Can My Employer Match My Designated Roth Contributions Must My Employer Allocate The Matching Contributions To A Designated Roth Account

Yes, your employer can make matching contributions on your designated Roth contributions. However, your employer can only allocate your designated Roth contributions to your designated Roth account. Your employer must allocate any contributions to match designated Roth contributions into a pre-tax account, just like matching contributions on traditional, pre-tax elective contributions.

You May Like: Can You Rollover A 401k To An Annuity

Example Of How A Reduced Limit Is Calculated

Below is an example of how the reduced limit is calculated for someone who is filing as single, head of household, or .

Please note that the divisor of $15,000 is set by the Internal Revenue Service , depending on your tax filing status. If your return is filed as or as a widow/widower, then you will use $10,000 as the divisor.

| Example Scenario 2021 |

|---|

Using the example information above, the calculated reduced limit would be $4,800 for this individual.

The 2021 contribution deadline for Roth IRAs is April 15, 2022.

Backdoor Roth Ira Vs Mega Backdoor Roth Ira

The backdoor Roth IRA allows people with a higher income to make Roth contributions by making a traditional IRA contribution and then converting it to a Roth IRA. You pay the taxes on that money straight away. Your investments then grow tax-free and you can make tax-free withdrawals later. Its completely legal and very simple! We discuss the steps to create a Backdoor Roth IRA here.

A mega-backdoor Roth IRA is a way for people with large amounts of excess funds that they would like to put away for retirement in a Roth IRA account. As discussed before, the yearly maximum contribution to a Roth IRA is $6,000 for people under age 50. There are also the income limits discussed before to consider. And, as we know, there is also a limit to the amount of 401 money people can defer .

So what happens when someone wants to put more money aside and avoid potential capital gains taxes when they withdraw that money? Enter Mega Backdoor Roth IRA.

You May Like: Who Pays Taxes On 401k In Divorce

Calculate The Compound Annual Growth Rate In Excel

You can calculate the growth rate from the beginning investment value to the ending investment value where the investment value will be augmenting over the given period of time with the CAGR.

In mathematical terms, there is a basic formula to calculate the Compound Annual Growth Rate.

The formula is:

=^-1

We can easily apply this formula to find the Compound Annual Growth Rate for our dataset shown below.

The steps to calculate the Compound Annual Growth Rate in Excel are discussed below.

Steps:

- Pick any cell from your dataset to store the CAGR.

- In that cell, write the following formula,

=^)-1

| Optional | A number to guess which is close to the result of XIRR. |

Before applying the XIRR function, you have to declare the Start Value and the End Value in other cells so that you can use them later inside the formula. And that is exactly what we have done with our dataset shown below.

According to our dataset that consists of Date and Sales Value, we stored the first value, $1,015.00 from the Sales Value column in Cell F5 and the last value, $1,990.00 from the Sales Value column in Cell F6. Remember to store the End Value as a negative value. meaning, with a minus sign before it.

Similarly, we stored the corresponding first date, 1-30-2001, from the Date column in Cell G5 and the last date, 1-30-2011 from the Date column in Cell G6.

Steps to calculate the Compound Annual Growth Rate with the XIRR function are given below.

Steps:

=XIRR

You Are Relatively Young And Earn A Lower Income Now But Expect To Earn A Much Higher Income And Expect To Be In A Higher Tax Bracket In The Future

If you expect your income to increase dramatically over your career, you may find contributing to the Roth feature today to be very advantageous, as you are in a lower tax bracket now than you will be in the future. Also, if you are many years from retirement, you could choose a Roth 401k as your best option as you expect your retirement plan to grow tax-free to a significant nest egg that can be withdrawn tax-free, more than compensating for the taxes paid when young and lower paid.

Read Also: What To Do With 401k When You Leave A Company

How To Calculate A 401 Annual Return

When you invest a lump sum of money, calculating the average annual return is simple. But since you make regular contributions to your 401, you can’t just take the ending balance and divide it by the starting balance.

If you’re calculating your return for a one-year period:

- Take the ending balance and subtract any contributions you made over the past year.

- Divide by the starting balance from one year ago.

- Subtract 1 and multiply the result by 100. That will tell you the percentage total return.

If you’ve used a period other than a year, there’s more math involved. Take the number you got from dividing the adjusted ending balance by the starting balance and then use an exponential calculation as follows:

- For a two-year period, you’ll need to take the square root. On a calculator, use the power key to raise the number to the 1/2 power. For a three-year period, you’d raise it to the 1/3 power, and so on.

- Then take the final answer, subtract 1, and multiply the result by 100. What’s left is the average annual return.

The longer the period you’re measuring and the more contributions you’ve made, the less accurate this simple calculation will be. A more appropriate calculation is the time-weighted return, which measures actual investment portfolio performance regardless of deposits or withdrawals.

