Consider Taking Out A 401k Loan Rather Than Withdrawing

To avoid early withdrawal fees, consider taking out a 401k loan. A 401k loan is money borrowed from your retirement fund. This loan charges interest payments that are essentially paid back to your future self. While some interest payments are put back in your account, your opportunity for compounding interest may slightly decrease. Compounding interest is interest earned on your principal balance and accumulated interest from past periods. While you may pay a small amount in interest fees, this option may help you avoid the 10 percent penalty fee.

As your retirement account grows, so does your interest earned thats why time is so valuable. While taking out a 401k loan may be a better option than withdrawing from your 401k, you may lose out on a small portion of compounding interest. When, or if, you choose to take out a 401k loan, you may start making monthly payments right away. This allows your payments to grow interest and work for you sooner than withdrawing from your 401k.

This type of loan may vary on principle balance, interest rate, term length, and other conditions. In most cases, youre allowed to borrow up to $50,000 or half of your account balance. Some accounts may also have a minimum loan balance. This means youll have to take out a certain amount to qualify. Interest rates on these loans generally charge market value rates, similar to commercial banks.

Save more, spend smarter, and make your money go further

Repaying Funds Now Vs Paying Taxes

If you have already taken a coronavirus-related distribution, the issue now is whether you recontribute the funds back to the plan , and whether you should pay taxes on the distribution if you dont put the money back this year.

On the first front, replacing withdrawn funds from tax-deferred savings accounts as quickly as you can is generally a good idea.

The length and costs of the average Americans retirement continue to increase, and you may live to regret spending retirement savings now.

The quicker you repay it, the quicker it begins earning a return again, said Luscombe of Wolters Kluwer.

The timing could be better.

Individuals who took distributions earlier this year, missed out, at least to a degree, on one of the strongest recoveries from a bear market in history. People reinvesting withdrawals back into the stock market now will be doing so at much higher valuations.

As for how to account for the distribution and when to pay taxes on it, it depends on your financial circumstances.

If you lost your job or took a hit to income this year, but expect your situation to improve, you can return the funds within the next three years and file an amended return.

This way, you get a refund of the taxes you paid in the years the withdrawal was included in your income.

However, if you ultimately cant repay the money within three years, you will owe taxes and possible penalties.

He recommends people pay taxes on one-third of the distribution this year.

Drawbacks To Using Your 401 To Buy A House

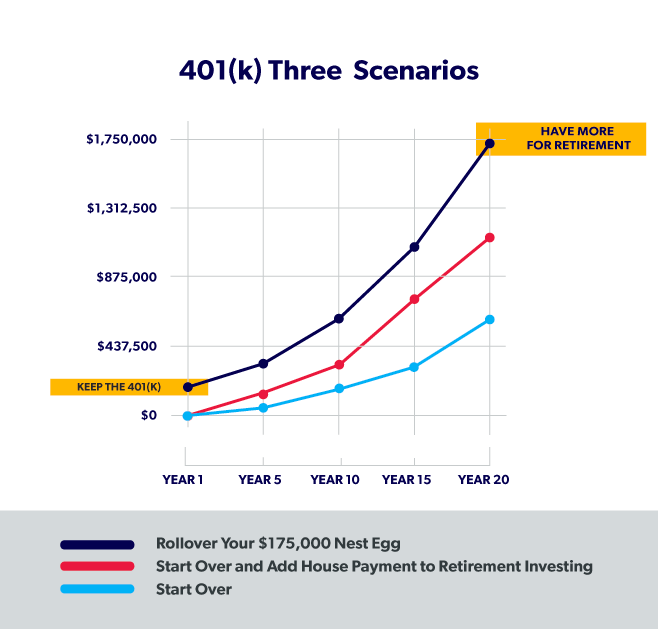

Even if its doable, tapping your retirement account for a house is problematic, no matter how you proceed. You diminish your retirement savingsnot only in terms of the immediate drop in the balance but in its future potential for growth.

