Our Experienced Consultants Can Help You Plan And Invest For Your Future

No matter where you are on your retirement journey, we can help you develop a flexible, personalized investment plan so that you can confidently pursue the retirement you want.

-

Discuss your financial goals and what matters most to you

-

Review how your current investments are working toward your goals

-

Explore strategies to help you make the most of your investments

Get personalized guidance from a Financial Consultant.

Or call us now:

Keep Your Retirement Dollars On Track

Leaving your job raises questions, especially those around what to do with your retirement savings. Many options are available to you, each with its own pros and cons. American Century Investments is here to help 401 participants like you keep your retirement dollars on track. Review the options in our educational tools tab below or call a Rollover Specialist at to discuss your options.

What Happens To Your Old 401 If You Quit

If you leave Walmart, you have a few different options for what to do with your 401 plan. First, you can likely leave the money where it is and let your investments continue to grow in Walmarts 401 plan. You cant make any additional contributions, nor will Walmart, but the money thats in there will grow.

You can also choose to roll your 401 balance over into either a different 401 plan or an IRA. There are a few benefits to choosing one of these options. First, rolling your money over into a different account allows you to keep all of your retirement savings in one place rather than keeping track of a 401 plan at each of your former employers.

And the benefit of rolling the money into an IRA is that you have more control over the investments. Instead of being able to choose from only a select list provided by an employer, you can choose to invest in anything.

Another option when you leave your job is to cash out your 401 and get a check for the full balance. While this is certainly an option, its not an advisable one. In addition to paying income taxes on the distribution, youll also pay a 10% penalty. Additionally, that money will no longer grow with compound interest, and youll have less money to live on during retirement.

Recommended Reading: What Is The Maximum Contribution For A 401k

Flexible Plan Designs That Are Easy To Set Up

Whether you are looking to establish a new retirement plan or move your plan to ADP, we can help you design a plan thatmeets the needs of your workforce and answers questions like:

- At what age should my employees be eligible to participate in the plan?

- How long should employees work for me before qualifying to join the plan?

- Should my employees have access to a third-party online investment advisory service?

- Is a Safe Harbor plan a good choice for my company?

- Should the plan offer employees a Roth 401 option?

- Would my employees benefit from automatic enrollment?

And when it comes to implementation, we make it easy, with a specialized ADP manager to help ensure the process runssmoothly.

ADP® Retirement Services Implementation

See how as a plan administrator youll have access to smart, flexible technology and tools, as well as an experienced, responsive team.

Does Anyone Have Any Experience With The Adp 401k Plan

Tags:

mdfamily wrote:They are claiming they only charge a flat fee and not a percentage of the portfolio, and no other fees such as trading, buying or selling stocks, and that this fee is tax deductible.Considering the tax deductible component its about 200-2500 per year, regardless of the size of your portfolio.They claim that this much better than fiedlity or vanguard.You can but different products with them, including vanguard and other known namesClick to expand…

Don’t Miss: What Can You Do With A 401k

What Are The Benefits Of A 401k Compared To Other Retirement Options

Compared to simplified employee pension individual retirement accounts and savings incentive match plans for employees , 401k plans have higher annual contribution limits. Thus, employees may be able to save more money in a shorter amount of time with a 401k, making it ideal for those who are older and short of their savings goals. It also allows employees to borrow money from their retirement savings accounts. SEP IRA and SIMPLE IRA plans do not.

