Consult An Expert And Make Sure That Tax Strategies Are Part Of Your Overall Retirement Plan

Taxes are confusing and complicated and are perhaps evolving. Before converting money to a Roth account, you may want to consult with a certified financial advisor or a tax accountant.

You also want to make sure that your tax strategy is part of your overall retirement plan. NewRetirement Planner is a rich and detailed tool that addresses many different aspects of personal finance, including taxes.

The tool enables you to try different scenarios including modeling a Roth conversion. You will be able to immediately see your tax differences and compare cash flow, estate value and more before and after the conversion.

PlannerPlus subscribers can even use the Roth Conversion Explorer to get a personalized multi-year Roth conversion strategy to minimize taxes and maximize your estate value.

The NewRetirement Planner makes it easy to take control of your money to live the life you want.

Can You Withdraw Contributions From A Backdoor Roth Ira

And you can withdraw both your contributions and earnings from a Roth IRA with no taxes or penalties after you turn 59 and a half, as long as the account is at least five years old. Otherwise, you will be subject to the 10% tax penalty unless an exception applies .

How do you remove a backdoor from a Roth IRA?

To reverse a conversion by returning an account to traditional IRA status, you must submit the required form to the Roth IRA trustee or custodian by October 15 of the year following the conversion.

Can I withdraw my contributions from a Roth IRA conversion without a penalty?

As a general rule, you can withdraw your contributions from a Roth IRA at any time without paying any taxes or penalties. If you withdraw money from a conversion too soon after that event and before the age of 59 and a half, you could incur a penalty.

T Substantially Equal Periodic Payments

72t SEPP is another popular way to make a withdrawal plan for early retirement. This withdrawal plan is called the 72t SEPP because it allows you to avoid the 10% tax penalty for early withdrawal as long as they are made as part of a series of equal payments over your life expectancy .

The first few steps are at the same as the Roth conversion ladder. You fill up your taxsheltered retirement plans while working. Then when you retire you rollover your 401k and 403b into a traditional IRA. You should have already calculated how much you plan to live on every year until you turn 59 ½. You can then take this number and calculate the SEPP.

Its important that you have a tax professional check your calculations. It is also important that you continue making the withdrawals for 5 years or until you are 59 ½. When you stop withdrawals or withdraw the wrong amount you will face major fees.

Read Also: Can You Contribute To 401k After Leaving Job

Can You Convert A Roth 401k To A Roth Ira

A Roth 401 can be rolled over to a new or existing Roth IRA or Roth 401. As a rule, a transfer to a Roth IRA is most desirable, since it facilitates a wider range of investment options. If you plan to withdraw the transferred funds soon, moving them to another Roth 401 may provide favorable tax treatment.

Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

You May Like: How Much Needed In 401k To Retire

Why Not Just Contribute Annually To A Roth Ira

You take money out of a tax-protected account when you transfer money from a traditional IRA into a Roth IRA. That means you need to be ready to pay taxes on any money you transfer from a 401k or IRA into a Roth IRA. This is because contributions to a Roth IRA dont lower your adjusted gross income, whereas you can get tax breaks when you make contributions to your 401k or traditional IRA. Instead, the money you transfer becomes taxable income for the year.

Another reason you should avoid contributing to a Roth IRA annually is if you are getting anywhere close to emptying your retirement accounts before retirement age. You need to have enough saved to keep up your preferred lifestyle for as long as you plan to be in retirement.

Additionally, you can only take money out of a Roth IRA five years after initially transferring the money into the account. You need to find some money to live on until then. You might already have this covered from

There are plenty of ways to do that, though. Here are a few we at IWT love:

Basics Of Roth Ira Conversions

20 years after 401ks were created, a new type of retirement account was born The Roth IRA.

Unlike traditional IRAs, or your 401k, all money that goes into a Roth IRA is after-tax. There are no tax deductions for contributing to a Roth IRA. But, in exchange the money in a Roth IRA grows tax free. Better yet, when the money is withdrawn the account owner pays no taxes at all.

If Americans had $7 trillion in Roth IRAs, every single penny of that $7 trillion would be theirs and $0 would go to the government in taxes.

The problem is amassing assets in Roth accounts is hard.

