Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer.

You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal, but you can only do this from a current 401 account that’s held by your employer. You can’t take loans out on older 401 accounts.

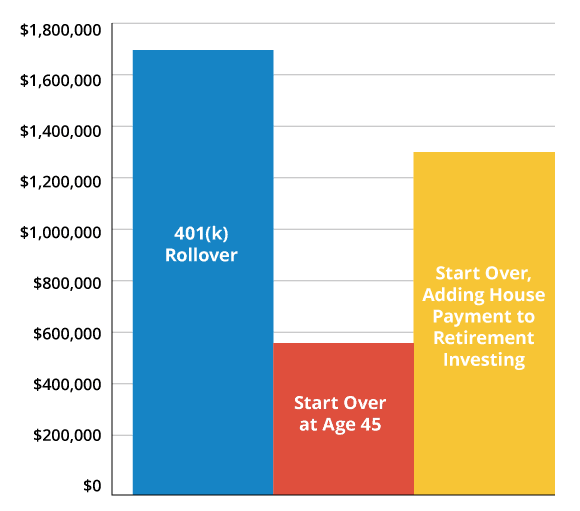

You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company, but these plans must accept these types of rollovers.

How To Withdraw Money From A 401k After Retirement

Finance Writer

During your working years, youve probably set aside funds in retirement accounts such as IRAs, 401s, or other workplace savings plans. Your challenge during retirement is to convert those accounts into an income stream that can continue to provide adequately throughout your retirement years.

If youâre approaching the age that you want to hang your hat from working, you may be wondering how to withdraw money from your 401 after retirement. It isnât always exactly straightforward, which is why weâve broken down some of the basics of using your 401. Hereâs what you need to know.

Recommended Reading: How Do I Cash Out My Fidelity 401k

Tax Consequences Of The One

Beginning in 2015, if you receive a distribution from an IRA of previously untaxed amounts:

- you must include the amounts in gross income if you made an IRA-to-IRA rollover in the preceding 12 months , and

- you may be subject to the 10% early withdrawal tax on the amounts you include in gross income.

Additionally, if you pay the distributed amounts into another IRA, the amounts may be:

- taxed at 6% per year as long as they remain in the IRA.

Don’t Miss: How To Use 401k To Buy Rental Property

How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

Read Also: How Can I Find My Old 401k

How To Transfer Money Between Bank Of America And Merrill Lynch

To transfer cash between your Bank of America and Merrill Lynch accounts, link your accounts, and then use our online tool to make a transfer. Regular mail Merrill P.O. Box 962 Newark, NJ 07101-0962. Overnight mail Merrill FL9-802-03-06 4803 Deer Lake Drive East Jacksonville, FL 32246 877.653.4732.

How long does it take for ACh deposit to get to bank account?

The result is that you may receive your money much sooner than you otherwise would. Your ACH deposit may end up in your bank account within two or three days as opposed to three to seven days.

How long does it take for a mobile check deposit to clear?

Funds are available for investing when posted, but they can be held for up to 8 days. How long does it take for a check to clear if I use a mobile device to make a deposit? The time it takes for the mobile check deposit to clear will vary, depending on when the deposit is made and other factors.

What Are The Rules When You Inherit A 401

The rules for an inherited 401 differ, depending on whether the money was inherited from a spouse or a non-spouse. Depending on your relationship, youll have different options for what you can do with the money and how those options affect your tax situation.

Additionally, if youve inherited a 401 and youre a minor child, chronically ill or disabled, or not more than 10 years younger than the decedent, you have different distribution rules. You can take distributions based on your own life expectancy and not be subject to the 10-year rule.

You May Like: What Is Difference Between 401k And Roth Ira

You May Like: Should I Open A 401k

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Can We Borrow Money From 401k

Can You Lose Your 401 If You Get Fired

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

How Long Does It Take To See Money In 401k

My last paycheck was on Friday, in which I’m pretty sure some was taken out to put into my 401k. I am not seeing the money in my 401k yet though. How long does it typically take to see that money?

This question is best suited for your company’s HR department. At my last company, I’d see the money the day after payday. At my current company, it’s on the Wednesday following payday.

Bottom line: It depends. Ask your manager/HR/benefits department.

in which I’m pretty sure some was taken out to put into my 401k

Does your pay stub show that it was taken out or not?

Im not actually sure how to see my paystub. I can only see my time card. But my paycheck was a few hundred dollars less than it normally is for the same amount of hours.