What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

STEP 4

Don’t Miss: Can You Enroll In 401k At Anytime

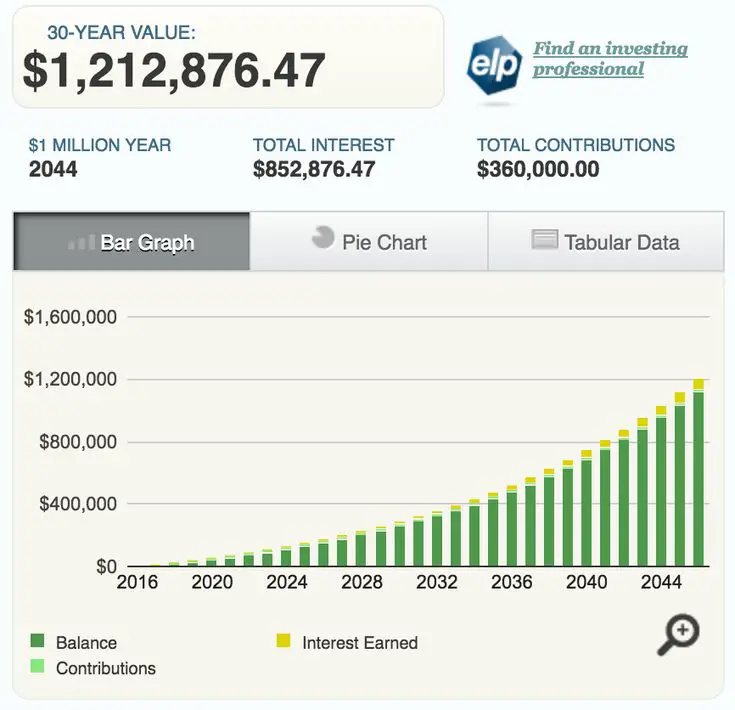

How Does Your 401 Balance Stack Up

In 2020, the average 401 balance for Vanguard participants was $129,157, according to Vanguards 2021 How America Saves report. The median balance, however, was considerably lower, coming in at $33,472.

Whenever you have a median thats considerably lower than the mean, you can infer that more people have less than the average than more. Or, to put it another way, that average $129,157 balance may be coming as a result of a small percentage of 401 participants who have saved extremely well and are pulling the mean upward. But that $33,472 may be more reflective of what the typical saver has actually socked away to date.

Doing Even More To Keep Stores Safe

Walmart is also increasing actions to add levels of safety for customers. It normally sells chemical spray sanitizing kits for individuals, but it will now be using these kits to disinfect shopping carts between uses throughout Walmart stores.

It will also be placing decals on the floors of stores by entrances and checkout lanes so customers can better judge how far away they are from each other in order to achieve proper social distancing.

America is getting the chance to see what weve always known that our people truly do make the difference, Walmart COO Dacona Smith said. Lets all take care of each other out there.

Dont Miss: How To Find Out If Someone Has A 401k

You May Like: When Can I Rollover 401k To Ira

How Do Small Business Owners Choose The Best 401 For Their Needs

To find the right 401 for their small business, employers generally look for plan providers that:

- Charge reasonable plan and investment fees and have no hidden costs

- Provide real-time integration between the 401 recordkeeping and payroll systems to eliminate manual data entry and reduce errors

- Offer a simplified compliance process

- Make administrative fiduciary oversight available

- Offer ERISA bond and corporate trustee services

- Help with investment fiduciary services and plan investment responsibilities

- Make investment advisory services available for employees

How Do Employers Choose The Best Mutual Funds To Offer Employees

Managing investments is sometimes beyond the expertise of employers. Thats why many of them outsource the process of selecting, diversifying and monitoring plan investments to an investment advisor. Professional assistance helps ensure that the investment options are in the best interest of the plan and its participants.

This article is intended to be used as a starting point in analyzing 401k and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. ADP, Inc. and its affiliates do not offer investment, tax or legal advice to individuals. Nothing contained in this communication is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

ADPRS-20220422-3172

Don’t Miss: Can You Convert A Traditional 401k To A Roth Ira

How Is The Walmart 401 Retirement Plan Funded

Employees who enroll in the 401 plan can choose to have a portion of their monthly wages sent directly into this plan.

For every dollar that an employee puts in to the plan, Walmart pledges to add another dollar, up to 6 percent of the employees eligible pay.

The longer that money stays in the plan, the more that can be earned towards retirement.

Employees can change how much they put into their 401 fund at any time, and even withdraw funds whenever they wish.

How Much Retirement Savings Should You Have

Theres no magic savings number thatll guarantee you financial security in retirement. A good rule of thumb is to stash away enough cash so that by the time you leave the workforce for good, you have 10 to 12 times your ending salary on hand in savings.

But remember, thats the total you should be aiming for at the time of your retirement. And so if youre 30 years old and are sitting on a retirement plan balance of $33,472, or something in that vicinity, you may not be in such poor shape.

Read Also: How Can You Get A 401k

Supplemental Executive Retirement Plan

WAL-MART STORES, INC.

| 2.1 | Definitions. |

Except as otherwise expressly provided below, capitalized terms used in thePlan shall have the same meanings as set forth for such terms in the ProfitSharing and 401 Plan, and such Profit Sharing and 401 Plan definitions andoperative terms are incorporated herein by reference. Should there be anyconflict between the meanings of terms used in the Plan and the meaning of termsused in the Profit Sharing and 401 Plan, the meaning as set forth in the Planshall prevail.