For example, if you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could potentially grow to $54,000 in 25 years with a 7% annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,000 in 25 years, earning the same 7% return.

Dont Miss: How To Find Old 401k Plans

Read Also: Why Is Ira Better Than 401k

Taking A 401k Loan Might Not Be Such A Good Idea

A 401K is supposed to help you have money in retirement. When you temporarily take money out of the plan, it inhibits its ability to compound with interest or stock market growth. You may end up with less money in retirement than if you had left the money in your 401K. In addition, if you terminate your employment, youll owe a 10% penalty and income taxes on the balance unless you can pay the loan back right away. 401K loans may also have fees and the payment terms are often very inflexible. Finally, taking a 401K loan may be a sign of broader financial distress.

Move Your Money To Your New Employers Plan

If you have a new employer offering a retirement plan, you may be able to transfer your savings into it.

- Your savings stay invested with the same tax advantages

- You might be able to roll in savings from other retirement plans

- You can make ongoing contributions.

- The investment options depend on what the plan offers.

- You may be able to take out a plan loan, or withdraw money before retirement under certain circumstances

Recommended Reading: How Long Will 500k Last In 401k

Use A Portfolio Line Of Credit

You could also consider taking out a portfolio line of credit, which is essentially a loan backed by securities held in your portfolio, such as stocks or bonds. Interest rates on a portfolio line of credit tend to be lower than that of traditional loans or credit cards because theyre backed by collateral that the lender will receive in the event you cant pay back the loan.

However, if the value of your collateral falls, the lender can require you to put up additional securities. The lender could also become concerned with the securities being used as collateral. Government bonds will be viewed as much safer collateral than a high-flying tech stock.

Taxes For Making An Early Withdrawal From A 401

The minimum age when you can withdraw money from a 401 is 59.5. Withdrawing money before that age results in a penalty worth 10% of the amount you withdraw. This is in addition to the federal and state income taxes you pay on this withdrawal.

There are exceptions to this early withdrawal penalty, though.

If you want to remove money from a 401 account without paying taxes, you will need to meet certain criteria. According to the IRS, you generally dont have to pay income tax or an early withdrawal penalty if you experience an immediate and heavy financial need. One situation where this may apply is when you have medical expenses that arent reimbursed by your insurance and which exceed 7.5% of your modified adjusted gross income . If this happens, you dont have to pay taxes on the money you withdraw to cover that financial need. There are also other exceptions, such as for disabled taxpayers. The IRS provides a more complete list of situations where you wont pay tax on early withdrawals.

The big caveat here is that the amount you can withdraw tax-free is exactly enough to cover the cost of this financial need. And youll still pay the full income tax on your withdrawal only the 10% penalty is waived.

Read Also: How To Find Out If I Have Any 401k

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Series Of Substantially Equal Periodic Payments

This is the classic Section 72t ) method for early withdrawal exceptions to the penalty. Essentially you agree to continue taking the same amount from your plan for the greater of five years or until you reach age 59½. There are three methods of SOSEPP:

7. Required Minimum Distribution method uses the IRS RMD table to determine your Equal Payments.

8. Fixed Amortization method in this method, you calculate your Equal Payment based on one of three life expectancy tables published by the IRS.

9. Fixed Annuitization method this method uses an annuitization factor published by the IRS to determine your Equal Payments.

Section 72 provides additional methods for premature distribution exceptions which can occur before leaving employment :

10. High Unreimbursed Medical Expenses for yourself, your spouse, or your qualified dependent. If you face these expenses, you may be allowed to withdraw a limited amount without penalty.

11. Corrective Distributions of Excess Contributions under certain conditions, when excess contributions are made to an account these can be returned without penalty.

12. IRS Levy when the IRS levies an account for unpaid taxes and/or penalties, this distribution is generally not subject to penalty.

