How Much Can You Contribute To A 401

The most you can contribute to a 401 is $20,500 in 2022 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

Max Out 401k Employer Contributions

Your employer may offer matching contributions, and if so, there are typically rules you will need to follow to take advantage of their match. An employer may require a minimum contribution from you before theyll match it, or they might match only up to a certain amount. They might even stipulate a combination of those two requirements. Each company will have its own rules for matching contributions, so review your companys policy for specifics.

For example, suppose your employer will match your contribution up to 3%. So, if you contribute 3% to your 401, your employer will contribute 3% as well. Therefore, instead of only saving 3% of your salary, youre now saving 6%. With the employer match, your contribution just doubled.

Since saving for retirement is one of the best investments you can make, its wise to take advantage of your employers match. Every penny helps when saving for retirement, and you dont want to miss out on this free money from your employer.

If youre not already maxing out the matching contribution, you can speak with your employer to increase your contribution amount.

Traditional 401s Vs Roth 401s

A 401 works best for someone who anticipates being in a lower income tax bracket in retirement compared with the one they’re in now. For example, someone currently in the 32% or 35% tax bracket may be able to retire in the 24% bracket.

Employers have been increasing tax diversification in their retirement plans by adding Roth 401s. These accounts combine features of Roth IRAs and 401s. Contributions go into a Roth 401 after you have paid taxes on the money. You can withdraw contributions and earnings tax- and penalty-free if you’re at least age 59 1/2 and have owned the account for five years or more. You’ll also be required to take minimum distributions from a Roth 401 once you turn age 72. However, you might be able to avoid RMDs if you can move the money from a Roth 401 into a Roth IRA, which has no required minimum distributions.

and a Roth 401, the total amount of money you can contribute to both accounts can’t exceed the annual limit for your age, either $20,500 or $27,000 for 2022. If you do exceed it, the IRS might hit you with a 6% excessive-contribution penalty.)

Don’t Miss: When Can I Start My 401k

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Access to thousands of financial advisors.

Expertise ranging from retirement to estate planning.

Match with a pre-screened financial advisor that is right for you.

Answer 20 questions and get matched today.

Connect with your match for a free, no-obligation call.

Benefits Of Contributing To Your 401 Plan

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

Don’t Miss: How Much Can You Borrow From 401k

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

The Maximum You Can Put Into A 401 In 2022

-

If youre under age 50, your maximum 401 contribution is $20,500 in 2022.

-

If youre 50 or older, your maximum 401 contribution is $27,000 in 2022, because you’re allowed $6,500 in catch-up contributions.

For 2022, your total 401 contributions from yourself and your employer cannot exceed $61,000 or 100% of your compensation, whichever is less.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000, and contribute 5% of your salary , and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

Also Check: How To Max Out 401k Calculator

Roth Ira And Traditional Ira Maximum Annual Contribution Limits

| 2021 |

| Less than $10,000 | Less than $10,000 |

11. The limit is generally the lesser of the dollar amount shown, or your taxable compensation for the year. For more information about IRA contributions, please see IRS Publication 590-A or consult your tax advisor.

12. If you will have attained at least age 50 during the tax year, you can contribute an additional amount to your IRA each year.

13. Married can use the limits for single individuals if they have not lived with their spouse at any time during the year.

14. As of 2010, there is no income limit for taxpayers who wish to convert a traditional IRA to a Roth IRA.

How Solo 401 Contribution Limits Work

If youre a self-employed individual, you must calculate the maximum amount of elective deferrals and nonelective contributions you can make. When figuring out your contribution, your compensation is your earned income, or, your net earnings from self-employment after deducting both:

-

Contributions for yourself

-

One-half of your self-employment tax

Keep in mind that self-employed individuals must often pay the employer costs associated with 401 plans, typically including a one-time start-up fee, as well as a monthly account maintenance fee. You must also pay fees on the specific stocks and bonds you purchase with your 401 investments .

For more information, refer to the IRS table and worksheets found in Publication 560, Retirement Plans for Small Business.

Read Also: How Do I Find Out How Much 401k I Have

Put Bonus Money Toward Retirement

Unless your employer allows you to make a change, your 401 contribution will likely be deducted from any bonus you might receive at work. Many employers allow you to determine a certain percentage of your bonus check to contribute to your 401.

