Things To Know Before Opening A 401 Brokerage Account

If you’re considering a 401 brokerage account, the first thing you must decide is what percentage of your retirement savings you’d like to put there. You can put all of it there if you’d like, but it may be better to leave part of it in a mutual fund chosen by your employer, just to be safe.

You should also note that some 401s only allow you to transfer funds to a brokerage account during a certain window each year. If this is the case for your plan, make a note of this time frame so you don’t miss it.

Next, look into the account maintenance fees and any other fees associated with the investment products you’re considering. Ideally, you can keep these at or below 1% of your assets. That means you’ll pay $1,000 or less per year for every $100,000 you have in the account. If you plan to employ a financial adviser to help manage or offer suggestions for your 401 brokerage account, don’t forget to factor in those fees as well.

If a 401 brokerage account isn’t a good fit for you, go with one of your employer’s investment selections instead. This is the safer bet if you don’t have the time or interest to learn more about investing. These are your retirement savings at stake, so you don’t want to take unnecessary risks.

The Motley Fool has a disclosure policy.

Using Your 401 Funds To Buy A Home Has Pros And Cons

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

If you need cash for a down payment for a home, and you have a 401 retirement plan, you might be wondering if you can use these funds.

Typically when you withdraw funds from a 401 before age 59½, you incur a 10% penalty. You can use your 401 toward buying a house and avoid this fee. However, a 401 withdrawal for a home purchase may not be best for some buyers because of the opportunity cost.

Learn how to tap your 401 to buy a home and more about some alternatives for funding a home purchase, such as using a mortgage program or saving up cash.

Why Would You Want To Day Trade With A 401

Usually, people invest in a 401 because it helps with taxes when you reach retirement age. It can also work against you if you want to withdraw from the account before you reach retirement. In this case, your tax advantages are still in play. As a result, this is a big advantage if you like making money on your money.

For example, when you sell a stock for a gain in a brokerage, you owe tax on that gain, immediately. With something like a 401, you wont owe taxes on the gain if the money stays in the account. This means that you can earn a higher after-tax return in the 401 as well as indirectly contribute more to your 401 with a winning trade. Whatever gains you make from day trading will likely end up accruing the same interest that the 401 will.

Keep in mind that even though this is the case, you still need to avoid taking a withdrawal on that gain until retirement age. If you do, youll have to pay the penalty. Either way, this is a great alternative to just watching and waiting for your 401 to grow. Just know the best strategies when youre looking to buy penny stocks.

Recommended Reading: How Do I Invest My 401k In Stocks

Scale Up Contributions Over Time

Once you’ve picked your investments, the best thing you can do is leave your account alone and let the contributions build.

In addition to low costs and diversity, consistently investing over time i.e., every paycheck will make the biggest difference in the size of your savings. Low-cost funds are only effective if you continuously invest in them and don’t try to time the market, or pull money out when it starts to drop, a recent report from Morningstar says.

Experts also advise increasing your contributions each time you get a raise or bonus by a percentage point or two, helping you reach your goals faster.

Finally, remember that while the stock market has historically increased around 10% per year, that’s not guaranteed, and there will be periods when it falls. Experts also expect returns to be lower, around 4%, over the next decade than they have been the previous 10 years.

Still, no one knows what will happen, except that the best course of action is typically to invest in low-cost index funds consistently, over many decades. Do that, and you’ll be on the path to building real wealth.

How Do Day Traders Pay Taxes

How day trading impacts your taxes. A profitable trader must pay taxes on their earnings, further reducing any potential profit. … You’re required to pay taxes on investment gains in the year you sell. You can offset capital gains against capital losses, but the gains you offset can’t total more than your losses.

Don’t Miss: Should I Convert 401k To Roth Ira

Determine How Much You Can Contribute

Workers under 50 can contribute up to $19,500 to a 401 in 2020, but how much you actually earmark for the account depends on your income, debt level and other financial goals. Still, financial experts advise contributing as much as you are able to, ideally between 10% to 15% of your income, especially when you are young: The sooner you start investing, the less you’ll have to save each month to reach your goals, thanks to compound interest.