And lastly, here are a few additional ways that you can withdraw your 401k funds without penalty:

Originally by Financial Ducks In A Row, 1/20/20

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM

Don’t Miss: Is It Worth Rolling Over A 401k

How Holtzmans Tax Team Can Help

Like other tax legislation, the CARES Act includes many intricacies that can complicate taking advantage of early 401k withdrawals. Holtzmans team of accounting and tax advisors can help you determine whether you qualify for a hardship withdrawal and identify other opportunities to minimize your taxes. Contact our Tax Services team to learn how this important piece of legislation can benefit you.

You May Like: When Can You Take Out 401k

See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

Also Check: Can I Borrow From My 401k To Refinance My House

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Withdrawing From A 401 After Leaving The Company Without A Penalty

In any of the following situations, you may qualify for early withdrawal without being subjected to any penalty:

-

If you leave a company the same year you turn 55 years old

-

If you suffer from total or permanent disability

-

If you cash out in equal installments spread over an expected period of your remaining lifetime

-

If you need to pay for medical expenses, which are more than 10% of your income

-

If as a military reservist, you have been called to active duty

You May Like: How To Find My 401k Contributions

You May Like: How To Withdraw Money From My Fidelity 401k

Making A Hardship Withdrawal

How Much Can You Withdraw From A 401k Or Ira Early

Before the pandemic, according to the IRS, the maximum amount that the retirement plan can permit as a loan is the greater of $10,000 or 50% of your vested account balance, or $50,000, whichever is less.

For example, if you have a 401k balance of $40,000, the maximum amount that you can borrow from the account is $20,000.

After the CARES Act passed, you are now allowed withdrawals of up to $100,000 per person taken in 2020 to be exempt from the 10 percent penalty. You cant get the special tax and CARES Act treatments for withdrawn amounts greater than $100,000 in total across all of your accounts. Now that its 2021, there may be new rules. Double check with your accountant.

The CARES Act also eliminates the 20 percent automatic withholding that is used as an advance payment on the taxes that you may owe on employer-provided plans like your 401k.

Just know that hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, youll be paying income taxes on the contributions and earnings withdrawn.

You then get a three-year period to pay the taxes to the IRS. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

With Biden as President, there continues to be pandemic relief of all sorts.

Read Also: When You Leave An Employer What Happens To Your 401k

Home Equity Loan Or Heloc

If you own a home with equity built up, a home equity loan or home equity line of credit can be a low-interest alternative to a personal loan. This type of loan is often referred to as a second mortgage because the loan is secured by your home. In other words, if you default on the loan, your lender may have a right to foreclose on your home.

One of the major benefits of a home equity loan or HELOC over a personal loan is the interest rate. Loans that are secured by homes including mortgages, home equity loans, and HELOCs often have some of the lowest interest rates on the market. As a result, the loan will cost you less money over the long term.

Its important to proceed with caution if youre considering a home equity loan or HELOC. As we mentioned, these loans are secured by your home. If you cant make your monthly payments, you risk having the lender take your home. As a result, you should avoid this option if you think for any reason you may not be able to repay the loan on time.

Reasons To Proceed With Caution

Experts suggest moving slowly with any withdrawal. Here are three things to consider.

Hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, you’ll be paying income taxes on the contributions and earnings withdrawn.

“You get a three-year period to pay the taxes to Uncle Sam,” said Paul Porretta, partner at Pepper Hamilton LLP in New York.

Plan ahead to cover the tax bill and spread it over that period of time, perhaps out of your cash flow.

Know your 401 plan’s rules. Be aware that a workplace retirement plan may allow hardship distributions from participants’ savings, but it isn’t required to do so.

You’ll need to talk to your human resources department or your plan administrator before you proceed.

“A 401 plan or a 403 plan, even if it allows for hardship withdrawals, can require that the employee exhaust other sources of money before taking a withdrawal,” said Porretta.

Also Check: How Do I Withdraw Money From My 401k