Consider possibly redirecting a large portion of a bonus to 401k contributions, or into another retirement account, like an IRA. Because this money might not have been expected, you wont miss it if you contribute most of it toward your retirement.

You could also do the same thing with a raise. If your employer gives you a raise, consider putting it directly toward your 401. Putting this money directly toward your retirement can help you inch closer to maxing out your 401 contributions.

When You Should Max Out Your 401

Maxing out your 401 can be a smart financial move under certain circumstances. You should consider contributing the maximum to this account if the following apply to you:

If you have the money to max out your 401 and have considered the opportunity costs of using your funds for this instead of other financial goals, then spending the money to maximize this tax-advantaged retirement account can make sense.

You’ll benefit from the ease of contributing directly via your paycheck and from the tax breaks a 401 provides. And, having most or all of your retirement money in one place can make it easier to monitor your portfolio and make sure you maintain the proper asset allocation.

Also Check: Who Can Open A 401k

If I Offer A 401 To My Employees Are There Compliance Regulations I Must Follow Or Can The Retirement Plan Provider Help With These

Certain employers who offer 401 and other retirement plans must abide by the Employee Retirement Income Security Act of 1974, as amended, which helps ensure that plans are operated correctly and participants rights are protected. In addition, a 401 plan must pass non-discrimination tests to prevent the plan from disproportionately favoring highly compensated employees over others. The plan fiduciary is usually responsible for helping comply with these measures.

This information is intended to be used as a starting point in analyzing employer-sponsored 401 plans and is not a comprehensive resource of all requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. For specific details about any 401 they may be considering, employers should consult a financial advisor or tax consultant.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

Drawbacks To A Solo 401

A solo 401 may not be right for small businesses that plan to expand and hire employees in the near-term, since doing so would likely result in plan ineligibility. In addition, calculating profit-sharing contributions for sole proprietorships and partnerships tends to be complex because it requires modified net profits. The formula for this calculation is available in IRS Publication 560.

Also Check: How Much Will 401k Pay Per Month

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $58,000 for 2021, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,500 employee contribution to the Roth solo 401k for 2021, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,500 employee contribution on the Roth solo 401k. Note that you can also split up the $19,500 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,500 of catch-up contributions to work with if you are age 50 or older in 2021 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

You May Like: Can I Transfer My Roth Ira To My 401k

When You Can Withdraw Money From A 401

You generally must be at least 59 1/2 to withdraw money from your 401 without owing a 10% penalty. The early-withdrawal penalty doesn’t apply, though, if you are age 55 or older in the year you leave your employer.

Depending on the plan sponsor, you may be allowed to borrow up to 50% of your vested account balance or $50,000, whichever is less, but unless the money is used to buy a primary residence, you will generally need to repay the loan within five years, making payments at least quarterly. If you miss a payment, the remaining balance is treated as a distribution, with taxes and penalties for early withdrawals applying.

Read Also: How To Borrow Money From 401k To Buy A House

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Is Maxing Out Your 401 A Good Idea

A 401 is an employer-provided retirement account you can contribute to with pre-tax dollars.

In 2022, you can contribute a maximum of $20,500 to your 401 if you are younger than 50. If you’re 50 or older, you become eligible to make additional catch-up contributions valued at $6,500. That means you can contribute a total of $27,000 . These limits can change annually, and they do not include any matching funds your employer provides.

If you have enough money to do so, you will need to decide if you should max out your 401 or if it would be smarter to do other things with your money. There are pros and cons to both options.

Recommended Reading: Can You Have More Than One 401k

Take Advantage Of Catch

401 catch-up contributions allow investors over age 50 to increase their retirement savingswhich is especially helpful if theyre behind in reaching their retirement goals. Individuals over age 50 can contribute an additional $6,500 for a total of $27,000 for the year. Putting all of that money toward retirement savings can help you truly max out your 401.

As you draw closer to retirement, catch-up contributions can make a difference, especially as you start to calculate when you can retire. Whether you have been saving your entire career or just started, this benefit is available to everyone who qualifies.

And of course, this extra contribution will lower taxable income even more than regular contributions. Although using catch-up contributions may not push everyone to a lower tax bracket, it will certainly minimize the tax burden during the next filing season.