“That’s your company literally saying: ‘Hey, here’s some free money, do you want to take it?'” financial expert Ramit Sethi told CNBC Make It. “If you don’t take that, you’re making a huge mistake.”

How To Use A 401 To Buy Private Stocks

There are several ways to use a 401 to buy privately-held stock.

Duncan Smith/Photodisc/Getty Images

A 401 plan makes for a fine financial vehicle on the road to a worry-free retirement. However, you need be sure you completely understand how it is being put to work for you, as no two 401 plans are alike. While you typically cannot directly use your 401 to buy private stocks, there are certain circumstances when you can access the funds in your 401. And, if youre over the age of 59 ½, you can make penalty-free withdrawals to do with as you like, including purchasing private stocks.

Don’t Miss: Can I Use 401k For Real Estate Investment

Using Your 401k To Purchase A Primary Residence

When you are first considering using your 401k or your traditional IRA to purchase real estate, it is a good idea to talk to your plan provider, plan administrator, or custodian.

According to the IRS rules, you are able to use the retirement funds in your 401k to buy a house.

If it is for your first home that will be your principal residence, you can have access to the money in your 401K.

There are two options when it comes to using your 401k to help you purchase a home.

You can either borrow money in the form of a loan or take the money from the 401k as a withdrawal.

The amount of money you are able to borrow from your 401k depends on the number of years you worked at your company and the guidelines of the IRS.

The amount you can borrow is the greater of $10,000 or half of the balance in your account that has been vested, but the loan cannot exceed $50,000.

If your company allows loans from your 401k, you will not be subject to an early withdrawal penalty.

However, you will incur a penalty if you leave your job before paying back your loan within a specific time frame.

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people get tripped up: According to a 2014 Charles Schwab survey, more than half of 401 plan owners wish it were easier to choose the right investments.

Heres what you need to know about investing your 401.

