What Is A Partial 401 Match

With a partial 401 match, an employers contribution is a fraction of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

Matching structures vary by plan, said Young. In fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.

Lets say you earn $40,000 per year and contribute $2,400 to your 4016% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

Understand The Value Of An Employer Match

A 401 or similar employer-sponsored retirement plan can be a powerful resource for building a secure retirementand an employer match can add a substantial amount to your nest egg. Letâs assume you are 30 years old, make $40,000 and contribute 3 percent of your salary$1,200to your 401. And, for the sake of this example, letâs assume you continue to make the same salary and the same contribution each year until you are 65. After 35 years, you will have contributed $42,000 to your 401.

Now letâs assume you get a match from your employer. One of the most common matches is a dollar-for-dollar match up to 3 percent of the employeeâs salary. Taking full advantage of the match literally doubles your savings, even assuming no increase in the value of your investments: Instead of having set aside $42,000 by the time you retire, you will have set aside $84,000, with $42,000 in free contributions. Look at it this way: itâs a no-cost way for you to increase your contributions by 100 percent.

In reality though, the impact will be even bigger than that. Thatâs because when you invest money its value compounds. Check out The Time Is Now: The True Value of Time for Young Investors to learn how taking full advantage of a match early in your career can add up.

Recommended Reading: Can I Open A 401k Without An Employer

Maximum 401 Contribution Limits

Many employers offer 401 matching contributions as part of their benefits package. With a 401 match, your employer agrees to duplicate a portion of your contributions, up to a certain percentage of your salary. In addition to matching contributions, some employers may share a percentage of their profits with employees in the form of non-matching 401 contributions.

While an employers 401 match and non-matching contributions dont count toward your $19,500 employee deductible contribution limit , they are capped by total contribution limits.

Total 401 plan contributions by both an employee and an employer cannot exceed $58,000 in 2021 or $61,000 in 2022. Catch-up contributions for employees 50 or older bump the 2021 maximum to $64,500, or a total of $67,500 in 2022. Total contributions cannot exceed 100% of an employees annual compensation.

Also Check: Why Transfer 401k To Ira

How Do 401 Matches Work

Every 401 plan is different, so youll have to check your employers plan for the details on exactly how yours works. But there are two common types of matches:

Partial matching

Your employer will match part of the money you put in, up to a certain amount. The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%. If you put in more, say 8%, they still only put in 3%, because thats their max.

Heads-up that you might see this written in a lot of different ways. 50 cents on the dollar up to 6%, 50% on the first 6%, 3% on 6% you get the picture. All various ways to describe a partial match.

Dollar-for-dollar matching

With a dollar-for-dollar match , your employer puts in the same amount of money you do again up to a certain amount. An example might be dollar-for-dollar up to 4% of your salary. In this case, if you put in 4%, they put in 4% if you put in 2%, they put in 2%. If you put in 6%, they still only put in 4%, because thats their max.

What Is A 401 Retirement Savings Plan

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The U.S. government established the 401 to incentivize workers to save for their retirement.

Employees volunteer to have a certain amount deducted from their paychecks each pay period to go toward their 401 savings accounts. While employees usually choose how much theyd like to deduct from their paycheck, they often have a limit on how much theyre allowed to contribute.

Employers can offer one of two plans: a traditional 401 plan or a Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years old or older and the employee is over 59 years old. There are specific regulations to follow regarding how much and how often an employee can withdraw these funds for their 401.

Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Employees can choose the specific types of investments from a selection their employer offers. Some of these investment types may include stock and bond mutual funds, target-date funds, guaranteed investment contracts or the employers company stock.

