Early Retirement Account Withdrawal Tax Penalty Calculator

Important: The $2 trillion CARES Act wavied the 10% penalty on early withdrawals from IRAs for up to $100,000 for individuals impacted by coronavirus. Individuals will have to pay income taxes on withdrawals, though you can split the tax payment across up to 3 years. If you return the cash to your IRA within 3 years you will not owe the tax payment. 401K and other retirement plans are treated somewhat similarly to IRAs. CNBC published a primer here.

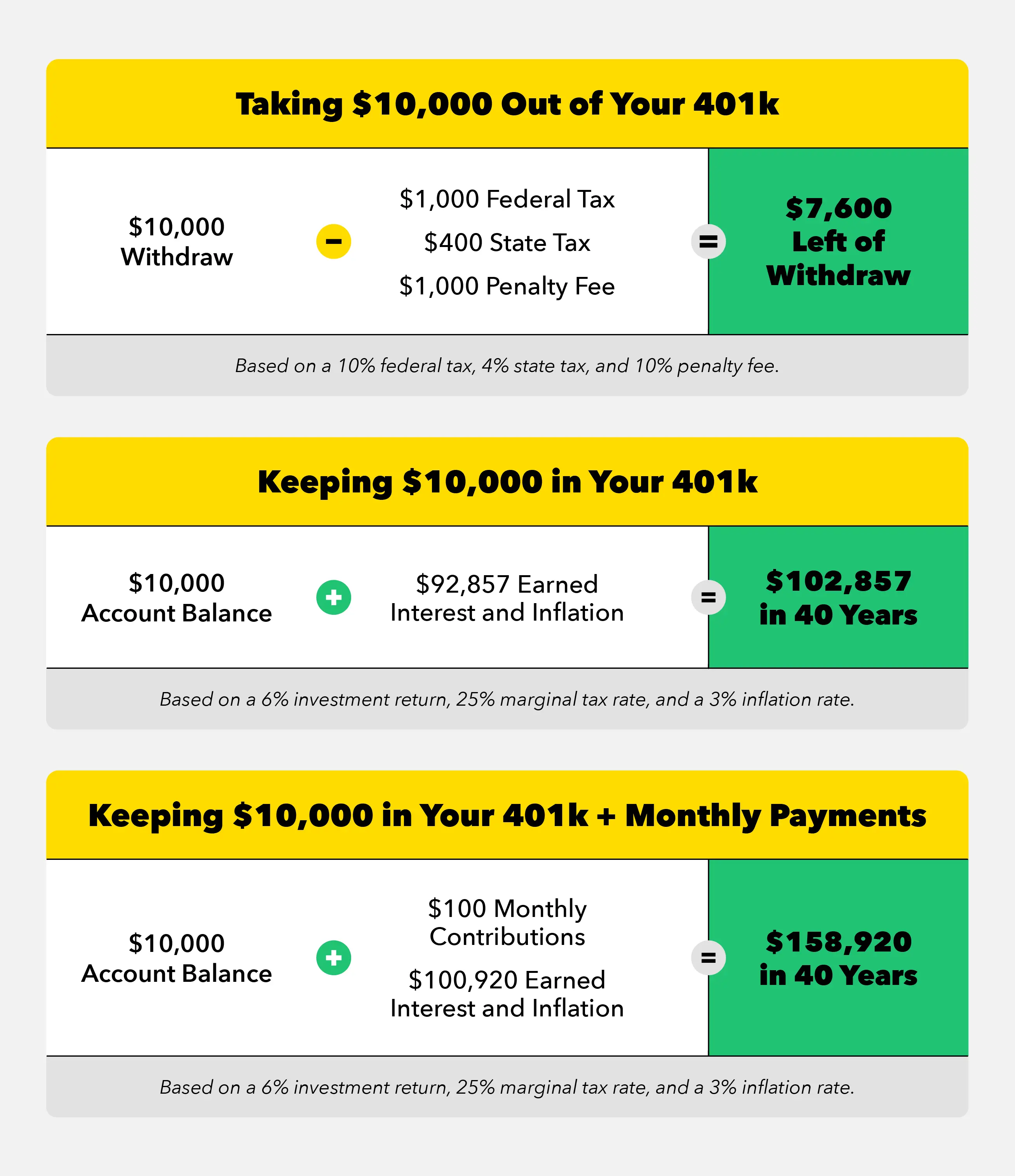

Qualified retirement plans are an important asset for American taxpayers which may allow them to compound wealth for decades on a tax deferred basis. Pulling money out of such an account not only eats principal while stopping compounding, but it can also come with a hefty tax liability as well. For the sake of this calculator, we presume retirement contributions were made with pre-tax dollars. Those types of contributions are typically taxed at the saver’s income tax rate & for people who are younger than 59-1/2 there is an additional 10% penalty tax. In many cases this means 1/3 or more of the total withdrawal goes toward income tax payments.

