How Much Can I Contribute To My 401

This 401 account might sound amazing, and if youre a super saver, you might decide to defer as much compensation as you can to really build that account. But there are limits on how much you can contribute each year. Federal rules dictate the maximum annual contribution limits: For 2020, employees under age 50 can contribute up to $19,500, while those age 50 or over are eligible to contribute an additional $6,500 .

The annual limits apply even if you have more than one 401for example, if you started one at a previous job, then quit the job during the year and started a new one at your current job.

Some companies might have their own rules, as well, and theres one other aspect that might cap your contributions. The IRS puts some additional limits on highly compensated employees. HCEs are those who either made more than $120,000 in the preceding year or owned more than 5 percent of the interest in the business. Some companies can add another layer, and designate someone as an HCE if they were in the top 20 percent of employees as ranked by compensation. These HCEs can only participate to the full extent depending on the participation of non-HCEstheres a formula that is based either on how many non-HCEs participate or how much they contribute. Thats because the IRS wants to ensure that 401 arent just a haven for the wealthy and that employees at all levels are able to participate.

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

What Kind Of Investments Are In A 401

401s often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your matching dollars, and then direct any additional retirement savings contributions for the year into an IRA.

Dont Miss: Can I Transfer My Ira To My 401k

Also Check: Why Cant I Take Money Out Of My 401k

Tips For Getting Retirement Ready

- If youre unsure of what your retirement plans should look like, a financial advisor can help you get things in order. Luckily finding a financial advisor doesnt have to be hard. SmartAssets free matching tool can pair you with up to three advisors in your area. Get started now.

- Dont forget about Social Security. Youll get a check from the government each month, which can help you get to your desired retirement income level. Find out how much youll get with our free Social Security calculator.

Dont Miss: Can I Roll My Roth 401k Into A Roth Ira

What Types Of Distributions Cannot Be Qualified Distributions And Must Be Included In Gross Income

You cannot treat the following types of distributions from a designated Roth account as qualified distributions and must include any earnings paid out in gross income:

-

Corrective distributions of elective deferrals in excess of the IRC Section 415 limits or 100% of earnings).

-

Corrective distributions of excess deferrals under Section 402 .

- Corrective distributions of excess contributions or excess aggregate contributions.

- Deemed distributions under IRC Section 72 .

Also Check: How To Get My 401k Statement

Federal Insurance For Private Pensions

If your company runs into financial problems, youre likely to still get your pension.

-

Insures most private-sector defined-benefit pensions. These are plans that typically pay a certain amount each month after you retire.

-

Covers most cash-balance plans. Those are defined-benefit pensions that allow you to take a lump-sum distribution.

-

Does not cover government and military pensions, 401k plans, IRAs, and certain others.

Since A Qualified Distribution From A Designated Roth Account Is Not Subject To Taxation Must The Distribution Be Reported

Yes, a distribution from a designated Roth account must be reported on Form 1099R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.PDF.

For direct rollovers, the plan administrator is required to provide the plan administrator of the plan accepting an eligible rollover distribution, with a statement indicating either the first year of the 5-taxable-year period for the employee and the portion of the distribution attributable to basis, or, that the distribution is a qualified distribution.

For other distributions, the plan administrator must provide to the employee, upon request, the portion of the distribution attributable to basis or that the distribution is a qualified distribution. The statement is required to be provided within a reasonable period following the employee request, but in no event later than 30 days following the employee request.

Also Check: How To Rollover 401k From Wells Fargo To Vanguard

Who Is Responsible For Keeping Track Of The Designated Roth Contributions And 5

The plan administrator is responsible for keeping track of the amount of designated Roth contributions made for each employee and the date of the first designated Roth contribution for calculating an employees 5-taxable-year period. In addition, the plan administrator of a plan directly rolling over a distribution would be required to provide the administrator of the plan accepting the eligible rollover distribution) with a statement indicating either the first year of the 5-taxable-year period for the employee and the portion of the distribution attributable to basis or that the distribution is a qualified distribution.

What Are The Tax Implications Of Cashing Out Your 401

Withdrawals from pre-tax 401s are taxed as ordinary income in other words, theyre taxed at your highest marginal tax rate. Note that this is the same rate at which your job or freelance income is taxed.

Ordinary income tax is higher than long-term capital gains tax, which is the tax charged on any realized stock gains after youve held the stock for a year or longer in a taxable account.

If you have a Roth 401, you wont pay ordinary income tax when you withdraw money, as you already paid tax on this money when you made contributions to the account. You will still be liable for the 10% early withdrawal penalty, however, if youre below 59 ½.

Dont Miss: How To Convert 401k To Silver

Read Also: What To Invest My 401k In

Rollover To Your New 401 Plan

If you have access to your new employers plan, then this might be a good option for you if the fees and investment choices are good. To rollover into your new plan, work with the new plan administrator to coordinate the process. This assumes that your new employer and plan administrator allows this.

