How Many People Have 401k Money

How many Americans have 401 s? In 2020 there were approximately 600,000 401 plans with approximately 60 million active subscribers and million former employees and retirees.

How much does the average person have in their 401k?

The average 401 balance is $ 106,478, according to Vanguards 2020 analysis of over 5 million plans. But most people havent saved that much for retirement. The median balance of 401 is $ 25,775, a better indicator of what Americans have been saving for retirement.

How many people have $1000000 in their 401k?

The number of 401 accounts with $ 1 million or more with Fidelity Investments rose 84% year over year to 412,000, while the number of seven-digit IRAs in the 12 months ended the second quarter, Fidelity said .

Inaction Can Be Costly

If you have left money behind, it would behoove you to track it down. The average balance in forgotten accounts is $55,400. Over a lifetime, says Capitalize, failure to reclaim these assets could cost individuals as much as $700,000 in retirement savings, an estimate based on data from the U.S. Department of Labor, the Census Bureau, 401 record-keepers, IRAs and the Center for Retirement Research at Boston College.

Forgetting about old 401s, and how much money is in them, is very common, says Kashif Ahmed, a CFP at American Private Wealth in Bedford, Massachusetts. Recently, we uncovered one for a client that had more than triple what she thought it had. Youve worked for this money, so its important to locate it and keep building it, says Tess Zigo, a CFP at Emerge Wealth Strategies in Palm Harbor, Florida. I’ve seen many young folks believe it or not who have old accounts sitting in money market funds not earning a dime.

Us Department Of Labors Abandoned Plan Search

In certain cases, such as in bankruptcies, employers abandon the 401 plans they provided to employees. If that happens, theyre required to notify you so you can receive the funds owed to you. If you werent notified or believe your plan may have been abandoned, you can use the U.S. Department of Labors Abandoned Plan Search. You can search by employer or plan name, and if a plan is found, youll receive the plan administrators contact information.

Also Check: How To Create A 401k

Questions To Ask Yourself Before Retiring

As you plan, consider these important questions:

- At what age do you plan to retire?

- Can you participate in an employer’s retirement savings plan? This includes 401 plans and traditional pension plans.

- If you have a spouse or partner, will they retire when you do?

- Where do you plan to live when you retire? Will you downsize, rent, or own your home?

- Do you expect to work part-time?

- Will you have the same medical insurance you had while working? Will your insurance coverage change?

- Do you want to travel or pursue a costly, new hobby?

Look For Contact Information

If you don’t know how to contact your former employer — perhaps the company no longer exists or it was acquired or merged with another company — see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

Read Also: How Much Income Will My 401k Generate

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Read Also: What To Do With 401k When Leaving A Job

Tracking Down Your Plan

If you think youve lost track of a savings plan, search your files for old retirement account statements. These should provide some key data to help your search, such as your account number and contact information for the plan administrator. If you dont have any statements, contact your former employers human resources department.

If your employer filed for bankruptcy, your 401 balance is protected from creditors and is likely still held at the investment company that administered your plan. In the case of a pension, it was either taken over by an insurance company or the federal Pension Benefit Guaranty Corp., which protects traditional pensions. You can track down your pension at pbgc.gov/search-all.

Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money. You can also check the National Registry of Unclaimed Retirement Benefits.

How Much Social Security Will I Get If I Make $100 000 A Year

If youre making $ 100,000 a year right now, congratulations! You roughly triple the Social Security Administrations estimated 2019 median annual earnings of $ 34,248, doubling the average individual annual earnings of $ 51,916 a figure that is skewed higher by a handful of super-earners.

How much Social Security tax would a person who makes $100000 a year pay?

The Social Security Administration charges 6.2% of your earnings up to the first $ 142,800 . Any income beyond this figure is not subject to additional FICA taxes. It is, of course, subject to higher income tax rates.

How much SS will I get if I make 100k a year?

If youre making $ 100,000 a year right now, congratulations! You roughly triple the Social Security Administrations estimated 2019 median annual earnings of $ 34,248 and double the average individual annual earnings of $ 51,916 a figure that is skewed higher by a handful of super-earners.

Recommended Reading: Can I Retire With 500k In My 401k

Contact Your Hr Department

If you dont know where to check your 401 balance, your HR department can at least direct you to the entity that manages your companys 401 plan. Then, you can contact the 401 plan administer by phone or over the internet to check the balance of your 401 plan. You can also check how the money is invested and whether its time for you to rebalance your portfolio.