Explore Net Unrealized Appreciation

If you have company stock in your 401, you may be eligible for net unrealized appreciation treatment if the company stock portion of your 401 is distributed to a taxable bank or brokerage account. When you do this, you still have to pay income tax on the stock’s original purchase price, but the capital gains tax on the appreciation of the stock will be lower.

So, instead of keeping the money in your 401 or moving it to a traditional IRA, consider moving your funds to a taxable account. This strategy can be rather complex, so it might be best to enlist the help of a pro.

Do I Have To Report My Social Security Income On My Taxes

Some of you have to pay federal income tax on Social Security benefits. from $ 25,000 to $ 34,000, you may have to pay income tax up to 50 percent of your benefits. over $ 34,000, up to 85 percent of your benefits may be taxable.

What is the maximum income before Social Security is taxed?

| Year |

|---|

| $ 132,900 |

Is Social Security ever 100% Taxable?

What percentage of social security is taxable? If you are applying as an individual, your National Insurance is not taxable only if your total income for the year is less than $ 25,000. Half of this is taxable if your income is between $ 25,000 and $ 34,000. If your income is higher, up to 85% of your benefits may be taxable.

Which taxpayers Social Security benefits will be taxed at 50%?

Taxation of Social Security Benefits Funds are taxed on up to 50 percent of benefits from individual taxpayers with income over $ 25,000 and taxpayers with combined income over $ 32,000.

Recommended Reading: Is 401k Divided In Divorce

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Recommended Reading: How To Cash Out Your 401k Fidelity

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

A Note On Individual Retirement Accounts

If your employer doesnt offer a 401 and you decide to contribute to a traditional IRA instead, your taxes will work very similarly. However, your employer doesnt manage your IRA. You are responsible for making contributions, so your employer wont consider any of those contributions when reporting your earnings at the end of the year. Because your employer isnt excluding IRA money from your earnings, you will need to deduct your contributions on your tax return if you want to get the tax benefits. One big difference with 401 plans and IRAs is that IRAs have a much lower contribution limit. You can only deduct $6,000 in IRA contributions for the 2021 and the 2022 tax year if you are 49 or younger. There are also income limits above which you cant contribute this full amount. If youre 50 or older you can add an extra $1,000 per year as a catch-up contribution, which raises limit to $7,000.

Read Also: How Do I Cancel My 401k With Fidelity

Why Doesn’t 401 Income Affect Social Security

Your Social Security benefits are determined by the amount of money you earned during your working yearsyears in which you paid into the system via Social Security taxes. Since contributions to your 401 are made with compensation received from employment by a U.S. company, you have already paid Social Security taxes on those dollars.

But waitweren’t your contributions to your 401 account made with pre-tax dollars? Yes, but this tax shelter feature only applies to federal and state income tax, not Social Security. You still pay Social Security taxes on the full amount of your compensation, up to a pre-determined annual limit established by the IRS, in the year you earned it. This limit is typically increased yearly and is currently capped at $147,000 in 2022.

In a nutshell, this is why you owe income tax on 401 distributions when you take them, but not any Social Security tax. And the amount of your Social Security benefit is not affected by your 401 taxable income.

Contributions to a 401 are subject to Social Security and Medicare taxes, but are not subject to income taxes unless you are making a Roth contribution.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How To Calculate 401k Employer Match

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Also Check: Can I Move My 401k To A Cd

Taxes Owed On A Roth 401

The money you contribute to a Roth 401, also known as the after-tax 401k, is made with after-tax dollars, so you dont get a tax deduction for the contribution when you make it. So, since youve already been taxed on your contributions, its unlikely that youll be taxed on your withdrawals if you follow IRS guidelines.

Recommended Reading: How To Take My Money Out Of 401k

Is Social Security Income Taxable

Some of you have to pay federal income tax on Social Security benefits. between $ 25,000 and $ 34,000, you may have to pay income tax up to 50 percent of your benefits. over $ 34,000, up to 85 percent of your benefits may be taxable.

Do I pay tax on my pension in France? If you live in France and are receiving a State Pension, Private Sector or Lifetime Pension from the UK, this is taxable in France. Only occupational, stakeholder and personal pensions that are granted a tax credit on contributions or the lump sum is tax-free qualify for taxation as retirement income.

What Income Reduces Social Security Benefits

In the year you reach full retirement age, the SSA will deduct $1 in benefits for every $3 you earn above the annual limit, which is $51,960 in 2022. If you are under full retirement age for the entire year, the SSA will instead deduct $1 from your benefit payments for every $2 you earn above the annual limit of $19,560.

