Do I Qualify For My Employers 401 Matching Program

If you started a new job, you should find out if your new employer has a 401 matching program and the eligibility requirements for new employees. Employee eligibility is at the employerâs discretion, and most employers may require the employee to have worked for the company for a specific period to get the benefit. Some companies may also offer 401 matching to the top executives as part of the employee compensation plan to retain top talents.

If you were recently enrolled in the employer’s matching program, but don’t know how it works, you should talk to the human resource manager or 401 plan administrator to get more information on the matching program. You should ask about the type of matching offered, whether it is a partial or full match, and the matching limits. You should contribute the highest amount that allows you to collect the full employer’s match, without stretching your finances beyond what you can afford.

Do Employers Match Contributions To A Roth 401

Yes, but theres a catch. If you contribute money to a Roth 401 plan, which allows you to make contributions with after-tax dollars in return for tax-free withdrawals during retirement, your employers matching contributions will be made in a separate traditional 401 plan. This is because youre required to pay taxes on contributions made by your employer and those taxes wouldnt be paid if they were made to a Roth 401 plan.

Also Check: How Do You Max Out Your 401k

How Companies Can Offer A 401 Match

Tax-advantaged retirement plans like 401s are regulated by the Internal Revenue Service and the Employee Retirement Income Security Act . They allow employees to contribute a percentage of their paycheck with pretax income and then choose their investments. The contributions are not subject to federal income tax until theyre withdrawn at a later date, typically during retirement years.

Companies can contribute to their employees 401 plans in several ways, such as dollar-for-dollar matches or partial matches. With dollar-for-dollar matches, the employer will contribute the same amount of money that the employee doesup to a certain amount. For example, if an employee contributes $100 per paycheck, the employer will also contribute $100.

With partial matches, the employer can contribute a percentage of what the employee contributes. For example, if an employee contributes $100 per paycheck, the employer may offer a 50% contribution, or $50.

Companies can offer a matching benefit or other types of contributions. Then, they can deduct their contributions up to the IRS limit. To receive tax deductions, companies cannot offer different contribution matches to management from what they offer to their employees. The company also cannot contribute more than the legal limit, which is 100% of the employees annual pay or $61,000 as of 2022, whichever is the lower value.

Don’t Miss: Can I Rollover My 401k

Simpson Thacher & Bartlett

The Simpson, Thacher & Bartlett law firm offers a defined contribution plan with a 401 component and a profit-sharing feature. The companys plan has over 1,200 users with a $270,000 average account balance. The firms other benefits include flexible work arrangements, off-site emergency child care, a subsidized on-site cafeteria, a $2,500 technology stipend and matching donations to law schools.

A Closer Look At Your Available Options

The good news is whatever money thats in your 401 is yours to do with as you like. But when you no longer work for a company, any retirement accounts you have through your former company might need to be moved to your new employer. Or you may need to roll it over or into a brokerage account that you own completely.

Don’t Miss: How To Search For Unclaimed 401k

How Does Employer 401 Matching Work

An employer 401 contribution match is one of the best perks going. An employer match is literally free money and with our good friend compound returns coming in clutch, it can make a serious difference in how much money youll have when you retire. Its kind of like being given magic beans without having to sell the cow.

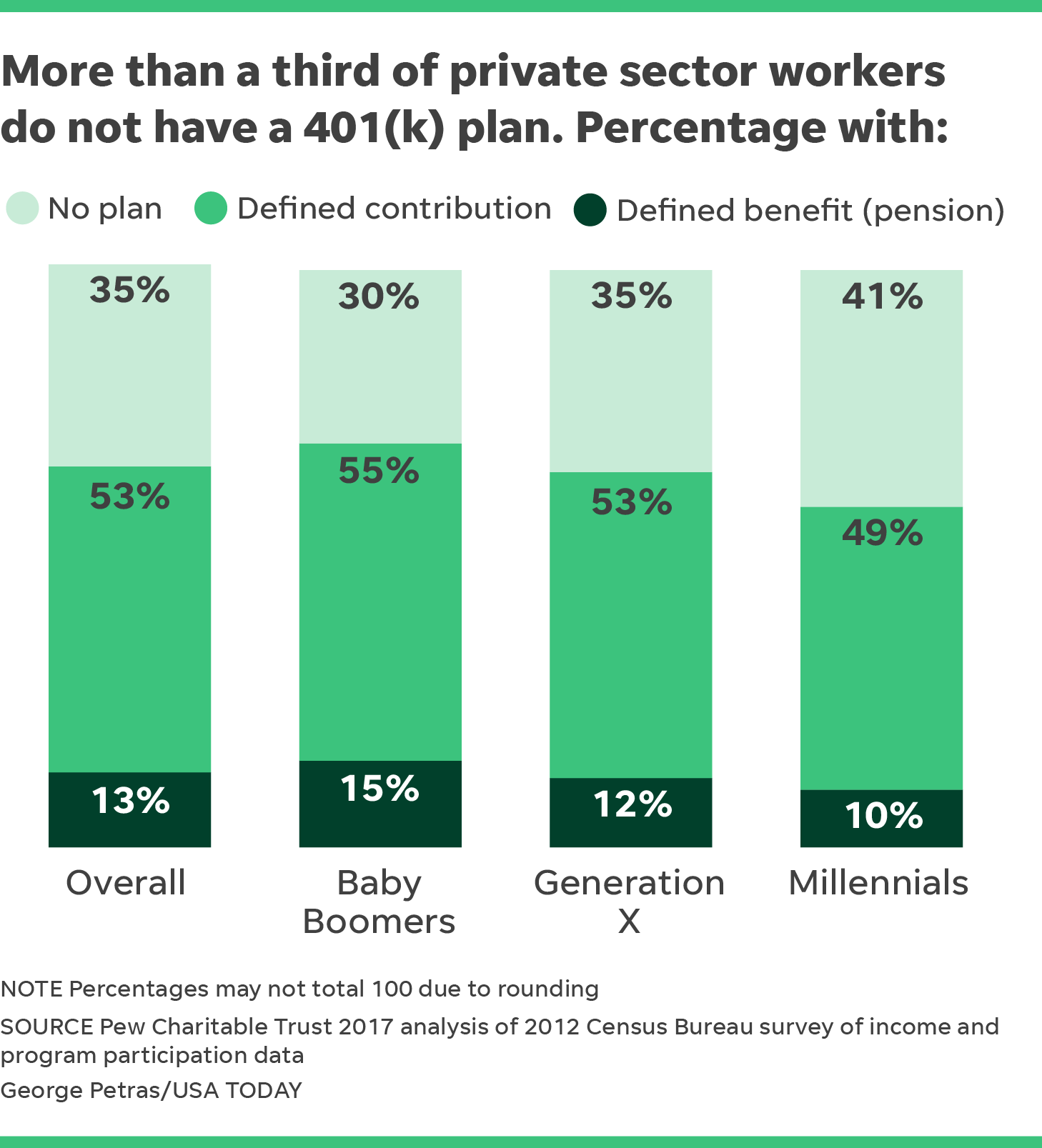

Even better: This is no fairy tale. In fact, employer matches are pretty common. More than three-quarters of employers with fewer than 1,000 401 plan participants offer a match and that percentage only goes up the bigger the company and the plan.

If your employer offers a 401 match, heres what you need to know.

Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

Read Also: Why Is A 401k Good

Changing Jobs You Might Be Able To Bring Your Old 401 With You

If youre moving to a new job with a new 401, you can simply keep your old 401 with your former employer, where it will continue to grow youll always retain complete ownership. But you also might be able to transfer the funds from your old plan directly to your new 401 without paying penalties or taxes. Its called a rollover, and some employers allow them and some dont. Check with HR at your new job.

More From GOBankingRates

United Technologies 401k Match

United Technologies has an automatic employee enrollment feature in its 401 plan that starts at a contribution rate of 6%. This rate increases by 1% every year until it reaches 10%.

United Technologies matches 60% of an employeeâs first 6% of their eligible pay contributed to the 401, which is equivalent to 3.5% for employees who contribute at least 6% or more into the plan.

Apart from matching contributions, United Technologies also makes automatic contributions to the 401 plan based on the employeeâs age. Employees below 30 receive 3% in automatic contributions while those above 50 receive 5.5%.

Employees are 100% vested in the matching contributions after three years of employment.

Read Also: When Can I Borrow From My 401k

Lockheed Martin 401k Match

Lockheed Martinâs 401 plan is one of the most generous plans in the US.

Starting 2020 January, the company increased automatic contribution from 2% to 6%, in addition to the existing 4% match. Therefore, Lockheed Martin contributes up to 10% of the employeesâ compensation i.e. 4% match and 6% automatic. The 4% match applies to salaried employees, who get 50% match up to 8% of their contribution to the 401.

Lockheed Martin employees get immediate vesting of the employerâs contribution.

How Does 401 Matching Work For Roth 401

If you contribute to a Roth 401 account, your employer will match your contributions at the same rate as traditional 401s. A Roth 401 has a lot of similarities with a traditional 401 plan, except that its contributions are taxed upfront, and you won’t be required to pay taxes on withdrawals.

If your employer matches traditional 401 plans, it should offer a match for Roth 401 plans. When matching Roth 401 contributions, the contributions are made before taxes are paid for it. Therefore, you will owe taxes on the portion of the employer’s contribution when you take a distribution. In simple terms, the employer’s matching contributions go into a traditional 401, and you will be required to pay taxes on the employer’s contributions and any investment growth associated with the match when you make a withdrawal.

Tags

Also Check: How To Get Money Out Of My 401k

Is It A Good Idea To Take Early Withdrawals From Your 401

There are few advantages to taking an early withdrawal from a 401 plan. If you take withdrawals before age 59½, you will face an additional 10% penalty in addition to any taxes you owe. However, some employers allow hardship withdrawals for sudden financial needs, such as medical costs, funeral costs, or buying a home. This can help you skip the early withdrawal penalty but you will still have to pay taxes on the withdrawal.

Why Do Employers Match 401 Contributions

Why would employers match 401 contributions? Perhaps the foremost reason is that employers view the matching contribution as a means of attracting and retaining top talent so that they dont have to continually hire and retrain a revolving door of workers.

Its also in their best interest to encourage as many eligible employees to participate in the plan and save as much as they can so the highly-compensated employees and business owners can contribute the maximum amounts to their own plans without failing annual IRS tests for fairness and nondiscrimination.

Favorable tax benefits make it even easier for companies to offer this benefit to their workers. Employers can deduct 100% of their matching contributions on their federal income tax returns, as well as 25% of what all eligible employees contribute.

How much will you pay for 401? Get an instant quote.

Read Also: How To Find Old Employer 401k

Is Offering A 401 Employer Match Mandatory

Although offering a 401 employer match for employees retirement plans may benefit your business, there are no laws requiring employer matching. However, if you do offer a 401 employer match contribution program, you are legally required to conduct nondiscrimination testing to ensure your program equally benefits all of your employees. These IRS-created tests, known as the Actual Deferral Percentage and Actual Contribution Percentage tests, ensure that your companys most highly paid employees benefit as much from tax-deferred contributions as your other employees.

Also, even though its not mandatory, the best employee retirement plans typically include matching as part of the retirement fund package. A certified financial advisor can walk employers through the legalities of 401 matching and the different components of 401 programs.

Did you know? Some payroll companies also operate 401 plans. See our review of ADP for one such example.

How 401 Plan Contribution Limits Work

The 401 plan is a long-term savings plan designed to help people build their retirement savings. The IRS labels a 401 as a qualified retirement plan, which means it has certain tax benefits for the employee, the employer, or both.

The tax advantage for employees is that their contributions are deducted from gross income, not net income. That means less take-home pay, which lowers the employees taxes, and the money goes into an investment account on an ongoing basis.

For some 401 plans, employers can match some percentage of their employees contributions, but its strictly voluntary. The average 401 match ranges from 3% to 7% of the employees gross salary.

Recommended Reading: How To Apply For 401k With My Job

How Do 401 Matches Work

Every 401 plan is different, so youll have to check your employers plan for the details on exactly how yours works. But there are two common types of matches:

Partial matching

Your employer will match part of the money you put in, up to a certain amount. The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%. If you put in more, say 8%, they still only put in 3%, because thats their max.

Heads-up that you might see this written in a lot of different ways. 50 cents on the dollar up to 6%, 50% on the first 6%, 3% on 6% you get the picture. All various ways to describe a partial match.

Dollar-for-dollar matching

With a dollar-for-dollar match , your employer puts in the same amount of money you do again up to a certain amount. An example might be dollar-for-dollar up to 4% of your salary. In this case, if you put in 4%, they put in 4% if you put in 2%, they put in 2%. If you put in 6%, they still only put in 4%, because thats their max.

The Role Of The Company In Matching The 401

Presently, many employers choose to match a portion or all of their employees retirement plan contributions. Generally, employers are not legally obligated to offer a matching contribution program to their employees retirement plan accounts. The only exceptions are for SEP IRA and Simple IRA plans that are implemented for employees of small businesses.

Most employers offer matching contributions to their employees 401 retirement plans as a significant portion of an employee benefits package. Also, employers are incentivized to offer such contribution plans as they stand to receive a tax benefit for such contributions to employee 401 accounts. Additionally, matching contributions provide a mechanism by which the value of the retirement savings accounts can greatly increase.

If you need help understanding 401 matching, you can post your legal need on UpCounsels marketplace. UpCounsel accepts only the top 5 percent of attorneys to its site. Lawyers from UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

Read Also: What Are Terms Of Withdrawal 401k

What Is A Partial 401 Match

With a partial 401 match, an employers contribution is a fraction of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

Matching structures vary by plan, said Young. In fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.

Lets say you earn $40,000 per year and contribute $2,400 to your 4016% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

Full 401 Matches In 2022

Full 401 matching means employers put in dollar-for-dollar what employees contribute, up to a set default rate or the IRS maximum. While 3% was the norm at one time, 65% of plans are now using a default rate higher than 3% in order to significantly boost savings for participants over time. In 2022, the most common default rate is now 6% of pay, according to the Plan Council Sponsor of America.

Don’t Miss: How Much Can I Contribute To My 401k Plan

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

What Is A Good 401 Match

A good 401 match is usually 5% to 7% of your salary, up to a dollar-for-dollar match. For example, if you contribute 5% of your $50,000 salary, your employer will contribute 5% as well, for a total contribution of 10%. If you contributed 7%, your employer would contribute the full 7%. The 401 contribution limit for 2019 is $19,000, so if youre contributing 5%, thats $950 per year. A good 401 match can help you reach your retirement savings goals sooner. And its free money! So if your employer offers a 401 plan with a good match, take advantage of it.

Dont Miss: How To Take Out 401k Without Penalty

Read Also: Where Can I Cash A 401k Check

Taxes And Employer 401 Matching Contributions

You dont have to pay any income taxes on employer 401 matching contributions until you start making withdrawals.

Gross income includes wages, salaries, bonuses, tips, sick pay and vacation pay. Your own 401 contributions are pre-tax, but still count as part of your gross pay. However, your employers matching contributions do not count as income, said Joshua Zimmelman, president of Westwood Tax & Consulting.

Your employers matching contribution grows tax-deferred in a traditional 401, boosting your compounding returns over the years. You dont have to pay any taxes on the employer match until you start making withdrawals, said Zimmelman. Traditional 401 withdrawals are taxed as ordinary income at whatever tax bracket youre in when you make those withdrawals..

Timing Payments For The Most Money

Some employers will pay their match no matter how many paychecks it takes for you to reach your allowed amount for the year. But many companies will make a contribution only during the pay periods when 401 money is taken from your paycheck. You can avoid leaving employer money on the table by putting in smaller amounts each pay period. That way, your employer will put money into your account in every period.

Let’s say you’re paid twice a month, and your employer will only add money into your 401 when you do. If you reach your $19,500 limit at the end of November, you’ve missed out on two chances for your employer to make its match. In this case, you’d be earning much more than $50,000 a year, but this issue could apply no matter how much you earn if you put too much money into your 401 too soon.

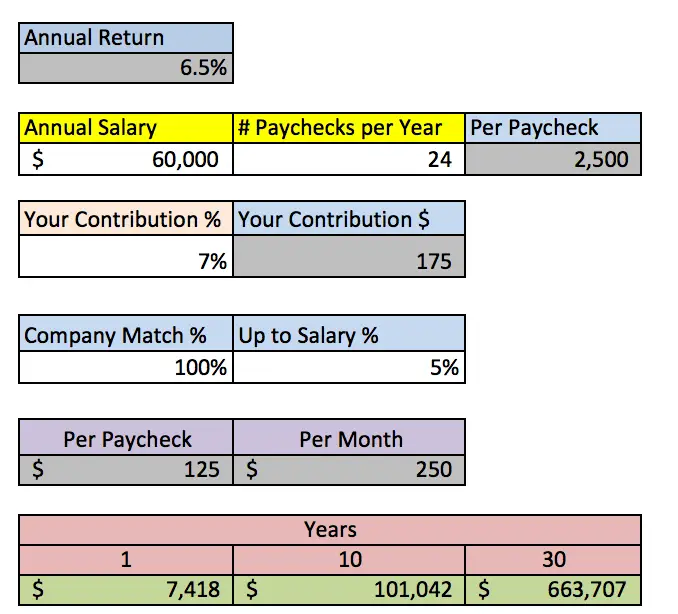

Your plan manager can help you manage your 401 account to make the most of your employer match. You can also use an online calculator to figure out how much you should put in from each paycheck.

Also Check: How Much Will My 401k Grow If I Stop Contributing