About 401 Investing In Down Markets

You might naturally feel nervous about continuing to invest while share prices are falling. There are two protective measures investors take during bear markets. They are:

You may already be taking these actions in your 401. If you’re younger than 50, you shouldn’t be withdrawing money for at least five years, or possibly 10. And your investment menu may not even offer speculative fund options.

Still, it’s smart to check in on your investment selections. Make sure most of your contribution is allocated to a large-cap or S& P 500 index fund.

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

What Is The Average 401 Plan Account Balance

When looking at 401 account balances it is important to account for participant age and tenure. Account balances tended to be higher the longer 401 plan participants had been working for their current employers and the older the participant. In the EBRI/ICI 401 database, at year-end 2018, participants in their forties with more than two to five years of tenure had an average 401 plan account balance of about $36,000, compared with an average 401 plan account balance of more than $306,000 among participants in their sixties with more than 30 years of tenure. The median 401 plan participant was 46 years old at year-end 2018, and the median job tenure was six years.

401 Plan Account Balances Increase with Participant Age and Job TenureAverage 401 plan account balance by participant age and tenure, 2018

The tenure variable is generally years working at current employer, and thus may overstate years of participation in the 401 plan.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project. See ICI Research Perspective, 401 Plan Asset Allocation, Account Balances, and Loan Activity in 2018.

Also Check: How To Change Your 401k Investments

What Does A 401 Stand For

The 401 is named after the section of the IRS code, added in 1978, that allows an employer to create a retirement plan that employees can put pretax money into.

The first 401 plan was born in 1981, after Ted Benna tried using that IRS tax code section for Johnson Cos., a benefits consulting company in Pennsylvania he co-owned.

This all may seem far away. If you haven’t saved anything, you’re not alone. Forty-five percent of people in the U.S. haven’t saved a penny toward retirement. But time is dumb and unfair. And it moves much faster the older you get.

YOU MIGHT BE INTERESTED IN:

In Some Cases Contributing To A 401 Can Be Costly

The 401 is an incredibly powerful investing tool, and there are plenty of advantages of contributing to this type of account.

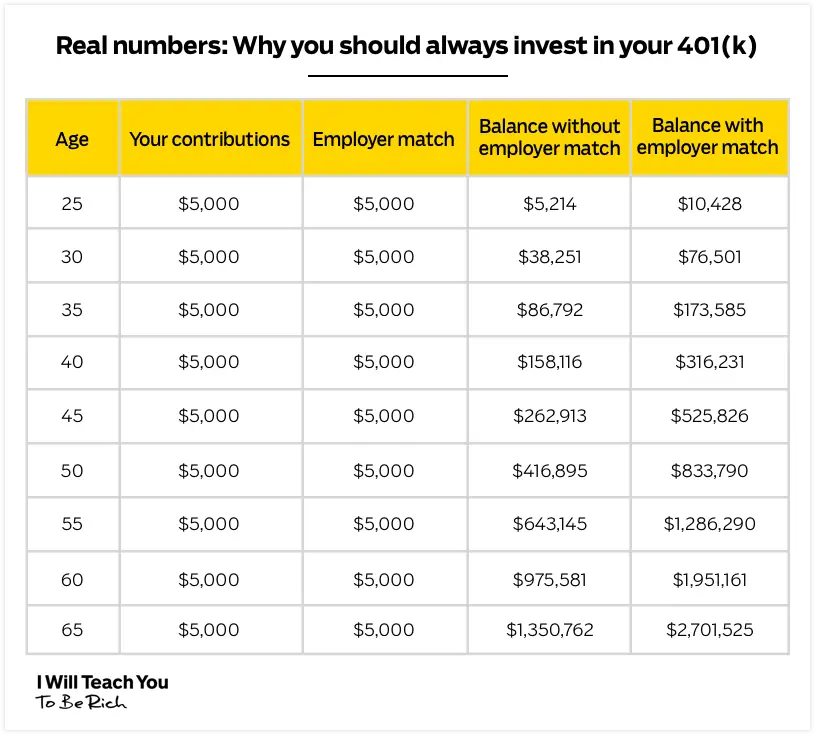

For one, 401s have much higher annual contribution limits than IRAs , and many 401 plans also offer employer matching contributions. It’s also easy to get started investing in a 401, especially considering some employers automatically enroll new workers.

