Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Average 401 Balances By Gender

Gender can also impact 401 balances. In particular, men have much higher average balances than their female peers.

This is explained by many factors, including the gender wage gap and the fact that women may have fewer years on the job because they are more likely to take time off due to caregiving responsibilities.

The table below shows the average and median 401 balances by gender.

| Gender | |

|---|---|

| $107,147 | $29,095 |

Unfortunately, women often face an uphill battle in investing enough for a secure future especially since they tend to live longer than men and need larger balances as a result.

Average 401 Balance By Age

Retirement savings grow with compound interest, which means account balances increase with time. Like other types of retirement accounts, money saved in a 401 grows like a snowball, with interest earning interest on itself. The older you are, the more time youve had to build up your savings.

Note: In 2022, employees can contribute up to $20,500 in their 401. Employees over 50 can contribute an additional catch-up contribution of $6,500.

With compounding interest, the earlier money is put into an account, the more opportunity it has to grow, and the greater the possible returns. In retirement accounts like 401s, building retirement savings early means a greater opportunity for growth.

Heres the average amount people have saved for retirement by age group, according to Vanguards data.

|

$107,147 |

$29,095 |

While a large disparity in savings exists, women often need greater retirement savings than men to retire comfortably. Women tend to live longer and could therefore need more long-term care than men, which could require greater spending in retirement.

Also Check: What’s The Best 401k Investments

Social Security Information You Can See Online

When you sign in to your online account, you’ll be able to view your Social Security statements. If you don’t yet receive benefits, you’ll see an estimate of the amount you could receive when you do retire.

There’s a table that shows your monthly benefit amounts if you retire — for instance, if you were born in 1960 or later, your chart may show retirement at 62 years old , 67 years old and 70 years old . Note that these retirement ages may change in the future. The longer you wait to retire, the more money you could receive per month.

You can also see your eligibility and earnings information. If you’ve worked at least 10 years, you’ll have enough work credits — you need 40 — to receive benefits. If you click on Review your Earnings Record, you’ll see your taxed Social Security and Medicare earnings for each year you worked.

Know Your Liquidity Options

You can find out about your annuitys liquidity options by consulting your contract or by contacting the firm that issued it. Early withdrawals may incur penalties, and you may receive less money than expected.

You can withdraw a portion of some annuities with withdrawal penalties. But others, like no-surrender or level-load annuities, may not have any penalty. The early withdrawal penalty tax on annuities is typically 10% if you withdraw them before you turn 59 ½.

Recommended Reading: How Much Goes Into 401k

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

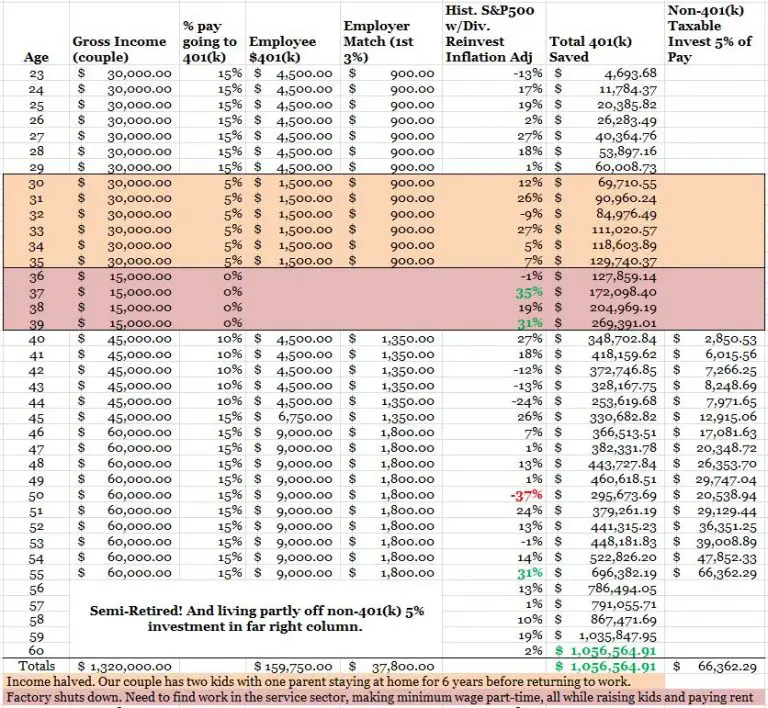

What Is The 401k Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

- The numbers are more forward-looking vs. backward, since the average 401k contribution limits were lower in the past.

- You start full-time employment at age 22 at a company that provides a 401k, without a company match.

- You contribute $8,000 to your 401k after the first year, then from the second year onward, you contribute the maximum annual amount of $20,500.

- The No Growth column shows what you could potentially have in your 401k after so many years of a constant $20,500-per-year contribution and no growth.

- The 8% Growth* column shows what you could potentially have in your 401k after so many years of a constant $20,500-per year contribution compounded over the next 43 years.

- The difference between the two columns emphasizes the power of growth, compounding over time. By starting early and enjoying a historically average return on 401k, at age 65, an individual could turn $869,000 of contributions into over $6.4M dollars.

