What To Do If You Maxed Out Your 401 Contributions

Companies have until March 15 to conduct this test for the previous year. So if youre an HCE who maxed out your contributions in the previous year, you may not know if the company failed the test until the following year. If so, your firm would most likely refund you the excess contributions you made. This will count as taxable income. So it could increase your tax liability for the current year. Plus, the money coming back reduces the tax savings and earnings potential of your 401.

So you may want to set some cash aside to cover a potential tax hike. Or you can make an estimated tax payment. And at some points, it may be best to hold off on reaching your 401 maximum contribution until you know whether you will face restrictions.

Plans For Certain Small Businesses Or Sole Proprietorships

The Economic Growth and Tax Relief Reconciliation Act of 2001 made 401 plans more beneficial to the self-employed. The two key changes enacted related to the allowable “Employer” deductible contribution, and the “Individual” IRC-415 contribution limit.

Prior to EGTRRA, the maximum tax-deductible contribution to a 401 plan was 15% of eligible pay . Without EGTRRA, an incorporated business person taking $100,000 in salary would have been limited in Y2004 to a maximum contribution of $15,000. EGTRRA raised the deductible limit to 25% of eligible pay without reduction for salary deferrals. Therefore, that same businessperson in Y2008 can make an “elective deferral” of $15,500 plus a profit sharing contribution of $25,000 , andâif this person is over age 50âmake a catch-up contribution of $5,000 for a total of $45,500. For those eligible to make “catch-up” contribution, and with salary of $122,000 or higher, the maximum possible total contribution in 2008 would be $51,000. To take advantage of these higher contributions, many vendors now offer Solo 401 plans or Individual plans, which can be administered as a Self-Directed 401, permitting investment in real estate, mortgage notes, tax liens, private companies, and virtually any other investment.

Why You Need A 401

Its great to have an in the moment mindset life is short after all! But its equally important to think about your future, especially when it comes to money. A 401k is designed to help you save for your retirement years, so youll be financially stable in those years where youre no longer working.

As you can see, 401 plans can be pretty complex, but are well worth the effort. However, each 401 plan is slightly different, so its best to talk with a financial advisor, a banking professional or your companys HR department to get the specific details of your plan. Looking to learn more about investing? Take a look at our investing 101 tips. Happy saving!

Don’t Miss: How To Contact Fidelity 401k

How A Simple 401 Plan Works

A SIMPLE 401 plan is very similar to how a traditional 401 plan works in that it allows employees to defer compensation on a pre-tax basis now to help fund retirement later. Assets contributed to the plan are able to be invested and grow tax free until you begin making withdrawals during retirement.

Benefits Of A 401 Plan

Heres a quick breakdown of the benefits of having a 401:

- The amount you contribute to your 401 is exempt from federal income tax, so it lowers your taxable income.

- Your 401 earnings accrue on a tax deferred basis.

- Matching contribution from your employers

- Investment customization and flexibility youre in control of where you want your money invested.

Read Also: How Do You Pull Out Your 401k

How Do 401k Withdrawals And Transfers Work

The best course of action is to wait until you retire to withdraw money from your 401. If you need to access the money before that, you can trigger taxes and fees. Heres what to know:

- You can withdraw money from your traditional 401 without penalty beginning at age 59½. For Roth 401s you need to reach that age and have had that account for at least 5 years.

- Traditional 401 withdrawals are taxed like regular income.

- Roth 401s withdrawals are not taxable because you paid taxes on the money when you deposited it.

- You must start taking at least the required minimum distributions after retirement beginning April 1 of the year after you turn 70½.

- If you fail to take the required minimum distribution when you are supposed to, the IRS charges you a penalty of 50% of the amount not distributed.

For more tips, investment and retirement strategies visit our Financial Wellness section.

Financial Wellness Center

What Is A Simple 401

Savings incentive match plan for employees, or SIMPLE 401 plans are intended to be cost-effective retirement plans offered to small businesses with 100 employees or less. With the plans, employer contributions are limited to either a dollar-for-dollar matching contribution, up to 3 percent of pay or a non-elective contribution of 2 percent of pay for each eligible employee. No other employer contributions can be made to a SIMPLE 401 plan.

Taking advantage of employer contributions can be a great way to help individuals boost retirement savings. Additionally, SIMPLE 401s offer safe harbor contributions, meaning employers are required to make fully vested contributions, regardless of the employee contributing or not.

Read Also: How Much Tax On 401k Distribution

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

The Tax Benefits Of Your 401 Plan

OVERVIEW

Your contributions to a 401 may lower your tax bill and help you build financial security.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Congress created the 401 plan in 1986 to encourage employees of for-profit businesses to save for retirement. Two primary versions exist:

- Tax-deferred 401

- Non-taxed Roth 401 introduced in 2006

Both retirement savings plans offer tax benefits and can help you build financial security for your retirement expenses, such as bills, food, and emergencies.

