Can I Roll My Retirement Assets Directly Into A Roth Ira

Yes. After-tax or Roth contributions from an employers plan can be rolled over directly into a Roth IRA tax free. If you roll over non-Roth assets to a Roth IRA, while you may not be required to withhold taxes, the amount rolled over will be included in your gross income for federal and/or state income tax purposes.

Talk to your financial professional about your options.

Move Your Retirement Savings Directly Into Your Current Or New Qrp If The Qrp Allows

If you are at a new company, moving your retirement savings to this employers QRP may be an option. This option may be appropriate if youd like to keep your retirement savings in one account, and if youre satisfied with investment choices offered by this plan. This alternative shares many of the same features and considerations of leaving your money with your former employer.

Features

- Option not available to everyone .

- Waiting period for enrolling in new employers plan may apply.

- New employers plan will determine:

- When and how you access your retirement savings.

- Which investment options are available to you.

Note: If you choose this option, make sure your new employer will accept a transfer from your old plan, and then contact the new plan provider to get the process started. Also, remember to periodically review your investments, and carefully track associated paperwork and documents. There may be no RMDs from your QRP where you are currently employed, as long as the plan allows and you are not a 5% or more owner of that company.

Rolling Over Your 401 To A Vanguard Ira Is Simple If You Know How

Thanks to its vast array of ultra-low-cost index mutual funds and exchange-traded funds , Vanguard has become one of the largest investment companies in the world. It’s also popular for those who are looking to roll over retirement savings from a workplace 401 plan to an individual retirement account . Many investment companies have worked to keep the rollover process as simple as possible to attract assets, and Vanguard is no exception.

You May Like: Can You Roll 401k Into Another 401k

What Happens If I Leave My Employer And I Have An Outstanding Loan From My Plan Account

Keep in mind that most plans require that loans be repaid when you leave. If you roll over your remaining account balance to a new employers plan, you may also be able to roll over the outstanding balance of your loan to your new employers plan. Check with your new employer to find out if the loan will be accepted by the new plan. You cannot roll over your loan to an IRA.

If you cant move the loan to your new plan, and if you dont repay the loan within the time allotted, the outstanding balance will be treated as a withdrawal, subject to federal and applicable state and local taxes. If youre under age 59½, you may also have to pay a 10% early withdrawal penalty unless you qualify for an exception.

