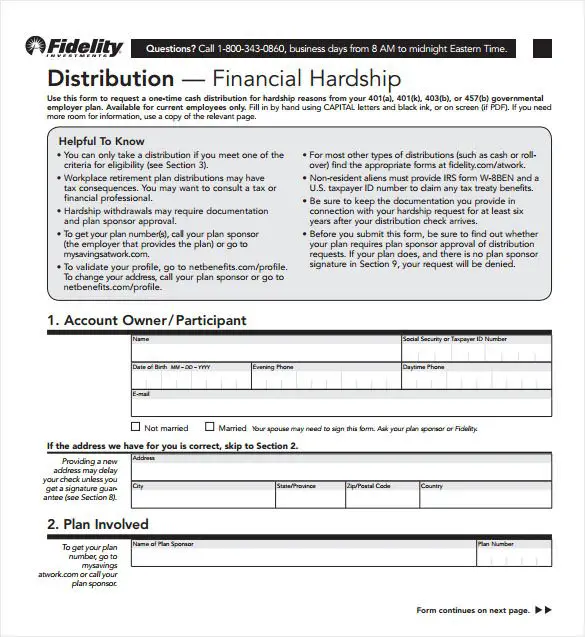

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

You May Like: How Do I Get Access To My 401k

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Dont Miss: Does 401k Roll Over From Job To Job

Withdrawing After Age 595

You May Like: What To Do With 401k When You Quit Your Job

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

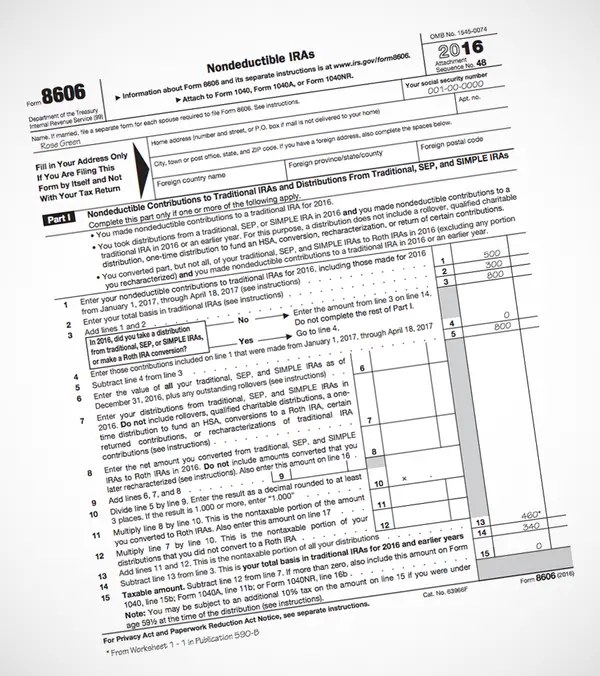

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

Read Also: What Is The Maximum I Can Contribute To My 401k

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will likely trigger a lump-sum distribution.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

You May Like: Is Rolling Over 401k To Ira Taxable

Transfer Regularly To/from Your Account

Schedule automatic transfers to a mutual fund position, IRA, or 529 account from your bank or brokerage Core account. Free1 Schedule automatic transfers from your Fidelity account to another Fidelity account or a bank account. Free1 Your employer deposits your paycheck to your Fidelity account. Free1

What Is A 401k

A 401k allows you to dedicate a percentage of your pre-tax salary to a retirement account.

Employers can also choose to match some or all of the contributions, but this isnt required so its not guaranteed.

There are two basic types of 401ks traditional and Roth with the main difference being how theyre taxed.

In a traditional 401k, employee contributions reduce their income taxes for the year they are made, but theyll pay tax when they withdraw cash.

Dont Miss: Where Can I Find My 401k

You May Like: How To Change 401k Contribution On Fidelity

Fidelity Solo 401k Brokerage Account From My Solo 401k Financial

A Fidelity Investments Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, notes, tax liens, and private shares in addition to processing a solo 401k participant loan.

