What May Be The Pros Of Rolling The Money Over To The New Plan

- The most obvious is that if your balance doesnt meet the old plans minimum requirement to stay, typically $5000, you cant leave it in the old plan, so this is the only way to have that money benefit from the advantages of a 401

- You dont have to be concerned that youll lose track of the money if you leave it in the old plan, and youll gain the simplicity of tracking one less account

- Your new plans investment options may be better than those available to you in your old employers plan or through an IRA for example, it may give you access to unique investments such as institutional-class shares and/or funds closed to new investors

- Your new plans fees may be lower than those in your new employers plan

- Your new plan may offer a free or low-fee advisory service that can help you make more informed investment decisions

- If youre 55 or older, and your new plan allows it, if you leave employment before turning 59½, you may be able to start withdrawing money under the so-called Rule of 55

- Money in a the new 401, just as in the old one, has better protection against lawsuits than money in non-retirement plans or IRAs

- If the new plan allows it, youll have access to 401 loans, where you borrow money from your account and when you pay it back, the interest goes into the account

What To Do With Your 401 When You Leave A Job

You’ve landed your dream job, or you’ve been laid off, and you’re ready to say goodbye to your current employer. But before you go, you have some decisions to make about your 401.

While there may be some guidance from human resources, is generally up to you to decide what you should do with your retirement savings when you change jobs. So, what happens to your 401k plan when you leave a job?

