General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions dont fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers dont allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Read Also: How Do I Move My 401k To An Ira

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Retirement Plan Fees And Expenses

This section shows a detailed breakdown of fees that were directly debited from your account during the period.

These were listed in the above example chart as Plan Administrative Expenses. This is your share of expenses that everyone in your plan pays.

These normally include day-to-day costs to run the plan, such as legal, accounting, and trustee and recordkeeping costs.

Not all of the 401 fees you are paying are easy to find.

Sometimes, it takes a little more research to understand your true costs in your 401 plan.

As you can see in the disclosure in the fine print below, there may be other expenses paid directly from the investment options you have to choose from, such as revenue sharing agreements, 12b-1 fees, and sub-transfer agent fees.

There are some additional fees that come from the funds themselves.

These fees are called expense ratios.

A quick definition: expense ratios are the total percentage of fund assets used for administrative, management, advertising , and all other expenses.

For example, the 2030 target date fund expense ratio is 0.43% basis points, versus Vanguards Institutional Index expense ratio of 0.04% basis points. The expense ratio of the 2030 target date fund here is 10 times that of the Vanguard Fund.

How does the difference relate to you in terms of actual dollars?

Lets say you had $100,000 invested in both the 2030 target date fund example with an expense ratio of 0.43% and the Vanguard Fund with an expense ratio of 0.04%.

Read Also: Should I Buy An Annuity With My 401k

Check Your 401 Beneficiary

While youre in your online account dont forget to check that youve named a beneficiary for your 401 account. Typically, a spouse must be the beneficiary unless they sign a waiver. If youre not married its important to name a beneficiary in your account. The Motley Fool shares additional tips on when someone inherits a 401.

Have A Realistic Understanding Of When You Want To Retire

Having clearly defined goals will help you determine how much you should have saved based on your personal goals. Your savings objectives will be different if you plan to retire at 50 than if you plan to continue working past 70. Additionally, its important to determine as accurately as you can what your cost of living will be in retirement. How much do you need to spend per year to maintain the lifestyle that you want for the rest of your life? Have a good sense of what your costs will be so you can factor that into your overall retirement strategy. Really evaluate how long you want to continue working, and what retirement age is realistic for you based on your income and your current level of savings.

You May Like: Should I Do Roth Or Traditional 401k

Are There Separate Limits For Roth 401s

No. Roth 401s have the same contribution limit as regular 401s. For 2022, that limit is $20,500. You can contribute to both a traditional 401 and a Roth 401 account in the same year, as long as your total contributions dont exceed that amount. If youre choosing between the two, learn about the differences between a Roth and traditional 401.

|

no account fees to open a Fidelity retail IRA |

|

Account minimum |

|

|

career counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

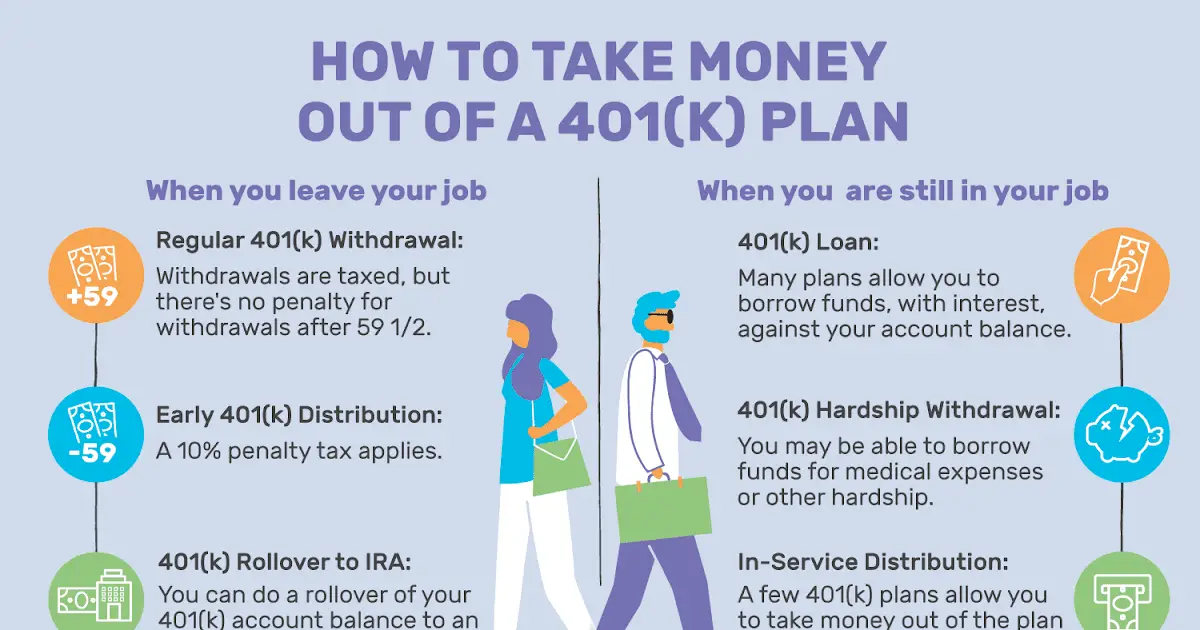

Can I Withdraw That Money

Access to funds in your retirement account depends on your situation.

