How Much Can You Contribute To A 401 For 2020

The 401 contribution limit increased by $500 for 2020. Plus, workers 50 and older can also save an extra amount for retirement.

One of the best and most tax-friendly ways to build a nest egg for retirement is by contributing to an employer-sponsored 401 account. If your employer offers this benefit, jump in as soon as you can, because it’s never too early to start saving for retirement.

> > For more 2020 tax changes, see Tax Changes and Key Amounts for the 2020 Tax Year.< <

Is There An Income Limit For Contributing To A 401

Not exactly. If you have access to a 401 plan at work, you can put money into it no matter how high or how low your salary is. But listen up, high-income earners: The IRS does limit how much of your salary and compensation is eligible for a 401 match.

For 2022, the compensation limit contributions and matches) is limited to $305,000. So keep that in mind! In 2023, the compensation limit increases to $330,000.7

Heres how it works. Lets say you make $500,000 in 2022 and your company offers a 4% match on your 401 contributions. You contribute $20,500the maximum amount youre allowed to put into your 401 in 2022. But instead of matching that $20,500 , your employer only contributes $12,200. Why? Because your employer is only allowed to apply your match on up to $305,000 of your compensation, and 4% of $305,000 is $12,200.

Noit doesnt really make sense. But dont let that stop you from using all the tools you have to build wealth for the future!

Covering Your Bases Through Tax Diversification

If you’re not sure where your tax rate, income, and spending will be in retirement, one strategy might be to contribute to both a Roth 401 and a traditional 401. The combination will provide you with both taxable and tax-free withdrawal options. As a retired individual or married couple with both Roth 401 and traditional 401 accounts, you could determine which account to tap based on your tax situation.

“You can’t really know what future tax rates will look like, so building in the flexibility to use multiple accounts to manage taxes is important and helpful,” says Rob.

For example, you could take RMDs from your traditional account and withdraw what you need beyond that amount from the Roth account, tax-free. That would mean you could withdraw a large chunk of money from a Roth 401 one yearsay, to pay for a dream vacationwithout having to worry about taking a big tax hit.

Besides the added flexibility of being able to manage your marginal income tax bracket, reducing your taxable income in retirement may be advantageous for a number of reasons, including lowering the amount you pay in Medicare premiums, paring down the tax rate on your Social Security benefits, and maximizing the availability of other income-based deductions. Be sure to weigh all your available options to maintain your retirement goals.

1Individuals must have the Roth 401 account established for five years and be over the age of 59½ for tax-free withdrawals.

5The Tax Foundation, 3/22/2017.

Don’t Miss: How To Start A 401k Account

Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.

Contribute To A Roth Ira

The Roth IRA is the peanut butter to the 401s jellythey just go better together! The beautiful thing about the Roth IRA, which stands for individual retirement account, is that it lets you enjoy tax-free growth and tax-free withdrawals in retirement. Tax-free . . . dont you just love the sound of that?

In 2021, you can put up to $6,000 into a Roth IRA .6 Sticking with our example above, maxing out your Roth IRA and investing $6,000 into your account brings your total retirement savings for the year to $9,750 . . . just a little bit short of your retirement savings goal.

So what are we going to do with the remaining $1,500? Its time to send you back . . . back to the 401!

Also Check: How To Transfer A 401k Account

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

Why Does The Irs Impose Contribution Limits

Contributions to 401 plans made using pretax dollars provide significant tax benefits. This means you dont have to pay federal income tax for contributions up to the $22,500 limit , which lowers your taxable income. And because earnings in a pretax 401 account are on a tax-deferred basis, earnings in your account are not subject to tax until you withdraw your funds.

Because of the substantial tax benefits offered by 401 retirement plans, the IRS works to ensure that plans do not unfairly benefit key employees and highly compensated employees. To ensure a 401 plan is structured fairly and not favoring specific employees, all 401 plans must pass a set of annual compliance tests.

You May Like: How To Cash Out 401k While Still Employed

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

Boost Your Emergency Fund

When was the last time you made sure you and your family had enough emergency savings? If it was more than one season of your favorite TV show ago, update your goal according to what you’d need tomorrow. You should be able to access that money quickly and not risk losing principal, so stick with a regular savings or money-market account or a six- or 12-month certificate of deposit .