Don’t Miss: What Can I Rollover My 401k Into

What Happens To Your 401 When You Change Jobs

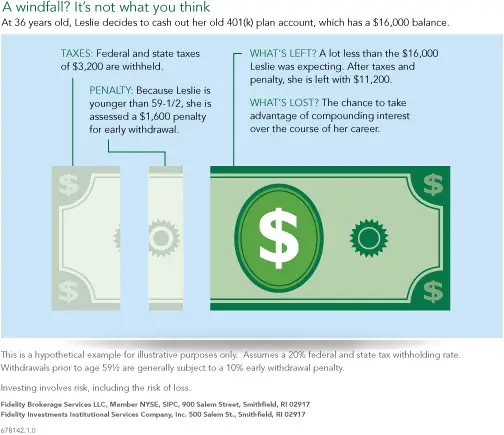

You have several options for your 401 balance when you change jobs. Avoid simply cashing out your savingsif youre under 59½ years old, youll get hit with the 10 percent early withdrawal tax penalty, and if its a traditional 401 youll own income tax on the balance.

If you have less than $1,000 in your 401, the plan administrator is empowered to write you a check for the balance. This gives you 60 days to reinvest the money in an IRA or your new companys 401 plan before you are subject to the additional 10% tax penalty and possible ordinary income tax. If you have more than $1,000 but less than $5,000 in your 401, the administrator can open an IRA in your name and roll your balance over into it.

How Does A 401 Earn Money

Your contributions to your 401 account are invested according to the choices you make from the selection your employer offers. As noted above, these options typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as you get closer to retirement.

How much money you contribute each year, whether or not your company matches your contribution, how your contributions are invested and the annual rate of return on those investments, and the number of years you have until retirement all contribute to how quickly and how much your money will grow. And provided you don’t remove funds from your account, you don’t have to pay taxes on investment gains, interest, or dividends until you withdraw money from the account after retirement , in which case you don’t have to pay taxes on qualified withdrawals when you retire).

What’s more, if you open a 401 when you are young, it has the potential to earn more money for you, thanks to the power of compounding. The benefit of compounding is that returns generated by savings can be reinvested back into the account and begin generating returns of their own. Over a period of many years, the compounded earnings on your 401 account can actually be larger than the contributions you have made to the account. In this way, as you keep contributing to your 401, it has the potential to grow into a sizable chunk of money over time.

Don’t Miss: How To Lower 401k Contribution Fidelity

Who Can Be An Alternate Payee

A QDRO can be used to assign funds to a child, as in the case of child support payments. It’s typically used for assigning a portion of a person’s retirement money to a spouse or ex-spouse as part of the transfer of marital property rights in a divorce. A QDRO allows the creation of alternate payees from a retirement plan provided they’re a dependant, spouse, or ex-spouse of the plan participant. The beneficiary is granted the funds and can have the money transferred to an existing or new retirement account in their name.

Who Is Ted Benna

At the time of the discovery of this provision known as section 401k, Ted Benna was working for Johnson Companies as a benefits consultant. As soon as he spotted this law, Benna recognized that it was a major opportunity for employers and employees all around the world.

The big benefit is the tax advantage savings. Employers have the opportunity to create a tax-advantaged savings account and give access to their employees. This account means that individuals working in regular jobs can set aside a portion of their salary although that rule didnt pass until 1981 and collect this money to save toward their retirement. If an individual can collect money for 30 years, and invest it so that it earns compounding interest, theyll have a nice chunk of change on their hands by the time they want to stop working for a living.

This massive accumulation of wealth and tax deferred investment growth is fueling todays retirement options for the wide majority of people. But in the beginning, it didnt work the way that it does now and well tell you all about it below.

Don’t Miss: Is It Better To Invest In Roth Ira Or 401k

How Does 401 Plan Matching Work

One major benefit of 401 plans is that employers often contribute to your account and match what you save. Each employer has its own methods and rules for how it makes matching 401 plan contributions. Importantly, a match does not necessarily mean that an employer matches your contributions dollar for dollar. Instead, employers typically match up to a certain percentage of your salary or your contribution. For instance, the average employer 401 match is 4.5% of an employees salary, according to the 2020 How America Saves survey.

If your company offers a match, be sure to consider taking advantage of this benefit. It could be a simple and effective way to boost your retirement savings.

One important note: Employers often require you to wait for a certain amount of time before their contributions to your account vest, meaning they become yours to keep. Consider this provision before changing jobs so that you dont inadvertently miss out on extra savings for your retirement.