You May Like: When Can I Roll A 401k Into An Ira

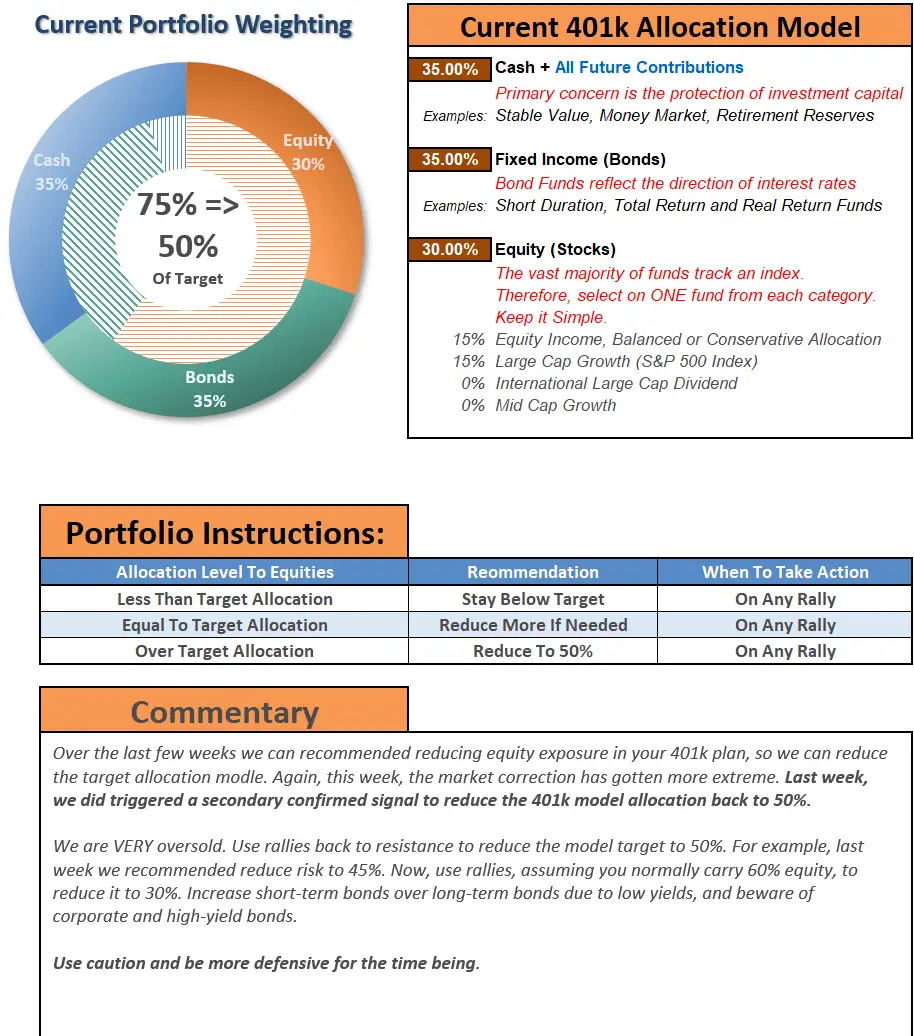

Diversifying Investments To Balance Risk

Most 401 plans rely on diversification to balance risk and ensure retirement income that meets employee expectations. This is why 401 plan managers invest in bonds, individual stock and mutual funds, among other investment types. Employees might be allowed to select how they want their 401 funds invested, but often this choice is between long-term, aggressive investment strategies and more short-term, conservative options. Only in a handful of cases can employees choose individual stocks or investments for their 401s.

Can I Use Robs To Start A Business

If youre looking into starting a new business, a ROBS might be an attractive option.

ROBS are unique 401 rollovers for an employee who has left their employer and would like to start a business, says Ryan Shuchman, Investment Advisor Representative and Partner at Cornerstone Financial Services in Southfield, Michigan. Effectively, the 401 funds can be used as the startup capital for a new business or to acquire an existing business.

There are specific rules you must follow if youre going to apply the ROBS strategy to your situation. This is where you may be entering uncharted territory.

Just because you may have already rolled over your retirement assets from your former employer doesnt mean youve missed this opportunity. ROBS funding can come from your IRA, too.

The technique here is that a small business establishes a 401 plan and the owner rolls over a sum of money from another qualified source such as an IRA or previous employer plan and that cash, once in the plan, is used to buy stock in that same business, says Jason Grantz, Managing Director at Integrated Pension Services in Highland Park, New Jersey. The plan is now the owner/custodian of the stock certificates and the owner has now gotten out the cash without taxes being applied to them. Youd use them as a form of cheap financing for a small business, and especially for owners who cant find or qualify for quality financing elsewhere.

You May Like: What Happens To Your 401k When You Leave A Company

Potential Risks In 401 Investments

- Being too conservative: Some people may think that the best way to manage risk is not to take any, but being too conservative with your investments can be a risk, too. Many investors dont allocate enough of their retirement portfolios to stocks, which will likely have the highest returns over the long term. Instead, they stick to assets perceived to be low-risk investments such as bonds. While stocks are volatile, they should be an important part of investing for goals like retirement.

- Paying too much in fees: Fund expenses eat into the return you earn as an investor, so pay special attention to the fees associated with the funds you invest in. If a fund has an annual expense ratio above 0.50 percent, its likely you can choose something cheaper. Most index funds cost less than 0.10 percent each year.

- Investment losses: This is what most people think of when it comes to investment risk. Stocks and bonds can decline in value, especially over short periods of time. Stocks tend to rise over the long term, though, making them ideal assets for goals far in the future like retirement.

Legal Protection For Companies

The main purpose of the guidance is to assure companies that offer certain types of target-date funds and other investments that include private equity, that they have legal protection. This comes in the wake of employee lawsuits against companies such as Intel and Verizon that included alternative investments in TDFs. These lawsuits caused other companies to avoid these types of investments.

According to Employee Benefits Security Administration Acting Assistant Secretary Jeanne Klinefelter Wilson, This letter should assure defined contribution plan fiduciaries that private equity may be part of a prudent investment mix and a way to enhance retirement savings and investment security for American workers.

DOL guidance provides no protection for stand-alone private equity fundsonly those types of managed funds mentioned in the Information Letter.