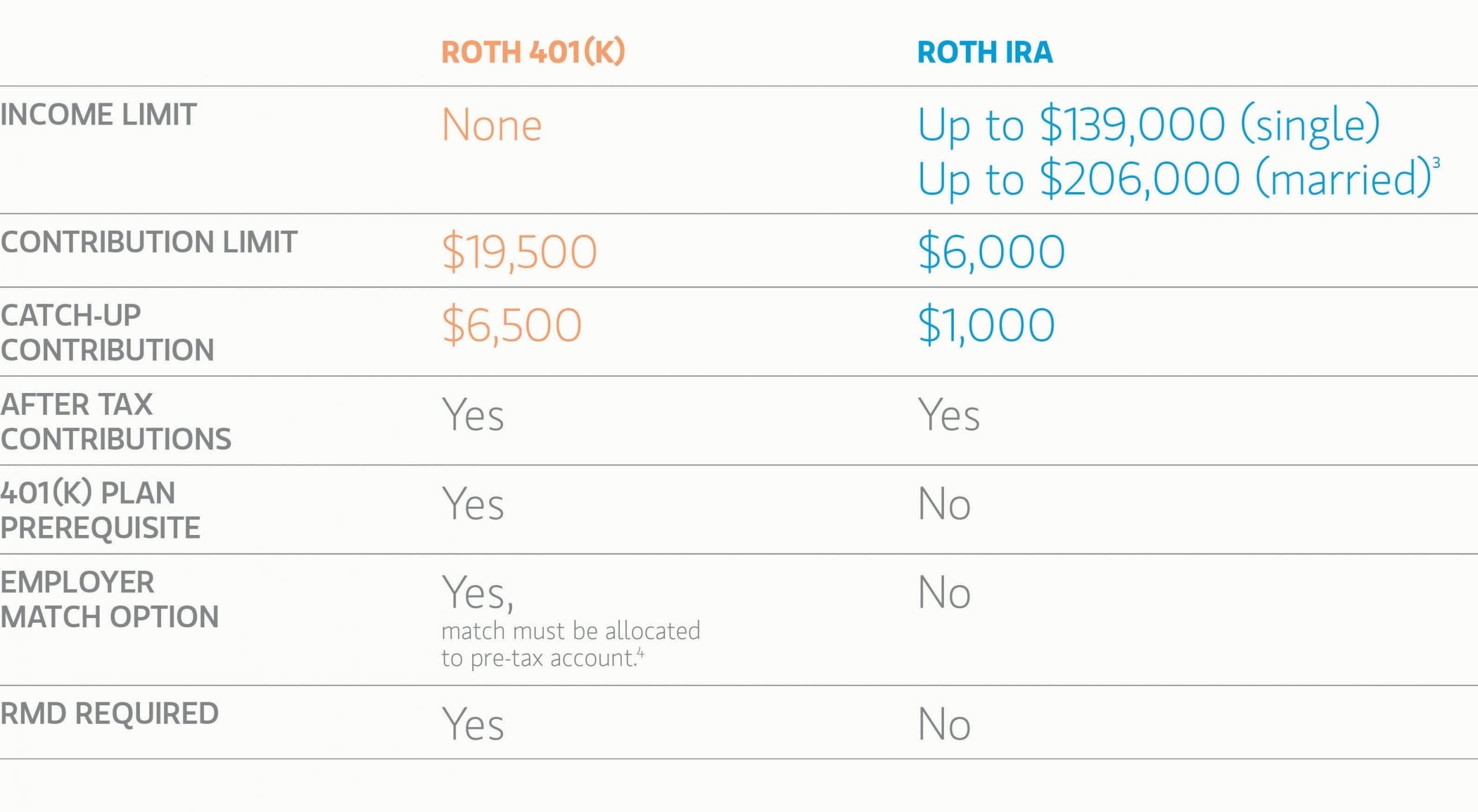

If you dont have a Roth 401k option, the IRS limits the amount you can contribute to a Roth IRA to $6,000 per year , and limits who can contribute to only those with a household taxable income of $206,000 or less .

But there is an additional way to get money into a Roth IRA besides regular annual contributions Regardless of your gross income!

A Roth IRA conversion.

A Roth conversion moves assets from a traditional IRA to a Roth IRA. But, there is a catch The conversion involves paying taxes today, since Roth conversions count as income.

How much in taxes will you pay when doing a Roth conversion? That depends on your other income and your effective tax rate. If we assume your effective tax rate is 15%, about where many retirees see themselves at today, that means you will pay $15,000 in taxes to convert $100,000 from a traditional IRA to a Roth IRA.

You May Like: How To Convert Your 401k To A Roth Ira

Where You Will Live In Retirement

Are you planning to move to another state after you retire? Even if you expect your federal tax rate to stay the same in the coming years, the difference between your current and future state’s tax rates may matter. And some states partially or entirely exclude retirement incomesuch as distributions from a traditional IRAfrom state income tax. So if you live in, or plan to live in, a state that does, a conversion from a traditional IRA to a Roth IRA may be less attractive.