The Available Options For Your 401

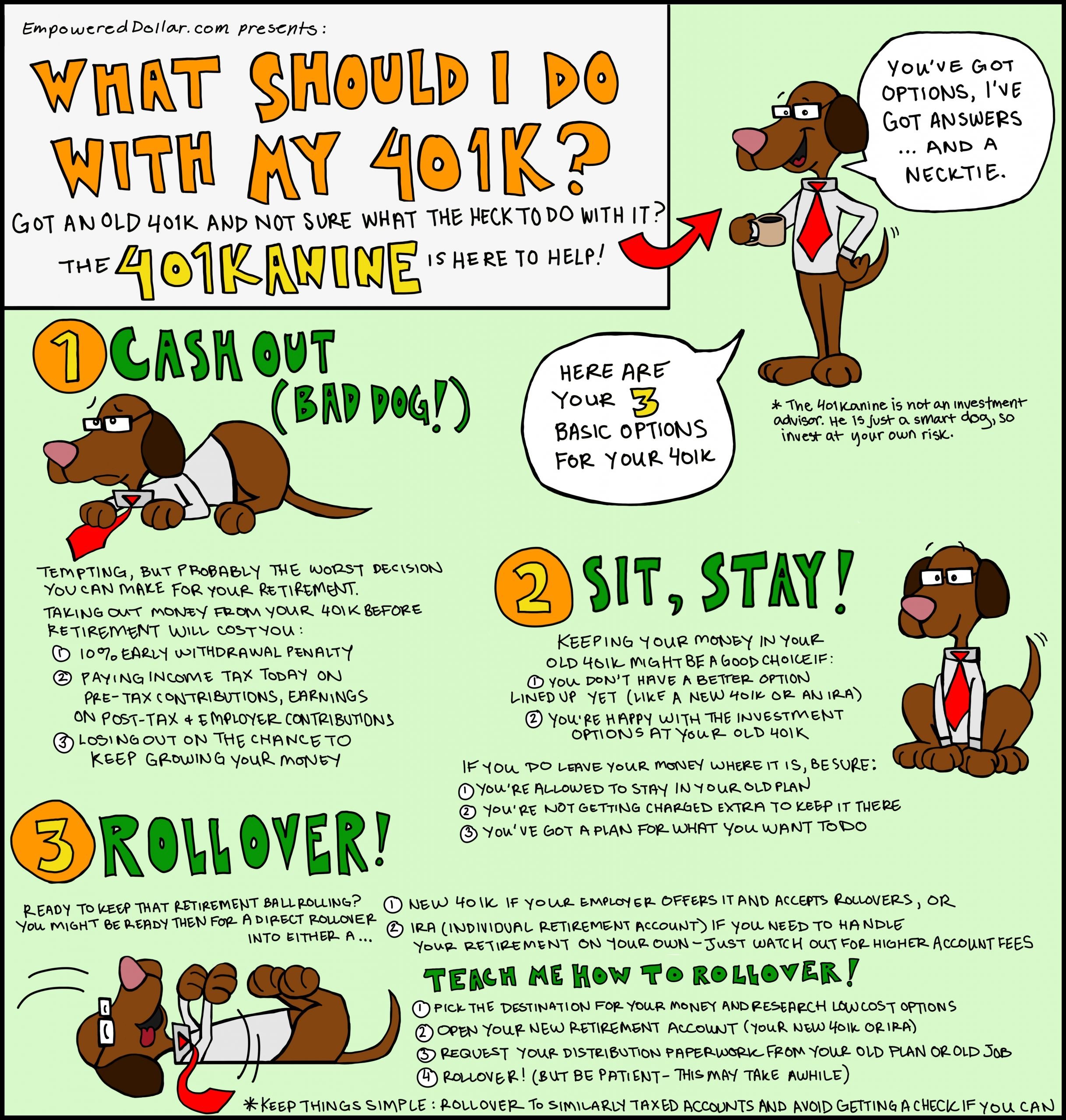

Lets consider the primary options available. As said earlier, there are three broad options for your 401 when you leave a job.

The fourth option of cashing out is not seen as a wise alternative. If you choose to cash out, your employer will send you your savings.

However, cashing out will subject the savings to stiff financial penalties.

The three options are:

Leaving your money with a former employer

This option is a straightforward choice for employees who leave a job close to their retirement age or are not seriously considering another job.

It allows a former employee to continue managing retirement savings of former workers, although most employers only allow this if the former employee has up to $5,000 in their retirement account. The employer may cash out for those with less than that amount and send it to the person..

This is a straightforward option, and many people find it very convenient as it allows you to keep investing the money even though you are no longer in the firms employment.

It also allows you to compare the plans of your new employer if youve got a new job. However, former employers often impose maintenance fees on the account, a practice that may cancel out any financial incentives.

If you choose to keep your 401 with a former employer, this may limit how you access your savings. This option is only viable for those not aggressively hunting for a new job or is close to retirement age.

Transfer to a new employer

Rollover to an IRA

Recommended Reading: How To Close Vanguard 401k Account

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How Long Do You Have To Move Your 401 After Leaving Your Job

Theres no time limit on how long you can keep your 401 after leaving your job. You can leave it in your former employers plan, roll it into an IRA, or cash it out. Each option has different rules and consequences, so its important to understand your choices before making a decision.

If you leave your 401 in your former employers plan, youll still be able to access your account and make changes to your investment choices. However, you may have limited options for withdrawing your money and may be subject to higher fees.

Rolling your 401 into an IRA gives you more control over your account and typically lower fees. Youll also be able to access your money more easily. However, youll need to roll over the account within 60 days to avoid paying taxes and penalties.

Cashing out your 401 should be a last resort. Youll have to pay taxes on the money you withdraw, and you may also be hit with a 10% early withdrawal penalty if youre under age 59 1/2. Cashing out will leave you without the tax-deferred savings to help you reach your retirement goals.

Don’t Miss: How To Use Your 401k Money

Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, youll pay no taxes until you start making withdrawals, and youll retain the right to roll over or withdraw the funds at any point in the future.

The cons: Youll no longer be able to contribute to the plan, and the plan provider may charge additional fees because youre no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

What May Be The Cons Of Rolling Over Into The New Plan

- Your new plans investment options may be more limited than those available to you in your old employers plan or through an IRA for example, your old plan may give you access to unique investments such as institutional-class shares and/or funds closed to new investors

- Your new plans fees may be higher than those in your old employers plan

- Your new plan may not offer a free or low-fee advisory service that your old plan may offer

Read Also: Is A 401k A Defined Benefit Plan

Just Because You’re Moving On Doesn’t Mean You Should Neglect Your Retirement Savings

The Great Resignation has been upon us for quite some time, and these days, Americans are leaving their jobs in droves. In November, a record 4.5 million Americans tendered their resignations. And given that the labor market is loaded with jobs, a lot of people aren’t hesitating to seek out better opportunities.

While moving on to a new job could be a great career move for you, it does beg the question of what to do with your 401 plan. While you’ll generally have the option to leave that money alone, you may want to consider one of these choices instead.

Image source: Getty Images.

Leave Your Money With Your Former Employer

For some people, the most plausible option is to leave their investment with their former employer. This option allows you to continue making investments with the money even if you are not working with that employer. In most cases, old employers allow you to leave your investment if you have more than $5,000 in your 401 retirement savings account. If your account holds less than this amount, your previous employer may decide to cash out your plan and send you a check for the balance.

The advantage of this option is that it allows you to leave your 401 with your former employer if they offer good terms. Leaving your retirement account with your previous employer allows you to wait for registration to open with your new employer.

When you leave your 401 savings with your former employer, your access to your money can be limited. Some employers can levy huge maintenance fees, implement restrictions on investment choices and prevent access to your savings until you reach retirement age. Unless you’re about to retire and you know you won’t change jobs often, avoid leaving your 401 with your former employer.

