How To Rollover An Employer 401k To The Solo 401k

Have funds at a current or previous employer 401k? Learn how you can rollover those funds to your Solo 401k and get them into your control. If you are an independent thinker, the Solo 401k is probably the best retirement account for you. Its definitely the best retirement plan for the self-employed and freelancers. Saving for retirement doesnt involve a one-size-fits-all plan. Since every situation is unique, its important to look for the retirement account that best lines up with your job situation and future goals. The Solo 401k offers the most flexibility and highest contributions allowed under the tax laws. That makes it the right choice for the person wanting full control of their future and especially control of their retirement future.

There are several ways to open and/or fund your Solo 401k. A rollover from an employer 401k is among the fastest and easiest. When you rollover funds from a current or previous employer to your Solo 401k, its important that it be done correctly to avoid taxes and penalties. If the rollover is done wrong, you can trigger an accidental distribution . To assure all of the forms are filled out correctly, we provide an easy-to-use rollover request generator that creates a customized rollover to transfer funds from another existing account into your Solo 401k.

Invest Your Newly Deposited Funds

You’ll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

Which One Do You Choose

Where are you now financially compared to where you think youll be when you tap into the funds? Answering this question may help you decide which rollover to use. If youre in a high tax bracket now and expect to need the funds before five years, a Roth IRA may not make sense. Youll pay a high tax bill upfront and then lose the anticipated benefit from tax-free growth that wont materialize.

If youre in a modest tax bracket now but expect to be in a higher one in the future, the tax cost now may be small compared with the tax savings down the road. That is, assuming you can afford to pay taxes on the rollover now.

Bear in mind that all withdrawals from a traditional IRA are subject to regular income tax plus a penalty if youre under 59½. Withdrawals from a Roth IRA of after-tax contributions are never taxed. Youll only be taxed if you withdraw earnings on the contributions before you’ve held the account for five years. These may be subject to a 10% penalty as well if youre under 59½ and dont qualify for a penalty exception.

Its not all or nothing, though. You can split your distribution between a traditional and Roth IRA, assuming the 401 plan administrator permits it. You can choose any split that works for you, such as 75% to a traditional IRA and 25% to a Roth IRA. You can also leave some assets in the plan.

Don’t Miss: Can I Move My 401k To An Ira

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if you’re leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employer’s 401

- Withdrawal from your 401, which would trigger a 10% penalty if you aren’t 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesn’t offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration won’t allow you to stay invested for some other reason

- Your new employer’s 401 plan charges high fees, offers limited investments, or has other drawbacks

- You’d prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an “NUA strategy” that could save you a lot of money.)

If these downsides aren’t deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022: Employees with 401 plans that allow after-tax contributions of up to $58,000 would no longer be able to convert those to tax-free Roth accounts. Backdoor Roth contributions from traditional IRAs, as described below, would also be banned. Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, its probably best to consult with a financial advisor to weigh your options.

Read Also: Can I Borrow Against My 401k

Exceptions To Additional Taxes

You dont have to pay additional taxes if you are age 59½ or older when you withdraw the money from your SIMPLE IRA. You also dont have to pay additional taxes if, for example:

- Your withdrawal is not more than:

- Your unreimbursed medical expenses that exceed 10% of your adjusted gross income ,

- Your cost for your medical insurance while unemployed,

- Your qualified higher education expenses, or

- The amount to buy, build or rebuild a first home

You May Like: How To Get Your 401k Without Penalty

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Read Also: How To Get Money Out Of Fidelity 401k

Simple Ira Contribution Limits

For 2021, the SIMPLE IRA contribution limits are $13,500 or $16,500 for people who are age 50 and older. For 2022, the SIMPLE IRA contribution limits rise to $14,000 or $17,000 for people 50 or older.

If you want to contribute more than that amount, you can also invest up to an additional $6,000 in a traditional or Roth IRA. You cannot, however, max out both a SIMPLE IRA and another employer-sponsored retirement plan, like a 401.

