Traditional Vs Roth 401

Depending on the plans your employer offers, you may have the opportunity to contribute to a traditional or a Roth 401. If both are offered, you may be able to split your contributions between the two. Although both plans offer tax benefits, your contributions and withdrawals are taxed in different ways.

With a traditional 401, the money comes out of your paycheck before taxes. That means if you contribute $100 per paycheck, the $100 comes out of your paycheck before taxes are calculated, which reduces your income tax bill for the year. However, youll be taxed on your withdrawals from the traditional 401 after you retire.

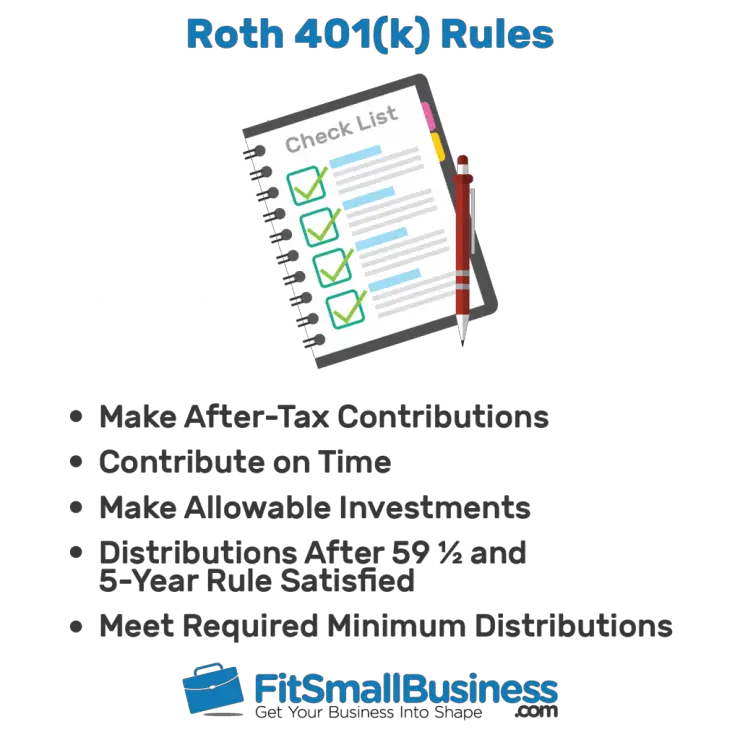

With a Roth 401, youll pay taxes on your entire paycheck, before your Roth contributions are deducted. Instead, your savings and investment earnings grow tax free, and you wont pay taxes on withdrawals made after age 59 1/2.

When deciding whether to contribute to a traditional or Roth 401, youll need to consider your age and your current tax bracket, as well as your potential tax situation when you retire. Does it make more sense to pay taxes now or later? If you expect to be in a lower tax bracket after retirement, you might prefer to pay taxes on withdrawals . If you think your tax bracket is lower now than it may be in the future, it might make sense to pay the taxes now and take tax-free distributions in retirement.

Change To Plan Establishment Deadline Means More Time For A 2020 Plan

Michelle Freiholtz, MBA

The year 2020 was definitely a year to remember. In the retirement savings industry, the year started with changes brought about by the Setting Every Community Up for Retirement Enhancement Act and the Bipartisan American Miners Act, parts of the Further Consolidated Appropriations Act, 2020 , enacted in December 2019. These acts of legislation created many changes in the industry after a long period of little change. Then March ushered in the start of the coronavirus pandemic, changing how and where employees work, or worse, preventing employees from working. Then came the Families First Coronavirus Response and the Coronavirus Aid, Relief, and Economic Security Acts, and focus shifted toward those pieces of legislation.

Its no surprise that the year 2020 saw many plan sponsors struggle to maintain their plans, and employers without a retirement plan, hold off on starting one. Now, as many employers look to close their tax year, the goal of establishing a retirement plan for 2020 may be something closer to the front of their minds. Fortunately, the SECURE Act changed the deadline for employers to adopt a plan under Internal Revenue Code Section 401.

