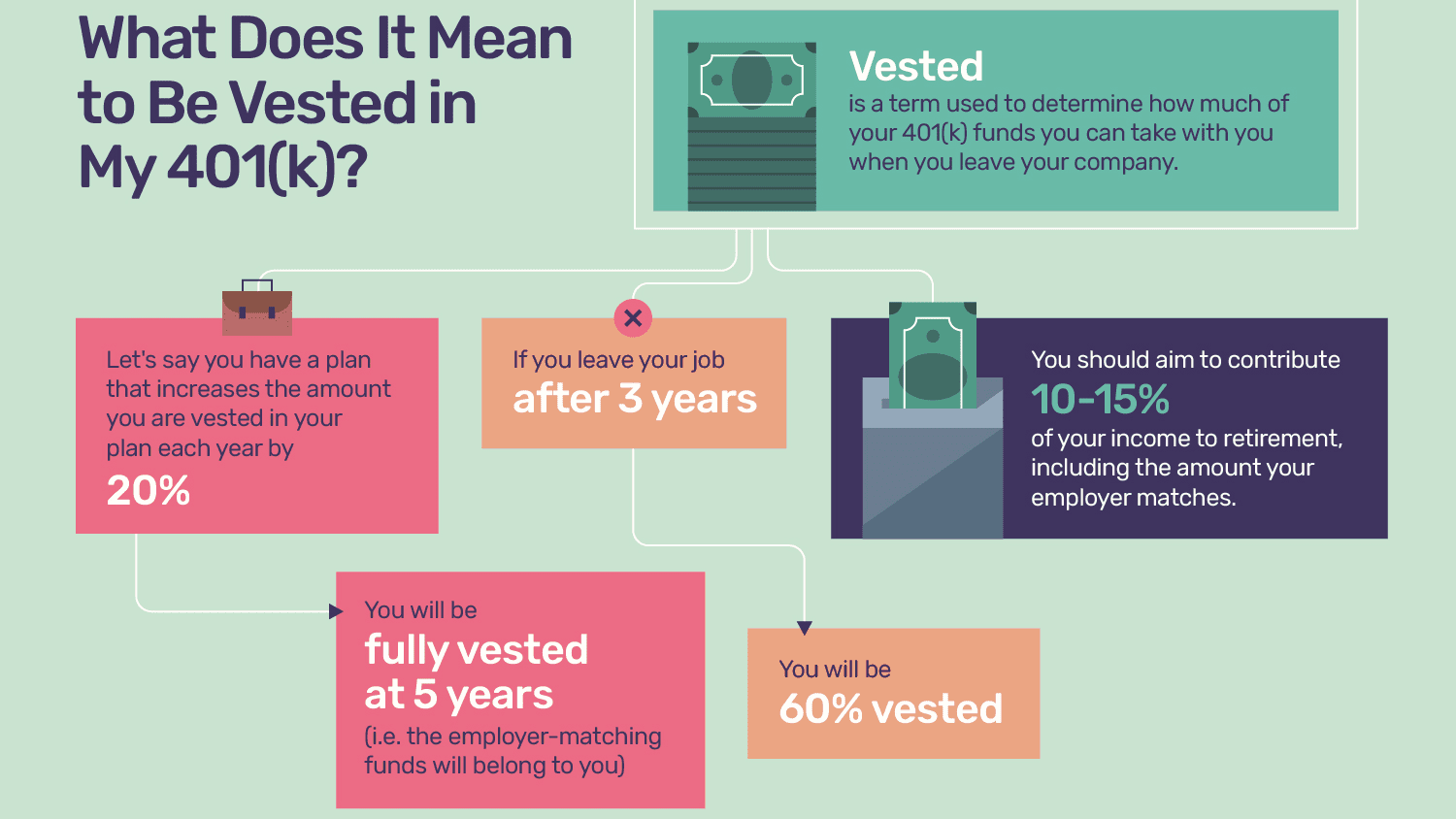

Does Your Employer Match Contributions

Many employers offer a contribution match to employees, which could be dollar-for-dollar or 50%. So if an employee puts $400 per month into their 401, the employer will put an additional $200 into the retirement savings plan on their behalf.

Most employer matches also have maximum limits, which are often represented as a percentage of the employeeâs salary. For example, an employer might offer a 100% contribution match up to 3% of a salary, which means an employee making $100,000 could receive as much as $3,000 from their employer as long as they contributed enough to earn that full match.

Knowing how much an employer matches can help determine how much the employee needs to contribute. For instance, if the goal is to contribute a total of $6,000 into a 401 retirement savings plan each yearâand the employer offers a 100% matchâthe employee only needs to budget for $3,000 in annual contributions in order to meet their goal.

What Is A Recession

Generally speaking, a recession is a period of significant economic decline. While theres no official definition, experts generally recognize a recession as being two consecutive quarters of a negative gross domestic product , the value of goods and services produced in a society.

Recessions come about for a variety of reasons, including:

-

An overheating economy

-

Economic shocks

Recessions can have a number of negative impacts on the economy. Because of the reduced economic output, some businesses may be forced to close their doors. Others lay off employees, which leads to increased unemployment. Finally, theres often a decline in asset prices, including those in your 401.

