How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

You May Like: How To Direct Transfer 401k To 403b

Option : Leave It Where It Is

You dont have to move the money out of your old 401 if you dont want to. You wont ever lose the funds provided you dont lose track of your old account again. But this option is usually the least desirable.

For one, its more difficult to manage your retirement savings when theyre spread out over many accounts. You also get stuck paying whatever your old 401s fees were, and these can be higher than what youd pay if you moved your money to an individual retirement account, for example.

But if you like your plans investment options and the fees arent too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you dont forget.

Roll Your 401 Money Into A New Employers Plan

Depending on the benefits package available with your new employer, you may have the ability to simply transfer your money to a new 401 plan. To do this, you would contact the administrator for your old plan and complete the required paperwork to disburse the funds to the new employers plan.

There are other benefits to this option as well, including not losing track of the account by leaving it with a previous employer, says Assaf.

Having only one 401 can make it easier to manage your retirement savings in one consolidated account, says Assaf. In addition, many plans offer lower-cost or plan-specific investment options.

Before taking this step, however, carefully read and understand the new plan rules. And consider the range of investment options available through the new plan to ensure they meet your financial goals and needs.

There may also be differences in the fees associated with one employers plan versus another. The user experience between plans may also varyall of which is worth considering.

The customer service experience and website experience may be different. Youll want to consider how usable the plans website experience is and how easy it is to navigate, as that can vary a lot between an old plan and a new employers plan, says Tierney.

You May Like: How To Check How Much 401k I Have

How Much Of Your 401 Do You Get When You Leave An Employer

You are entitled to 100 percent of any contributions youve made into the 401 plan, but how much of an employer match youre entitled to is based on how the plan is set up and the vesting period. A vesting schedule is based on the length of time required to have ownership in the employers contributions. If you are 100 percent vested in employer contributions, you will receive all of the money the company has contributed on your behalf.

If you have not been with the company for the required amount of time, you may receive a percentage of employer contributions, based on the plans vesting schedule. The rest of the money set aside for you is forfeited back to the company. Most 401 providers delineate how much of your balance is fully vested. If youre not sure, you can always call to inquire.

Make The Best Decision For You

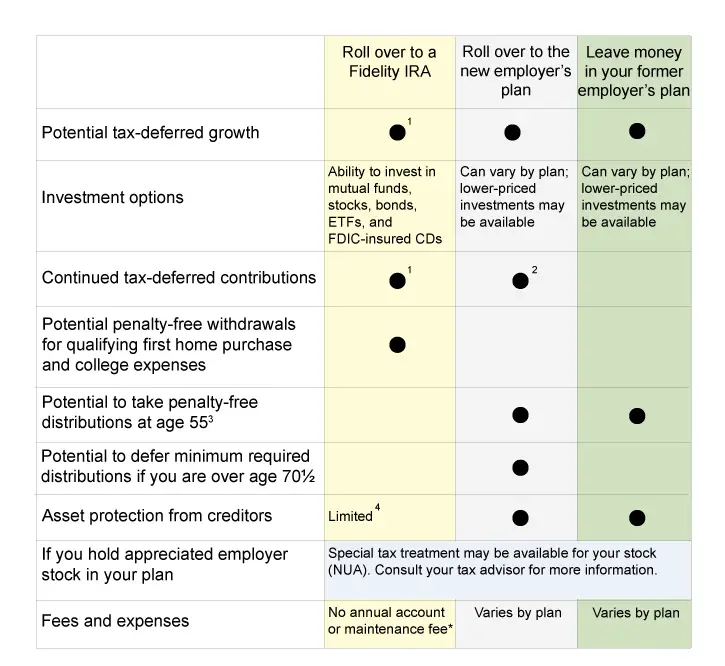

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

You May Like: How Much Money Can You Contribute To A 401k

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps thats why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 If left unattended for too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them:

Cons Of Leaving 401 With Old Employer

Limited Withdrawal

Once you leave your employer, you have limited withdrawal options. If you decide to make a withdrawal, you can only take the entire 401 balance and not a partial withdrawal. Also, you canât take a 401 loan against your 401 savings.

Higher fees

When you leave a 401 account with the employer, the plan administrator charges various fees such as bookkeeping, administration costs, and legal charges to manage the account. Over time, these fees can reduce your 401 balance if the returns are lower than the fees charged.

You wonât deposit money into the account

You wonât make further contributions to the 401 account after leaving your job. This limits the 401 growth potential since it will only grow based on the balance at the time of your exit from the company.

Minimum required distributions

Once you attain age 72, you must take the required minimum distributions from the 401 account and pay income taxes.

Don’t Miss: How To Take Money From Fidelity 401k

Can You Lose Your 401 If You Get Fired

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Also Check: How To Start A 401k Self Employed

Rollover Your Old 401k Money Into A New Ira

Known as a rollover IRA, this type of IRA is designed to accept the transfer of assets from a former employers 401k. If your new employer doesnt offer a 401k or youre not pleased with the plans costs or investment options, this is probably your best option because it will give you the most flexibility and control to stay on track with your retirement savings goals. In fact, this is what we generally recommend to our clients who have old 401ks. IRAs generally have more investment options, no plan fees, and greater withdrawal flexibility.

In order to execute a rollover IRA, your first step is to open a new IRA with an investment advisor or financial institution. The rollover process is similar to the one described above except that you will instruct the administrator of your former employers 401k to transfer plan assets directly into your new rollover IRA.

Conversely, you can have a check sent directly to you, but make sure that the check is made payable to your IRA custodian for benefit of your name. The former plan administrator will withhold 20% of the amount for the payment of taxes and you will have 60 days to deposit the full balance, including the 20% withheld, into your rollover IRA. Failure to deposit the entire amount into your new IRA could result in current tax liabilities plus a 10 percent penalty if youre under age 59½.

