Sales Loads And Other Purchase

If you invest your new rollover IRA money in mutual funds, be careful to check whether they charge a sales load. These charges essentially divert money away from your investable assets into your new financial provider’s pocket, and there’s little reason to stomach that immediate loss of investing power. No-load mutual funds are common, and exchange-traded funds also avoid the high cost of an upfront sales load. Certain other types of securities also impose upfront purchase fees that immediately reduce the value of your investable assets. The best course is to avoid such investments and be more fee-conscious in your choice of financial institution and investment options.

How To Move Your 401k To Gold Ira All You Need To Know

There are several moving parts to complete a 401 to gold rollover.

Working with a reputable gold IRA company experienced in gold IRA rollovers takes the effort out of the process.

It is important that the rollover process is executed as per the Internal Revenue code guidelines to avoid IRS penalties, including an early withdrawal tax penalty.

Fortunately, there are plenty of gold IRA companies experienced in rolling over 401 to gold IRA plans without any tax penalties.

Also Check: Where Do You Get A 401k

Do You Get Taxed On 401k After Retirement

A withdrawal you make from a 401 after you retire is officially known as a distribution. While you’ve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw.

Don’t Miss: How Do You Invest Your 401k

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Contact Your Current 401 Provider And New Ira Provider

Ideally, you want a direct rollover, in which your old 401 plan administrator transfers your savings directly to your new IRA account. This helps you avoid accidentally incurring taxes or penalties. However, not every custodian will do a direct rollover.

In many cases, youll end up with a check that you need to pass on to your new account provider, Henderson says. Open your new IRA before starting the rollover so you can tell the old provider how to make out the check.

The goal, Henderson says, is to avoid having to ever put the money into your personal bank account.

You only have 60 days to complete the transaction to avoid it being a taxable event, and its best to have everything set up before getting that check, Henderson says.

Also Check: How To Find Out If You Have A 401k

How To Roll A 401 Into An Ira

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

Tax Consequences Of The One

Beginning in 2015, if you receive a distribution from an IRA of previously untaxed amounts:

- you must include the amounts in gross income if you made an IRA-to-IRA rollover in the preceding 12 months , and

- you may be subject to the 10% early withdrawal tax on the amounts you include in gross income.

Additionally, if you pay the distributed amounts into another IRA, the amounts may be:

- taxed at 6% per year as long as they remain in the IRA.

Also Check: Can You Invest Your 401k In Stocks

What Are The Contribution Limits Of An Ira Rollover

There are no contribution limits to an IRA rollover. If youve been working at a particular company for 10 years and have accumulated a huge nest egg for your tax-free retirement, you can roll all of it into an IRA.

Remember, however, that there are time limits. In most cases, you can only do one rollover per year per account. Additionally, if you are doing an indirect rollover you are limited by a 60-day window to execute the rollover to avoid having it treated as taxable income.

Rolling Over A 401 To An Ira Can Cost You Thousands Of Dollars

401 to IRA

GETTY

The most common qualified retirement plan transaction is the rollover. Quite often when an employee leaves an employer, the employee rolls over the 401 or other retirement plan balance to an IRA.

These rollovers could be costing many investors thousands of dollars, according to a new study from Pew Charitable Trusts.

Many 401 and other employer retirement plans allow participants to buy institutional shares in mutual funds and other investment funds. These shares have lower expenses and fees than the standard retail shares of the funds.

An individual can purchase institutional shares through an IRA, but only when the individual has a significant IRA balance. Most institutional share classes have a minimum initial investment of $1 million. Most people, after rolling over money from an employer plan to an IRA, have to buy the retail shares.

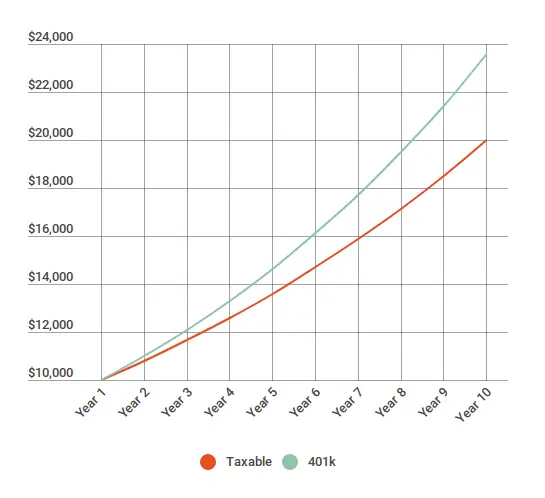

The cost difference between the two share classes might seem very small, but the total additional cost mounts over time. Hybrid mutual funds had the lowest cost difference between retail and institutional shares at 0.19 percentage points.

