How To Check Your 401 Balance

If you already have a 401 and want to check the balance, itâs pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America âGet Bank of America Corp Report, T. Rowe Price âGet T. Rowe Price Group Report, Vanguard, Charles Schwab âGet Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Recommended Reading: What Is A 401k Vs Roth Ira

How To Enroll In Walmart 401k

To enroll in Walmart 401, do any of the following:

- Login to the employee portal, then go to WalmartOne.com/Enroll

- Go to the WIRE and choose I want to contribute to the Associate Stock Purchase Plan or Walmart 401

- Visit BenefitsOnLine benefits.ml.com

- Contact Merrill Lynch at 968-4015

Remember that you can adjust your monthly contributions anytime. You can increase your contributions as your income grows, so you can save more for your retirement.

Serving Up A Menu Of New Services

The first hint that Walmart intended to go beyond its own ecosystem was when it announced in July that it would sell to other retailers its e-commerce technology that allows shoppers to buy items online and pick them up at the store. Walmart started integrating its Marketplace platform with the commerce platform of Adobe, allowing the software giants merchants to use the mega-retailers cloud-based capabilities to provide pickup and delivery to their own customers.

Its not unlike Amazon selling its just walk out payment technology to other retailers and supermarkets. Theres an opportunity to make more money by distributing its technological prowess to other businesses instead of keeping it all in-house.

On last weeks earnings call, Walmart President and CEO Doug McMillan said, These are a few examples of how were using our assets to scale new businesses within the company and build new streams of revenue and profit.

Read Also: How To Collect 401k After Quitting

Don’t Miss: Do I Have To Rollover My 401k When I Retire

What Is A Dcmp

DCMPs allow eligible employees to defer income beyond a 401 or similar retirement plan. This is an excellent way to delay salary & Management Incentive Plan into future years. This is great for retirement, college funding or other expenses. Deferring compensation can help reduce your tax liability as well.

DCMPs get complicated fast. Lets discuss three important factors to consider when making your elections:

Who Can You Name As Beneficiary

You can name anyone as a beneficiary including minors under the age of 18. If youâre nominating a child, you might consider naming an adult custodian to manage the account until the child reaches adulthood. Usually, thereâs a space on the TOD paperwork to specify a custodian. The TOD beneficiary would then be listed as âAnna Perkins, as custodian for Tommy Thomas under the Florida Uniform Transfers to Minors Act,â for example.

You can also name multiple beneficiaries to inherit your stock in equal shares, for example, 50/50 or 25/25/25/25. You can only leave the stock in unequal shares, such as 70/30, if the transfer agent allows it. Walmartâs transfer agent is Computershare, so youâll need to ask whatâs permitted when arranging the change of beneficiary paperwork. The dedicated Walmart stock phone number is 1-800-438-6278.

Something else to consider is whether you should name an alternate beneficiary to inherit the stock if the primary beneficiary dies before you do. Again, you can name an alternate only if the transfer agent allows it, so youâll need to check the rules with Computershare.

