Can I Roll My Retirement Assets Directly Into A Roth Ira

Yes. After-tax or Roth contributions from an employers plan can be rolled over directly into a Roth IRA tax free. If you roll over non-Roth assets to a Roth IRA, while you may not be required to withhold taxes, the amount rolled over will be included in your gross income for federal and/or state income tax purposes.

Talk to your financial professional about your options.

Rolling The Assets Into An Ira Or Roth Ira

Moving your funds to an IRA is the route financial experts advise in most instances. Now youre in charge and you have more investment flexibility, said Smith. Try not to go it alone, he advises. Once you roll the money over, its you making the decisions, but getting a financial professional should be the first step.

Your first decision: whether to open a traditional IRA or a Roth.

Traditional IRA. The main benefit of a traditional IRA is that your investment is tax-deductible now you put pre-tax money into an IRA, and those contributions are not part of your taxable income. If you have a traditional 401, those contributions were also made pre-tax and the transfer is simple. The main disadvantage is that you have to pay taxes on the money and its earnings later, when you withdraw them. You are also required to take an annual minimum distribution starting at age 70½, whether if youre still working or not.

Roth IRA. Contributions to a Roth IRA are made with post-tax income money you have already paid taxes on. For that reason, when you withdraw it later neither what you contributed nor what it earned is taxable you will pay no taxes on your withdrawals. Investing in a Roth means you think the tax rates will go up later, said Rain. If you think taxes will increase before you retire, you can pay now and let the money sit. When you need it, it is tax-free, said Rain.

What Kind Of Plan Is It And Have You Already Started Withdrawing From It

If the client has already started withdrawing from the plan, she cannot transfer it into an RRSP, says Power. She adds 401s that have been rolled over into annuities cannot be transferred.

There are considerations for each plan. For 401s, only the employee-contributed amounts can be transferred to an RRSP without using up RRSP room. Any employer contributions can still be transferred, but the client needs commensurate RRSP room. To get around that, We always recommend converting from a 401 to an IRA first, says Altro. Thats not a taxable event, he adds, and it allows both portions to be transferred to an RRSP without using up contribution room.

Another reason to convert is if a client was a Canadian resident while she participated in the 401 planfor instance, a cross-border commuter, says Wong. Thats because shes ineligible for a direct 401 to RRSP transfer.

For IRA-to-RRSP transfers, Wong says that the transferred value cannot include amounts contributed from someone other than the taxpayer or taxpayers spouse, such as employer pension amounts.

With 401s, the employer plan administrator is responsible for keeping track of the after-tax and pre-tax contributions. With IRAs s are rolled over to IRAs), that tracking responsibility shifts to the individual, says Altro. Advisors must ask clients if they have any after-tax contributions in their U.S. plans.

Also Check: How To Roll Over 401k To Fidelity Ira

What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

STEP 4

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

You May Like: What Is The Max 401k Contribution

Set Up Your Rollover Account

In the event that your funds arent in the new retirement account within 60 days of them being pulled from the old one, its treated as a withdrawal for tax purposes and youll owe a hefty penalty. As such, you should set up your rollover account in advance so that you can send your savings there directly.

You will also get the benefit of the new company managing your account helping you through the process. These companies are competing for your business, so they should be more than willing to provide you with ample support and direction in the process and might even have some additional perks offered to entice customers.