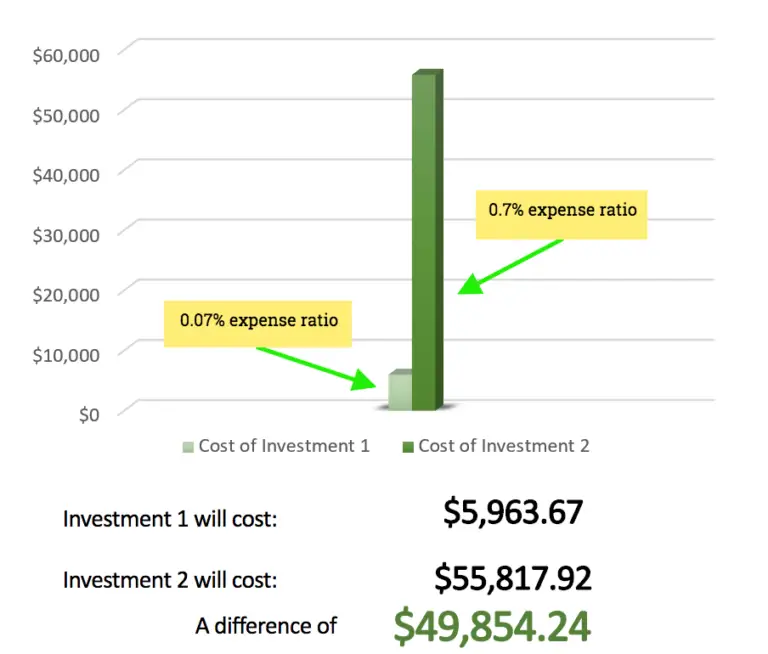

However, there’s one major drawback to investing in a 401, and it could potentially cost you tens of thousands of dollars or more over a lifetime.

Image source: Getty Images.

Also Check: How To Borrow From 401k To Buy A House

What Is A 401 Administrator

A 401 administrator like Vanguard, Fidelity or T. Rowe Price oversees your actual 401 account. Those administrators make sure that the money from your paycheck is invested according to your demands. They also offer information about the money in your 401 account or changes to your plan, and can answer questions you might have about the plan.

“We are in charge of keeping it all organized,” said Meghan Murphy, a vice president at Fidelity Investments.

For many plans, you can go online to a website overseen by the administrator, and decide how much money you want to take out of your paycheck and put into your 401. With a Fidelity account, for instance, Fidelity would send your request to the payroll company your employer uses to give you your paycheck.

Say you wanted to put $10 worth of every paycheck you get into your 401. Before you get your paycheck, the payroll company takes that $10 and sends it to the 401 administrator. From there, the 401 administrator sends that $10 off to be invested.

Keep Calm And Invest On

The first mistake most people make when they see big losses in their retirement accounts is rushing to sell.

Everyone has heard the old adage, buy low, sell high, but in practice, it can be easier said than done.

While financial advisors everywhere preach about buying low and selling high, investor emotions will tempt opposite behavior, Kimberly Nelson, an advisor at the wealth management firm Coastal Bridge Advisors, told Fortune. The urge to do something to stem the carnage in your retirement account during a market pullback, recession, or full-on bear market can be hard to ignore.

Nelson believes that investors should avoid offloading their 401 holdings at this point because stocks are already down over 24% this year, and timing market entries and exits can be a challenge.

Usually taking action after the market has fallen does very little to protect your nest egg, Nelson said. Coming out of the market means that you have to be right about the exit point and right again about your re-entry pointmarket timing is almost always a fools errand and not the right strategy to build long-term wealth.

