Rollover The Money Into An Ira

If you moved to a higher-paying job, you should consider a rollover IRA to get greater control over your investments. A rollover IRA allows you to combine all your old 401s so that you have a single location for your retirement money.

Unlike a 401 where you are the participant, an IRA gives you full ownership of your retirement savings, and you can make decisions on your portfolio composition, and how much to invest in each type of security. You can also choose to convert your IRA account into a Roth IRA account if you think that your retirement income will be higher than your current income.

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but here are just a few examples of when I suggest that clients might want to leave funds with their employer.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Some Government Workers

If you worked for a federal, state, or local government, be sure to explore your options. Those with 457 plans can potentially avoid the early-withdrawal penalty thats commonly associated with 401 and similar plans. Plus, some public safety workers can avoid early withdrawal penalties from a retirement planincluding the TSPas early as age 50.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

NUA Opportunities

Do I Have To Leave My Job To Withdraw My Retirement Plan Money

Not necessarily, although thats what most plans require. If your employer terminates your retirement plan, or if you become disabled, you may be given an opportunity to take a distribution. Also, some retirement plans permit you to draw on your retirement plan money after a fixed number of years or upon reaching a certain age, such as 59½ or the plans designated retirement age.

Recommended Reading: Can I Transfer Money From 401k To Ira

Do I Have To Take My Retirement Plan Assets When I Change Jobs

Company retirement plan rules can vary, but most follow the same basic guidelines. If your account balance is less than or equal to $1,000, your plan might cash you out. If your balance is greater than $1,000 and less than or equal to $5,000, your plan might roll over your balance into an IRA selected by your former employer. If your balance is greater than $5,000, you will generally be permitted to leave your balance in the plan however, you will not be able to contribute to the account and will be subject to any restrictions and rules of the plan.

Also Check: How To Set Up A 401k Account

Capitalize Can Help You Rollover Your Adp 401

401 rollovers are a great way for you to consolidate the savings in old 401 accounts you have. If you roll over into an IRA, you may also be able to invest in a wider range of assets.

The process can seem a little daunting, but theres just five key steps to follow and Capitalize can help get you started. Weve made it our mission to make rollovers easier for everyone, so if you choose to do a 401-to-IRA rollover, we can handle the entire process for you.

Contents

Don’t Miss: How Do You Roll Over Your 401k

Restate Or Amend Your Plan Document

Your companys retirement plan comes with an owners manual, also known as your plan document. This important piece of documentation lays the ground rules for how your retirement plan works. Some of the important details covered include:

- When employees are eligible to participate

- Vesting schedule information

- Employer matching and/or profit-sharing details

- How distributions are handled

- Contact information for the employer and applicable third parties

Youll need to share your current plan document with your new 401 provider. This will help them understand how your plan functions and guide the conversation if you want to make any changes moving forward. If you dont, your new provider will keep the same provisions in your plan document.

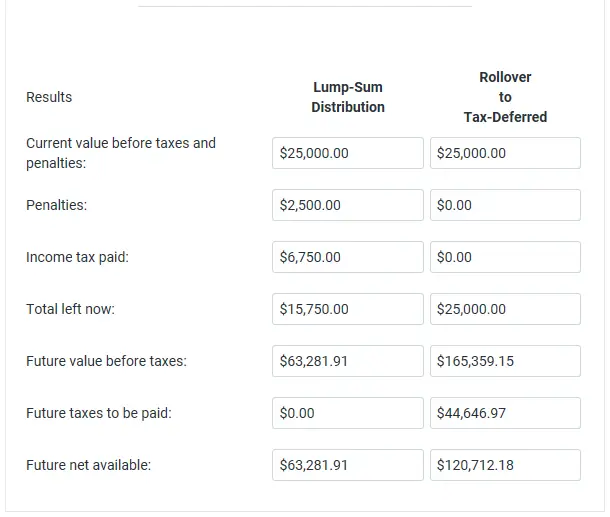

How Do I Avoid Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Also Check: How Much Do I Need To Contribute To My 401k

A Rollover Or Transfer Ira May Be Right For You If You Want

Streamlined account management

Access your accountswhenever you need to, however you want. Whatever your preferences, you can securely manage and monitor your accountsalmost anytime, anywhere.

A centralized view of your investments

Whether youre saving for future education, saving for a major life event, or simply want to build your wealth over time, you can invest all your goals in one place.

Ongoing tax-deferred growth potential

Choose an option that allows you to continue to benefit from your savings tax-advantaged status and increase the growth potential of your wealth.

Additional select client benefits

As your assets with us increase, so will your benefits. All our clients enjoy a competitive list of benefits aligned to your investment tier.

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Also Check: What Happens To My 401k If I Leave My Job

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

What Is A 401 Rollover

A 401 rollover is when you move the assets you accumulated in a previous employers 401 plan into a new employers 401 or into a traditional IRA. Its something you want to take advantage of when you leave your job. By rolling over your old 401 assets, you can keep your retirement savings all in one place, says Amy Richardson, CFP, Senior Manager and Financial Planner at Schwab Intelligent Portfolios Premium.