K And Your Tax Burden

One of the best things about a 401 k is that the money in these accounts is not subject to tax. With an IRA, you can save and invest money without having to worry about the tax burden. However, this only applies while the money remains in your IRA. It is also not uncommon to have more than one IRA, so it may help to learn how many IRA you can have and how it affects your 401k. If you remove the money or roll it into another account, it becomes part of your taxable estate. This is why its important that you make decisions regarding your 401 k wisely and dont rush into anything.

Its crucial that you educate your beneficiaries on how your 401 k works, too. If you pass away before youve retired, the company you work for ensures that your beneficiary gets access to your 401 k. However, you have to make sure that your beneficiary understands how this works. Your 401 k money may be subject to income tax if its removed from your IRA. If the balance in your account is substantial, a lump distribution could result in substantial income taxes for your beneficiary.

If your beneficiary wants to avoid paying tax on all of your 401 k at once, its important that they take this into consideration. You have to make sure they understand all of the options that are available. Its not necessary to transfer all of the money in an IRA at once, for example. Distribution can be spread out into multiple distributions over an extended period.

Recommended Reading: How To Invest Without A 401k

Roll It Over Into An Ira

If youre not moving to a new employer, or if your new employer doesnt offer a retirement plan, you still have a good optionyou can roll your old 401 into an IRA. Youll be opening the account on your own, through the financial institution of your choice. The possibilities are almost limitless. That is, youre no longer restricted to the options made available by an employer.

If you have an outstanding loan from your 401 and leave your job, youll have to repay it within a specified time period. If you dont, the amount will be treated as a distribution for tax purposes.

How To Decide Which Rollover Is Right For You

When you leave an employer for non-retirement reasons, for a new job, or just to be on your own, you have four options for your 401 plan:

Let’s look at each of these strategies to determine which is the best option for you.

Recommended Reading: What Are The Benefits Of A 401k Plan

Take Your Assets With You

Probably the best way to keep track of your retirement funds is to take them with you when you change jobs. There are usually limited options with a defined benefit pension. You may be able to take the money as a lump sum if the vested balance is small. Be sure to ask. The lump sum payments are eligible for rollover to an IRA to avoid tax. Defined contribution plans like 401s and 403s can also be rolled over to an IRA and sometimes to your new employers plan.

Your goal should be to have all your retirement funds working together for you in the most efficient manner possible. Some people think having multiple accounts is a form of diversification. It is not. The investments within the account are what provides diversification. Having fewer accounts to monitor makes implementing your investment strategy easier and helps to avoid losing track of a plan in the future.

How To Get Emergency Cash From Your 401 And Keep On Investing

With a partial cash withdrawal, you would first roll all of your 401 funds into an IRA. By leaving part of your funds in a cash position within the IRA, you have cash as needed. Meanwhile, you can invest the remainder as per your retirement strategy. Its really an option of last resort. However, a partial approach makes the most of a dire situation, says Markwell.

No matter what options you consider or eventually choose, Markwell has this advice to offer: One of the advantages of working with a financial advisor during a career transition is that you can reduce your stress level and emotions, says Markwell. And with a clearer head, you can make decisions that will help in putting you on a more solid track to a successful retirement when the time comes.

Also Check: Is It Better To Combine 401k Accounts

Cashing Out A 401 In The Event Of Job Termination

In case you are fired, you can cash out your 401 plan even if you are below the age of 59 ½ years. You just need to contact the administrator of your plan and fill out certain forms for the distribution of your 401 funds. However, the Internal Revenue Service may charge you a penalty of 10% for early withdrawal, subject to certain exceptions.

You May Like: How Often Can I Change My 401k Investments Fidelity

The Cons Of Leaving Your 401 Behind

Risk of Losing Track of Old 401s

Rolling over an old 401 or managing your savings during a job transition can be stressful and chaotic. Some people end up leaving behind an old account with the intention to revisit it later, only to forget about it or lose track of it as they are faced with other aspects of their job transition. This will make it difficult to put your savings to good use in a way that promotes your financial stability in the future.

As of now, if you have less than $5,000 in any old accounts, your previous employers will likely either cut you a check for the remaining balance or move the money into an IRA. Its up to you to find it, though.

Missing Out on Investment Opportunities

Do you know when you forget your old 401 accounts, you miss out on a chance for a solid investment plan? You were wise enough to set up a retirement plan to secure your financial freedom for the future. But, when you leave behind any amount of savings, it leads to loss of earning capacity.

Leaving behind money in an old retirement account also means that your savings dollars may not be invested in the most beneficial way possible for you. Staying on top of old accounts or rolling them over into your current plan can help you ensure you are investing every dollar with purpose, efficiency and your unique goals in mind.

Dont Miss: How Soon Can I Borrow From My 401k

You May Like: Does 401k Transfer Between Jobs

Is Rolling A 401 Into An Ira A Better Option

When it comes to the 401 advice she gives most often, Priya says it comes down to one thing. “Roll your old 401 into a traditional IRA. This is where you walk away with the biggest win. All of your old retirement accounts are consolidated into one place, you are working with fewer fees because of the lack of employee sponsorship, and your investment options are nearly unlimited.”

How To Find Old 401 Accounts

E. NapoletanoEditorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

Billions of dollars are left behind in forgotten 401 plans in the United States. Thats a massive amount of unclaimed property just waiting to be returned to its right fully owners. So if youre looking to find old 401 accounts, youve come to the right place. Well help you track them down in four different ways.

Recommended Reading: Should You Always Rollover Your 401k