How much should you save? That depends on the size of your family and whether you work as an employee or rely on contract or freelance income, but after you max out your 401, a common goal is to have emergency dollars to cover six months’ worth of living expenses.3

You May Like: How To Transfer 401k From Fidelity To Vanguard

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

Average 401k Balance At Age 22

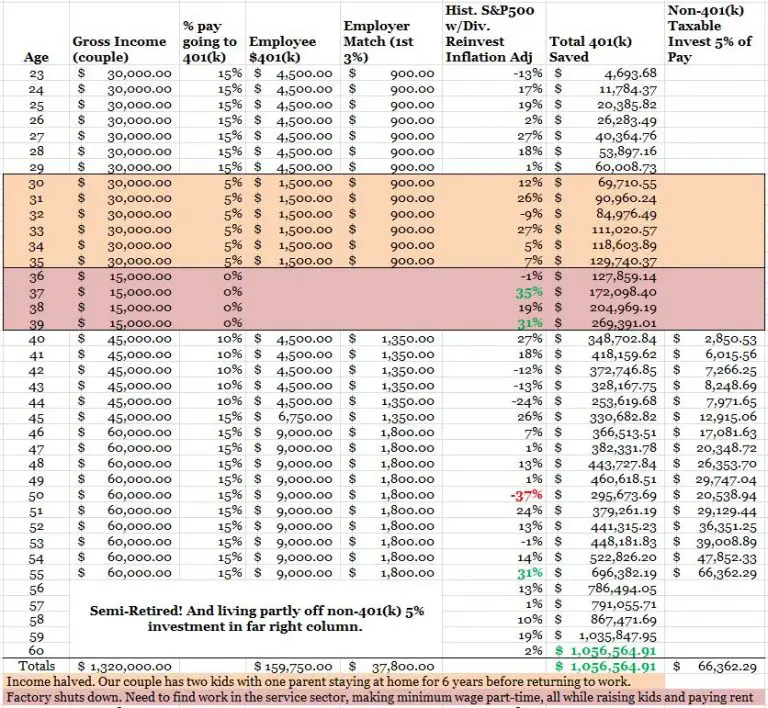

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart , compounding interest is no joke.

Also Check: How To Transfer From One 401k To Another

Calculate How Your 401k Balance Compares To Others Your Age

See if youre on track to the retirement you want with this free 401k calculator.

Tip: Get a handle on your money with Personal Capitalsfree financial dashboard. You get a quick overview of your net worth, cash flow, investment allocation, and more. You can also plan for long-term goals like retirement.

Saving With Your Spouse

Look across the breakfast table. Is your spouse taking advantage of their maximum 401 contribution limit and also an IRA? Making sure your significant other is also saving the max can set up both of you better for the future. Your spouse can contribute to an IRA even if they’re not working outside the home.

Draw up a list of reasons to stay, focusing first on the practical. For example, proximity to school, a good neighborhood, special features that accommodate aging parents, etc. Once that is done, it’s time to consider more emotionally charged reasons, the most common of which include maintaining a sense of continuity for your children. Remaining close to neighbors who are also supportive friends or the garden you cultivate in your “me time” may be other reasons to stay.