Recommended Reading: Which 401k Investment Option Is Best

The Adp 401k Doesnt Have Set Pricing

Price is also a drawback for many employers considering the ADP 401k plan. It is not the cheapest solution available especially for physicians with small practices that have only a few employees. ADP fees tend to be a bit higher than those of their competitors.

Unfortunately, there is no pricing on the ADP website. Youll need to take the time to contact them to receive a quote. This is because the plans are customized. There is no one set price for every business different businesses get different quotes.

If you need advisory and management services, ADP will charge you even more. Those additional fees can add up quickly, so make sure youre well aware of them before deciding to go with an ADP plan.

Also Check: How To Transfer 401k From Old Job To New Job

Alternative Adp Pass Conditions

The plan can still pass the ADP test if the HCE deferral rate is less than the smaller result of these two calculations:

1.) The NHCE rate times 2.

2.) The NHCE rate plus 2%.

Ok thats confusing, so lets go through this second option. Lets stick with our HCE rate of 5% and NHCE rate of 3.9% and run those rates through each formula:

Formula 1: 2 x 3.9% = 7.8%Formula 2: 2% + 3.9% = 5.9%The lesser of the two figures is 5.9%. So the plan passes as the HCE rate of 5% is less than the allowed rate of 5.9% under this second option.

Plan sponsors have additional flexibility when it comes to the ADP test.

Its permissible to compare the prior years average NHCE deferral rate to the current years HCE deferral rate. This can help plan sponsors predict the amount of HCE contributions that would result in a failed test, allowing the HCEs to plan accordingly.

Dont Let Your Adp 401 Fees Get Out Of Hand

Even if yours are below average now, ADPs revenue sharing can cause them to very quickly become excessive as assets grow. For this reason, its crucial that you compare your plans fees on a regular basis.

Too much trouble? Weve got a solution.

Simply switch to a 401 provider that charges fees based on headcount not assets – to the extent possible. Such a fee structure will make it easier for you to keep your 401 fees in check as your plan grows. You just might save some money while youre at it.

Recommended Reading: What To Do With 401k At Retirement

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Does Walmart Offer Any Extra Insurance Plans For Retirees

Yes. Walmart offers a number of insurance policies to their employees that can cover retirees.

Walmarts retirement help page stipulates a number of extra insurance coverage plans that employees can take advantage of.

These insurance plans are able to cover an employee even well after they have retired from the Walmart company.

These insurance policies include: Life insurance, and accidental death and dismemberment policies covered by prudential, and accident and critical illness coverage from All-state.

Recommended Reading: How Does My 401k Work When I Retire

Invest With Your Ira Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

How Does Your 401 Balance Compare To The Average

- Maurie Backman, The Motley Fool,

Theres a reason working Americans are often warned to not rely too heavily on Social Security for retirement. Those benefits will only replace about 40% of the average earners pre-retirement wages, and most seniors need roughly 70% to 80% of their former income to maintain a decent lifestyle. Furthermore, because Social Security cuts may be on the table, its even more important to save independently for retirement.

If you have access to a 401 plan through your employer, you have a prime opportunity to accumulate some nice cash reserves for your senior years. Currently, annual 401 plan contributions max out at $19,500 for workers under 50 and $26,000 for those 50 and older. And since many employers offer matching incentives, its possible to sneak even more money into a 401 plan .

If youre saving for retirement in a 401, you may be wondering how your balance compares to that of the average American. And Vanguard may have your answer.

Don’t Miss: How To Roll Over 401k To Another Company

Is Adp Better Than Gusto

ADP is a much larger, more established company than Gusto. That said, Gusto is among our picks for the best HR services and best payroll services. Given ADPs size and legacy, the brand has considerably more robust offerings. However, ADP is also less transparent about its pricing and likely to be more expensive in many cases.

Tip: Read our review of Paychex employee retirement benefits to learn about another well-established company that provides comprehensive service.

How To Avoid The Mistake:

One way to avoid this type of mistake is by establishing a safe harbor 401 plan or by changing an existing plan from a traditional 401 plan to a safe harbor 401 plan. Under a safe harbor 401 plan, the employer isnt required to perform the ADP and ACP tests, if it meets certain requirements.

Problems may happen when theres a communication gap between the employer and plan administrator regarding what the plan document provides and what documentation is needed to ensure compliance. Several main areas where these communication problems may occur:

- Count all eligible employees in testing:

Don’t Miss: How Do I Open A Solo 401k