How Much Can You Contribute To 401

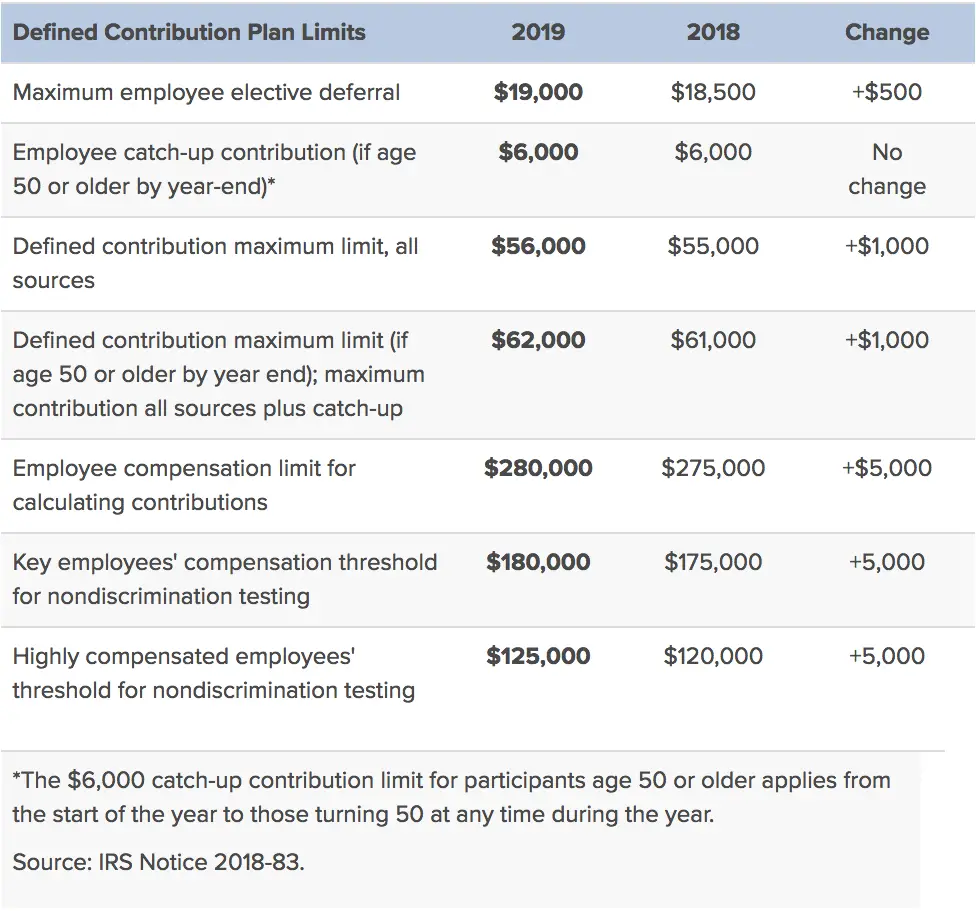

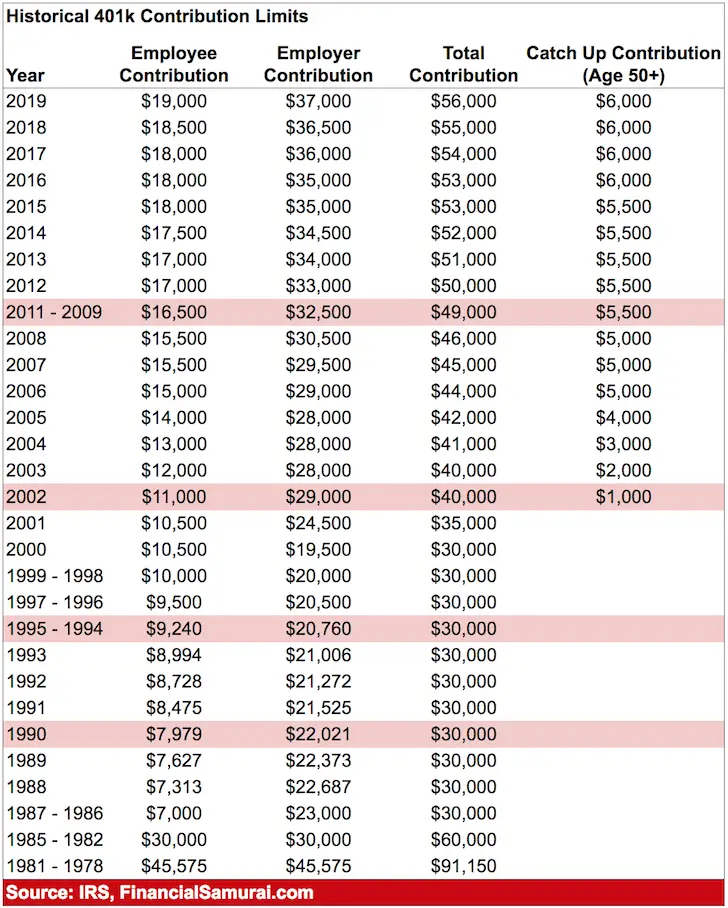

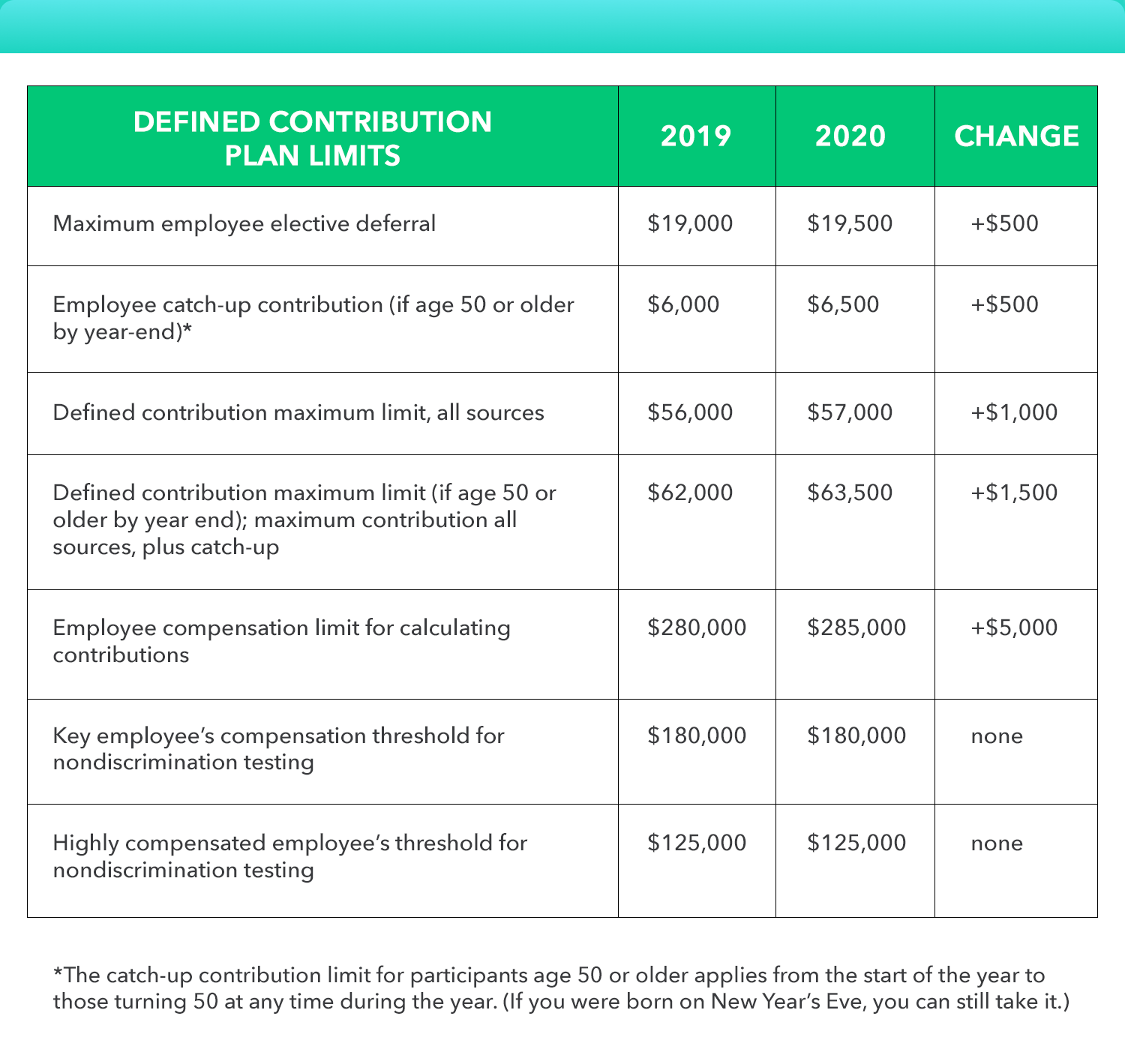

Before determining how much to contribute to a 401, you should understand the annual IRS contribution limits. If you are younger than 50, you can contribute to the 401 account up to $19,500 in 2021. If you are above 50, you can contribute up to $26,000, which includes $19,500 plus an additional $6,500 in catch-up contributions.

If your employer offers a company match, it will make additional contributions to your 401 above the employeeâs limit. For 2021, the combined employee-employer contribution limit is $58,000 if you are below 50, or $64,500 for individuals who are above age 50.

The Maximum You Can Put Into A 401 In 2022

-

If youre under age 50, your maximum 401 contribution is $20,500 in 2022.

-

If youre 50 or older, your maximum 401 contribution is $27,000 in 2022, because you’re allowed $6,500 in catch-up contributions.

For 2022, your total 401 contributions from yourself and your employer cannot exceed $61,000 or 100% of your compensation, whichever is less.