After You Leave Your Job

Once you quit, retire, or get fired, you should have access to your vested balance. You can withdraw those funds and reinvest in a retirement accountor cash out, although there may be tax consequences and other reasons to avoid doing so.

While Still Employed

While youre still employed, you typically have limited access to money in a retirement planeven your fully vested balance. Rules may require that you meet specific criteria and that your plan allows you to access your money. There are several potential ways to withdraw money before you leave your employer:

Other Situations

You might become fully vested in all of your balances if your employer terminates or shuts down the retirement plan, enabling you to transfer the funds elsewhere. Likewise, death or disability can trigger 100% vesting. Check with your employers plan administrator to learn about all of the plans rules.

Recommended Reading: What Is A 401k Rollover

Proper Planning For Retirement

Your financial objectives and investment goals relate to you and your family alone. The steps you should take to ensure a safe and happy financial future aren’t based on what your peers require but on what you estimate that you’ll need.

However, finding a benchmark for an appropriate amount of retirement savings at any given time isn’t a bad idea. In fact, knowing the amounts that others in your age group have put away in their 401s may help you focus your savings efforts and stay on a successful retirement savings track.

Don’t Ditch Your 401 But Consider Shifting Your Investments To Lower

If you feel your 401 plan’s fees are high but you’re still employed at the company sponsoring your plan, there’s little that can be done. You might be able to transfer money from your 401 to an IRA, which can help you save money if you go with a low-cost account and can give you more flexibility to invest in other assets. Either way, it’s almost always still worth continuing to contribute to your current 401 thanks to the tax benefits, especially if your employer offers company matching.

However, you might decide that it’s not worth contributing more than what your employer matches. In that case, you can funnel those additional funds into a different investment account. For example, you could look for a low-cost individual retirement account and aim to max that out every year2021 contribution limits for IRAs are $6,000 per year if you’re under 50 and $7,000 if you’re 50 or older.

You could also consider opening a retirement account or other investment account with a low-cost robo-advisor. For example, Betterment offers investment accounts with annual fees as low as 0.25% to 0.40%.

Betterment

Don’t Miss: How To Close Out A 401k Early

How Much It Costs To Retire In These Places Near Water

Find great options coast to coast — and lakes in between. Plan Your Retirement

Retired life can mean different things to different people, but nothing says peaceful bliss like spending your golden years near the water. A 2022 study by American Advisors Group showed that nearly all of the top 10 states where people want to live during retirement were on the coast.

Discover: 7 Surprisingly Easy Ways To Reach Your Retirement Goals

According to SoFi, the average household headed by someone age 65 or older spent $48,791 per year or $4,066 per month. Housing was the biggest living expense, costing approximately $16,880 per year.

Unfortunately, not all waterside communities fit within this budget. Many coastal and lakefront areas well exceed the national average. So, while waterfront living may be in your retirement dreams, not everyone can make it a reality.

How To Calculate Your Fees

Lets get to it. You should be able to calculate your 401K fees in just a few minutes. There are actually two types of general fees you will need to calculate: administrative and investment fees. Administrative fees are the hardest to locate and the least understood. Investment fees are based on the individual funds or investments you have within the plan.

Figure Your Share of the Plans Administrative Costs

It costs money to run the 401K plan. Sometime these expenses are passed on to you. To find the fees, first locate your plans summary annual report. On this report, you will see a basic financial statement section. Here, you will need to find two numbers: total plan expenses and benefits paid. Subtract the benefits paid from the total plan expenses.

Next, you will divide that number by the total value of the plan. The resulting number is your plans administrative cost percentage. Multiply the percentage times the total value of your holdings within the plan to get the amount of administrative costs that you paid for during the year.

Calculate Your Individual Investment Fees

You May Like: Can I Transfer Money From 401k To Ira

Do I Have A 401k I Dont Know About

If you think that you may have enrolled in a 401K plan with a previous employer, but youre not quite sure, there are a few ways to find out if you did.

The easiest way is to contact the HR department of your former employer and ask them whether you ever contributed to a 401K while in their employment. Youll need to give them your personal details along with the dates that you worked for them, so keep this information to hand.

If your old employer has since gone bust or you cant remember which companies youve worked for in the past, check the National Registry of Unclaimed Retirement Benefits website. Youll be able to see whether youve been listed on their database by your old employer as someone with unclaimed retirement plan funds.

If you havent been listed on the National Registry of Unclaimed Retirement Benefits database, there are a couple more options to explore. Visit NAUPA or missingmoney.comwhere you can search by state based on where youve lived or worked to find out whether any unclaimed assets belong to you.

You May Like: What Is The Difference Between Roth 401k And Roth Ira

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Also Check: Can You Roll Over A 403b Into A 401k

Don’t Miss: How Do You Collect Your 401k

Your Next 401 Statement Will Show How Far Your Savings Will Actually Go In Retirement

Your next 401 statement may look like a scary Halloween prank, but dont spit out your pumpkin spice latte just yet.