Don’t Miss: How Much Can You Contribute To A 401k Annually

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

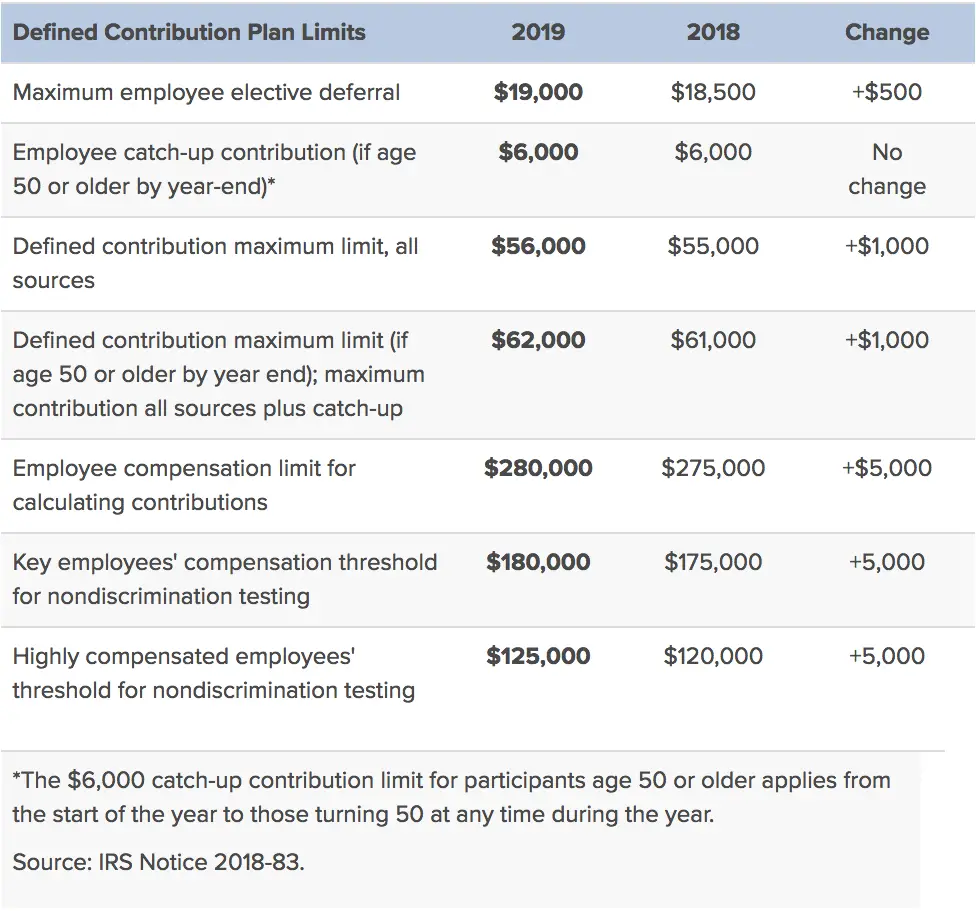

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Here’s an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Need More Information On Retirement Planning

Important Disclosures

1 Contribution limits change slightly each year and may vary by plan. For specific information about your employer-sponsored retirement plan, see your benefits website or contact your Human Resources department.

Withdrawals from an IRA or qualified retirement plan are subject to ordinary income tax. Prior to age 59 ½, they may also be subject to a 10% federal tax penalty.

Investing involves risk, including loss of principal. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

The information provided is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner or investment manager.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Also Check: Can You Get A Loan Using Your 401k As Collateral

Traditional 401 Vs Roth 401 Contributions

If you have a traditional 401 and Roth 401, these retirement accounts have different tax treatments. With a traditional 401, you will get a tax break on your income when you contribute to the retirement account. For example, if your annual salary is $50,000, and you contribute to a 401 up to the allowed limit of $19,500, your taxable income will be $30,500.

In contrast, if you contribute to a Roth 401, you will not get a tax break. This is because a Roth 401 is funded with after-tax money, meaning that you contribute money on which taxes have been taken out. If you take a distribution from a Roth 401 after attaining retirement age, you wonât pay any income taxes on the distribution. Also, if your employer offers a 401 match, the matching contributions cannot be added to a Roth 401. Instead, the employer contributions are added to a traditional 401.

Employers Have A Higher Contribution Ceiling

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $58,000 in 2021, up from $57,000 in 2020. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $290,000. Even at that level, the employer would have to contribute a hefty amount to reach the $58,000 limit.

Also Check: Can Business Owners Have A 401k

What Is 401 Employer Matching

401 employer matching is the process by which an employer contributes to an employees retirement account based on the employees contributions. Employers tend to set their 401 contribution limits based on the employees annual salary. In other words, an employers contribution rate may be at most a certain percentage of the employees salary. For example, an employer may be willing to match 50% of an employees contribution, up to 6% of their annual salary. So, if the employee contributed 6% to their 401 plan, the employer would contribute an additional 3% to the employees retirement savings.

Rarely, some employers instead set a contribution limit of a predetermined dollar amount thats unrelated to the employees annual salary. In either case, these contributions are typically made per pay period and reflected on the employees paycheck.

Key takeaway: 401 employer matching is when an employer also contributes to an employees retirement account based on the amount the employee contributes.