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000, and contribute 5% of your salary , and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways well need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, its okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially free money so you dont want to leave any sitting on the table.

You May Like: Can I Rollover From 401k To Roth Ira

Also Check: How Much Can I Contribute To Solo 401k

Can I Have A 401 And An Ira

Yes. IRAs make a great supplement to retirement savings in addition to a 401 if youre contributing enough to receive a full match from your employer, or youre planning on maxing out your 401. If you dont receive a match on your 401 or it has narrow investment options or high fees, it may be a good idea to invest primarily in an IRA. The annual contribution limit for an IRA in 2021 and 2022 is $6,000, or $7,000 if youre 50 or older.

» Ready to try an IRA? Check out our list of the best IRA accounts

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

Recommended Reading: Is It Smart To Roll Over 401k To Ira

Review The Irs Limits For 2022

The IRS has announced the 2022 contribution limits for retirement savings accounts, including contribution limits for 401, 403, and 457 plans, as well as income limits for IRA contribution deductibility. Contribution limits for Health Savings Accounts have also been announced. Please review an overview of the limits below.

Work With A Financial Advisor

Whether you have questions about your 401 investment options or want to open up a Roth IRA, working with a trusted and qualified financial advisor can go a long way. They can help answer all your investing questions and give you the guidance you need to start investing for retirement and building wealth.

Dont have an advisor? We can help with that! Our SmartVestor program can connect you with up to five financial advisors who are ready to help you take the next step toward the retirement youve always dreamed about.

Ready to get started? Find your SmartVestor Pro today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Also Check: Can You Withdraw From Fidelity 401k

Maximize Your 401k Returns And Fees

Are you getting the most for your fees? Most people dont know what theyre paying in 401k fees. By some estimates, the average fees for 401k plans are between 1% and 2%, but some outliers can have up to 3.5%. Fees add upeven if your employer is potentially paying the fees, youll have to pay them if you leave the job and keep the 401k.