Also Check: Who Does Adp Use For 401k

How Long Does It Take To Be Fully Vested For Retirement From Walmart

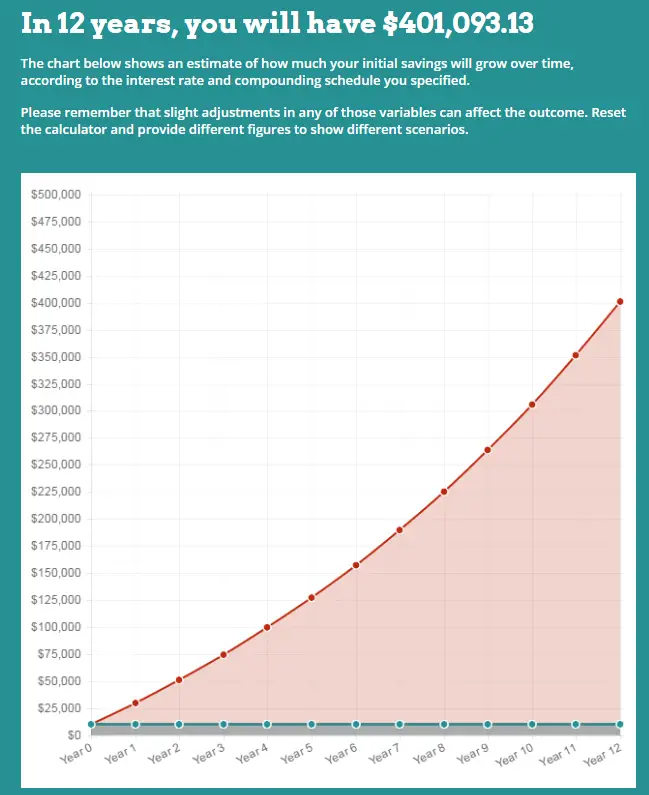

To determine how much you should be contributing, you can use the following chart as a reference.

If you put more money into your bank account, you could potentially retire sooner, but you would be left with very little money.

If a person is given a retirement package based on years of service, the person would need to complete that time period by age 55 to be paid for remaining service.

How Do I Get My W2 If I No Longer Work There

If you havent received yours by mid-February, heres what you should do:

Donât Miss: When Can You Rollover A 401k Into An Ira

Don’t Miss: How Do You Find An Old 401k

Associates Who Are Eligible To Participate In The Plan

The Plan is open to all associates of WalMart Stores Inc. and any participating subsidiary except:

- Nonresident aliens without income from the U.S. leased employees independent contractors and consultants

- Anybody not considered an employee by Walmart or any of its subsidiaries.

- Associates are covered by a collective bargaining arrangement, except where it does not include participation in the Plan.

- Associates represented by a representative of collective bargaining after Walmart has reached an agreement in good faith with the representative regarding the issue of benefits.

All participating subsidiaries are called Walmart for this Summary Plan description.

What Happens To Your Old 401 If You Quit

If you leave Walmart, you have a few different options for what to do with your 401 plan. First, you can likely leave the money where it is and let your investments continue to grow in Walmarts 401 plan. You cant make any additional contributions, nor will Walmart, but the money thats in there will grow.

You can also choose to roll your 401 balance over into either a different 401 plan or an IRA. There are a few benefits to choosing one of these options. First, rolling your money over into a different account allows you to keep all of your retirement savings in one place rather than keeping track of a 401 plan at each of your former employers.

And the benefit of rolling the money into an IRA is that you have more control over the investments. Instead of being able to choose from only a select list provided by an employer, you can choose to invest in anything.

Another option when you leave your job is to cash out your 401 and get a check for the full balance. While this is certainly an option, its not an advisable one. In addition to paying income taxes on the distribution, youll also pay a 10% penalty. Additionally, that money will no longer grow with compound interest, and youll have less money to live on during retirement.

Recommended Reading: How To Get A Loan From My 401k

Does Walmart Offer Any Extra Insurance Plans For Retirees

Yes. Walmart offers a number of insurance policies to their employees that can cover retirees.

Walmarts retirement help page stipulates a number of extra insurance coverage plans that employees can take advantage of.

These insurance plans are able to cover an employee even well after they have retired from the Walmart company.

These insurance policies include: Life insurance, and accidental death and dismemberment policies covered by prudential, and accident and critical illness coverage from All-state.

How Much Retirement Savings Should You Have

Theres no magic savings number thatll guarantee you financial security in retirement. A good rule of thumb is to stash away enough cash so that by the time you leave the workforce for good, you have 10 to 12 times your ending salary on hand in savings.

But remember, thats the total you should be aiming for at the time of your retirement. And so if youre 30 years old and are sitting on a retirement plan balance of $33,472, or something in that vicinity, you may not be in such poor shape.