Also Check: Investing In Gold Etfs Pros And Cons

Don’t Miss: Can You Cash Out 401k After Leaving Job

Mistake #: Buying Too Much Of Your Companys Stock

If your employers stock shares are an investment choice in your 401, you may want to consider keeping your allocation to no more than 10 percent. Youre not being disloyal even the mightiest of companies think Enron and WorldCom can falter. With your salary already tied to your companys fortunes, you dont want a sizable part of your retirement savings to be similarly dependent.

Retirement Rollovers And Withdrawals

First, consider how withdrawals from a retirement plan normally work when you retire.

Normally you would roll your 401k into an IRA to take advantage of better investment options, get professional help, or simply because your 401k plan requires it when you retire. You can handle the investments you roll over in one of two ways:

- You roll your investments as-is into the IRA. The stocks, bonds, and mutual funds you hold in the retirement plan are transferred into the IRA.

- You sell everything and move the cash. You purchase new investments in the IRA.

Then, you would withdraw from the IRA by selling a portion of the investments and withdrawing the cash.

In a traditional IRA, your withdrawals from the IRA are taxed at your ordinary income tax rate.

We will revisit this process in a moment when we discuss distributing employer stock.

You May Like: Is An Ira Better Than 401k

Types Of Investments Offered In 401

The following are some of the investments commonly offered in a 401:

Mutual Funds

Mutual funds are the most common types of investment offerings in a 401 plan, and they spread the money across multiple investments. These funds are professionally managed there are money managers who are tasked with choosing the specific bonds and stocks for the fundâs investors. Mutual funds have different grades, ranging from conservative to aggressive. The average mutual fund has hundreds of securities, and this allows investors to gain diversification at a low price.

The main types of mutual funds include stock funds, bond funds, balanced funds, and target-date funds.

Exchange-Traded Funds

An ETF comprises different types of investments such as stocks, bonds, commodities, and other types of assets. These securities are traded on an exchange, just like stock. ETFs have similar characteristics with mutual funds, except that the former is traded on a public exchange and it trades throughout the day. In contrast, mutual funds are not traded on an exchange, and they only trade once a day after the markets close. ETFs are a popular choice for 401 participants looking to grow the 401 savings.

Company Stock

Individual stocks and bonds

Variable Annuities

How To Protect Your 401k From A Stock Market Crash

Are you riding your retirement on the success of the stock market? If so, its understandable that youre worried about what a crash could mean for your 401k.

If thats you and youre wondering how to protect your 401kfrom a stock market crash, Ive got good news for you:

You dont have to worry.

The stock market is volatile, but you can minimize that risk with the right investing strategy.

If you invest your money the right way, you can not only protect your retirement but also experience even greater returns so your retirement can be even sweeter. Ill show you how to take advantage of stock market volatility, which includes a stock market crash, so you can profit from the fluctuations instead of watching your portfolio take a plunge.

Are you with me?

Recommended Reading: Are Iras Better Than 401k

When It Makes Sense To Borrow From Your 401

You should do other things first, but sometimes a 401 loan is a valid way to pay down high-interest credit card debt

Tapping your retirement plan to pay off high-interest debt sounds tempting, especially with interest rates on the rise. Then theres the added satisfaction of paying the interest on a 401 loan back to yourself, not the bank.

But theres a whole host of reasons why you shouldnt touch that money. Perhaps the biggest right now is that youre taking money out of the stock market after a major sell-off.

Chances are your account is down right now, so youre locking in a loss, says Lauren Lindsay, a certified financial planner based in Houston.

Thats why financial professionals recommend you explore other options before raiding your 401.

First Id be hammering on the expenses and seeing if theres anything that can be done to get some cash to throw toward the credit card, says Jim Holtzman, a wealth advisor based in Pittsburgh.

Among the strategies Holzman recommends: Call your credit card company and ask for a lower rate. Negotiate with the utilities to get a break for a period of time. Seek a credit counseling agency to negotiate with creditors. Shop at less expensive supermarkets, if you can.

Those arent fun processes to go through but youre really trying to lower that burden, he says.

There are times, however, when a 401 loan makes sense.

Here are some of the benefits of 401 loans: