Where Can I Move My 401k Without Penalty

A direct 401 rollover gives you the option to transfer funds from your old plan directly into your new employer’s 401 plan without incurring taxes or penalties. You can then work with your new employer’s plan administrator to select how to allocate your savings into the new investment options. Transfer rules.

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

How Can I Withdraw Money From My 401k Without Penalty

Here are the ways to get free withdrawals from your IRA or 401

- No medical payments.

- The first of the health insurance.

- If you owe the IRS.

- Home buyers for the first time.

- Higher education costs.

- For entry purposes.

What qualifies as a hardship withdrawal for 401k?

Eligibility for Retirement Difficulty Certain medical expenses. Home purchase expenses for a main residence. Up to 12 months of schooling and expenses. Expenses to prevent them from being foreclosed on or expelled.

When can you withdraw from 401k tax free?

Stashing pre-tax cash on your 401 also allows you to grow it tax-free until you pick it up. There is no limit to the number of withdrawals you can make. After you turn 59, you can withdraw your money without having to pay an early retirement penalty.

Read Also: Is Fidelity Good For 401k

Tax Rules: Withdrawals Deductions & More

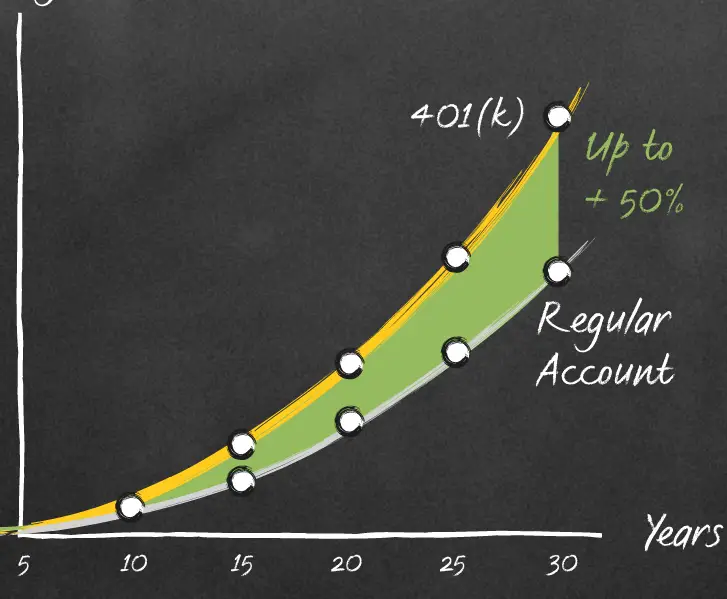

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pretax money in 2021 or $20,500 in 2022. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

Can You Avoid Paying Taxes On A 401 Cash

A 401 is an employer-sponsored retirement account. It’s a long-term investment account designed to reward employees who wait to cash out until retirement, while it penalizes those who withdraw money early. That said, there are a couple of ways to tap the funds in your 401 well before retirement without incurring taxes and penalties.

First, let’s briefly explain how a 401 works. An employee chooses to set aside a percentage of each paycheck before taxes and invest it in an employer-approved investment portfolio. The IRS limits how much an individual can invest annually in a 401 before taxes. The 2019 cap is $19,000, up from $18,500 in 2018 workers over 50 can make additional payments of up to $6,000 . Many employers offer to match a portion of employee contributions, usually 50 cents on the dollar up to 6 percent of the employee’s salary . These before-tax investments continue to grow tax-free, and the interest is compounded to maximize potential growth.

Once you reach 59 1/2 years old, you have a couple of options. You can cash out entirely and pay ordinary tax on the investment income, or you can avoid paying taxes by rolling the 401 distribution into another retirement account like an IRA. At some point, you will pay taxes to withdraw that money, but you won’t right away. If you try to take money out of your 401 before you turn 59 1/2, the funds are taxed as regular income — plus, you’ll get hit with a 10 percent early withdrawal penalty.

Also Check: Can I Withdraw 401k To Buy A House

Set Up A Direct Deposit

Direct deposit automatically deposits your payroll and other funds directly into your checking or savings account, eliminating the need to manually deposit checks. But all your funds neednt go into just one account. Setting up a split direct deposit allows you to direct a specific amount of money to your emergency fund with the remainder going to your checking account or vice versa. Automating the process not only simplifies saving, it can also help keep you on track toward your savings goals.

Penalties For Home And Tuition Withdrawals

Under U.S. tax law, there are several other scenarios where an employer has a right, but not an obligation, to allow hardship withdrawals. These include the purchase of a principal residence, payment of tuition and other educational expenses, prevention of an eviction or foreclosure, and funeral costs.

However, in each of these situations, even if the employer does allow the withdrawal, the 401 participant who hasn’t reached age 59½ will be stuck with a sizable 10% penalty on top of paying ordinary taxes on any income. Generally, youll want to exhaust all other options before taking that kind of hit.

In the case of education, student loans can be a better option, especially if they’re subsidized.

You May Like: When You Switch Jobs What Happens To Your 401k

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

How Do Rrsps Work

First off, if youve got a healthy RRSP, congratulations on being ahead of the game 39% of Canadians dont have any retirement savings at all. Not everyone who has an RRSP has a firm grasp on how they work, though, so lets quickly cover the basics.

The money you put into an RRSP is tax-deferred. You get to deduct your contributions from your taxable income for the year reducing the amount you pay or netting you a refund at tax time and you wont be taxed on any growth in the account.

You only pay when you withdraw the money, ideally when youre retired and in a much lower income-tax bracket.

Its a smart way to build your wealth, but there is a limit to how much you can contribute.

Each year, youre allowed to contribute up to 18% of your pretax income Any unused contribution room rolls over, increasing your limit next year so you can make up for lost time.

Also Check: How Much Can I Take Out Of My 401k

Do You Have To Pay Back A Hardship Withdrawal From A 401

Qualified hardship withdrawals from a 401 do not need to be repaid. However, you must pay any deferred taxes due on the amount of the withdrawal. You may also be subject to an early withdrawal penalty if the hardship withdrawal is not deemed qualified or if you withdraw more than needed to exactly cover the specific hardship.

How Much Is Taxed On A 401k Withdrawal

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal.

Also Check: How To Open A Solo 401k

What Happens If Your Hardship Letter Is Rejected

If your hardship request is denied, you can appeal. If all else fails, you can withdraw the funds and pay the 10% penalty along with the income tax.

There are also alternatives to hardship withdrawals, including:

-

401 loans: Many 401 plans let you take out a loan. Youre essentially borrowing your own money and paying yourself back with interest. The IRS restricts the loan amount to 50% of your vested account balance or $50,000 whichever is less. Generally, you have up to 5 years to pay it back.

A 401 loan may not work for you if you doubt youll be able to pay back the funds within 5 years. Also, its not the best option if your job isnt secure. If you were to leave the company, youd have to repay the loan balance all at once.

-

Balance transfer credit cards: You may be able to qualify for a new credit card with a promotional 0% interest rate and a high credit limit. If so, that may buy you some time to pay the medical debt without interest. But you would want to make sure you can pay off the credit card balance during the special intro period, which is typically 12 to 18 months, Otherwise youll be stuck with a high interest rate possibly 25% or more.

-

Personal loans: Taking out a personal loan or home equity loan could help you avoid dipping into your retirement funds. If youre in financial hardship, though, it may be difficult to get approved.

Taking Normal 401 Distributions

But first, a quick review of the rules. The IRS dictates you can withdraw funds from your 401 account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work. Depending on the terms of your employer’s plan, you may elect to take a series of regular distributions, such as monthly or annual payments, or receive a lump-sum amount upfront.

If you have a traditional 401, you will have to pay income tax on any distributions you take at your current ordinary tax rate . However, if you have a Roth 401 account, you’ve already paid tax on the money you put into it, so your withdrawals will be tax-free. That also includes any earnings on your Roth account.

After you reach age 72, you must generally take required minimum distributions from your 401 each year, using an IRS formula based on your age at the time. If you are still actively employed at the same workplace, some plans do allow you to postpone RMDs until the year you actually retire.

In general, any distribution you take from your 401 before you reach age 59½ is subject to an additional 10% tax penalty on top of the income tax you’ll owe.

Don’t Miss: How To Move A 401k To A Roth Ira

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Don’t Miss: Where Is My 401k Account

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

career counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

A Note On Individual Retirement Accounts

If your employer doesnt offer a 401 and you decide to contribute to a traditional IRA instead, your taxes will work very similarly. However, your employer doesnt manage your IRA. You are responsible for making contributions, so your employer wont consider any of those contributions when reporting your earnings at the end of the year. Because your employer isnt excluding IRA money from your earnings, you will need to deduct your contributions on your tax return if you want to get the tax benefits. One big difference with 401 plans and IRAs is that IRAs have a much lower contribution limit. You can only deduct $6,000 in IRA contributions for the 2021 and the 2022 tax year if you are 49 or younger. There are also income limits above which you cant contribute this full amount. If youre 50 or older you can add an extra $1,000 per year as a catch-up contribution, which raises limit to $7,000.

Also Check: How Do I Withdraw Money From My 401k Fidelity

Stay Within The Limits

Hardship withdrawals must stay within the limits of the actual financial hardship, however thats defined by the plan. For example, a 401 hardship withdrawal is limited to the immediate financial need. So you cannot take out more than you need in any one hardship scenario.

Your 401 plan may limit your hardship withdrawal to your own contributions, as well. So youll want to carefully check how much you are able to access and stay within the rules.

In the case of IRAs, you can avoid a 10 percent penalty on IRA withdrawals related to medical hardship, among other reasons. But the hardship amount must be the difference between the actual need and 10 percent of your adjusted gross income. So youre footing the bill for that first 10 percent and only then may you receive a penalty-free withdrawal on the subsequent amount.

In either case, abide by the plans rules carefully.

Taxes On 401 Contributions

Contributions to a traditional 401 plan come out of your paycheck before the IRS takes its cut. Youll sometimes hear this referred to as pre-tax income, and it means two things: 1) you wont pay income tax on those contributions, and 2) they can reduce your adjusted gross income.

An example of how this works: If you earn $50,000 before taxes and you contribute $2,000 of it to your 401, that’s $2,000 less you’ll be taxed on. When you file your tax return, youd report $48,000 rather than $50,000.

A few other notable facts about 401 contributions:

-

In 2022, you can contribute up to $20,500 a year to a 401 plan. If you’re 50 or older, you can contribute $27,000.

-

The annual contribution limit is per person, and it applies to all of your 401 account contributions in total.

-

You still have to pay some FICA taxes on your payroll contributions to a 401.

-

Your employer will send you a W-2 in January that shows how much it paid you during the previous calendar year, as well as how much you contributed to your 401 and how much withholding tax you paid.

See more ways to save and invest for the future

-

Our retirement calculator will show whether you’re on track for the retirement you want.

-

Stocks are a good long-term investment even during periods of market volatility. Here’s what to know.

Read Also: Can I Borrow Against My 401k To Pay Off Debt