Moving your old 401 over helps keep your money in one place. Rather than have many different retirement accounts spread out everywhere, you can keep all your retirement money in one account. It makes it easier to keep track of. It also means you can avoid paying fees or charges twice, if both accounts charge them.

It also helps increase investment choices and ownership. Even if you dont move your 401 to your new employer, you can roll it over to an IRA. This gives you more ownership of your own account regardless of what happens with your new employer. If you ever leave in the future, your traditional or Roth IRA can stay with you.

Don’t Miss: Should You Use 401k To Pay Off Debt

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Freeze Retirement Account Changes

Under normal circumstances, participants can update their contributions, make withdrawals, or request loans at any time. But when youre in the middle of switching 401 providers, that kind of activity can complicate the behind-the-scenes work needed to make the handoff a success. Thats why switching requires you to go through a blackout period where employees cant touch their retirement accounts.

Because blackout periods can last as long as two months, companies are required to give plan participants written notice at least 30 days beforehand, per IRS rules.

Read Also: Can I Create My Own 401k Plan

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if youre leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employers 401

- Withdrawal from your 401, which would trigger a 10% penalty if you arent 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesnt offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration wont allow you to stay invested for some other reason

- Your new employers 401 plan charges high fees, offers limited investments, or has other drawbacks

- Youd prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an NUA strategy that could save you a lot of money.)

If these downsides arent deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

Recommended Reading: Can You Transfer Money From 401k To Bank Account

Is There Any Portion Of A Distribution Thats Tax

Yes, if the distribution includes after-tax contributions or Roth contributions. Non-Roth after-tax contributions can be distributed tax-free, but earnings are taxable. Qualified distributions from Roth 401 or Roth 403 accounts are tax-free. However, the earnings portion of nonqualified Roth distributions is taxable.

You May Like: Does 401k Roll Over From Job To Job

How Do I Roll Over My 401 To An Ira

When you leave your job for any reason, you have the option to roll over a 401 to an IRA. This involves opening an account with a broker or other financial institution and completing the paperwork with your 401 administrator to move your funds over.

Usually, any investments in your 401 will be sold. The money will then be deposited into your new account or you will receive a check that you must deposit into your IRA within 60 days to avoid early withdrawal penalties.

How To Transfer 401 To A New Job

If you recently changed jobs, learn how to transfer 401 to the new job, and the pros and cons of moving old 401s to a new retirement plan.

Changing jobs after years of working for your employer can be an emotional time, and you may likely forget about your old 401 account. Unless you let the former employer continue managing your retirement savings, you must decide where to move your 401 within 60 days. Usually, you can let your former employer continue managing your 401 account if you have at least $5,000.

If you decide to transfer 401 to your new employerâs 401, you must first contact the new plan sponsor to discuss the transfer. If the new employer accepts 401 rollovers from other employers, you will be required to fill forms for the transfer, detailing your personal information and the old 401 plan details. Once approved, you should provide the new 401 account details to the old plan sponsor to initiate the transfer. You can opt to have the former employer transfer the funds directly to the new employerâs 401 or choose to receive a check, which you must deposit to the new 401 plan in 60 days.

Don’t Miss: Can You Transfer A 401k Into An Ira

Cashing Out: The Last Resort

Avoid this option except in true emergencies. First, you will be taxed on the money. In addition, if youre no longer going to be working, you need to be 55 to avoid paying an additional 10% penalty. If youre still working, you must wait to access the money without penalty until age 59½.

Most advisors say that if you must use the money, withdraw only what you need until you can find another income stream. Move the rest to an IRA or similar tax-advantaged retirement plan.

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Don’t Miss: Can I Roll My Wife’s 401k Into My Ira

A Closer Look At Your Available Options

The good news is whatever money thats in your 401 is yours to do with as you like. But when you no longer work for a company, any retirement accounts you have through your former company might need to be moved to your new employer. Or you may need to roll it over or into a brokerage account that you own completely.

Disadvantages Of Rolling Over Your 401

1. You like your current 401

If the funds in your old 401 dont charge high fees, you might want to take advantage of this and remain with that plan. Compare the plans fund fees to the costs of having your money in an IRA.

In many cases the best advice is If it isnt broken, dont fix it. If you like the investment options you currently have, it might make sense to stay in your previous employers 401 plan.

2. A 401 may offer benefits that an IRA doesnt have

If you keep your retirement account in a 401, you may be able to access this money at age 55 without incurring a 10 percent additional early withdrawal tax, as you would with an IRA.

With a 401, you can avoid this penalty if distributions are made to you after you leave your employer and the separation occurred in or after the year you turned age 55.

This loophole does not work in an IRA, where you would generally incur a 10 percent penalty if you withdrew money before age 59 1/2.

3. You cant take a loan from an IRA, as you can with a 401

Many 401 plans allow you to take a loan. While loans from your retirement funds are not advised, it may be good to have this option in an extreme emergency or short-term crunch.

However, if you roll over your funds into an IRA, you will not have the option of a 401 loan. You might consider rolling over your old 401 into your new 401, and preserve the ability to borrow money.

Don’t Miss: What Is My Fidelity 401k Account Number