A Brief History Of 401k

A 401K is a tax deferred, defined contribution retirement plan. The name comes from a section of the Internal Revenue Code that permits an employer to create a retirement plan to which employees may contribute a portion of their wages on a pretax basis. This section also allows the employer to match employee contributions with tax-deductible company contributions. Earnings on all contributions are allowed to accumulate in a tax-deferred trust.

If you read books on 401K or internet sites on 401K, most will tell you that Congress enacted 401K law when it modified ERISA in 1978. That is not true. It is completely wrong information and it gets circulated again and again.

401K was not the idea of some smart legislator. The 401K name comes from a section of the IRS code. This section was added in 1978 but for 2 years no one paid much attention to it. A creative interpretation of that provision by a smart consultant gave birth to first 401k savings plan. The government tried to repeal the 401K provision twice once it realized the enormous tax loss from the 401K provision.

401K plans as they evolved today are a brainchild of Ted Benna, a retirement benefit consultant working for a Pennsylvania based Johnson Cos. . He devised the plan for a client who declined to use it because of the fear that once the government realized the tax loss potential of the plan the 401k provision would be repealed. After the client rejected it, Ted Benna persuaded his own company to use it.

Read Also: How To Transfer 401k To Bank Account

Results Of An Empirical Study

This study uses a different data set, the 1998 Survey of Consumer Finances , to explore the relationship between individual and plan characteristics and employees’ decisions to participate in and contribute to 401 plans. The SCF is a triennial survey sponsored by the Federal Reserve Board in cooperation with Statistics of Income of the Department of the Treasury. The SCF collects detailed information on households’ assets, liabilities, and demographic characteristics, as well as on pension coverage, participation, and pension plan characteristics.19 It provides much more information about individuals than other studies do, specifically with regard to workers’ attitudes toward saving and to nonpension assets owned by covered workers or by others in their family.

Table 1. Weighted means of the variables| Variable |

|---|

| NOTE: DB = defined benefit . . . = not applicable. |

| a. For those with a defined benefit plan. |

Although the SCF provides information on wealth and tastes not available elsewhere, it suffers from lack of information about 401 plans offered to employees who choose not to participate in them. Therefore, our participation equation does not include information about the availability and level of employer matches or the potential for access to retirement funds. However, since the SCF does provide plan information for those who participate in 401 plans, our contribution equation can include plan data as well as individual characteristics.

How Does A 401 Work

401 accounts can only be sponsored by an employer. In most organizations, the 401 plan is offered as an optional retirement benefit.

A 401 is a defined contribution account. If an eligible employee participates in a 401, they will decide an amount of their salary that will be deducted from their paycheck into a separate account.

Employer matching. Employers may or may not match the employee’s contributions, up to a limit. Employers who decided to match employee contributions do so according to a determined formula. Employer contributions might be on the basis of $0.50 or $1.00 for every $1.00 contributed by the employee.

Investments. Companies typically offer employees several investment options for their 401 accounts. These can include mutual funds, index funds, large- and small-cap funds, real estate funds, bond funds and foreign funds. These options are managed by financial service groups.

For traditional 401 accounts, contributions from employee paychecks are made with pre-tax dollars and taxed as ordinary income upon withdrawal. Contributions to Roth 401s are made with post-tax paycheck deductions but are not taxed upon withdrawal.

Withdrawals. Usually, once the money is deposited into a 401, employees must meet certain criteria in order to make an unpenalized withdrawal from their 401 account . These criteria are known as triggering events:

Early withdrawals that do not satisfy these criteria are typically subject to income taxes and an additional 10% in penalties.

Read Also: How To Get My 401k Money From Walmart

Open A Health Savings Account

If youre enrolled in an eligible high-deductible health plan , you may be able to open a health savings account . These savings vehicles help Americans save for future medical expenses, which can leave you burdened with major bills.

They also offer a triple tax advantage. You fund these accounts with pre-tax dollars and your earnings grow shielded from taxes. As with 401 plans, you can invest these savings in securities like stocks, bonds and mutual funds. In addition, you can withdraw money from HSAs tax-free as long as they cover qualified medical expenses. So while not designed as a retirement plan, you can use these accounts to pay for health costs that you otherwise would have relied on 401 money to cover. In a sense, that money can keep growing in the plan.

You Can Take It With You

If you leave your job someday for another, you can take your 401 with you. This won’t go into a box with your other belongings rather, you’ll need to roll over that account into a new one and for many people, converting that 401 to an IRA is a great idea. You’ll want to consult our guide for 401 rollovers when that time comes.

About the author:Dayana Yochim is a former NerdWallet authority on retirement and investing. Her work has been featured by Forbes, Real Simple, USA Today, Woman’s Day and The Associated Press.Read more

You May Like: What Happens If I Quit My Job With A 401k