Don’t Miss: How Is My 401k Doing

Pro: Enough Funds To Build Custom Portfolios

Retirement single-fund solutions are a great choice. The downside to many target-date funds is overexposure to large U.S. stocks.

Many funds offered to U.S. investors do the same thing as asset managers in other nations: they overweight their portfolios to stocks based abroad.

A portfolio that consists of 60% U.S. stocks and 40% international stocks is closer to the current market capitalization for all stores.

Building your portfolio will make you more inclined towards small caps if you believe that large caps will outperform small caps over long periods.

If you are looking for more exposure to international stocks and small caps, the Walmart 401k can help you build one. Compare the below allocation with the 2050 MyRetirement Fund.

These two portfolios are very different.

Leveraging Its Massive Footprint

Walmart has invested billions of dollars in its supply chain in a bid to support its stores and distribution centers and earlier this year, the retailer announced it was stepping up those capital expenditures with a special focus on the supply chain.

The pandemic has also benefited Walmart because it was allowed to remain open as a so-called essential business even as many competitors were forced to close. The company intends to use the advantage it gained at the expense of rivals to widen its gap with them.

It needs to because Amazon is quickly narrowing Walmarts lead as the largest U.S. retailer. The e-commerce leader is expected to surpass Walmart as the biggest by 2025 even though most of Amazons sales come from third-party retailers.

Walmart executives revealed to advertisers that it is losing market share in groceries, the growth engine of the business, and noted that privately owned Instacart is on nearly equal footing in grocery delivery.

Also Check: Do Employers Match Roth 401k

Don’t Miss: How To Use 401k To Buy Stock

How Should You Invest

When you sign up for Walmarts 401 plan, youll have a few decisions to make. First, youll have to decide whether to contribute to a traditional or Roth 401.

When you contribute to a traditional 401, you contribute with pre-tax dollars. As a result, you reduce your taxable income and therefore, your tax burden for the current year. The money grows tax-deferred in your 401, and youll pay income taxes on the money you withdraw during retirement.

In the case of a Roth 401, on the other hand, you contribute with after-tax dollars. The downside is that you dont reduce your taxable income with your contributions. However, the money grows tax-free in your account, and you can withdraw without paying taxes during retirement.

When it comes to choosing between traditional or Roth contributions, consider your income today and what you expect it to be in the future. In general, a traditional 401 is better for people who expect their tax rate to be lower during retirement, while a Roth 401 is better for those who expect their tax rate to be higher during retirement.

Unfortunately, Walmart doesnt currently offer Roth conversions. So if you change your mind later, you may have to utilize a Roth IRA later to convert your money.

The other decision youll have to make when you sign up is what you want to invest in. As we mentioned, you have two options: You can either invest in the offered target-date funds or choose your own funds.

Contribution Scheme For Retirement Funds

To access the Walmart 401 retirement plan, an employee should have an OneWalmart account. The retirement funds of employees are deposited in this account. A fixed amount is deducted from an employees paycheck every month. Additionally, the employer also contributes the amount equal to the employees contribution up to 6% of their tax-free income.

Walmart allows up to 50% contribution of employees salary in the 401 retirement scheme. More the contribution, more the savings for the future. But access contributions should not disturb your monthly budget.

Apart from employees contribution Walmart also contributes the same amount up to 6% of employees income. It means that if you contribute $2000 per month to your 401 retirement plan every month which is 6% of your total monthly income. Then your employers will also contribute the same amount to your funds. But if your contribution is more than 6% then the employer will only contribute 6% of your income.

Walmart employees can also invent these funds in various funds, bonds, or real estate, etc. With their contribution and Walmarts contribution employees could earn a good fund for retirement. Presently Walmarts contribution is 6% of the employees pay. But it can increase or decrease or stop contributing at any time.

Read Also: How Do You Transfer Your 401k

How Is The Walmart 401k Retirement Plan Funded

Employees can opt to have a portion of their monthly wages transferred directly to the 401.

Walmart will add $ to every dollar an employee contributes to the plan. This could amount to up to 6 percent of eligible pay.