The annual total for both SIMPLE IRA contributions and 401 contributions cant be more than $19,500 for 2021 . In 2022, this increases to $20,500 . Because an employer cannot offer both a 401 and a SIMPLE IRA, this scenario would only occur if you changed employers during one year, your employer changed your plan mid-year or you had multiple jobs with retirement benefits.

What Is A Simple Ira

A simple IRA is a typeof retirement account that is established by employers for the benefit of theiremployees. It may be used by small businesses that do not have 401 plans, includingsole proprietorships and partnerships.

With this type of plan, employers make matching contributions into theIRA. The contributions that employees make are made on a pre-tax basis, meaningthat they will have to pay taxes when they begin taking distributions.

Read Also: How Can I Pull Money From My 401k

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

I often help clients prepare these requests and do a three-way call with them , making it quick and easy to get things done. But if you prefer, you can probably figure this out on your own.

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

What to Say

Ira Fees To Be Aware Of

If you do opt for a self-directed IRA account, there may be some fees to be aware of. However, self-directed IRA fees are almost always lower than 401 fees.

Examples include:

- Annual fee. This may go by different names, such as an administrative fee, and may be something like $50 per year. But most IRA trustees dont charge this fee.

- Trading commissions. Most major brokerages have waived these fees on trades of stocks, exchange traded funds and options. But many still charge trading fees on mutual funds and some other investments.

- Load fees. These are sales charges on mutual funds, and they can be as high as 3%. However, many mutual funds are no-load, and you can avoid the fee by holding these funds.

- Management fees. These apply to managed funds, like robo-advisors. They generally charge an annual fee to manage your portfolio, ranging from 0.25% to 0.50%. For example, if you have $100,000 in the plan, and the robo-advisor fee is 0.25%, youll pay $250 per year, which is usually pro-rated on a monthly basis.

- Expense ratios. These are the fees charged by funds for administrative and marketing expenses. Called 12b-1 fees they can be as high as 1% annually. But you can find many funds that charge less than 0.20%. You dont pay this fee separately. Rather its an internal fee, charged within the fund, thus reducing its net return.

Also Check: What Is Asset Allocation In 401k

Conduct An Ira Rollover

Next, you’ll need to move the money from your current retirement plan into a gold IRA rollover account. Your previous IRA custodian may send the money directly to your new custodian in a direct rollover. Or your previous retirement account’s holdings are sent to you straight, with the intention that you’ll conduct the IRA rollover yourself. You may need to file additional papers as proof. Specialists prefer a direct rollover as it takes less paperwork and time.

Should You Choose A Simple Ira

If your employer offers a SIMPLE IRA and youâre eligible for the plan, itâs a good idea to participate, especially if the employer provides matching contributions. Matching contributions are free money, and with a SIMPLE IRA that money is immediately yours as soon as it hits your account.

If youâre an employer with 100 or fewer employees and want to provide an employee retirement benefit, a SIMPLE IRA can be a solid choice that allows you to attract high-quality workers without some of the paperwork and hassle that can come with a 401. However, itâs important to review your options and consider whether it makes sense for you. Remember that youâll likely have to provide some amount of employer contribution as long as you have a SIMPLE IRA retirement plan.