The chartered financial analyst, who has worked as a financial advisor for over two decades, had a simple tip for people who are worried about their 401s: Keep calm and invest on!

Cameron Starr, a wealth advisor at Gratus Capital, echoed Nelsons comments.

We believe it is important to resist reacting to the markets by selling and going to cash, Starr told Fortune.

Recommended Reading: How To Avoid Taxes On 401k

If You’re Younger In Your Career

Your best bet is to leave your 401 account alone and continue making contributions as normal. This guidance is even more important for younger 401 savers who still have a long way to go before retirement and therefore have time to wait out any market dips their accounts can recover and bounce back long before they enter their nonworking years.

“For investors who have long runways ahead of them, market declines can provide great opportunities,” Winsett points out, suggesting that there are a couple of items younger investors should consider. If you have excess fixed income or cash holdings, it can provide a great opportunity to rebalance capital into equities at discounted prices. Or, if you’re contributing to your 401 on a regular basis through your paycheck, you may want to consider increasing your contribution rate so more money can be deployed during a market decline.

If you’re young and still worried, make sure you know where your 401 money is being invested to make sure the risk is something you can afford taking on, as employers will usually automatically assign a 401 portfolio based on your age and target retirement date. Remember that you can always consult your 401 plan provider for help.

How Much Can I Contribute To A 401 Plan

401 plan accounts have higher contribution limits than individual retirement accounts . In 2021, you can set aside up to $19,500 across your 401 plan accounts.

To boost your contributions even further, you might consider catch-up contributions. If you are 50 or older, you can contribute an extra $6,500 to your 401 account. This increased limit can help increase your savings as you near the retirement finish line. But you dont actually have to be behind in your savings to take advantage of catch-up contributions.

Also Check: How To Collect Your 401k From Previous Employer

The Best 401 Investment Accounts

Modified date: Nov. 26, 2020

What if you could choose the trustee for your 401 plan? In most cases, you cant, but if you could, we would recommend the five platforms below as the best 401 investment accounts available.

Weve also included two tools to help you manage your 401blooom and Personal Capital.

But before we get into the best 401 investment accounts, lets first take a look at the basics of what 401 accounts are.

Whats Ahead:

Dont Miss: Buying Investment Property With Less Than 20 Down

Best Funds For A 401k: Vanguard Balanced Index

Type: Moderate AllocationExpenses: 0.22%

Balanced funds with moderate allocations make outstanding 401k fund choices, and Vanguard Balanced Index is one of the best funds in this category.

Many investors have investment assets outside of their 401k plan, so having a solid, set-it-and-forget-it balanced fund like VBINX inside of the 401k is both smart and convenient.

As a plus, VBINX is passively managed, and the asset allocation of roughly two-thirds stocks and one-third bonds is an ideal balance for most investors, in terms of risk in relation to return.

Speaking of performance, its tough to beat a 10-year return of 6.2%, which is better than nearly 90% of other moderate allocation funds and even better than most stock funds during that time frame! The rock-bottom expense ratio of 0.22% caps off the attractive attributes of VBINX.

HONORABLE MENTIONDodge & Cox Balanced : Charges 0.53%.Vanguard Wellesley Income : Charges 0.23%.

Also Check: When To Withdraw From 401k

How Did 401 Participants Fare Through The Financial Crisis And Economic Recession

401 participants generally stayed the course through the financial crisis and economic recession. An examination of account records of more than 22 million DC plan participants found that in 2008, only 3.7 percent of participants stopped contributing to their accounts. In addition, most participants maintained their asset allocations, with 14.4 percent changing the asset allocation of their account balances and 12.4 percent changing their contribution investment mix. These activities have become even less prevalent since 2008. For example, an analysis of more than 30 million DC accounts in 2021 found that 1.1 percent of participants stopped contributing, 7.3 percent changed the asset allocation of their account balances, and 4.5 percent changed the asset allocation of contributions.