If your future state of residence has a higher state income tax rate than that of your current one, it might make sense to convert at least some of your eligible assets to a Roth IRA before you move. Similarly, if you’re moving from a state with a higher tax rate to one with a lower rateor no income taxyou may want to avoid a conversion, or at least consider waiting to convert until you’ve established your new residency.

Leaving Money To Others

If you’re planning to leave retirement savings to heirs, consider how it may affect their taxes. Because of their RMDs, inherited traditional IRAs generate taxable income for heirs, often during their peak earning years. These distributions could incur taxes when they’d rather avoid them, or unintentionally push them into a higher tax bracket. Inheriting Roth IRA assets, which generally don’t incur any income taxes, can be a benefit to your heirs. In addition, the income taxes paid on a Roth IRA conversion may also help reduce the size of a taxable estate.

But there are many details to consider. For example, if your heirs are likely to be in a much lower tax bracket than you are, it may be advantageous to leave them a traditional IRA. That’s because it may be better for them to pay lower taxes in the future than for you to pay higher taxes now.

Also, Roth IRA conversions may be disadvantageous to those who intend to leave at least some of their assets to charitable institutions. Traditional IRAs can typically be left to charity without any tax bill at all for either party. So, in that case, conversion will mean that the tax was paid needlessly.6

If leaving money to others is part of your plan, no matter what your goals are, be sure to consult an estate planning attorney and think carefully before taking any action.

Read Viewpoints on Fidelity.com: An all-in-one wealth transfer checklist

You May Like: What Is A 401k For

Roth Conversion Ladder: The Ultimate Key To Early Retirement

Get paid to take surveys! and start earning today.

Are you tired of not knowing where all of your money is going? as your first step towards financial freedom!

Many of you know that if you try to take money out of a 401k or traditional IRA early, there will be a 10% early withdrawal penalty. This isnt good news for the FIRE community, most of whom plan to access these investment funds well before they turn 59 ½. Thankfully there is a solution to this problem- the roth conversion ladder.

If you want to retire early, then you need to know everything about how the roth conversion ladder can work for you.

Is There A Limit I Can Convert Into A Roth Ira

There is no limit to how much you can convert from your various retirement accounts into a Roth IRA. However, keep two things in mind.

First, once that money leaves the tax-protected accounts, you will have to be ready to deal with the annual taxes.

The second thing to remember is that a Roth ladder strategy only works as it should if you dont run out of money. Therefore, it is essential to evaluate the long term to ensure you will still have the funds to continue supporting your lifestyle even after turning 59 1/2.

Also Check: How Do I Take Money Out Of My Voya 401k

How Do I Complete A Rollover

What Is A Roth Account

A Roth account is a type of 401k or IRA.

The main difference between a Roth account and a traditional retirement savings account is tax treatment:

- Money in a traditional 401k or IRA grows tax deferred, meaning that you pay taxes on the money when you withdraw the funds .

- Money in a Roth account grows tax free. Contributions to this account are made with after-tax earnings, but you owe zero taxes when you withdraw the funds no matter how much the account has grown. , although Roth 401ks do.)

Recommended Reading: How To Find Out Whats In Your 401k

Employer Retirement Plan Backdoor Roth Conversions

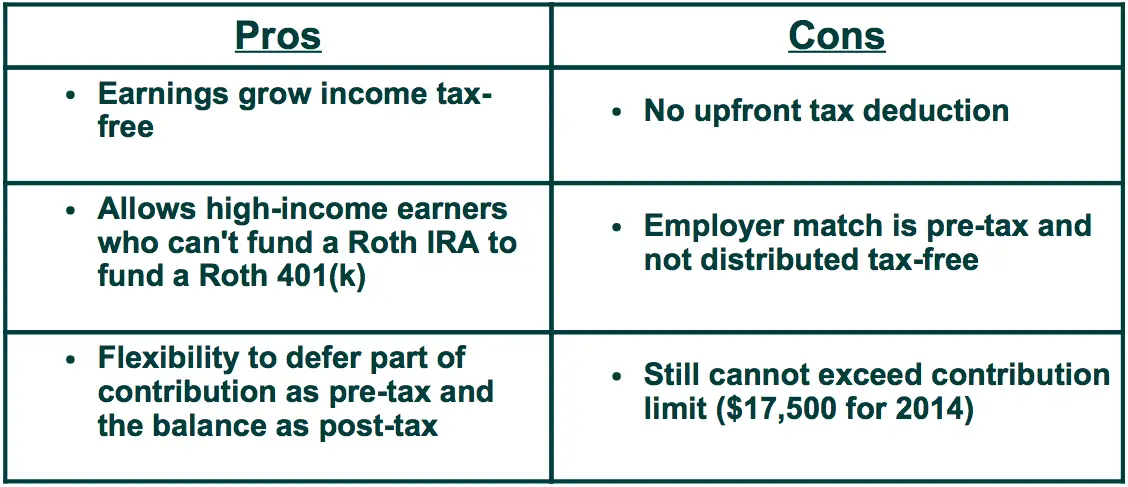

One increasingly popular strategy we have seen is the backdoor Roth conversion through an employers workplace retirement plan. If your employers plan allows, this strategy will enable you to convert after-tax voluntary 401 contributions to a Roth 401. When is it a good idea to contribute to an after-tax voluntary 401 and convert to a Roth 401? Here are some factors to evaluate if you are considering this strategy:

- Your plan allows after-tax voluntary contributions, and you want to save more than the pre-tax/Roth 401 2022 elective deferral contribution limit of $20,500 or $27,000 if youre over 50 years old.

- You have a fully-funded emergency savings account, a reasonable debt situation, and do not need the liquidity.

- You make too much to contribute to a Roth IRA but still want to save Roth dollars for your retirement.

- You dont want the hefty tax bill of a taxable conversion of pre-tax to Roth.

- And most importantly, you love TAX-FREE money for your retirement!

Why Would You Want To Convert A 401 Into A Roth Ira

When youre employed by a company that offers a 401 plan, its an indispensable investing tool. Many companies match some of your contributions, which is essentially free money.

However, when you leave that job, this is a great time to look at the 401 youve been given and evaluate what is working for you, says Nicole Stanley, a financial coach and founder of Arise Financial Coaching.

Here are some of the most common reasons you might want to convert your 401 into a Roth IRA:

Also Check: How Do I Put My 401k Into An Ira

How Does A Roth In

A Roth in-plan conversion lets you take a distribution that is rollover-eligible from your 401 plan and roll it over to a Roth account in the same plan. The Roth in-plan conversion can be a valuable tax-saving strategy, if used correctly. It can also help high-income taxpayers legally avoid the contribution limits placed on income. Heres how it works.

A financial advisor could help you optimize your retirement investments to minimize your tax liability.

Should You Convert Your Traditional 401 Into A Roth 401

7 Minute Read | December 14, 2021

Over the past few years, you might have received an email from your companys human resources department introducing a new retirement savings plan option: the Roth 401.

More and more companiesespecially large onesare adding Roth options to their 401 plans. In fact, seven out of 10 employers now offer this option to their employees.1 If the Roth 401 is on the table at your workplace, thats great news for you!

But if you now have a Roth 401 option, youre probably wondering what to do with your existing 401. Is converting an existing 401 to a Roth the way to go? Or should you just leave it alone?

There are some things to keep in mind before you make this decision, so lets dive in.

Also Check: What Is The Interest Rate On A 401k

Roth 401s As An Alternative

A Roth 401 combines the employer-sponsored nature of the traditional 401 with the tax structure of the Roth IRA. If your employer offers this type of plan, youll contribute after-tax money to your account and you wont owe taxes when you start receiving distributions. If your employer offers a match, though, that money is in a traditional 401 plan. So if you choose to convert it, you will owe taxes on it the year you do so.

If youre looking to do a rollover from a Roth 401 to a Roth IRA , the process is quite simple. All youll have to do is follow the same steps as if you were rolling over a traditional 401 to a traditional IRA. The tax structure is staying the same. If youre looking to convert your Roth 401 into a traditional IRA, youre out of luck. Unfortunately, this isnt possible, since you cant un-pay taxes on the money in your Roth 401.

You May Like: How To Find Your 401k

How Is A Roth Ira Conversion Taxed

A Roth IRA Conversion is a taxable event since you are converting funds from a pre-tax account into a Roth account that will no longer be taxed in the future.

This tool is a legitimate way to fund your early retirement and possibly pay no tax on your 401K/IRA funds. Think about that!

These funds were contributed pre-tax, and there is a way to access them BEFORE AGE 59 ½ and pay NO TAX!

Roth IRAs are unique because you can withdraw your contributions before age 59 ½ as long as they were made 5 years ago.

The government also considers any money converted from an IRA to a Roth as a contribution.

This is critical to the success of the Roth Conversion Ladder.

This means any contribution you make from a Traditional IRA to a Roth account can be withdrawn penalty-free and tax-free as long as it has been in the Roth account for at least 5 years.

You DO have to pay taxes when you convert the money from an IRA to Roth account.

However, we in the FIRE community will benefit from paying much lower taxes because of our financial flexibility and frugal lifestyle.

You can convert the money while not earning much traditional income, such as a W2 salary.

Therefore, you pay no taxes on some contributions, and you are taxed at the lowest brackets for the rest.

Also Check: Can You Roll Your 401k Into An Ira