Also Check: How To Grow 401k Fast

What Are The Best Ways To Invest My 401k Retirement

In itself, the process of investing 401 money should not be difficult, since companies usually offer a series of plans that you can join and they do all the heavy lifting. However, there is a lot of preparation work that you must do before selecting the one that best suits what you are looking for. Lets look at the factors you need to know before you invest money in your 401.

Don’t Sell Yourself Short

It’s a good idea to put enough money in your 401 to claim your full employer match. Beyond that, you really shouldn’t feel obligated to save and invest in a 401 if you’re not happy with your investment choices especially when there are other options that could get you closer to your goals.

5 things people get wrong about IRAs: Bankruptcy protection limits, inheritances and more

Read Also: Can You Borrow From Your 401k

How Much Money Should You Invest

If youre still a long way from retirement and struggling with current issues, you might think your 401 isnt exactly a priority. However, the combination of employer match and tax benefits make the theme irresistible.

When youre starting out, your goal should be to make a minimum payment on your 401. That minimum should be the amount that qualifies for your employers full match. To get the full tax savings, you must contribute a maximum annual contribution.Lately, most employers contribute a little less than 50 cents for every dollar the employee puts in, or 6% of your salary. This is a 3% salary bonus. Plus, youre reducing your federal taxable income when you contribute to the plan.

As your retirement date approaches, you may also begin to accumulate a higher percentage of your income. Considering the time horizon isnt that far off, the dollar value is probably much larger than it was in your early years, even when we factor in inflation and income growth. For the year 2022, taxpayers can contribute up to $20,500 of their pre-tax income, while people over 50 can contribute an additional $6,500.

In addition to this, as you get closer to retirement, you can start reducing your marginal taxes by contributing to your companys 401 plan. When you retire, your taxes may drop, allowing you to withdraw your funds at a lower tax assessment percentage.

After Establishing The Plan

Once your portfolio is in place, monitor its performance. Keep in mind that various sectors of the stock market do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, it is very likely that the small-cap portion of the portfolio will grow more quickly than the large-cap portion. If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks.

While it may seem counter-intuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation. When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed toward the best-performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy.

Borrowing against 401 assets can be tempting if times get tight. However, doing this effectively nullifies the tax benefits of investing in a defined-benefit plan since you’ll have to repay the loan in after-tax dollars. On top of that, you will be assessed interest and possibly fees on the loan. Plus, you will often not be able to make 401 contributions until the loan has been paid off.

Read Also: How Do I Know Where My 401k Is

This Market Won’t Break Your Retirement

At some point, the stock market will shift back to growth. Whether that happens this year or two years from now, no one knows. But either way, it shouldn’t break your retirement or zero out your 401 balance.

If your retirement timeline and cash reserves allow it, continuing to invest now could reap big rewards later. And seeing big, unrealized gains in your 401 is probably the best way to get that awesome feeling about investing.

The Motley Fool has a disclosure policy.

Is A 401 Worth It

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician . He is also a member of CMT Association.

You don’t have to master investing to allocate money in your 401 account in a way that meets your long-term goals. Here are three low-effort 401 allocation approaches and two additional strategies that might work if the first three options aren’t available or right for you.

Read Also: Can You Take A Loan From Your 401k

Shift Your Asset Allocations As You Near Retirement

So weâve covered the different investment options, how time is your best strategy to weather the stock market storms, and what to do if the stock market does crash. But the absolute best way to protect your 401 from a stock market crash is to limit your risk from one the closer you get to retirement.

Obviously, no one can predict when the next stock market crash will be. So the next best option is to limit the effects of one on your 401 when you donât have as much time to recover before retirement.

If youâre invested in a target-date fund, your investments should already be reallocated to less risky funds, like bonds, the closer you get to 65. If youâre invested in index funds or mutual funds, youâll need to move your money to safer investments yourself. As mentioned earlier, if your 401 provides an online portal, itâs easy to reallocate your assets to lean more towards bonds. If not, your planâs custodian will be able to facilitate moving your money to other investments within the plan.

If your plan doesnât provide investment options that donât satisfy your goals, you can roll over your 401 to an IRA at an outside institution. These investment institutions like Fidelity have seemingly endless investment options to choose from within their IRAs.

Other Places To Put Your Retirement Money After Retirement

Theres no question that the stock market is the best investment after retirement. However, there are a few other options we want to present, too. One such option is bonds. These are often seen as a safe investment, as theyre not as volatile as stocks. But, they also dont have the potential to generate as high of returns. Nevertheless, a portion of your post-retirement investment portfolio may consist of bonds as a steady stream of income.

Perhaps the second most common place to put your money after retirement is real estate. This is a great option for those looking to generate supplemental income after retirement. You can rent out apartments, houses, office space, storage units you name it! And, with the help of a property management company, being a landlord can be surprisingly passive.

Of course, there are risks associated with real estate investing as well and actually purchasing properties isnt feasible for many. Thats where REITs or real estate investment trusts come in. These are a more accessible means of investing in real estate, as they are essential stocks for companies that own or finance income-producing real estate. That means theyre more liquid which is always an important consideration when investing your capital.

You May Like: How Do You Get 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.