Balancing Risk And Returns

Now, its time to return to that 5% to 8% range we quoted up top. Its an average rate of return, based on the common moderately aggressive allocation among investors participating in 401 plans that consists of 60% equities and 40% debt/cash. A 60/40 portfolio allocation is designed to achieve long-term growth through stock holdings while mitigating volatility with bond and cash positions.

On the risk/reward spectrum, the 60/40 portfolio is about in the middle. For instance, if you invest in a more aggressive portfoliosay 70% equities, 25% debt, and only 5% cash you may expect higher, double-digit returns over time. However, the volatility within your account may also be much greater.

Conversely, if you went more conservative75% debt/fixed-income instruments, 15% equities, 10% cashyour portfolio would have a pretty smooth ride, but returns of only 2% to 3% .

Typically, an individual with a long time horizon takes on more risk within a portfolio than one who is near retirement. And its common, and prudent, for investors to gradually shift the assets within the portfolio as they get closer to retirement.

As a one-stop-shopping way to accomplish this metamorphosis, target-date funds have become a popular choice among 401 plan participants. These mutual funds allow investors to select a date near their projected retirement year, such as 2025 or 2050.

Also Check: What Happens To 401k Money When You Quit

You May Like: What Happens To Your 401k When You Die

What Is A Good 401 Rate Of Return

The average 401 rate of return ranges from 5% to 8% per year for a portfolio that’s 60% invested in stocks and 40% invested in bonds. Of course, this is just an average that financial planners suggest using to estimate returns.

However, if you invest a higher percentage in stocks — as is common for many investors who can afford more risk — you’ll typically earn higher average returns. Investing conservatively by allocating more to bonds reduces your risk of losing money, but also produces lower returns.

Keep in mind, though, that your returns for any given year shouldn’t concern you too much. Short-term fluctuations are normal. Long-term results are what matter for any investment.

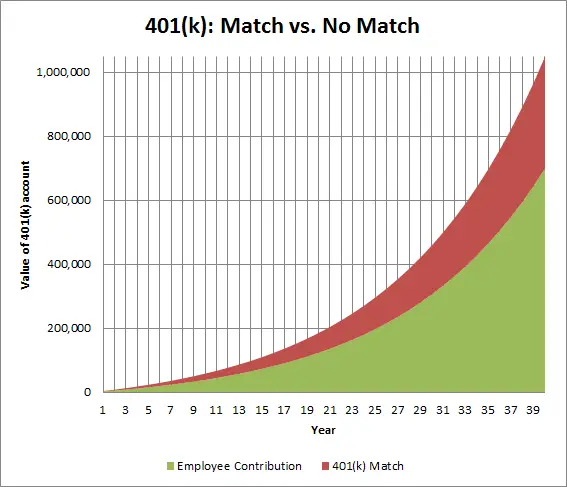

There’s also a surefire way to boost the returns on the money you contribute, which is to take full advantage of your employer’s 401 match. If your company matches 50% of your contribution, that’s a 50% return on your investment.

Details Of Roth Ira Contributions

The Roth IRA has contribution limits, which are $6,000 for 2022 and $6,500 for 2023. If youâre age 50 or older, you can contribute an additional $1,000 as a catch-up contribution. Contributions, not earnings, can be withdrawn tax-free at any time.

Itâs worth noting that an investor can have both a Roth and a traditional IRA and contribute to both, but the contribution limits apply across all IRAs. For example, suppose an investor contributes $4,000 to a Roth IRA. In that case, that same investor could contribute $2,000 to their traditional IRA in that same year . If that taxpayer is age 50 or older, they could contribute an additional $1,000.

Don’t Miss: How To Transfer 401k From Prudential To Fidelity

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Your 401 Rate Of Return Doesn’t Depend Only On The Stock Market Your Investment Choices Have A Huge Impact On What You Earn

A 401 plan can be invaluable in saving for retirement. But achieving your retirement goals isn’t just a matter of how much you save in your 401. Your returns, or how much your investments earn each year, play a major role, too. Periodically reviewing your annual returns is a must for your 401 plan, as well as your entire investment portfolio.

With your 401 returns, results will vary based on a number of factors. Some of these, like how the stock market performs, are out of your hands. But the decisions you make about how you invest have a big impact as well.

Recommended Reading: How To Roll Your 401k Into A Roth Ira

Gave Up Weekly Restaurant Visits

Adds $200 a month in contributions, but creates

in additional growth

Youve got the numbers. Now its time to connect with a SmartVestor Pro. These pros teach and guide but wont intimidateso you can feel confident about investing for retirement, no matter whats going on in the market. You got this!