Also Check: How To Access 401k From Old Job

Calculate Your Retirement Earnings And More

A 401 can be one of your best tools for creating a secure retirement. It provides you with two important advantages. First, all contributions and earnings to your 401 are tax deferred. You only pay taxes on contributions and earnings when the money is withdrawn. Second, many employers provide matching contributions to your 401 account which can range from 0% to 100% of your contributions. The combined result is a retirement savings plan you can not afford to pass up.

Also Check: What Should I Do With 401k

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employers plan. As with an IRA rollover, this maintains the accounts tax-deferred status and avoids immediate taxes.

It could be a wise move if you arent comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plans administrator.

Also Check: How Do You Find Lost 401k Accounts

Read Also: Can You Borrow Money Against Your 401k

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

It Only Takes A Few Minutes To Check Your Benefit Amount Online

In 2023, the average retiree will receive around $1,827 per month in Social Security benefits. The maximum you’ll be able to collect, though, is $4,555 per month.

Exactly where your benefit amount will land depends on several factors, including your earnings history, the length of your career, and the age you file for Social Security.

Even if you’re still years away from retirement, it’s possible to see approximately how much you can expect to receive in benefits. Here’s how.

Image source: Getty Images.

Don’t Miss: How To Transfer Your 401k To An Ira

Income And Percent Of Income To Save

Deciding what percentage of your annual income to save for retirement is one of the big decisions you need to make when planning. If youre just starting out on your retirement planning journey, saving any amount is a great way to begin. Just keep in mind that youll need to keep increasing your contributions as you grow older.

So how much is enough? Financial services giant Fidelity suggests you should be saving at least 15% of your pre-tax salary for retirement. Many financial advisors recommend a similar rate for retirement planning purposes.

But even then, the 15% rule of thumb assumes that you begin saving early. It also assumes youd be comfortable replacing 55% to 80% of your pre-retirement income. If you start later or expect youll need to replace more than those percentages, you may want to contribute a greater percentage of your income.

Create A My Social Security Account

To see all of your Social Security benefits online, you’ll first need to create a My Social Security account. Here’s what to do.

1. Go to ssa.gov on your browser and click Learn about my account next to my Social Security account.

2. Next, click Create an Account.

3. You’ll be prompted to sign in with your ID.me account or login.gov account unless you created an account before Sept. 18, 2021. Note that you’ll need to create one of those accounts if you don’t have one.

4. Once you have an account, you’ll need to agree to the terms of service to continue.

5. Next, you’ll need to verify your identity. The Social Security Administration will send a one-time security code to your email that you’ll need to enter within 10 minutes to continue to your account.

You should now have access to all of your Social Security statements and other details online.

Read Also: What Is A Good Percentage To Contribute To 401k

Develop Other Sources Of Income

Think about other ways you can secure sources of income in retirement outside of collecting Social Security and withdrawing from your 401k. This will not only prevent you from having all your retirement eggs in one basket, but it is also something to consider if your 401k balance is lower than youd like. Where can you invest and how can you optimize your portfolio for greater returns? Consider other ways you can supplement your retirement income, and speak to your financial advisor about what solutions could work for you.

Also Check: How To Move 401k To Vanguard

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Read Also: How To Cancel 401k Plan

How Much Could Your 401 Grow If You Stop Contributing

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

How Much Of Your Salary Should Go Into Your 401k

A common answer is as much as you can contribute. Instead of aiming for a numerical amount, instead consider a percentage of your salary. This way, your contributions will increase in line with your salary. Numerous financial planning studies indicate the ideal contribution percentage to save for retirement is between 15% and 20% of your gross income. You can put these funds into your 401k, Roth IRA, or other tax-advantaged retirement accounts.

If your employer offers 401k matching, consider at least contributing enough to get the full employer match. Otherwise, youre leaving part of your overall compensation on the table.

Read More:What is 401k Employer Matching & How Does It Work?

Read Also: What Is The Deadline For Setting Up A 401k Plan

Average Current Retirement Savings Balance

Unfortunately, many people are woefully under-prepared for retirement from a financial standpoint.

Here are some statistics on the median current retirement savings balances of Americans based on their age.

| Families Between |

|---|

| 70+ | 12.3% |

Workers save more for retirement as they get older and pay off other debts like student loans and a home mortgage.

At a minimum, many experts recommend saving at least 10% of your income for retirement. Dave Ramseys Baby Steps recommend saving at least 15% into retirement accounts after getting out of debt and building an emergency fund.

You can use a retirement calculator like NewRetirement to review your personal progress and project how long your nest egg will last. This tool is free but paid plans are available too.

Read our NewRetirement review to learn more about this interactive retirement planner.

How To Calculate Your Annuity Payments

Annuities provide periodic payments for an agreed-upon period of time, either now or in the future, for the annuitant or beneficiary. You can annuitize the annuity by making monthly, semiannual, or annual payments, and interest keeps accruing on the balance. On the other hand, you can calculate an annuitys payout to see if its better than a lump sum.

Why should you calculate your annuity payments? First, calculating an annuitys monthly payout may help you decide whether the annuitys payout is adequate for your investment goals. Studies have shown that retirement plan participants who see their account balances as level monthly annuities for life can better assess their retirement readiness and plan.

Because insurance companies can set their own rates and contract terms, calculating annuity payments can be tricky. Thankfully, there are some tactics you can use to calculate your annuity payments.

Recommended Reading: How Much Can An Employer Contribute To A Solo 401k

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.