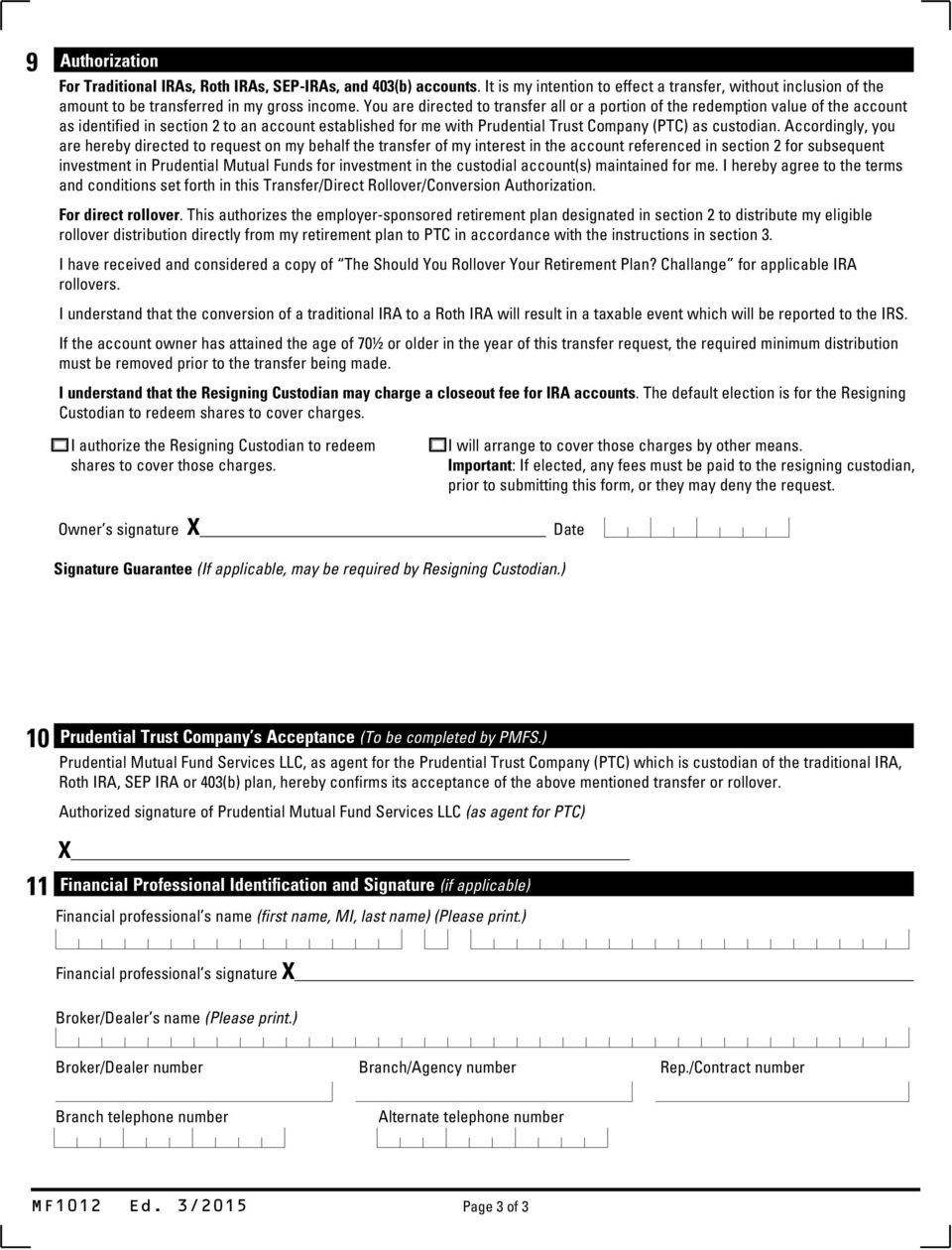

Of course, if youve been happy with Prudential, you can simply open a rollover account with it and keep your money under its management.

Changing Jobs The Ins And Outs Of A 401 Rollover

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If youve decided to leave your current job for another, you will need to decide what to do with the money that you have invested in your current companys 401 plan. Options typically include leaving it where it is, rolling it over to a new employers plan, or opting for an IRA rollover.

If you are about to change jobs, heres what you need to know about rolling over your funds into a new employers 401 plan and the ins and outs of other options.

Recommended Reading: How Often Can I Rollover 401k To Ira

Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

Recommended Reading: How To Cash Out Nationwide 401k

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Also Check: Can You Put 401k Into Roth Ira

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

How Long Does A 401k Rollover Take

While weve heard stories of 401K rollovers taking weeks, it can as quick as a few days. Here is an illustrative timeline of how that would work.

The ideal 401K rollover timeline: you can complete the rollover in as little as 4 days from start to finish.