Youve got the numbers. Now its time to connect with a SmartVestor Pro. These pros teach and guide but wont intimidateso you can feel confident about investing for retirement, no matter whats going on in the market. You got this!

How Much Can I Contribute Into A Solo 401k Sep Ira Defined Benefit Plan Or Simple Ira

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Enter your name, age and income and then click Calculate.

The result will show a comparison of how much could be contributed into a Solo 401k, SEP IRA, Defined Benefit Plan or SIMPLE IRA based on your income and age.

Note: If you are taxed as a sole proprietorship use your NET income when using the calculator. If you are incorporated, then only use your W-2 wages when using the calculator. For example, S corporation K-1 distributions are not included when making the contribution limit calculation.

Read Also: Where To Put My 401k Rollover

Also Check: Can I Withdraw Money From My 401k To Pay Taxes

Maximize Employer 401 Match Calculator

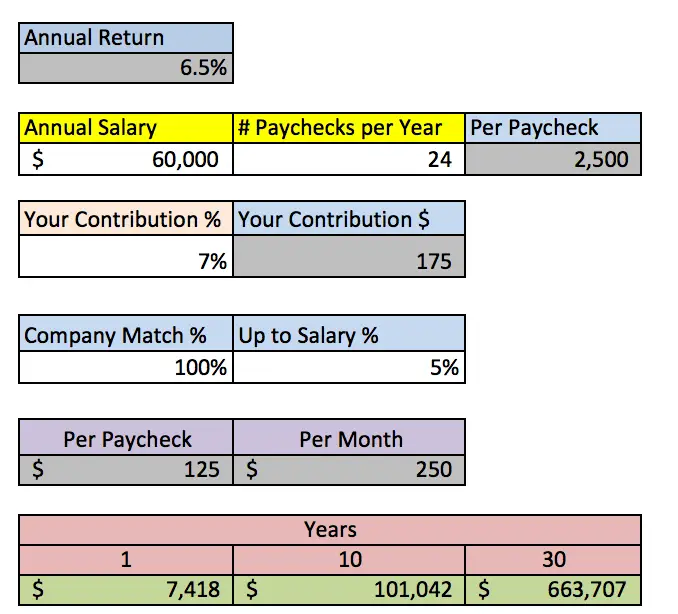

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

How To Use Credit Karmas 401 Calculator

If youre trying to save for retirement, having a 401 may be an important part of your retirement savings plan. A 401 is an employer-sponsored retirement plan that allows you to invest a portion of your pre-tax earnings into long-term investments like mutual funds.

Our 401 calculator can help you determine how much money you may be able to save by the time you retire. But keep in mind that it can only give you an estimate based on the information you provide. Your actual balances at retirement may be affected by certain factors not included in the calculator, such as a change in your job, income, retirement age or adjustments to your 401 plan.

To get started with the 401 calculator, youll need to enter the following information:

This is your current annual income, before taxes.

You May Like: How Do You Transfer A 401k

Do I Pay Taxes On 401 Withdrawals

401 plans offer several tax benefits that can help you to save for retirement. One of the primary tax benefits is that your 401 balance can grow on a tax-deferred basis. This special tax treatment means that you wont pay taxes on your account balance until you withdraw income from the plan, which applies to employee and employer contributions. However, you can not withdraw from the account until 59 1/2 without paying an early withdrawal penalty. The tax benefits of 401 plans can help you to save more money for retirement.

When Must I Be Able To Elect To Make Designated Roth Contributions

You must have an effective opportunity to make an election to make designated Roth contributions at least once during each plan year. The plan must state the rules governing the frequency of the elections. These rules must apply in the same manner to both pre-tax elective contributions and designated Roth contributions. You must make a valid designated Roth election, under your plans rules, before you can place any money in a designated Roth account.

Also Check: How Much Can You Contribute To 401k

You May Like: Can You Transfer Money From An Ira To A 401k

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

See How Much You Can Save By Starting Now

Contributing to a 401 can generate a large immediate rate of return on your investment. Let’s see how investing 10% of a $1,250 biweekly paycheck could affect your assets.

In other words, contributing 10% of your salary to a 401 would generate a whopping 140% immediate rate of return.

You can see the effect of contributing to a pre-tax account such as a 401 in the pie charts below.

Recommended Reading: What To Do With 401k After Quitting

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

Recommended Reading: How Do I Sign Up For 401k

How To Calculate Annual Growth Rate In Excel

To calculate annual growth over multiple periods, Compound Average Growth Rate and Annual Average Growth Rate are the two most common and efficient methods in Excel. In this article, you will learn how to calculate the Compound and Average Annual Growth Rate in Excel.

Calculating Annual Growth Rate.xlsx

You May Like: How To Cash Out 401k From Fidelity