Adding Safe Harbor Provisions For Next Year: December 1st

While not a deadline for those without a plan, weve thrown this in for good measure. If you already sponsor a 401 plan and are looking to implement a safe harbor provision for next year, this is the date you need to keep in mind. Safe harbor plans require a notice to participants before the beginning of the plan year to explain the new features for the upcoming year. The rules say that the notice must be provided within a reasonable time frame before the year starts, but that generally means 30 to 90 days ahead of time .

Keep in mind, though, that implementation of a safe harbor provision requires a plan document amendment as well as the preparation of the participant notice. In order to meet that December 1st deadline, you will want to get moving on this change before Thanksgiving to ensure ample time for the roll out.

Also Check: Should I Convert 401k To Roth Ira

What Is The Role Of The Employer In Administering 401k Plans

Under ERISA, plan fiduciaries, including the employer and any third parties who manage the plan and its assets, must act solely in the interest of the plan beneficiaries. Some of their responsibilities include:

- Managing the plan with the exclusive purpose of providing the plans retirement benefits to participants

- Ensuring that the investment menu offers a broad range of diversified investment alternatives

- Choosing and monitoring plan investment alternatives prudently

- Ensuring that the costs of plan administration and investment management are reasonable

- Filing reports, such as Form 5500 Annual Return/Report, with the federal government

These tasks should be taken seriously since fiduciaries can be held personally liable for plan losses or profits from improper use of plan assets that result from their actions.

Icipant 401 Contribution Deadlines

The end of each year brings important 401 contribution deadlines to consider. Generally, the last business day of the year is the deadline for employees who make Roth contributions and/or for those over age 50+ catch-up contributions. As most employees contribute with each payroll, this happens automatically and any changes to deferral amounts often need to occur one to two weeks ahead of a payroll to be effective. Note that Solo 401 owners can often do one-time contributions on any given day and are not typically beholden to payroll or other system restrictions.

You May Like: Can You Take From 401k To Buy A House

Under The New Rule Can An Employer Establish A Qualified Retirement Plan In 2020 For The 2019 Plan Year

No. An employer may not establish a plan in 2020 for the 2019 tax year. The new rule is effective for the 2020 tax year and subsequent tax years, meaning that an employer may first use this extended timeframe if it wishes to establish a plan in 2021 for the 2020 business year, as long as the plan is established by its 2020 tax return due date, plus extensions.

More Time To Set Up Plan But Dont Wait Too Long

Making the decision and taking action to establish a retirement plan should not be left until the deadline is just around the corner. After all, the new plan establishment deadline did not extend employer contribution deposit deadlines plan sponsors must still make their deposits and claim any deductions by their tax return due date, plus applicable extensions, to avoid potential operational failures. As such, its worth noting that the deadline to sign a plan document is now the same deadline to fund the plans employer contributions.

As the deadline approaches, recordkeepers, document providers, and other service providers may see an influx of potential clients requesting to establish a plan. And, though business processes are becoming more efficient, the plan establishment process is not instantaneous. Employers who push too close to the deadline may find themselves so late that they are only on time for the next plan year.

Read Also: What Is A 401k Profit Sharing Plan

Safe Harbor 401k Deadline Quickly Approaching

The IRS deadline to establish a new 2022 Safe Harbor 401k plan is October 1meaning there is still time for small business owners to establish a new plan and take advantage of maximum contribution limits.

Many small businesses prefer the simplicity of the Safe Harbor 401k plan design versus a traditional 401k due to a variety of benefits and savings for business owners seeking to lower taxes, save for retirement, and help attract and retain top talent.

Of course, the key benefit of the Safe Harbor 401k is that it automatically satisfies IRS non-discrimination testing requirements and enables the option for any employee, including highly compensated employees, to maximize their 401k contributions up to the maximum 2022 limits of $20,500 .

Considering all 401k plans are subject to government tests, the Safe Harbor plan can make 401k management easier and more efficient.