Even that small difference compounds to a big number. The Pew study said that many investors dont realize how much the shift from institutional shares to retail shares costs them over time.

You May Like: How Much Can I Put In My 401k Per Year

Rollover To An Annuity

A guaranteed lifetime income annuity, similar to a pension distribution, will provide a steady stream of income that’s guaranteed to last for the rest of your lifeno matter how long you live.1 With an annuity that offers a guaranteed payout, you wont have to worry about the impact a decline in the market will have on your payments.

Drawbacks Of Rolling Over Into A New 401

Like keeping your money in your previous employers plan, rolling over into a new 401 limits your control of your money and poses some other potential drawbacks.

Higher fees: After comparing fees and expenses, you may find that the new plan is more expensive than the previous one. Remember, even a margin of a percentage point can drastically eat into your earnings over a long period of time.

Less diversification: The investments offered in the new plan may be less varied than your old plan or potential IRA investments. And because the account will be managed by someone else, you wont have much of a say in how your money is invested.

Also Check: Can I Contribute To A Roth Ira And A 401k

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

You May Like: Can Business Owners Have A 401k

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you don’t have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: There’s a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: There’s a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

Read Also: Do I Need A Financial Advisor For My 401k

Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

Ira Rollovers Are Common For Job Switchers Retirees

Investors rolled $516.7 billion from workplace plans into traditional IRAs in 2018, the latest year for which data is available. That’s nearly 28 times more money than as contributed to traditional IRAs that year.

A Pew survey from 2021 found that 46% of recent retirees rolled at least some of their workplace retirement funds to an IRA, and 16% of near retirees plan to do so.

A rollover may not be optional, either: About 15% of 401 plans don’t allow workers to retain funds in the plan when they retire, according to a survey conducted by the Plan Sponsor Council of America, a trade group.

Also Check: How To Find Old 401k Funds

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Rollovers: The Complete Guide

A 401 rollover is the process by which you move the funds in your 401 to another retirement account usually either an IRA or another 401. A 401 rollover typically happens when you leave your employer, either to retire or to start a new job. There are certain regulations you need to follow when rolling over your assets, most notably the 60-day rule. And you will also need to choose a new financial institution to house your account when you roll over your money into an IRA. If youre considering a 401, a financial advisor can help you set up a retirement plan for your nest egg. Lets break down everything you need to know about 401 rollovers.

Also Check: How Much Can You Take Out Of Your 401k

Read Also: Which Is Better Roth Or Traditional 401k

Benefits Of A Rollover Into A New 401

Distributions at 55: Under an IRS provision known as the Rule of 55, you can withdraw funds from your current companys 401 penalty-free starting at age 55, instead of 59.5 . By combining 401s, you may have access to your older assets at 55.

Loan options: By rolling over an old 401 into a new plan, you may be able to borrow against the account, which is not an option with a 401 that remains with a former employer.

Lower fees: As stated above, the fees associated with your new employers plan may be lower than those of your former plan or a future IRA.

Which Types Of Distributions Can You Roll Over

Any distribution eligible to an employee is eligible to be distributed as a rollover. This includes all the assets in a 401, 403, or profit-sharing plans, such as stocks, bonds, and shares in a mutual fund or ETFs.

You might be wondering if you can roll over assets from one person to another, say if an individual has passed away. As it turns out, a rollover is not an actionable strategy for avoiding estate taxes because the funds will have to be withdrawn and then passed onunless the recipient is a named beneficiary of the funds in question. This is one reason why its a good idea to get familiar with your companys retirement plan so you can avoid estate planning mistakes.

Recommended Reading: How Much Will Be In My 401k When I Retire

Rollover To A Roth Ira

Rollovers are a great time to alter the tax treatment offered by your retirement account, such as rolling your 401 funds over into a Roth IRA. Itâs a beneficial choice for many retirement savers, but it may be especially appealing for people with high incomes who may not be able to otherwise save in a Roth IRA.

This type of rollover can also help you avoid required minimum distributions that come even with a Roth 401.

However, there will most likely be tax consequences. Because traditional 401 contributions are made with pre-tax dollars, you will owe income taxes on the funds you convert to a Roth IRA, which holds after-tax contributions.

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employer’s plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

Also Check: How To Rollover Vanguard 401k