Recommended Reading: How Can I Take Money Out Of My 401k

Options For Cashing Out A 401 After Leaving A Job

The amount in your 401 account, including your contribution, your employers contribution, and any earnings on your investments, belongs to you and can supplement your retirement fund. The huge amount of money accumulated in your 401 account may tempt you to cash out your plan, but its in your best interest not to do so.

Leaving your account with your old employer may not a good idea. There are chances that you may forget the account after some time. You can, instead rollover to your new employer or even set up an IRA to roll 401 funds into.

Rolling over your 401 to an IRA gives you the flexibility to invest your funds the way you want. However, in some states like California, your creditors have easier access to your IRA funds than the money kept in a 401 account. If you see any potential claim or lawsuit against you, you may want to let your funds lie in a 401 account rather than transferring into an IRA.

Alternatively, if you are eligible for the 401 plan of your new employer, you may want to roll over your old 401 to your new account. No matter where you invest, always consider minimizing the risk by diversifying your portfolio. You may never want to invest a large portion of your savings in a single company, no matter how much you trust it.

Option #: Leave Your 401 Account With Your Former Employer

Your first option is as simple as it gets: Do nothing.

Theres nothing stopping you from simply leaving your money where it is inside your current 401 account and letting it sit. As we covered above, your 401 account is portable, so it remains yours even if you leave the employer its tied to. And while this isnt the worst option you could choose , it does come with a few notable disadvantages.

Fund Availability

The first disadvantage of leaving your funds inside your old 401 account has to do with the lack of low cost, high quality funds available for you to invest in.

Many companies rely on third party administrators to run their 401 plans for them, which tend to have relationships with other mutual fund companies that want their funds to be featured in the plans. Often, these plan administrators will offer to manage a companys entire 401 program either for free or at a very low cost. Thats great for the employer, but theres a catch: the way they make money is through the high fees and sales commissions that go along with the funds available in the plan. Unsuspecting employees will think their money is being invested wisely, when in reality, its being subjected to onerous fees that are being kicked back to the plan administrators.

Difficulty of Managing Your Portfolio

Maintaining Financial Discipline

Recommended Reading: Is It Worth Rolling Over A 401k

Also Check: How To Pull Money From Your 401k

Find Accounts From Failed Banks

You have a couple options if your bank failed and you have yet to claim your money:

- You can find unclaimed money from banks that have failed at this Federal Deposit Insurance Corp. website.

- If your unclaimed money was held at a failed credit union, you can track it down at this National Credit Union Administration website.

What May Be The Pros Of Leaving The Money In The Old Plan

- Most obvious, though not necessarily most important simplicity this doesnt require you to do anything special

- Your old plans investment options may be better than those available to you in your new employers plan or through an IRA for example, it may give you access to unique investments such as institutional-class shares and/or funds closed to new investors

- Your old plans fees may be lower than those in your new employers plan

- Your old plan may offer a free or low-fee advisory service that can help you make more informed investment decisions

- If youre 55 or older, and your old plan allows it, you may be able to start withdrawing money from the plan without penalty before you turn 59½ under the so-called Rule of 55 this can be a lifesaver if you were laid off and have no new income source )

- Money in a 401 has better protections against lawsuits than does money in non-retirement plans or an IRA

Recommended Reading: How Do I Take My Money Out Of My 401k

Options For What To Do With Your 401 When You Leave Your Job

Should you decide to leave your job, youll have four main options to consider regarding what to do with your 401 account tied to your previous employer. Some of these options are better than others, and it pays to know the difference between them. These four primary options are listed below in no particular order :

- Leave Your 401 Account With Your Former Employer

- Cash Out Your Old 401

- Rollover Your Old 401 to Your New Employers Plan

- Rollover Your Old 401 into an IRA

Also Check: What Is A Simple 401k

Former 401 To New Employer 401 Rollover

If you are interested in rolling over your 401 into your new employers plan, you will first need to ask if your current employer allows you to do so. Then, suppose you have the capability its essential to complete a direct rollover. A direct rollover involves your 401 brokerage sending a check directly to your new 401 brokerage. The payment will include instructions regarding the rollover.

It would be best if you did not have the 401 check sent directly to your address. However, if the check has your name on it , the IRS requires your employer to withhold 20% in taxes, you will only have 60 days to place the money into a new 401 or IRA, and risk coming up with the 20% out of pocket or face further penalties.

Pros

|

Cons

|

Recommended Reading: What Are The Different 401k Plans

Consider Your Options Carefully

There is no one right 401 move for everyone, but by exploring your options, you can determine what is right for you.

Consider your choices carefully before deciding. Talk to human resources representatives and plan administrators at your old job and your new job. You may also want to discuss options with financial advisor.