Recommended Reading: How To Invest In 401k Without Employer

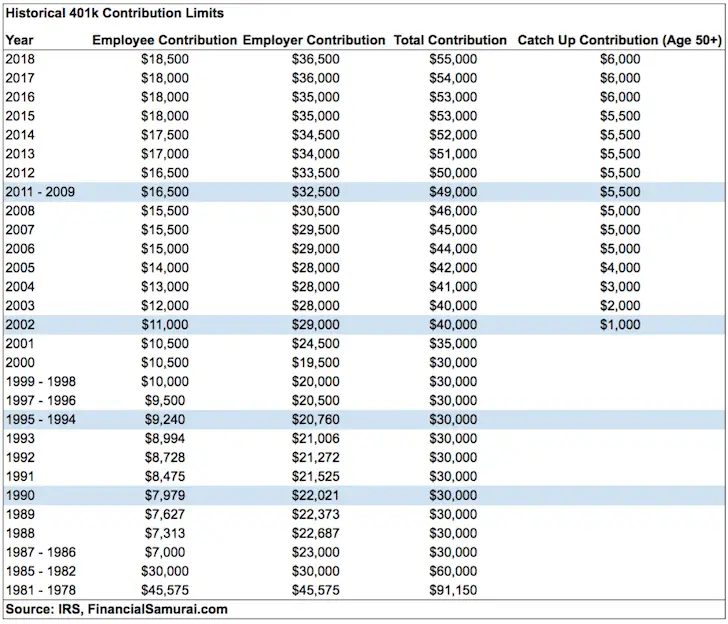

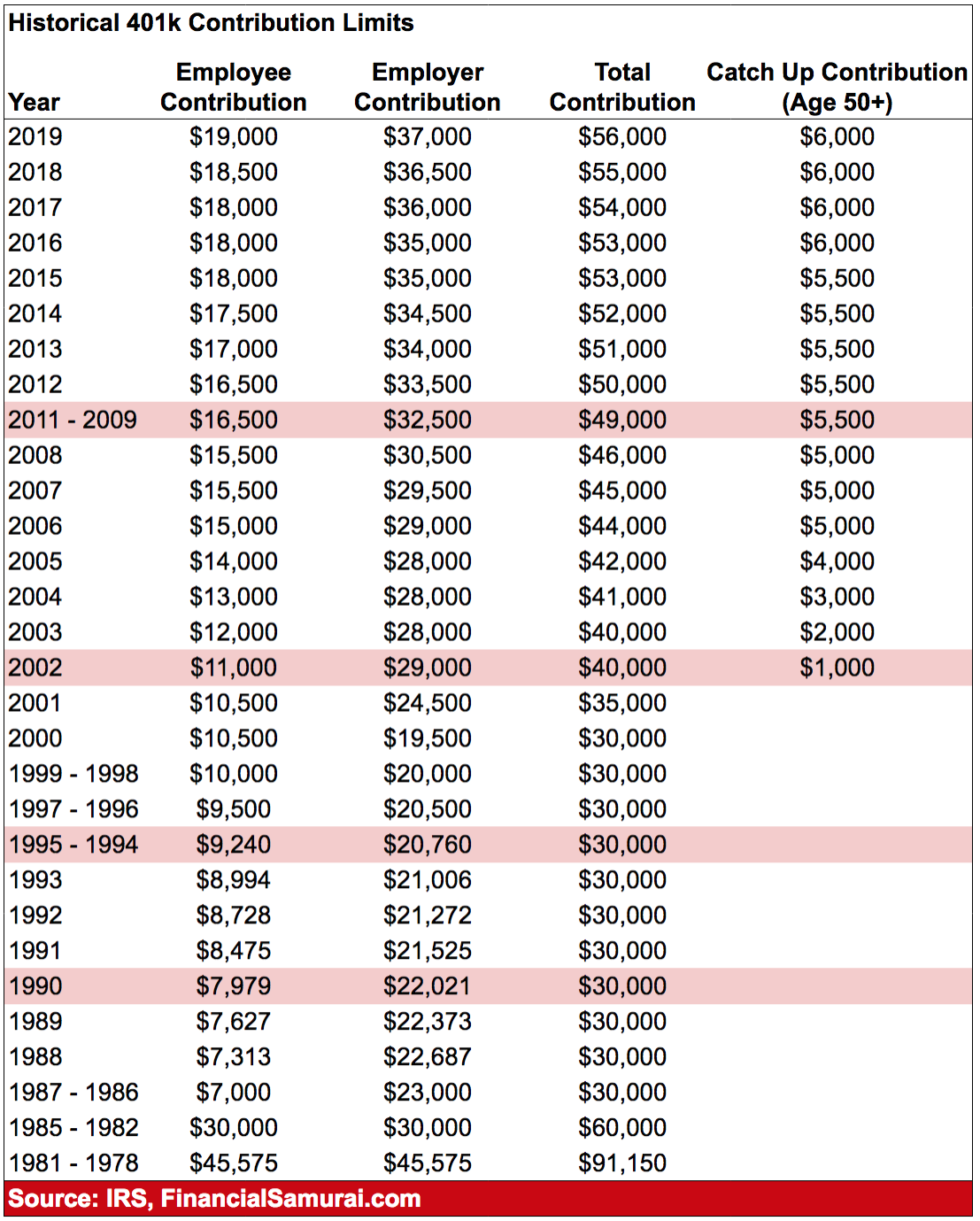

Limitation On Elective Deferrals

The maximum amount you can defer into your 401 plan adjusts each year for inflation. As of 2012, the standard limit is $17,000. However, for people age 50 and older, the contribution limit increases by $5,500 because of what is known as a catch-up contribution. This extra $5,500 increases the total limit for someone older than 50 to $22,500. The catch-up contribution does not count toward the general 401 plan contribution limits.