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Also Check: How Often Can I Change My 401k Investments Fidelity

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employer’s plan. As with an IRA rollover, this maintains the account’s tax-deferred status and avoids immediate taxes.

It could be a wise move if you aren’t comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plan’s administrator.

Read Also: How To Sell 401k Stock

How Long Do You Have To Move Your 401 After Leaving Your Job

Theres no time limit on how long you can keep your 401 after leaving your job. You can leave it in your former employers plan, roll it into an IRA, or cash it out. Each option has different rules and consequences, so its important to understand your choices before making a decision.

If you leave your 401 in your former employers plan, youll still be able to access your account and make changes to your investment choices. However, you may have limited options for withdrawing your money and may be subject to higher fees.

Rolling your 401 into an IRA gives you more control over your account and typically lower fees. Youll also be able to access your money more easily. However, youll need to roll over the account within 60 days to avoid paying taxes and penalties.

Cashing out your 401 should be a last resort. Youll have to pay taxes on the money you withdraw, and you may also be hit with a 10% early withdrawal penalty if youre under age 59 1/2. Cashing out will leave you without the tax-deferred savings to help you reach your retirement goals.

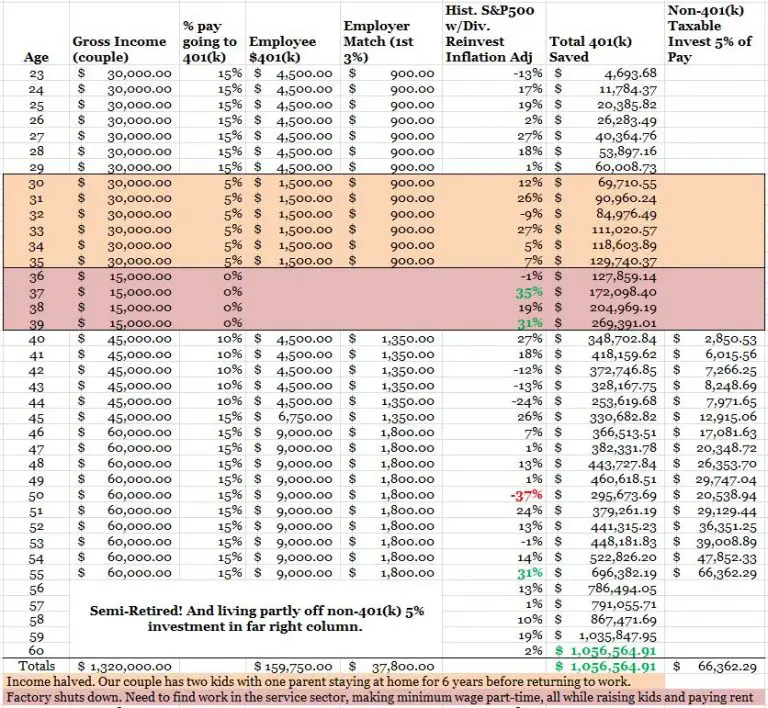

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $20,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.

The average life expectancy for men is around 84 years old, and 86.5 years old for women.

Also Check: Can I Use 401k To Pay Off Credit Card Debt

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

What Are Required Minimum Distributions

Required Minimum Distributions generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 , if later, the year in which he or she retires. However, if the retirement plan account is an IRA or the account owner is a 5% owner of the business sponsoring the retirement plan, the RMDs must begin once the account holder is age 72 , regardless of whether he or she is retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time every year from their accounts, and they face stiff penalties for failure to take RMDs.

You May Like: What To Do With 401k When You Quit

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Check A National Plan Database

For 401 plans that have been left with employers for a significant amount of time, companies have the option of sending these accounts off to their stateâs treasury department.

Although not the best option, leaving it with your former employer is an optionâfor now. You shouldnât plan to leave it alone for too long.

Most 401 plans will cash your 401 out and mail it to you if the balance is under $1,000, subjecting it to penalties and taxes. If the balance is over $1,000 but less than $5,000, they can transfer it over to an IRA of their choosing.

Once youâve found an old 401, make a plan to do something with it soon before the planâs administrator does something with it you donât want.

You May Like: Should I Cash Out My 401k To Start A Business

If You’re Younger In Your Career

Your best bet is to leave your 401 account alone and continue making contributions as normal. This guidance is even more important for younger 401 savers who still have a long way to go before retirement and therefore have time to wait out any market dips their accounts can recover and bounce back long before they enter their nonworking years.

“For investors who have long runways ahead of them, market declines can provide great opportunities,” Winsett points out, suggesting that there are a couple of items younger investors should consider. If you have excess fixed income or cash holdings, it can provide a great opportunity to rebalance capital into equities at discounted prices. Or, if you’re contributing to your 401 on a regular basis through your paycheck, you may want to consider increasing your contribution rate so more money can be deployed during a market decline.

If you’re young and still worried, make sure you know where your 401 money is being invested to make sure the risk is something you can afford taking on, as employers will usually automatically assign a 401 portfolio based on your age and target retirement date. Remember that you can always consult your 401 plan provider for help.