401k plans are a lot less expensive than many businesses thinkfor example, a plan of 10 employees will pay less than $100 per month, says Stuart Robertson, CEO of Seattle-based . Any business with fewer than 100 employees that opens their first 401k plan can receive a tax credit that is designed to cover half of these costsup to $15,000 for the first three years.

Starting today, Sharebuilder 401k is offering incentives for businesses who sign up for its Safe Harbor or Traditional 401k plansto the tune of 50% off set up costs between Aug. 19-Sept. 12, or 25% off plans set up between Sept. 13-25.

How Much Does It Cost To Set Up A 401k For Small Businesses

The cost of setting up a 401k generally depends on business size, plan design and the extent to which employers make contributions. Employers must also consider the administrative fees of third-party fiduciaries who help manage the plans investments. Applying for certain tax credits, however, can help offset some of these costs.

Don’t Miss: Where To Open A 401k Account

Can I Lose Money In A 401 Plan

401 plans are designed to be long-term investment plans. Therefore, over long time horizons, the likelihood of you losing money, especially a significant amount of money, in a 401 plan is considered to be low. That said, due to typical market fluctuations, it is common to see the value of your account drop from time to time. Furthermore, the performance of a 401 will be dictated by the risk level and type of securities one invests in. A well-diversified portfolio following a passive indexing strategy is generally recommended.

Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

You May Like: Which Is Better A Roth Ira Or A 401k

Early November: Plan Ahead For Required December 1 Notices

To meet the upcoming December 1 deadlines for employee notices, its wise to take the following proactive actions:

-

If you have an existing safe harbor plan: If youd like to change the type of safe harbor , this must be decided prior to December 1, so notices can be distributed by then.

-

If you have an existing 401 plan thats not safe harbor: To amend your IRS plan documents to enact a safe harbor match design 401 plan for the following calendar year, you must let your provider know prior to December 1.

Other required upcoming notices include qualified default investment alternative and automatic contribution arrangement notices. For administrative ease, a combined notice may be provided.

How Much Should An Employer Contribute To The Plan

The amount you as an employer decide to contribute is entirely up to you. As you make this decision, consider the tax savings you can receive for making employer contributions. Employer matches are tax-deductible on federal corporate income tax returns, and some administrative fees associated with managing a 401 plan are tax-deductible as well.

You can match as much as you want as long as it stays within the IRS limitations, which combine both employer and employee contributions. According to the IRS, this combined total is the lesser of 100 percent of an employee’s compensation or $61,000 for 2022, not including “catch-up” elective deferrals of $6,500 for employees age 50 or older.

Also consider factors such as the positive impact a matching contribution can have on employee morale and worker retention strategies. Given the steep costs of hiring and training new employees, an employer match offers the opportunity to truly invest in your workforce. These considerations may help guide your decisions about how much to contribute to the 401 plan.

Don’t Miss: Can I Cash Out My 401k After Leaving My Employer

Deadline Approaching To Adopt A Safe Harbor 401 Plan For 2021

Have you been talking with prospective clients about adopting a new 401 plan? Even in todays environment, many businesses are thriving and want to secure deductions for the 2021 Tax Year. If so, the deadline for adopting a safe harbor 401 plan for 2021 is quickly approaching, so now would be a great time to schedule a follow-up conversation!

Safe harbor 401 plans are attractive for many employers because they provide relief from certain plan testing requirements. Specifically, a safe harbor plan is generally exempt from ADP/ACP testing enabling the plans highly compensated employees to maximize elective deferrals, i.e., 401 deferrals/Roth contributions, without concern over the non-highly compensated employees level of participation. Safe harbor plans may also be exempt from the top-heavy requirements if certain conditions are met.

What is the deadline for adopting a safe harbor 401 plan?

In general, the deadline for adopting a new safe harbor 401 plan is October 1, 2021. There are, however, certain notice requirements that must be satisfied, and eligible employees must be provided a reasonable period to make their deferral elections. In a new plan, the rule is that all eligible employees must have at least three months to make elective deferrals under the plan, so planning is key! Remember, most investment platforms take 30-45 days to be ready to accept contributions.