The more money left in the plan, you can earn towards retirement.

Employees can change the amount they contribute to their 401 and withdraw funds whenever they want.

Your Walmart 401 Plan Accounts

Walmart 401 Plan has several accounts. You can use these accounts:

- Your 401k Account: This account contains your contributions to the Plan, including your catch-up contributions. It is adjusted for earnings and losses.

- Company match Accou This account holds Walmarts matching contributions, adjusted for earnings and losses.

- Rollover Account for 401. This account holds contributions you have rolled over from an eligible retirement plan to this Plan. These contributions are adjusted for earnings and losses.

- Company-Funded 401 Account: This account contains the discretionary company contributions to the 401 portion for Plan years ending on or before January 31, 2011. These contributions are adjusted for earnings and losses.

- Company-Funded Profit Sharing Account This account holds the discretionary company contributions to the profit-sharing portion of the Plan for Plan years ending on or before January 31, 2011. These contributions are adjusted for earnings and losses.

Below is a summary of some differences between the accounts. This summary will discuss these differences in greater detail.

You May Like: How To Convert 401k To Silver

How Should I Invest

Signing up for a Wal-Mart 401 plan requires you to make some decisions. First, you need to decide whether to contribute to a conventional or a loss 401 .

When donating to a conventional 401 , donate in the amount before tax. As a result, this years taxable income, or tax burden, will be reduced. The money will be deferred at 401 and you will have to pay income tax on the money you withdraw when you retire.

On the other hand, in the case of a Roth 401 , we will donate the amount after tax. The downside is that donations do not reduce taxable income. However, the money in your account is tax exempt and can be withdrawn without paying taxes at retirement.

Consider your current and future income when deciding whether to make a traditional donation or a loss donation. In general, the traditional 401 is suitable for those who expect a lower tax rate at retirement, while the Roth 401 is suitable for those who expect a higher tax rate at retirement.

Unfortunately, Walmart does not currently offer Loss conversion.. Therefore, if you change your mind later, you will need to use RothIRA later to convert your money.

Other decisions you need to make when signing up are those you want to invest in. As mentioned earlier, you have two options. You can invest in the offered target date fund or choose your own fund.

The good news is that no matter which option you choose, you wont be trapped forever. You can change your mind at any time.

What Other Perks Do Walmart Employees Get On Retirement

The 401 is a very fascinating retirement plan for Walmart employees. But apart from a retirement plan, there are a few more perks that employees receive after taking retirement-

Medical care

Walmart also covers employees medical requirements on retirement. Medicare is provided to retired employees for aiding in their health at old age. Medicare covers medicines, doctors fees, and various other benefits.

Insurance

Apart from the retirement funds, Walmart also has several insurance plans for its employees. These plans cover employees benefits even after their retirement.

These insurance include life insurance, serious illness insurance, accidental death, and dismemberment insurance. These insurance and policies are for the employees of every Walmart store in the USA.

Don’t Miss: Can You Pull From Your 401k To Buy A House

Employee Discounts At Walmart

Walmarts employee discount program offers a variety of different options. For associates, they can receive an associate discount card which offers a 10% discount on all fresh fruits, vegetables, and regularly priced merchandise available at any Walmart store.

Walmarts Associate Discount Center also provides discounts on travel, cell phone providers, entertainment, and other perks outside Walmart stores.

Walmart Will Never Be Costco

What retailer wouldnt want to be Costco ? Costco has a strong customer following and loyal employees, and the retailer makes money without even selling a single product. It does this by operating in eight countries with locations that are far from aesthetically pleasing. Walmart , on the other hand, has a multi-billion dollar plan to improve its American stores and is venturing into Costcos territory, paying its staff higher wages and improving the customer experience to regain its customers. But Walmart, or its Costco-like warehouse Sams Club for that matter, will never be Costco.

You May Like: How Do I Cash Out My 401k Early

Don’t Miss: How To Switch 401k To Ira