Video of the Day

Read Also: Can You Convert Your 401k To A Roth Ira

What Happens To Old 401s

401 administrators have different procedures for what to do with left behind accounts. Depending on the amount, they could be distributed directly to you, transferred to an IRA on your behalf, or sent to a separate holding account until you claim them.

Unwilling to bear the burden of maintaining vast amounts of accounts from former employees, 401 plans prefer to unload them any way possible. This can make it challenging to find your old 401s.

Dont Miss: How To Cash Out 401k After Leaving Job

You May Like: How To Use Your 401k To Start A Business

How To Find Your Old 401 Accounts

1. Contact your former employer

You can start your search for your missing retirement savings by contacting your former employers human resources department. Simply tell them youre a former employee who wants to access a 401 plan you left behind. Then, theyll likely ask you for identifying information and dates of employment to help search their record.

If the HR department can locate your 401 account, theyll let you know what your options are for accessing the account. They can also give you steps to take to roll those assets over into your new employers 401 or to a rollover IRA account.

However, you might run into a hiccup if youre previous employer has been acquired by another company. In this case, you can search online for news about the acquisitions details, including the name and location of the purchasing company. If youre still in touch with former colleagues from that job, they may be able to provide you with the information as well.

2. National Registry of Unclaimed Retirement Benefits

If your online sleuthing doesnt turn up the information you need to find your old 401, dont despair. You can search the National Registry of Unclaimed Retirement Benefits, which helps employers connect with former employees who have left assets behind in a retirement plan.

3. U.S. Department of Labors Abandoned Plan Search

4. Use Beagle, the 401k super sleuths

How To Send A Package Via India Post

Follow the below steps to send the article to avoid delays or return of the parcel:

- Always write complete and correct address with pin code of the sender and receiver.

- Make it easy to read. Avoid periods, commas, or other punctuation.

- Check the weight of the package, then calculate the postage value according to weight.

- Donât put the prohibited items in the package.

- Visit the nearest post office.

- Pay the money according to weight.

- Post office attendee will give you a receipt.

- Put receipt safely until the parcel reaches the destination.

- Track consignment status here.

Don’t Miss: How Much Fidelity Bond For 401k

Texa$aver 401 / 457 Program For Active Employees

Its never too soon to plan for a more financially secure retirement. As you begin to plan for retirement, be sure to make good use of tax-advantaged savings like the Texa$aver program. With the Texa$aver voluntary retirement savings program, you can increase your personal retirement savings to bridge the financial gap between your pension and Social Security.You already contributed to the ERS retirement fund, with the State and the agency you worked for also contributing on your behalf, but your ERS annuity may replace only about 50% of your salary when you retire. Your State of Texas retirement plan does not include automatic cost-of-living adjustments . During retirement, a Texa$aver account can help you weather inflation and increased medical expenses as you age.

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Recommended Reading: How To Claim 401k Money

Also Check: How To Use 401k To Pay Off Debt

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

Track Down Old 401 Plan Statements

The first thing you can do to find money held in forgotten 401 accounts is to go through old plan statements you may have. The statements could have come in the mail or you may have received them electronically through email.

Finding these statements makes it easier to know which employers you were at during the period when you had the 401 plan and can help you determine who to contact to access your account. You can also check with former co-workers who are still with the company to see who you should get in touch with.

You May Like: Should I Roll Over 401k To Ira

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Why You Should Recover Your Old 401

Theres a simple reason why you should attempt to recover a lost 401 account: Its your money. Whether your old 401 plan holds a lot of money or a little, every penny counts when staying on track with your retirement savings.

Another important point to consider: If youve changed jobs multiple times, its possible that you could have more than one lost 401 and taken together, that money could make a surprising difference to your nest egg.

Last, if you were lucky to have an employer that offered a matching 401 contribution, your missing account may have more money in them than you think. For example, a common employer match is 50%, up to the first 6% of your salary. If you dont make an effort to find old 401 accounts, youre missing out on that free money as well.