Analysis of workers with consistent participation in 401 plans finds that 401 accounts accumulate significant assets. According to research released as part of the Employee Benefit Research Institute and ICI Participant-Directed Retirement Plan Data Collection Project, the largest database on participants in 401 plans, the average account balance of 401 participants with consistent participation from year-end 2010 through year-end 2018 increased at a compound annual average growth of 13.9 percent over that six-year period.

How To Invest In Your 401

Starting a new job? Here’s a beginner’s manual to understanding 401s.

Editor’s note: This article originally ran on Jul. 24, 2020.

This month marks a significant milestone for my family as my oldest child, who graduated from college in May, begins his first full-time job, which gives him access to a 401 for the very first time.

Given the work my team at Morningstar does providing advice on 401 lineups, along with the many years I’ve spent researching and working on retirement products, I felt I was well-placed to offer my son a few tips on how to best invest in his own 401. I hope these guidelines will be valuable to others starting their careers or looking for a refresher.

Note that while I reference 401s throughout this article, my comments are generally applicable to workers whose employers offer 403 or 457 plans instead, which are intended for nonprofit, governmental, and educational institutions.

Here are some insights into how 401s work and my top suggestions for getting the most out of yours:

What a 401 Is, and What It’s Not Although the 401 plan wasn’t originally designed to be the primary retirement vehicle for U.S. workers, the decline of pension plans since the early 1980s has forced plans like 401s to occupy that role. The key consequence for most new workers is that the heaviest burden of saving for retirement now rests largely on their shoulders.

Don’t Miss: Can You Do Your Own 401k

Investment #: Bond Funds

A bond is a fixed-income investment representing a loan made by an investor plan) to an entity like the U.S. Treasury, which offers a specific amount of money as a return on investment. When a corporation or a government body needs capital for a project, they will issue bonds publicly. In a 401, some of the fund options you will want to include are bond funds. They represent an important tool for balancing any retirement portfolio. Because they offer a defined amount of return, a bond fund investment can give employees an investment option that will grow their savings at a predictable rate.

How To Choose The Best 401 Provider

The right 401 provider for your business depends on a few factors.

First, you should decide whether you want one company to handle both the investments and the administrative work, or if youd like to divide it between two. Dividing between two means managing multiple accounts but gives you the flexibility to find the best fit for each part of running your 401.

In terms of reviewing companies, cost is an important factor. You should weigh both the costs for you as the employer as well as what your employees would pay for using the plan. If employee costs are too high, they might not enroll at all.

You should also ensure the 401 plan provider offers the investments your employees want, especially if you know they want specific mutual funds or a certain other type of investment.

Consider whether the provider has the 401 features you want, like whether they offer a Roth 401 vs a traditional 401 or 401 loans. Lastly, consider how they manage customer service, such as whether they offer in-person or online only.

You might also want a provider that offers robust employee education, so your workers understand how their investment decisions will affect their ability to fully fund their retirement.

You May Like: Quicken Loans Investment Property Rates

You May Like: How Much Can A Business Owner Contribute To A 401k

Should You Invest In 401

Well, 401 is worth investing in, only that it is important that before you make that decision, you consider these two options:

First, if your employer is ready make it a match contribution. With that, the free money you get for he or she would serve as an encouraging tool.

Secondly, if the plan will allow you to invest in ETFs and mutual funds. If its possible, then you can easily take the money out and put it into a regular IRA of your own and then invest it on your own.

Convert To An Ira To Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

Also Check: What Can You Roll A 401k Into

What Benefits Does A Traditional 401 Plan Offer

There are a number of benefits that traditional 401 plans offer investors. Making payroll contributions means it’s a no-fuss, no-muss process. These plans allow you to contribute pre-tax dollars for retirement, which lowers your taxable income and, therefore, your tax liability. If your employer provides a contribution match, it sweetens the pot. That’s because it’s like free money going into your retirement pocket. If you start investing earlier, your savings compound. This means that any interest your earn also earns interest. And even if you change employers/jobs, you can take it with you.