Recommended Reading: Is It Good To Have A 401k

What Happens If I Exceed My 401 Limit By Mistake

If you contribute too much to your 401 and notice your mistake before the tax filing deadline, you can probably correct it with your employer. Youll need to notify your plan administrator. Theyll return the excess money to you, and youll get a new W-2 and pay taxes on your new total taxable wages.

If you dont catch the mistake before tax day, you may have to pay taxes twice on the amount you contributed over the limit. Thats because the excess contribution cant be deducted from your taxes in the year it was made, and because the IRS will still count that money as taxable when its distributed too.

Also Check: How Much Does A 401k Cost An Employer

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Saving In An Ira After You Max Out Your 401 Or 403

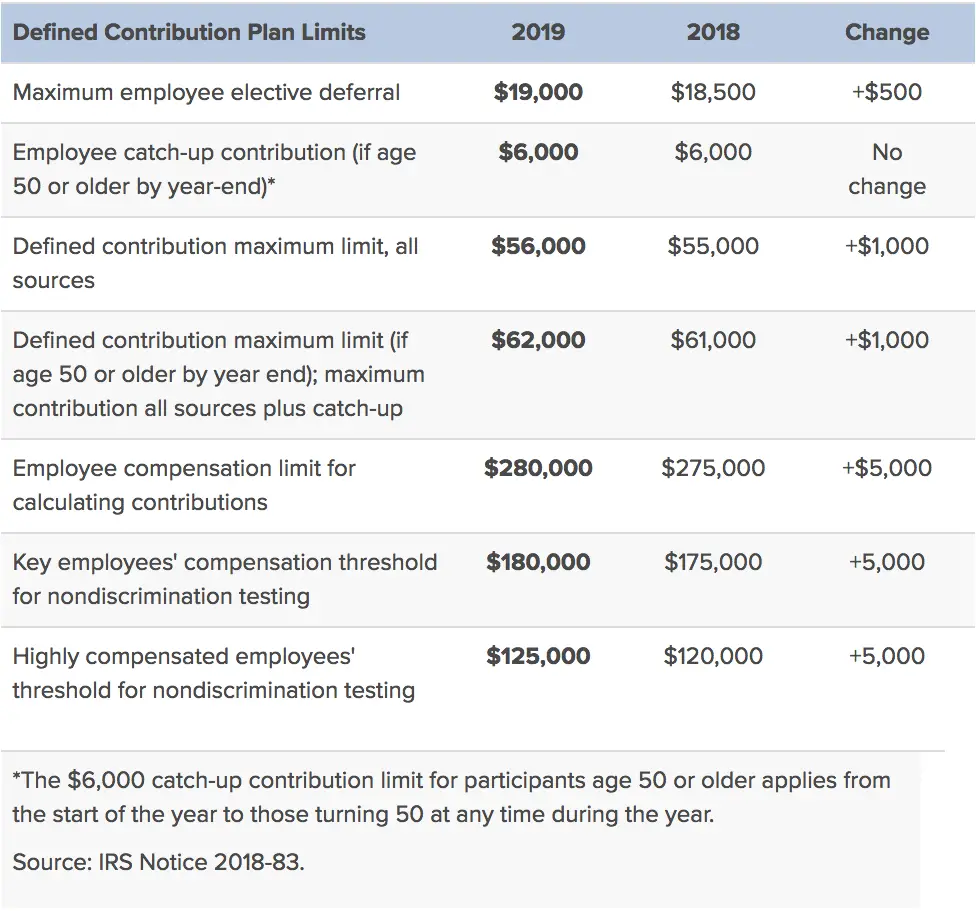

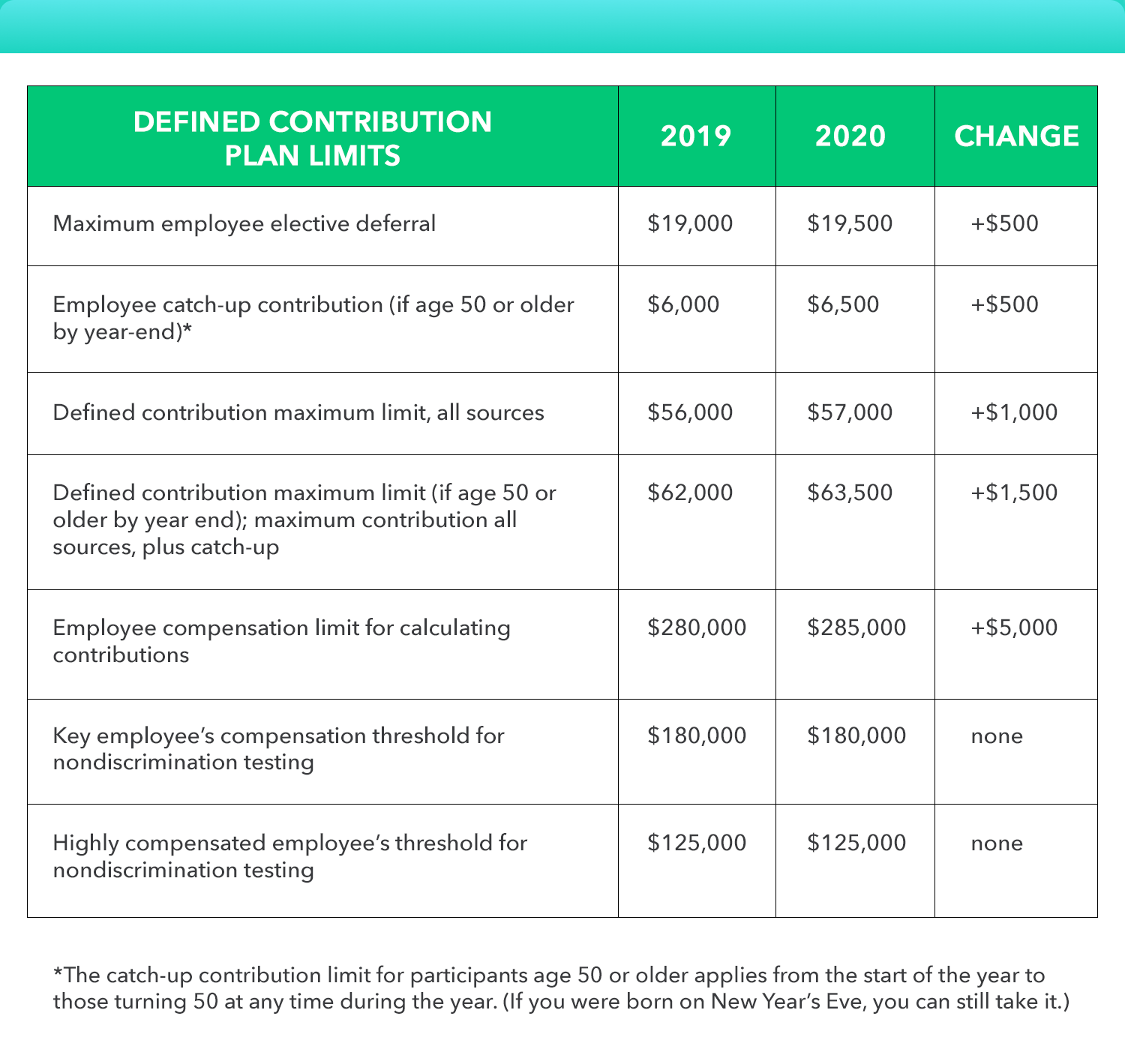

First, make sure you’re really on track to max out your 401 or other workplace plan contribution limit. For 401 or similar workplace retirement plans, you can contribute up to $19,500 in 2020 . Plus, if you’re age 50 or older in 2020, the retirement catch-up contribution is $6,500 , allowing you to contribute up to $26,000 .

If you have maxed out your 401 or 403, next look into an individual retirement account . Wherever you are in life, an IRA can help complement your workplace plan. The pretax savings guidelines for IRAs look pretty straightforward at first glance:

- If you’re younger than age 50, you may sock away up to $6,000 pretax in an IRA if you meet certain IRS guidelines.

- If you’re 50 or older, the IRS lets you contribute an additional $1,000, totaling $7,000, to an IRA.1

It’s a good idea to see if you are eligible for a Roth IRA, which has income limits. If you are eligible, you make contributions with after-tax dollarsbut retirement withdrawals in many cases are tax-free.

Don’t Miss: Can I Borrow Against My 401k