Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is choosing between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that, since there is no tax on withdrawals, all the money that the contributions earn over decades of being in the account is tax free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

How To Check Your Gift Card Balance At Walmart Stores

Another way to check your Walmart gift card balance is to visit your local store.

To check your balance in-store:

You May Like: Can I Get A 401k

How Do I Roll Over A 401 From A Previous Employer

Rolling over a 401 plan from an old employer is easy. Contact the plan sponsor of both the new and old company and they can often manage the rollover directly. If you want to roll it over to an IRA, you can also contact the IRA sponsor . In some cases, the old plan sponsor will send you a check in the amount of the 401, which you must submit to your new plan within 60 days in order to maintain the tax benefits.

Recommended Reading: When Is An Audit Required For A 401k Plan

Follow These Steps With Help If You Need It

At the same time, finding your old accounts may be challenging for several reasons. In the first year of the pandemic, for example, hundreds of thousands of U.S. businesses closed permanently. In addition, says Zigo, you may have moved, or changed your email address, so your previous employer cant find you. Your old 401 plan may have changed sponsors. One of my clients has tried 10 times to reach a previous sponsor. It can be a frustrating process. And the bigger the hurdle, the less likely we are to try, she says. But help is available. A qualified financial planner can guide you through the following steps.

1. Take stock of your accounts

First, make a list that includes every employer where you contributed to a 401, suggests Charles Sachs, a CFP at Kaufman Rossin Wealth LLC in Miami, Florida. Next, call each one to see if they still have an account in your name, and update your contact information, if needed. Reaching out to them is the only way to find out where you stand, Sachs says. Its common for our clients to discover one or two old plans where they still have funds.

2. If a company has closed, check these websites

You can search for your money, which may be considered unclaimed property, at databases such as unclaimed.org and missingmoney.com. Both have links to state treasurers, comptrollers or other officials who update their lists of unclaimed assets regularly.

3. Rollover the money directly to avoid expensive withholding

Looked For Unclaimed Money

Ghosted 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the websites directions, if you get a hit on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

Don’t Miss: How Do You Get A 401k Started

What Is Actual Deferred Percentage

Actual deferral percentage is the percentage of wages deferred by employees under a 401 retirement plan.

An employers ADP helps to ensure that employee 401 benefits are compliant with IRS and ERISA rules that require such plans to be non-discriminatory against lower-paid employees or in favor of higher-earning employees.

The IRS states that traditional 401 plans must ensure that the contributions made by and for rank-and-file employees ) are proportional to contributions made for owners and managers ).

Recommended Reading: How To Withdraw My 401k

What Is The Maximum Contribution To A 401

For most people, the maximum contribution to a 401 plan is $20,500 in 2022 and $22,500 in 2023. If you are more than 50 years old, you can make an additional 2022 catch-up contribution of $6,500 for a total of $27,000 . There are also limitations on the employer’s matching contribution: The combined employer-employee contributions cannot exceed $61,000 in 2022 and $66,000 in 2023 .

Read Also: Can I Retire With 500k In My 401k

Average 401k Balance At Age 65+ $458563 Median $132101

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Option : Leave It Where It Is

You dont have to move the money out of your old 401 if you dont want to. You wont ever lose the funds provided you dont lose track of your old account again. But this option is usually the least desirable.

For one, its more difficult to manage your retirement savings when theyre spread out over many accounts. You also get stuck paying whatever your old 401s fees were, and these can be higher than what youd pay if you moved your money to an individual retirement account, for example.

But if you like your plans investment options and the fees arent too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you dont forget.

Don’t Miss: What Is A Good 401k Contribution

Build Wealth Through Real Estate

In addition to investing in stocks and bonds through your 401, I recommend diversifying into real estate as well. Real estate is a core asset class that has proven to build long-term wealth for Americans. Its important to own a tangible asset that provides utility and a steady stream of income.

Given interest rates have come way down, the value of rental income has gone way up. The reason why is because it now takes a lot more capital to generate the same amount of risk-adjusted income. Inflation is picking up steam, which further boosts the value of real estate.

With real estate, you can earn a steady stream of passive to semi-passive income well before age 59.5, which is when you can withdraw from a 401k penalty-free.

The Average 401 Balance By Age

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

A record number of 401 holders at Fidelity Investments hit millionaire status in 2018. Not one of them? Youre in very good company: A seven-figure 401 balance is the exception, not the rule.

In fact, the average 401 balance at Fidelity which holds 16.2 million 401 accounts and is consistently ranked as the largest defined contribution record-keeper was $103,700 as of March 2019.

If that still seems high, consider that averages tend to be skewed by outliers, and in this case, that number is being propped up by those rare millionaires. The median, which represents the middle balance between the highs and lows, is just $24,500.