Dont Miss: When Can I Set Up A Solo 401k

Could You Increase Your 401 Contribution

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road.

Cutting or reducing non-essentials could allow you to bump up the money youre putting into your 401 or 403. Like the gym membership you havent used in 6 months, for example. Or buying a certified used car instead of a new one. How about those merit increases or a bonus?

A little could go a long way in the future. Consider this example1 for a $35,000 annual income:

| Additional contribution |

|---|

| $18,068 |

Imagine if you could increase it to 10% of your pay?

If youre wondering how to save more toward retirement, read 5 smart money tips from super savers.

Tip: Dont forget inflations impact on retirement savings. You may feel like youre saving enough to maintain your current lifestyle. Even though your income may increase over the years, so will your cost of living . If you spend $50,000 a year to live in todays dollars, for example, how much more will it take 30 years from now?

Also Check: Why Is An Ira Better Than A 401k

Calculator: How 401 Contributions Affect Your Paycheck

? If you have a 401 at work, thats a great start. Increasing your 401 contributions today may greatly improve your retirement outlook. Use our 401 contribution calculator below to see how that extra money could affect your paycheck and your future.

Why Use a 401 for Retirement Savings?

Tax-deferred contributions and earnings. With a traditional 401, you wont pay taxes on contributions or earnings until you withdraw the money.

Employer match. Many employers match contributions to your account up to a maximum amount. For instance, if you deposit 4% of your salary into your 401, your employer may add the same amount to your account. If you don’t contribute at least the match amount, you could miss out on this additional money.

Can You Afford to Contribute More to Your 401?

This calculator shows how increasing your 401 contributions would affect your paycheck. It also shows how much your retirement savings may grow with that increase. You may be surprised at how .

How to Use the 401 Contribution Calculator

To get started, youll need your most recent pay statement. It shows how much youre getting paid and how much youre contributing now, as well as other deduction information.

This calculator uses the latest withholding schedules, rules and rates .

Get Started

Self Employment Income Compensation Limits For 2022 And 2023

IRS records show that, in Tax Year 2014, an estimated 53 million taxpayers contributed almost $255 billion to tax-qualified deferred compensation plans. A popular form of deferred compensation plans, known as a solo 401 plans, permits employees to save for retirement on a tax-favored basis.

Video Slides: 2022 & 2023 Self-Directed Solo 401k Contribution Limits and Types

You May Like: Can I Close My 401k

Can You Contribute To A Simple Ira And A 401k In The Same Year

If you belong to a 401 and a SIMPLE IRA in the same year, your contributions to either plan count toward the overall limit of $17,500, or $23,000 if youve reached age 50. If youve reached age 50, you can contribute up to $5,500 to your SIMPLE IRA to bring your total annual contributions to $23,000.

Recommended Reading: How Do You Pull Out Your 401k

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path. Below is a chart that shows the maximum 401k contributions in 2021 by employee and employer.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

Just imagine 30 years from now, the government deciding to raise penalty free 401k withdrawal to age 75 from 59.5? Unfortunately, you need the money at age 60. Because you withdraw, the government imposes a 30% penalty on top of the taxes you have to pay. Dont think it cant happen. Expect it to happen!

Also Check: Can I Set Up A 401k For My Child

Key Employee Contribution Limits That Remain Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

The catch-up contribution limit for employees aged 50 and over who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan remains unchanged at $6,500. Therefore, participants in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan who are 50 and older can contribute up to $27,000, starting in 2022. The catch-up contribution limit for employees aged 50 and over who participate in SIMPLE plans remains unchanged at $3,000.

Details on these and other retirement-related cost-of-living adjustments for 2022 are in Notice 2021-61PDF, available on IRS.gov.

Dont Rely Only On Social Security

Based on Personal Capitals recent retirement survey, we found that a quarter of Americans expect Social Security to be their primary source of income during retirement. With half of Americans planning to retire at 65 or younger, its crucial to save in other investment vehicles, such as a 401k, in order to maintain your desired lifestyle in retirement.

We recommend not relying on Social Security it may not fully be there when you retire!

Also Check: Can I Get My Own 401k Plan