Also Check: How To Convert My 401k To Roth Ira

Read Also: How To Withdraw Money From 401k Before Retirement

Tips To Save For Retirement

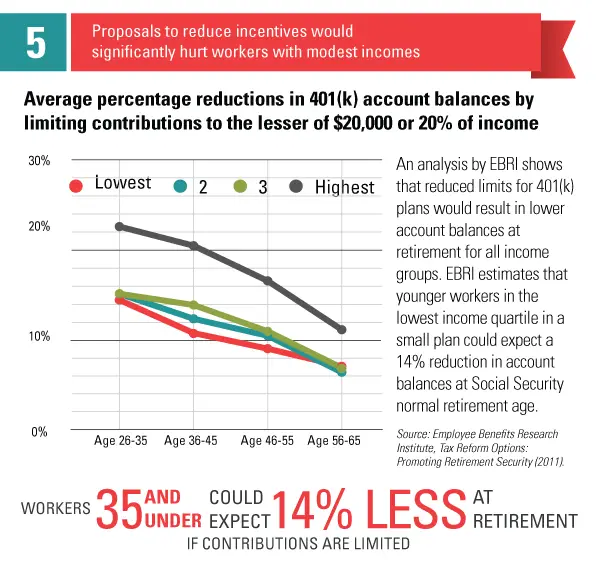

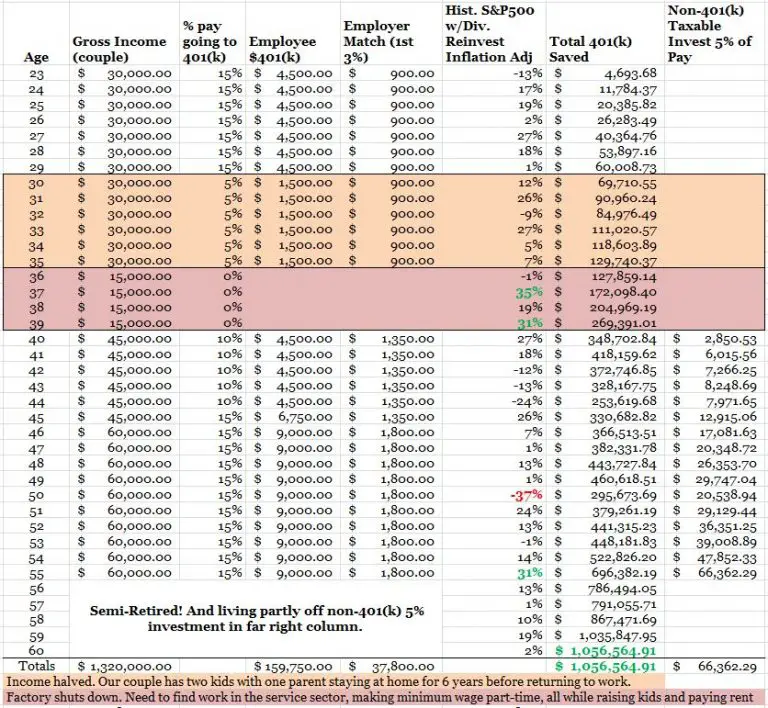

That most Americans dont have nearly enough savings to sustain them through retirement is sad but true. How do you avoid that fate? Here are some steps that you can take, whether youre early in your career or closer to your retirement.

Of course, start saving and investing as early as you possibly can. The longer you have, the better, especially where the power of compounding interest is concerned. Retirement may seem a long way off but when it comes to saving for it, the days can dwindle away quickly and any delay costs more in the long run.

Speed Post Tracking Enquiry Through Online Live Website

This is the method that is recommended the most and the feature that is considered to be the best when inquiring about the status of your present package. It accomplishes its goals with pinpoint precision. It is uncomplicated, dependable, and quick. Additionally, it is an inexpensive service of the highest possible quality. The following is a list of some of the greatest websites that you can use to conduct research:

Read Also: How To Get Your 401k From An Old Job

Follow These Steps With Help If You Need It

At the same time, finding your old accounts may be challenging for several reasons. In the first year of the pandemic, for example, hundreds of thousands of U.S. businesses closed permanently. In addition, says Zigo, you may have moved, or changed your email address, so your previous employer cant find you. Your old 401 plan may have changed sponsors. One of my clients has tried 10 times to reach a previous sponsor. It can be a frustrating process. And the bigger the hurdle, the less likely we are to try, she says. But help is available. A qualified financial planner can guide you through the following steps.

1. Take stock of your accounts

First, make a list that includes every employer where you contributed to a 401, suggests Charles Sachs, a CFP at Kaufman Rossin Wealth LLC in Miami, Florida. Next, call each one to see if they still have an account in your name, and update your contact information, if needed. Reaching out to them is the only way to find out where you stand, Sachs says. Its common for our clients to discover one or two old plans where they still have funds.

2. If a company has closed, check these websites

You can search for your money, which may be considered unclaimed property, at databases such as unclaimed.org and missingmoney.com. Both have links to state treasurers, comptrollers or other officials who update their lists of unclaimed assets regularly.

3. Rollover the money directly to avoid expensive withholding