Changes are expected to Americans retirement plan statements thanks to federal legislation, and one act in particular the 2019 SECURE Act will require 401 savings to be presented as a monthly income stream in addition to the usual lump sum.

Investors in 401s, a retirement savings and investment plan offered through employers, traditionally receive statements after each financial quarter showing information like overall savings, investment allocations, risk analysis and progress toward retirement savings goals. But lawmakers want to rewire how Americans think about those savings by breaking down the numbers to show what their financial situation could look like month-to-month based on their current 401 balance.

Increase Your Deferral Rate

Taking advantage of a company match helps you capture valuable contributions from your employer, but it may not be enough. Many 401 providers recommend saving at least 10% annually over the course of your career.3 But, the average 401 contribution is closer to 6%.4

If you arent able to save 10% to 15% of your pay at the beginning of your career, aim to gradually increase your deferral rate over time. One smart tactic is to boost your 401 deferral rate every time you get a raise or bonus. This enables you to save more without reducing your take-home pay.

Another way to consider for enhancing your savings rate is to increase your deferral rate by 1 percentage point every year. Some companies offer an automatic escalation feature that will periodically increase your savings rate with a simple click of a box other companies require you to manually make this change.

A good time to review your contribution amount is at the beginning of the year when youre looking carefully at other benefits elections, such as medical and dental insurance, since the amount you put towards these benefits will have an impact on your paycheck. Another good time to revisit your contribution amount is when you receive additional compensation, whether through a raise, promotion or bonus.

Read Also: Where Can I Start A 401k

Read Also: How To Access An Old 401k Account

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Don’t Miss: How To Project 401k Growth

Tips To Save For Retirement

That most Americans dont have nearly enough savings to sustain them through retirement is sad but true. How do you avoid that fate? Here are some steps that you can take, whether you’re early in your career or closer to your retirement.

Of course, start saving and investing as early as you possibly can. The longer you have, the better, especially where the power of compounding interest is concerned. Retirement may seem a long way off but when it comes to saving for it, the days can dwindle away quickly and any delay costs more in the long run.

How Much Should I Contribute To My 401

Generally, its a good idea to contribute the maximum amount allowed to your 401. And according to the IRS, this is $20,500 for 2022. But if you combine your contributions with your employers match, the total cant exceed 100% of your salary or $61,000, whichever is less.

If youre turning 50 this year, or if youre already older than that, youre allowed to make catch-up contributions as well. This amounts to an additional $6,500 in 2022 for most plans. In this case, your total limit after employer matching would be $67,500.

But, if you cant contribute the maximum amount, its a good idea to just try to contribute what you can. You can always increase the amount if your financial situation changes.

Recommended Reading: How Can I Take My 401k Out

K Savings Potential By Age

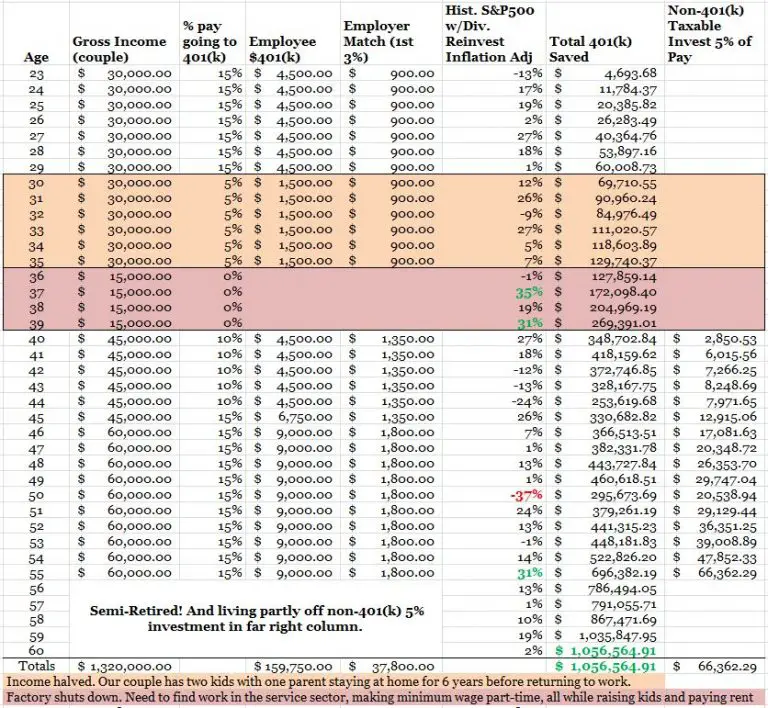

The following chart depicts 401k savings potential by age, based on several assumptions. So this is how much you could have saved. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

| AGE | |

|---|---|

| $827,000.00 | $6,610,084.46 |

*Generally, financial planners say the expected rate of return for a 401k is between 8% and 10%.

So, how do you stack up? Are you on the high end? The low end? Do you think these numbers are realistic?

Recommended Reading: How To Invest 401k With Fidelity