It depends on HR/payroll. They are who you should ask.

What do you mean pretty sure some was taken out for 401k? What doas your pay stub show?

From IRS – Department of Labor rules require that the employer deposit deferrals to the trust as soon as the employer can however, in no event can the deposit be later than the 15th business day of the following month. Remember that the rules about the 15th business day isn’t a safe harbor for depositing deferrals rather, that these rules set the maximum deadline. DOL provides a 7-business-day safe harbor rule for employee contributions to plans with fewer than 100 participants.

I agree with others, ask HR. Mine is the following Thursday after payday

Read Also: How To Open A Self Directed 401k

How Long Does It Take To Get A 401 Loan Direct Deposit

Knowing how long it takes to get a 401 loan direct deposit can help you decide whether a 401 loan is the best option for your current situation.

A well-funded retirement account can be a safety net in times of emergencies. Ideally, you donât want to tap into your retirement funds. However, in desperate times, a 401 can act as an emergency fund by taking out a 401 loan. Knowing how long it takes to get a 401 loan and have the funds direct deposited into your account can help you plan ahead should you ever need one.

The 401 loan process can anywhere from a day if you do it online to a few weeks if done manually. Once completed, it may take two or three days for a direct deposit to reach your account.

Before relying on a 401 loan to fund an emergency or any other large purchase you may need it for, there are many things to keep in mind.

Read Also: When You Quit Your Job What Happens To Your 401k

What Happens To My 401 If I Quit My Job

When you leave a job, you have several options for what to do with your 401.

You can cash it out, leave it with your old employer, or roll it into an IRA. Each option has different tax implications, so choosing the one thats best for your situation is important.

If you cash out your 401, youll have to pay taxes on the amount you withdraw. You may also be subject to a 10% early withdrawal penalty if youre younger than 59 1/2. If you decide to leave your 401 with your old employer, youll still be subject to taxes and penalties if you withdraw the money before retirement. However, leaving your money in a 401 can be a good way to keep it invested and grow over time.

Rolling over your 401 into an IRA is another option. With an IRA, youll have more control over how your money is invested. And, if you roll over your 401 into a Roth IRA, your withdrawals in retirement will be tax-free. Talk to a financial advisor to find out which option is best for you.

- You can keep your 401 with your former employer or transfer it to a new employers plan.

- You can also convert your 401 into an Individual Retirement Account via a 401 rollover.

- Another choice is to withdraw your 401, which may result in a penalty and taxes on the entire amount.

You May Like: What The 401k Maximum Contribution

Withdrawing After Age 595

Are There Tax Implications Of Cashing Out A 401

Withdrawals from pre-tax 401s are taxed as ordinary income in other words, theyre taxed at your highest marginal tax rate. Note that this is the same rate at which your job or freelance income is taxed.

Ordinary income tax is higher than long-term capital gains tax, which is the tax charged on any realized stock gains after youve held the stock for a year or longer in a taxable account.

If you have a Roth 401, you wont pay ordinary income tax when you withdraw money, as you already paid tax on this money when you made contributions to the account. You will still be liable for the 10% early withdrawal penalty, however, if youre below 59 ½.

Read Also: How To Find Out How Much 401k You Have

What Does It Mean To Cash Out Your 401

Cashing out your 401 is just another way of saying taking money out. When you take money out, its yours to spend, invest, or use in whatever way you see fit. This is not to say youll be free of taxes and penalties, though well explore this later.

Note that cashing out your 401 and rolling over your 401 are two entirely different processes with entirely different tax and financial planning consequences. Rolling over your retirement account, if done properly, should result in no tax due cashing out your 401 will typically result in taxes and/or penalties, depending on your age and a variety of other factors.

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Also Check: Can I Have A Personal 401k

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period.

When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount.

This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Read More: 7 Essential Steps for Retirement Planning

Who Gets My 401 When I Die

Your 401 would be considered a survivor benefit to your designated beneficiary or beneficiaries to receive any remaining assets upon your death. By designating beneficiaries, you can:

- Help ensure your assets are paid per your wishes

- Avoid the potential costs and delays of probate

- Allow non-spouse beneficiaries to receive additional tax benefits

Note: If youre married, most plans require your spouse be your beneficiary for 100% of your account, unless your spouse formally waives this right.

If you are a MissionSquare plan participant and have any questions, contact us.

You May Like: When To Convert 401k To Roth Ira