Essentially, if an investor has $100,000 in a 401 and pays $1,000 or more in fees, the fees could add up to thousands of dollars. Any fees you have to pay can chip away at your retirement savings and reduce your returns.

Its important to ensure youre getting the most for your money in order to maximize your retirement savings. If you are currently working for the company, you could discuss high fees with your HR team. One of the easiest ways to lower your costs is to find more affordable investment options. Typically, the biggest bargains can be index funds, which often charge just 0.3% to 0.5 %

If your employers plan offers an assortment of low-cost index funds or institutional funds, you can invest in these funds to build a diversified portfolio.

If you have a 401 account from a previous employer, you might consider moving your old 401k into a lower fee plan. Its also worth examining what kind of fund youre invested in and if its meeting your financial goals and risk tolerance.

How Solo 401 Contribution Limits Work

If youre a self-employed individual, you must calculate the maximum amount of elective deferrals and nonelective contributions you can make. When figuring out your contribution, your compensation is your earned income, or, your net earnings from self-employment after deducting both:

-

Contributions for yourself

-

One-half of your self-employment tax

Keep in mind that self-employed individuals must often pay the employer costs associated with 401 plans, typically including a one-time start-up fee, as well as a monthly account maintenance fee. You must also pay fees on the specific stocks and bonds you purchase with your 401 investments .

For more information, refer to the IRS table and worksheets found in Publication 560, Retirement Plans for Small Business.

You May Like: Can I Take Out From My 401k

How Much Should You Have In Your 401k By Age

How much does the average person have in their 401k by retirement?

Many workers in the US retire by age 65. Vanguard data shows that the average 401 balance at retirement is $255,151, while the median balance is $82,297.

How much 401k should I have at 35?

So, to answer the question, we believe that one to one and a half times the income saved for retirement by age 35 is a reasonable goal. Thats an achievable goal for someone who starts saving at age 25. For example, a 35-year-old woman earning $60,000 would be on track if she saved about $60,000 to $90,000.

Traditional 401s Vs Roth 401s

A 401 works best for someone who anticipates being in a lower income tax bracket in retirement compared with the one they’re in now. For example, someone currently in the 32% or 35% tax bracket may be able to retire in the 24% bracket.

Employers have been increasing tax diversification in their retirement plans by adding Roth 401s. These accounts combine features of Roth IRAs and 401s. Contributions go into a Roth 401 after you have paid taxes on the money. You can withdraw contributions and earnings tax- and penalty-free if you’re at least age 59 1/2 and have owned the account for five years or more. You’ll also be required to take minimum distributions from a Roth 401 once you turn age 72. However, you might be able to avoid RMDs if you can move the money from a Roth 401 into a Roth IRA, which has no required minimum distributions.

and a Roth 401, the total amount of money you can contribute to both accounts can’t exceed the annual limit for your age, either $20,500 or $27,000 for 2022. If you do exceed it, the IRS might hit you with a 6% excessive-contribution penalty.)

Read Also: How To Find 401k Money

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Contributions With One Working Spouse

When there is only one working spouse, both spouses should determine what makes sense for the family. The working spouse should max out his/her 401 contributions, and collect any employerâs match or profit-sharing contributions provided by the company. If the working spouse has additional income to save, he/she can contribute to an IRA in addition to the 401 contributions. IRAs have an annual contribution limit of $6,000. There is an extra $1000 catch-up contribution for those age 50 or older.

An often overlooked retirement account is a spousal IRA. This type of IRA allows the working spouse to contribute to an IRA that is in the name of the non-working spouse, who has little or no income. A spousal IRA is not a joint account rather, it is a regular traditional IRA that married couples filing jointly can use to increase their IRA contributions. A spousal IRA allows both couples to contribute up to $12,000 annually, or $14,000 if both spouses are above 50.