No matter which number is closer to your reality and certainly for some, both will feel out of reach its important to remember that numbers like this are akin to train wrecks: They will tempt you to gawk, but they wont likely offer you much actionable information.

Also Check: How To Start Withdrawing From 401k

You May Like: What Does The K Stand For In 401k

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Recommended Reading: Can You Move Money From Ira To 401k

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

Donât Miss: Can You Withdraw Money From 401k

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Don’t Miss: Do Banks Have 401k Plans

How Do You Start A 401

The simplest way to start a 401 plan is through your employer. Many companies offer 401 plans and some will match part of an employee’s contributions. In this case, your 401 paperwork and payments will be handled by the company during onboarding.

If you are self-employed or run a small business with your spouse, you may be eligible for a solo 401 plan, also known as an independent 401. These retirement plans allow freelancers and independent contractors to fund their own retirement, even though they are not employed by another company. A solo 401 can be created through most online brokers.

The Average 401 Balance By Age According To Fidelity

Fidelity announced that 401 balances reached records highs. This is due to the surging stock market during that time in addition to a great economy. In fact, in the last decade, assets nearly doubled. This is what you want to see as an investor. Watching compound interest work its magic.

The following are the average and median balances of over 22,000 businesses employee benefit programs under Fidelitys management.

These metrics will show you how lousy Americans are at saving. If your 401k is your primary retirement plan, and you are below these numbers, try to increase your savings by 1% every other month. This will allow you to ramp up your savings over time.

Read Also: How Soon Can I Get My 401k After I Quit

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Average 401 Balance By Age

Retirement savings grow with compound interest, which means account balances increase with time. Like other types of retirement accounts, money saved in a 401 grows like a snowball, with interest earning interest on itself. The older you are, the more time youve had to build up your savings.

Note: In 2022, employees can contribute up to $20,500 in their 401. Employees over 50 can contribute an additional catch-up contribution of $6,500.

With compounding interest, the earlier money is put into an account, the more opportunity it has to grow, and the greater the possible returns. In retirement accounts like 401s, building retirement savings early means a greater opportunity for growth.

Heres the average amount people have saved for retirement by age group, according to Vanguards data.

|

$107,147 |

$29,095 |

While a large disparity in savings exists, women often need greater retirement savings than men to retire comfortably. Women tend to live longer and could therefore need more long-term care than men, which could require greater spending in retirement.

Also Check: How To Recover 401k From Old Job

Contact Your Hr Department

If you dont know where to check your 401 balance, your HR department can at least direct you to the entity that manages your companys 401 plan. Then, you can contact the 401 plan administer by phone or over the internet to check the balance of your 401 plan. You can also check how the money is invested and whether its time for you to rebalance your portfolio.

Video of the Day

Dont Miss: How To Transfer 403b To 401k

Vested Versus Unvested Balances

The vested portion of your 401 plan is the portion that you get to take with you if you stopped working for the company. You are always fully vested in the contributions that you make to your 401 plan, so dont stop making contributions because you dont know how long youre going to remain with the company. But, if youre not vested when you leave, a portion or all of the contributions your employer made on your behalf could be lost.

Don’t Miss: Should I Transfer 401k To Roth Ira

Why Employers Offer 401s

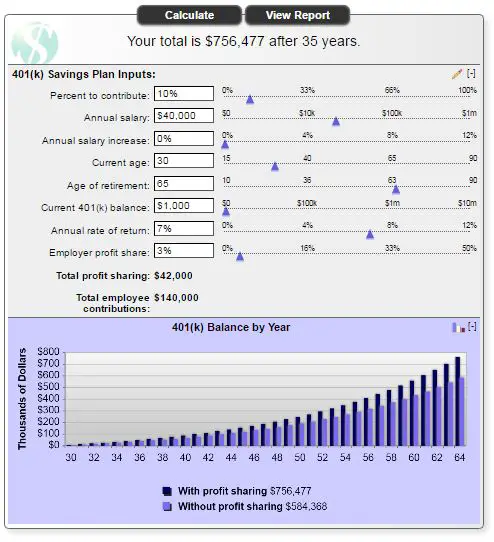

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Nondiscrimination Tests: How To Stay Compliant

Does your companys 401 plan benefit all your employees, or does it favor owners and executives who make more money? Thats what the two major 401 nondiscrimination tests try to assess each year.

What do you need to do to pass the tests? Well, our friends at the IRS have made that piece of the equation a little more complex, so lets take a closer look at what each nondiscrimination test measures, how to apply them, and what it means if your plan fails. As you read this, also keep in mind that its possible to set up a Safe Harbor 401 plan, thats exempt from nondiscrimination testing.

Don’t Miss: Does 401k Count As Income