Are there limits on the amounts that can be deferred?

What are the contribution requirements?

How Do Employers Choose The Best Mutual Funds To Offer Employees

Managing investments is sometimes beyond the expertise of employers. Thats why many of them outsource the process of selecting, diversifying and monitoring plan investments to an investment advisor. Professional assistance helps ensure that the investment options are in the best interest of the plan and its participants.

This article is intended to be used as a starting point in analyzing 401k and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. ADP, Inc. and its affiliates do not offer investment, tax or legal advice to individuals. Nothing contained in this communication is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

ADPRS-20220422-3172

Also Check: How To Rollover 401k From Empower To Fidelity

What Is A 401 Plan

A 401 plan is a retirement savings account offered through your employer. Once youve signed up for the plan , you can contribute a portion of every paycheck into a 401 account and select specific investments from an approved list. In some cases, your employer may match your 401 contributions, up to a certain percentage of your paycheck.

Solo 401k Contribution Calculator

Now is the time to take a close look at what a Solo 401k can do for your future and your retirement. You start paying much less in taxes today while growing those savings into a wealthy retirement account for your golden years.

Use this Solo 401k Contribution Comparison calculator to estimate the potential contribution that can be made to your Solo 401k plan by comparing it to Profit Sharing, SIMPLE, or SEP plans.

Setup Your Solo 401k Today

Others imitate, but as the #1 Solo 401k provider we innovate. You can be a freelancer, independent contractor, or small business owner. Your business can be structured as a sole proprietorship or a formally structured LLC, C Corp, or S Corp. All of these meet the IRS qualifications for a Solo 401k as long as there are no outside full-time employees in any business owned by you and/or your spouse.

Read Also: What Is The Tax Rate On 401k After 65

Requirements For A Safe Harbor 401

The main requirement for a traditional Safe Harbor 401 is that the employer must make contributions, and those contributions must vest immediately. Contributions can take three different forms, the first two of which are matching, which means employees must defer funds to their accounts in order to receive contributions. The third option requires your company to make a contribution, even if employees dont defer any of their income into their plan.

Here are examples of the different contribution formulas:

1. Basic matching: The company matches 100% of all employee 401 contributions, up to 3% of their compensation, plus a 50% match of the next 2% of their compensation2. Enhanced matching: The company matches at least 100% of all employee 401 contributions, up to 4% of their compensation 3. Non-elective contribution: The company contributes at least 3% of each employees compensation, regardless of whether employees make contributions

This is what the matching and nonelective contributions would look like for an employee under the three different Safe Harbor formulas. The employee in this case earned $150,000 of eligible compensation during the year.

Note that these contributions are only the minimums. For example, a more generous employer can match up to 6% of employees pay, and it could still qualify as Safe Harbor.

Solo 401k Dates To Remember

Deadline to Establish Solo 401k plan

As per IRS Publication 560, your Solo 401k must be established by December 31st of the given year in order to make contributions to the plan.

The plan doesnt necessarily have to be funded by the date, but the documents must be executed by December 31st for the plan to be in existence.

Lets look at an example: Jamie Fraser has a single-member LLC and wants to open a Solo 401k in order to make tax deductible contributions to lower the amount of taxes he pays, and to save for his future. Jamie established his Solo 401k and signed his plan documents by December 31st. This gives him the freedom and flexibility to wait until he files his taxes for that year to open his 401k trust bank and/or brokerage account and to make his contributions

Contribution Deadline: Sole Proprietorship

If your sponsoring business is a Sole Proprietorship, you have until April 15th to make your annual Solo 401k contribution , or October 15th if you submit an extension to file your tax return.

The amount so use when calculating your annual contribution for a sole proprietorship is line 31 of Schedule C.

Contribution Deadline: Single-member LLC

If your single member LLC is taxed as a corporation, you have until March 15th to make your annual Solo 401k contribution , or September 15th if you submit an extension to file your tax return. The amount so use when calculating your annual contribution for a single-member LLC taxed as an S-corp is your W-2 income.

You May Like: How To Switch 401k To Ira