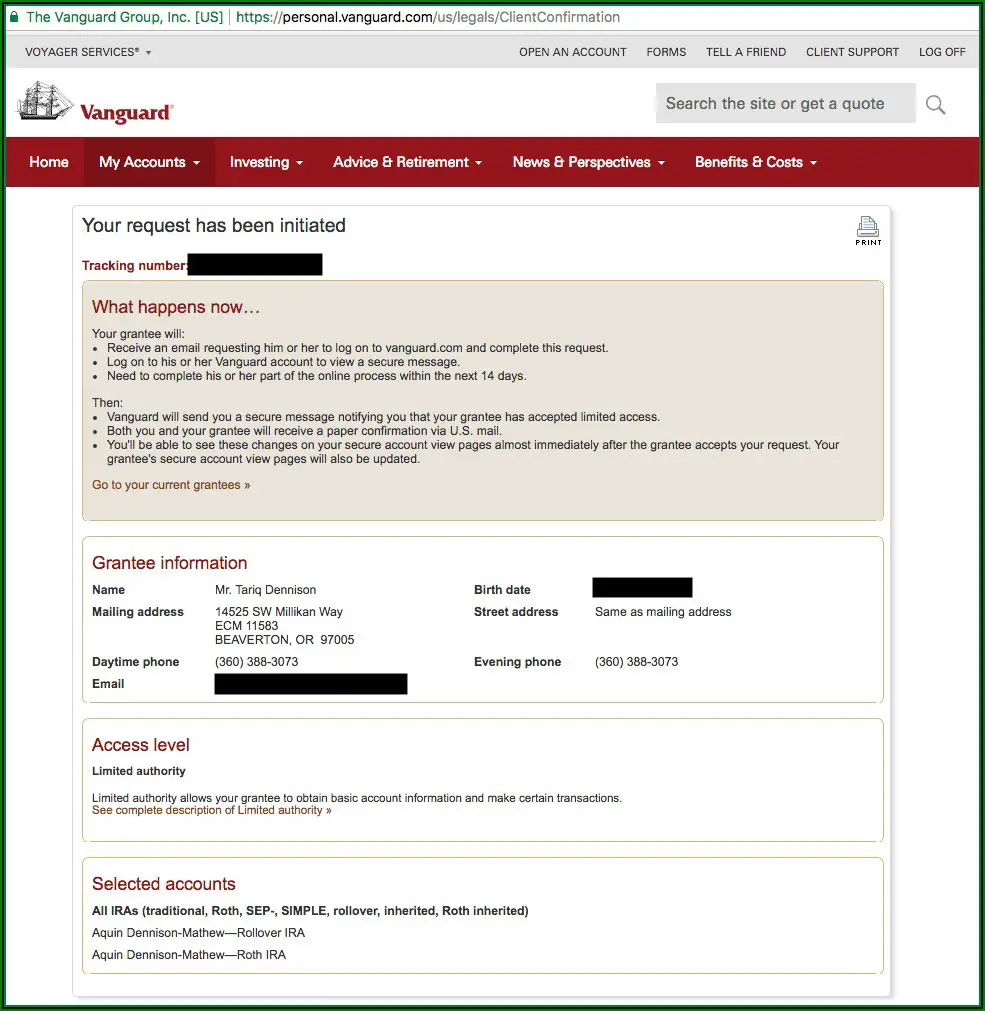

What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

STEP 4

Also Check: How Much Can I Take From 401k For Home Purchase

Vanguard: Best For Companies Seeking The Widest Range Of Low

| $25 per participant can be waived | |

| Annual fee: Small plan 401 | One-time setup fee applies annual fees based on number of plan participants |

As a company with five of the top six largest mutual funds globally in 2021, Vanguard is a popular choice for a 401 provider. Its largest fund, Vanguard Total Stock Market Index Fund, had more than $1.3 trillion in funds. This was approximately four times larger than its nearest competitor, Fidelity 500.

Vanguard offers access to several types of 401 and IRA plans, including an individual 401 plan thats our choice for the best solo 401 plan on the market. It also has a small plan 401, in addition to SEP-IRA and SIMPLE IRA plans.

This provider offers simple, straightforward plans with options to meet the needs of businesses of all sizes. You can contact Vanguard through a toll-free phone number or its company website to start the process.

Vanguard Vs Fidelity Iras: The Biggest Differences

When it comes to IRAs, Vanguard and Fidelity are neck and neck in many areas. Both offer traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and many other retirement accounts for individuals and small businesses. The two platforms also give investors the option to manage eligible IRAs on their own or utilize automated portfolios and/or advisor assistance.

Fidelity, however, has a wider range of IRA options. Unlike Vanguard, Fidelity offers a Roth IRA account for minors. The brokerage could also suit those in search of lower costs, mainly because most of its index mutual funds have no minimum requirements .

Vanguards advisor-assisted, automated investing account has Fidelitys equivalent account beat when it comes to advisory fees, but Fidelity is still hard to pass up on the account minimum end.

| Vanguard |

You May Like: Do You Get Your 401k When You Quit

Choosing The Right Ira

Vanguard offers two IRA products:

Commissions:Invest in:Limitations:Access to Research:

In order to pick the best account for you, theres one up-front question to answer:

Do you want to make your own investment decisions, or would you rather have the investing decisions made for you so you can just set-it-and-forget-it?

If you want to make your own decisions, then what youll want to open the self-directed Vanguard IRA. That allows you to make your own trading decisions and invest in whichever financial securities youd like.

If you want the investing decisions made for you, then youll be best served by opening a Vanguard Personal Advisor, which is their automated IRA product . When you open a Vanguard Personal Advisor account, youll answer a series of questions, known as a risk-tolerance questionnaire, and your answers will be used to create a diversified portfolio that suits your personal and financial situation. That portfolio is then rebalanced automatically over time without you having to do any work. Its a great tool for those who dont want to spend much time managing their investments.