You May Like: Can I Use My 401k To Pay Off Irs Debt

Where Should You Invest First Ira Or 401

Another consideration when contributing to your 401 plan is whether or not you should contribute to it at the expense of contributing to a Roth or Traditional IRA. I covered this topic in a previous article where should you invest first IRA or 401?

In general, it is best to contribute enough to maximize any employer contributions you may be eligible for, then try to max out a Roth IRA if you are eligible to contribute to one.

This ensures you are taking advantage of the free money through your employers matching contributions. It also gives you the best of both worlds when it comes to current and future taxes. Tax flexibility is an important retirement planning tool.

If your company doesnt offer 401k matching contributions, then you may consider contributing to a Roth IRA first, then contributing to your 401k if you are able to do so.

What Happens To My 401k If The Stock Market Crashes

Your mutual funds may not perform as well, the stock market dives or your 401 may need reallocating. If your 401 is invested heavily in stocks at the beginning of your career, a stock market crash or recession isn’t the end of the world. You’ll still have years for the economy and your 401 to recover.

Don’t Miss: How Much Goes Into 401k

K Contribution Limits 2023 Is Still Unknown But There Are Some Robust Projections You May Need To Know We Have Compiled Every Detail In This Guide For You

401k contribution limits are pretty important for many people who want to invest in their future. The revised limits on these contributions are often announced towards the end of the year. Although we are in the middle of October, we still have some weeks.

As you know, with employer-based plans such as 401s, 403, and TSP, there is a yearly limit for the amount to be deposited during the year. In the same way, other plans such as SIMPLE IRAs, FSAs, HSAs, Roth IRAs, and IRAs also have yearly limits for deposits.

Anyone who is planning to invest in their future can deposit the maximum amount into these plans and secure their future. However, the government puts some limitations on how much you can deposit into these plans every year.

These limitations are generally determined according to the cost-of-living and inflation indices of the previous year. However, other factors affect these calculations. As we get closer to the end of the year, the inflation rate becomes more obvious, and thus, we can make better predictions for 401k contribution limits in 2023.

We have prepared a chart for you about all contributions, their 2022 limits, and possible 2023 limits. Please note that these are just predictions, and the IRS has not announced 401K contribution limits for 2023 yet. However, most experts, as well as we, are pretty sure that in 2023 the contribution limits will be as follows:

| Contribution |

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

You May Like: What Is The Tax Rate On 401k After 65

What’s Next After You Max Out Your 401 Or 403

Maybe you didn’t ever think you could do it. Or you didn’t even realize you had until you looked at your retirement account. But nowbig kudos!you did it. You were able to max out your 401 this year. Now that you’ve reached that crucial financial goal, how else can you keep saving to maximize your retirement? We’ll help you answer that question with these money-savvy strategies that can help you keep saving toward your retirement goals:

How Much Should I Have In My 401k At 40

Fidelity says that by age 40 you should aim to have three times your salary saved. This means that if you earn $75,000, your retirement account balance should be around $225,000 when you turn 40. If your employer offers both a traditional and a Roth 401, you may want to split your savings between the two.

How much should you have saved for retirement by age 40? To stay on track for retirement at age 67, you should have saved 3 times your income by age 40, according to retirement plan provider Fidelity Investments.

Read Also: How Does Taking A Loan From Your 401k Work

Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.

How Much Should I Contribute To My 401

Planning for retirement is a complex process that starts with an easy first step: saving money. A commitment to regular savings, as early as possible, will launch your retirement planning in the right direction.

As you get closer to retirement, you may want to be more purposeful about your savings. How much should I contribute to my 401? is one of the most common questions that financial services folks hear.

Figuring out how much to put in your 401 depends on your overall goals and financial situation, so it will vary for each person. The amount you can save is also determined by the Internal Revenue Service , because there are limits on how much money can be put aside.

You May Like: How Do I Find My 401k Account Number