Most importantly, if you do decide to move the money from one plan to another, pay attention to asset transfer rules to avoid missing a deadline or creating an unexpected taxable distribution.

What Is A 401 Everything You Need To Know

11 Min Read | Aug 16, 2022

If you just started a new job and youre looking at the 401 options that are available, you probably have questions about how it all works.

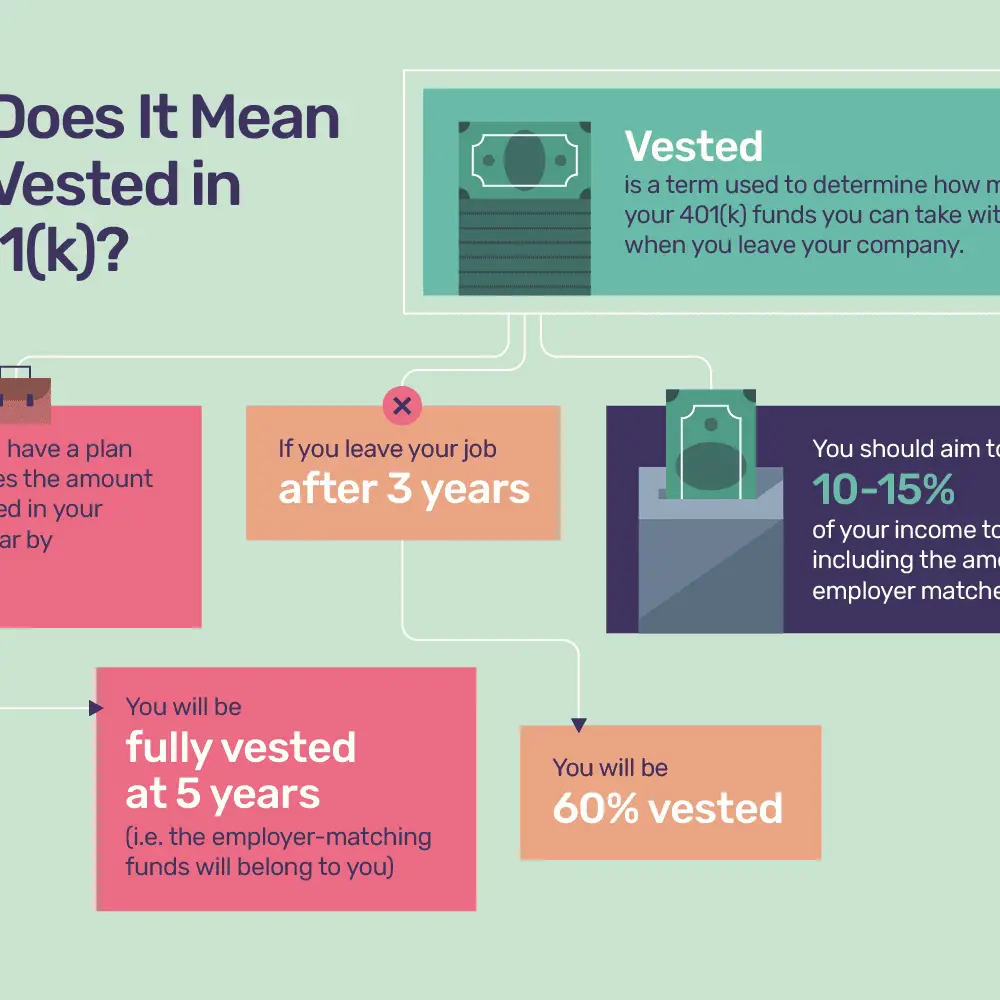

You might be wondering: How do I know these are good investment options? How much should I invest? What kind of return should I expect? And what in the world does vesting mean?

If youre leaning on your 401 to be a big part of your financial picture, its important to get your questions answered. Your golden years literally depend on investment choices you make today. Learning how your 401 works is the first step toward making confident decisions about your retirement future.

Lets get started!

Read Also: How Much Should I Put In My 401k Calculator

Take Distributions From The Old 401

After youve reached 59½, you may withdraw funds from your 401 without paying a 10% penalty.

You may have decided to retire and are considering withdrawing funds from your account. If youre retiring, it may be a good time to start drawing on your savings for income. Youll have to pay tax at your regular rate on any distributions you take out of a traditional 401. Annuities are a reliable tool for spending your 401 without running out of money.

If you have a designated Roth 401, any payments you take after 59 1/2 are tax-free if youve held the account for at least five years. Only the earnings portion of your distributions is taxed if you do not fulfill the five-year requirement.

When you reach age 72, you must begin taking RMDs from your 401 if you leave your employment. The amount of your RMD is determined by your expected life span and 401 account balance.