Also Check: How To Check For 401k

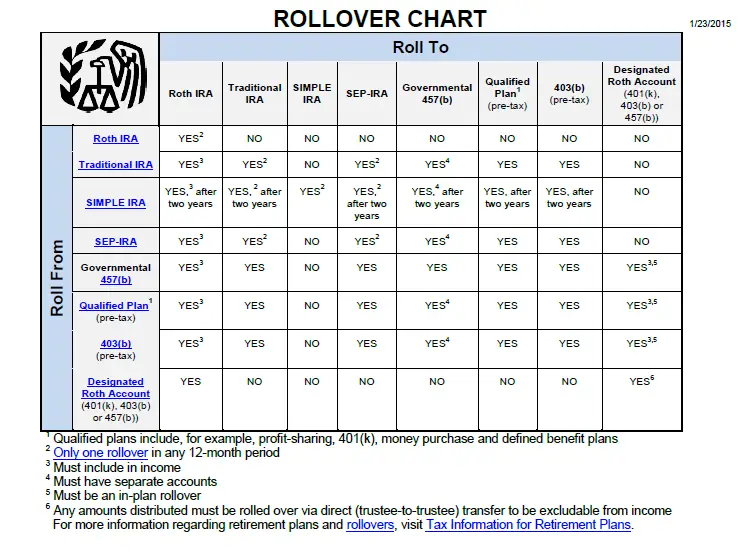

Can Simple Ira Participants Roll Their Account To The New 401 Plan

Yes, but there is a catch. SIMPLE IRAs are subject to a 2-year rollover rule. For their first two years, SIMPLE IRAs can only be rolled to another SIMPLE IRA. This 2-year period commences on the date that contributions are first made to the SIMPLE IRA. Only once the 2-year period has ended can a SIMPLE IRA be rolled to a 401 plan.

These Erisa Rules Are Applied To Simple Iras:

-

Enacted in 1974, ERISA outlines the requirements for establishing and managing employer-sponsored retirement plans. For SIMPLE IRAs, ERISA dictates the eligibility of the employees and how employee contributions are handled by the companyEmployers are given the flexibility to customize the eligibility requirements, but usually, employees who have put in at least one year of service and are 21 years or above are eligible for the plan. However, some employers may decide to make their employees eligible sooner or, in some cases, even immediately.

-

ERISA defines key issues while handling employee contributions. For example, with a SIMPLE IRA, the salary deferral contributions have to be deposited in the account by the end of the month following the month in which the funds were withheld from the employees paycheck. SIMPLE IRAs are subject to contribution limits. You can find the details here.

-

When it comes to investment choices, a SIMPLE IRA functions like any other IRAs. It means the employee has full control of the investment choices for their accounts, unlike a 401 plan where the employer offers a limited option from which the employees have to choose.

The two-year time frame begins the day you and your employer make the first contribution to the SIMPLE IRA.

Don’t Miss: Is A Rollover From A 401k To An Ira Taxable

What Is A Gold Ira Rollover

IRA rollovers allow you to move money from a current retirement plan into a new precious metal asset. A gold IRA holds physical gold or coins instead of standard holdings like equities or stock exchange shares. The most popular method is to move your money straight from your previous 401k account to your new IRA. This straightforward procedure can be completed over the telephone or the internet.

You can buy actual gold in an IRA rollover to shield your retirement funds from economic uncertainties and devaluation. This method effectively deals with a tangible commodity with an inherent worth that is not dependent on the stock market progress. Even in periods of high economic volatility, this can be beneficial security for your retirement assets.

However, before activating a gold IRA or purchasing a precious metal product, carefully go through the criteria set forth by the Internal Revenue Service . The organization has clearly set the standard for evaluating metal fineness, and by knowing such information, you will certainly be a confident first-time gold investor.

Cash Or Other Incentives

Financial institutions are eager for your business. To entice you to bring them your retirement money, they may throw some cash your way. In late 2021, for example, TD Ameritrade was offering bonuses of up to $2,500 when you rolled over your 401 into one of its IRAs. If it’s not cash, free stock trades can be part of the package at some companies.

Recommended Reading: How Can I Borrow Money From My Walmart 401k

What Are Your Options

When you leave an employer with whom you had a SIMPLE IRA, you have a few options for those assets. Funds from a SIMPLE IRA can be rolled over into another SIMPLE IRA, a traditional IRA, or another qualified plan, such as a 401. But just like with a 401, you have to ensure that you follow the proper process. This can help you avoid taxes or penalties on the asset transfer.

Opt for a trustee-to-trustee transfer, which will cash out your assets in your former employer’s SIMPLE IRA plan. Then, either cut a check or do a wire transfer for the benefit of your rollover SIMPLE IRA. That way, the funds can be deposited in your new rollover account.