You Prefer Convenience Over Control

Perhaps you opened an IRA with the intention of putting together a diverse portfolio and actively managing your investments. However, youre now finding that you dont have the time or energy to devote to your portfolio and feel that youre in over your head. Rolling over your IRA to a 401 and giving up some control may better fit your needs as an investor.

Read Also: What Is A 401k For

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

Don’t Miss: Which Is Better A Roth Ira Or A 401k

What About M1 Finance

Im a big fan of the online broker M1 Finance. Like Robinhood, M1 Finance charges no fees to buy and sell stocks and ETFs. Investing on M1 Finance is not the same as most online brokers, but I like the intuitiveness of building a dividend portfolio with pies.

Ive created an M1 pie of 10 dividend stocks that I contribute to every month. Its a convenient way to dollar cost average into high-quality dividend growth stocks over time.

Dividends are easily reinvested back into the portfolio, much like DRIPs, but more flexible. I always liked dollar cost averaging with DRIP investing, but now theres a better way to accomplish the same thing. Thats my primary reason for keeping this account active. Someday, I may transfer those assets to Fidelity as well.

I recommend M1 Finance for investors looking to build a long-term dividend growth or index ETF portfolio. RBD is an affiliate partner with M1 Finance and recommends several investing platforms.

You can open individual accounts or IRAs, making it a good choice for many investors. The no-fee model, I do believe, is the future, today.

However, Ive chosen not to use my M1 Finance account for my tax-advantaged investing. Fidelity is a long-established company in the space, and I have built a 20-year relationship with them, and Ive never had a reason to leave. Plus, my employer-sponsored accounts are there, and I expect to remain for a while.

On top of that, the M1 Finance platform does not support mutual funds.

Questions To Ask Your Former Provider

| What to ask | What to know |

|---|---|

| Is a distribution form required? |

It might be. If additional paperwork is required, have them send it to you, and we can help you complete it if needed. |

| If a distribution form is required, who, aside from myself, needs to sign it before I send it back to you? |

It’s most often a spouse, and sometimes, Fidelity. |

| Is a Letter of Acceptance required? |

Quite often, it is. But we will automatically generate one for you. |

| Does my account include company stock? |

If you have shares of company stock included in your old 401, it’s easiest to give us a call at 800-343-3548 so that we can discuss how to include them in your rollover. |

| Where will you send my distribution check? |

It’s fine to send it directly to us or to you. However, how the check is made out is very importantplease ensure your provider follows the guidelines in Step 3. |

You May Like: How Can I Pull Out My 401k

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

View Important Information About Our Online Equity Trades And Satisfaction Guarantee

- View important information about our online equity trades and Satisfaction Guarantee

-

1. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

2. If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. , Charles Schwab Bank, SSB , or another Schwab affiliate, as applicable, will refund any eligible fee related to your concern. No other charges or expenses, and no market losses will be refunded. Refund requests must be received within 90 days of the date the fee was charged. Schwab reserves the right to change or terminate the guarantee at any time. Go to schwab.com/satisfaction to learn whats included and how it works.

Don’t Miss: Should I Roll Over 401k To Ira

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

Also Check: How Do I Use My 401k To Start A Business

Employee Fiduciary: Best For Small Businesses Looking For Personalized Service

| $500 for solo 401 $1,500 for 401 plan | |

| Annual Custodial Fee | 0.08% |

Employee Fiduciary is a 401 plan administrator that caters to small businesses of all sizes. Every company that signs up for a 401 plan with Employee Fiduciary will go through a plan design consultation to create one that meets the companys goals and budget. Companies with existing 401 plans will also benefit from Employee Fiduciarys plan conversion services as they move to this new provider.

The company is a bundled 401 provider, meaning that it provides all the administration services needed, including asset custody, participant recordkeeping, and third-party administration. On its website, you can compare Employee Fiduciarys fees to more than 40 other leading 401 providers, or you can request a no-cost fee comparison for your current plan.

Employee Fiduciary offers a detailed fee schedule with startup fees and annual base and custodial fees listed on its website. Startup fees range from $250 to $500, with annual fees at $500 or $1,500, plus 0.08% annually in custodial fees.

You can reach the company through a web contact form or by phone at a toll-free number.

You May Like: How To Find How Much Is In My 401k