How Much Can An Employer Match 401 Contributions

One of the most common questions asked when it comes to 401 plans is what is the maximum amount an employer can contribute on a 401. The answer is the employer can match up to 6% of the employees contribution. This matching amount would be repeated each year, but is subject to change.

How this works out for a 50% match is the employer contributes 50 cents for every dollar you contribute to your 401 based on a maximum of 6% of your annual gross income. If your earnings are $50,000 annually and your maximum contribution is $3,000 . In this example, your employer matches half that amount, $1,500, so the annual contribution comes out to $4,500.

With a dollar-for-dollar plan, your employer will match your contribution to the plan until you reach the percent limit allowed. For example, a $50,000 salary with a maximum contribution percentage of 5% would allow you to put $2,500 into your 401. Your employer would match that figure with its 100 percent match resulting in a contribution of $2,500 for a grand total of $5,000 for the year invested into your 401 plan.

Before committing to a plan, its important to know how much your employer will be contributing. Discuss this with your employer or someone in your companys human resources department when you first set up the plan, and every year thereafter, as the contribution amount can vary based on how much your earnings change from year to year.

You May Like: Where Can You Rollover A 401k

Should You Max Out Employer Matching

If your employer offers a match, you should definitely strive to contribute enough to take advantage of the full match. If you dont, youre leaving free money on the table, says ODonnell. It adds up over time.

Even if you dont want to max out your 401, getting the full employer match helps you save the most and take advantage of all the benefits available to you through your employer. Its therefore a good idea to at least contribute enough to get whatever your company is willing to match.

Its important to start small and start now because you can always increase the amount you save each year. Even a 1% increase will add up, especially if your company matches those contributions. That puts the power of compounding to work for you, adds Winston.

Does My Employers 401 Match Count Toward My Maximum Contribution

To put it simply, the answer is no. An employer matching contribution does not count towards your maximum contribution of $20,500. However, the IRS does limit total contribution to a 401 from both the employer and the employeewhich means total contributions can’t exceed either:

-

100% of an employee’s salary, or

-

The limit for defined contributions .

The limit for defined contribution plans in 2022 under section 415 is $61,000 . Workers older than 50 years are still eligible for a $6,500 catch up contribution and can have a maximum of $64,500 in employer and employee contributions. This applies to both traditional and Roth 401s.

Recommended Reading: Can I Transfer From 401k To Roth Ira

Does The 401 Max Contribution Limit Include The Employer Match

There is a maximum limit on the total yearly employee pre-tax salary deferral. The limit is $20,500 for the year 2022, . Employees who are 50 years old or over at any time during the year are now allowed additional pre-tax catch up contributions of up to $6,500 for 2022.

For future years, the limit will be indexed for inflation, increasing in increments of $500. In eligible plans, employees can elect to have their contribution allocated as either a pre-tax contribution or as an after tax Roth 401 contribution, or a combination of the two. The total of all 401 contributions must not exceed the maximum contribution amount.

If the employee contributes more than the maximum pre-tax limit to 401 accounts in a given year, the excess must be withdrawn by April 15th of the following year. This violation most commonly occurs when a person switches employers mid-year and the latest employer does not know to enforce the contribution limits on behalf of their employee. If this violation is noticed too late, the employee may have to pay taxes and penalties on the excess. The excess contribution, as well as the earnings on the excess, is considered non-qualified and cannot remain in a qualified retirement plan such as a 401.

How Much Can You Contribute

For 2022, you can contribute up to $20,500, and an additional $6,500 if you are age 50 or older, or a total of $27,000. Note that employer matching contributions dont count toward this limit, but there is a limit for employee and employer contributions combined: Either 100% of your salary or $57,000 , whichever comes first.

When it comes to matching, specific terms of a 401k plan can vary widely. Your employer may use a very generous matching formula, or choose not to match employee contributions at all. Additionally, not all employer contributions to an employees 401k plan are the result of matching. Employers may make regular deferrals to employee plans regardless of employee contributions, though this is not particularly common.

Make sure you check your employers plan documents for the details on exactly how your 401k works.

Following are two common types of company contributions.

Recommended Reading: How To Open 401k For Individuals

Can I Contribute To Both A Roth 401 And A Traditional 401

You can. Depending on your personal situation, it may be smart to contribute to both a Roth 401 and a traditional plan, allowing you to diversify your tax strategy. If you participate in both types of plan, you can split your contribution any way you wish up to the maximum contribution limit. For example, you could defer $9,000 into your Roth 401 and $10,500 into a pre-tax 401 plan.

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

You May Like: Can I Pull My 401k To Buy A House