Also Check: How To Roll 401k Into Roth Ira

What Taxes Are There If You Dont Pay Your 401 Loan On Time

If you miss payments and default on your loan, the remaining balance of the loan becomes an early distribution. You pay your ordinary income tax rate plus a 10% early withdrawal penalty.

The distribution counts as taxable when you defaulted on the loan. Its not when you originally took out the loan. The default occurs when you miss a payment or the quarter after you miss a payment depending on the terms of your 401 plan.

The tax and distribution is based on the remaining balance of the loan when you default. If you took out $10,000 and had already repaid $6,000, your taxable early distribution is $4,000.

How Long Does A 401 Distribution Take

There is no universal period of time in which you must wait to receive a 401 distribution. Generally, it takes between three and 10 business days to receive a check, depending on which institution administers your account and whether you are receiving a physical check or having it sent by electronic transfer to a bank account.

You May Like: Can You Take A Loan From Your 401k

Tips For Retirement Savings

- Taxes can be complicated, especially when it comes to retirement savings plans. Thats where a financial advisor can be invaluable. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Prefer to take a DIY approach to investing and retirement planning? You can start by using this retirement calculator to see if youre on pace for a comfortable retirement. If youd like to invest more to grow that nest egg, check out one of these brokerages where you can open an IRA. You might also use a robo-advisor, which generates an investment plan for you for less than youd pay a traditional advisor.

- If youre over the age of 50, take advantage of catch-up contributions. Catch-up contributions are a great way to boost your savings. Use SmartAssets retirement calculator to ensure youre saving enough to retire comfortably.

Should Canadians Working In The Us Contribute To A 401

Canadians working in the US for a US employer can contribute to a 401. The first question you need to consider whether you live in Canada or the US is does your employer match your 401 contributions. Because employers often offer an employer match, it may make sense to contribute.

The second consideration is whether you are living and working in the US or residing in Canada but commuting to the US. In the second scenario, as a Canadian resident you are also eligible to contribute to your RRSP. Doing this reduces your Canadian tax. Just keep in mind that your RRSP deduction room is used up by 401 contributions deducted on your Canadian return

If you are in a situation where your 401 contributions are not deductible on your Canadian return, it may still make sense to contribute to a 401 if you can benefit instead from employer matching. As each persons situation is unique, it is advisable to consult with your cross border accountant to determine whether this would be beneficial for you.

Read Also: What Can I Roll My 401k Into Without Penalty

How Much Tax Is Withheld On 401k Withdrawal

The IRS generally requires you to automatically withhold 20% of your prior 401 tax withholding. So if you withdraw $ 10,000 of your 401 at 40, you can only receive about $ 8,000.

How much will I be taxed on 401k withdrawal?

If you withdraw your funds early with 401 , you will be charged 10% penalty tax plus the income tax rate on the amount withdrawn. In short, if you withdraw your retirement early, the money will be treated as income.

At what age is 401k withdrawal tax free?

Taxes on the Roth 401 While the designated Roth 401 grows tax free, be careful to comply with the five-year aging rule and plan distribution rules to get tax exemption upon reaching age 59½ according to Charlotte A.

Do you have to pay taxes on 401k after 60?

The IRS defines early withdrawal as the cash withdrawal of a retirement plan before the age of 59½. In most cases, you will have to pay an additional 10% tax on early withdrawals, unless you qualify for an exception. This is above the normal tax rate.

Have Investment Income We Have You Covered

With TurboTax Live Premier, talk online to real experts on demand for tax advice on everything from stocks, cryptocurrency to rental income.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: Can I Have A 401k And An Ira

What Determines Your Social Security Benefit

Your Social Security benefit amount is largely determined by how much you earned during your working years, your age when you retire, and your expected lifespan.

The first factor that influences your benefit amount is the average amount that you earned while working. Essentially, the more you earned, the higher your benefits will be. The SSA’s annual fact sheet shows workers retiring at full retirement age can receive a maximum benefit amount of $3,345 for 2022. The Social Security Administration calculates an average monthly benefit amount based on your average income and the number of years you are expected to live.

In addition to these factors, your age when you retire also plays a crucial role in determining your benefit amount. While you can begin receiving Social Security benefits as early as age 62, your benefit amount is reduced for each month that you begin collecting before your full retirement age. The full retirement age is 66 and 10 months for those who turn 62 in 2021. It increases by two months each year until it hits the current full retirement age cap of 67 for anyone born in 1960 or later.

To ensure benefits maintain their buying power, the Social Security administration adjusts them every year in accordance with changes in the cost of living. For example, as of January 2022, the COLA will cause Social Security and Supplemental Security Income benefits to increase by 5.9%.

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

Recommended Reading: How Much Do You Have To Withdraw From 401k