Roll Money Into An Ira

If you are not satisfied with the 401 investment options, you can rollover the money into an IRA since the latter has more investment options and offers greater control. You can reallocate your portfolio of investments to help you grow your investments further in years to come.

If you have a string of old 401s when you retire, you should consolidate them into an IRA for better management of your retirement savings. Also, you can reduce the administration fees of your retirement money, and even qualify for discounts on sales charges.

Dont Miss: How To Sell 401k Plans

Don’t Miss: Can I Roll My 401k Into A Traditional Ira

How To Protect Your 401k From A Stock Market Crash

Are you riding your retirement on the success of the stock market? If so, its understandable that youre worried about what a crash could mean for your 401k.

If thats you and youre wondering how to protect your 401kfrom a stock market crash, Ive got good news for you:

You dont have to worry.

The stock market is volatile, but you can minimize that risk with the right investing strategy.

If you invest your money the right way, you can not only protect your retirement but also experience even greater returns so your retirement can be even sweeter. Ill show you how to take advantage of stock market volatility, which includes a stock market crash, so you can profit from the fluctuations instead of watching your portfolio take a plunge.

Are you with me?

Borrowing Or Withdrawing Money From Your 401 Plan Before You Retire

Borrowing or withdrawing money from your 401 before you retire is a big decision. After all, youve worked hard and saved hard to build up your retirement fund. While taking money out of your 401 plan is possible, it can impact your savings progress and long-term retirement goals so its important to carefully weigh the risks, costs and benefits.

Don’t Miss: When Should I Start A 401k

Understanding Early Withdrawal From A 401

The method and process of withdrawing money from your 401 will depend on your employer and the type of withdrawal you choose. Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. Its really a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available. If it is, then you should check the fine print of your plan to determine the type of withdrawals that are allowed or available.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds. For a $10,000 withdrawal, once all taxes and penalties are paid, you will only receive approximately $6,300. There are some non-penalty options to consider, however.

Before deciding upon taking an early withdrawal from your 401, find out if your plan allows you to take a loan against it, as this allows you to eventually replace the funds. You may also want to consider alternative options for securing financing that could hurt you less in the long run, such as a small personal loan.

Find The Mortgage Option Thats Right For You

Your 401 account may seem tempting as an untapped source of cash, especially if youre struggling to come up with the money for a down payment on your new home. While this is a viable option, and there are ways to mitigate the penalties, it should only be used as a last resort. Consider applying for a low down-payment loan like an FHA or VA loan, or, if you have one, making a withdrawal from your IRA.

Whatever you decide, make sure you consult with a mortgage specialist before committing to an option. Rocket Mortgage® has experts waiting to help you navigate the tricky waters of home loans. If youre ready to take that next step toward a mortgage, then get started with our experts today.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Don’t Miss: Can You Buy Individual Stocks In A 401k

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.

Where Fidelity Go Shines

Low cost: Fidelity Go charges no fees for accounts below $10,000, and a flat monthly fee of $3 for account balances between $10,000 and $49,999.

Fidelity integration: Customers who already have an IRA or taxable account with Fidelity can easily take advantage of the companys robo offering.

Human portfolio oversight: The day-to-day investment and trading decisions for portfolios are handled by a team of humans from Strategic Advisors, a registered investment advisor and Fidelity company.

You May Like: How To Increase 401k Contribution Fidelity

Recommended Reading: How Does 401k Work For Employer

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

The 4% Withdrawal Rule

The 4% rule says that you can withdraw 4% of your savings in the first year, and calculate subsequent yearâs withdrawals on the rate of inflation. This rule is based on the idea that you should withdraw 4% annually, and maintain the financial security in retirement for 30 years. This strategy is preferred because it is simple to compute, and gives retirees a predictable amount of income every year.

For example, if you have $1 million in retirement savings, 4% equals $40,000 in the first year. If the inflation rises by 2.5% in the second year, you should take out an additional 2.5% of the first yearâs withdrawal i.e. $1000. Therefore, the withdrawal for the second year will be $41,000.

Read Also: How To Check Your 401k Balance Online

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

Also Check: What Is A Traditional Ira Vs 401k

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Read Also: What Is The Max You Can Put In A 401k