When you are ready to get started on the 401K rollover process, were here to help. The rest of this guide walks through that process step-by-step. We assume you plan to open an IRA, but have included instructions for rolling into your new employers 401K as well. Before you jump in, be prepared with this checklist of information you will need:

-

Contact info for HR

-

Contact info for old 401K provider

-

401K account number

-

IRA account number

You May Like: How To Close 401k Without Penalty

How To Roll Over Your Prudential 401k

Follow these steps to roll over your 401k with no problems. You and Your 401K

Leaving your job can be a good or bad thing for you, but it tends to create a lot of chaos in the short term either way. And that chaos can lead you to overlook certain important steps in the transition, like rolling over your Prudential 401k.

Failing to roll over an old 401k can end up causing you problems down the line, so its important to be sure youre exploring all of your options. Fortunately, the process for rolling over your Prudential 401k can be relatively simple and easy.

Heres a closer examination of what it takes to complete your rollover from your old Prudential 401k.

Start With Your Old 401k

When you want to do a 401K rollover, start with your old employer and the company that managed your 401K with your old employer . We start here as each 401K plan has its own rules and processes. Some have an online process, some require you to send an email to the plan provider, and some require signed forms from different parties in the process.

If you have an online portal that you used to see your 401K account information, find the contact information for somebody at the provider to reach out to and tell them you want to begin a rollover. Even emailing the general email inbox at the custodian typically works as these companies are very familiar and comfortable with their clients performing a rollover. If you are unsure about an online portal or dont have your account information, reach out to an HR representative at your old employer and tell them you want to do a 401K rollover and they will help you get started.

At this point, you are mostly in information-gathering mode. When you talk to an HR representative or 401K custodian, tell them you want to do a rollover and ask the following:

-

What is their process for completing a rollover?

-

What forms and signatures do they require?

-

What will you need from your old employer and from your current employer?

-

How quickly can they complete the rollover?

In some cases, you will be required to fill out a paper form and fax it to your old employer for signatures.

Also Check: What Is The Difference Between A Pension And A 401k

You May Like: How Can You Get Money Out Of Your 401k

How Old Are You

If your client is 59½ or younger, theres typically a 10% early withdrawal penalty for both IRAs and 401s . Fortunately, CRA allows the 10% penalty to be claimed as a FTC on the Canadian return in addition to the 15% withholding. On a $100,000 plan, thats $75,000 net the client would also need to owe at least $25,000 in Canadian tax for the transfer to be tax-neutral.

If your client is 70½ or older, she must start withdrawing from the U.S. plan by April 1 of the year following the year the client reached that age. If youre comfortable with where the money is and how its being invested, its probably better to leave it tax-deferred as long as you can, says Altro. You can even withdraw the IRA at a slower pace than a RRIF the minimums are lower than they are in Canada.

If your client is 71 or older, she must convert her RRSP to a RRIF, and its no longer possible to contribute to the RRIF.

If I Roll My Account Into An American Funds Ira What Sales Charges Or Account Fees Will I Have To Pay

It depends. Generally, an amount already invested in American Funds can be rolled over into an American Funds IRA without paying any up-front sales charges. Any amount held in investments other than American Funds is subject to applicable sales charges.

A one-time $10 setup fee will be deducted from your account when you open an American Funds IRA. There is also an annual custodian fee .

You May Like: What Is A 401k For

You May Have Accumulated

There are many factors to keep in mind when considering a 401 rollover, including where you’re at in your career, your current financial status, and your tax and investment preferences. You should consider all of your options before making a decision, and can use the information provided here to help. If you decide a rollover is right for you, contact a Schwab Rollover Consultant at .

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

Don’t Miss: How Do You Access Your 401k

Taking The Cash Distribution May Cost You

Avoiding cash distributions can save you from taxes and penalties, because any amount you fail to roll over will be treated as a taxable distribution. As a result, it would also be subject to the 10% penalty if you are under age 59 1/2.

Since the taxable portion of a distribution will be added to any other taxable income you have during the year, you could move into a higher tax bracket.

Using the previous example, if a single taxpayer with $50,000 of taxable income were to decide not to roll over any portion of the $100,000 distribution, they would report $150,000 of taxable income for the year. That would put them in a higher tax bracket. They also would have to report $10,000 in additional penalty tax, if they were under the age of 59 1/2.

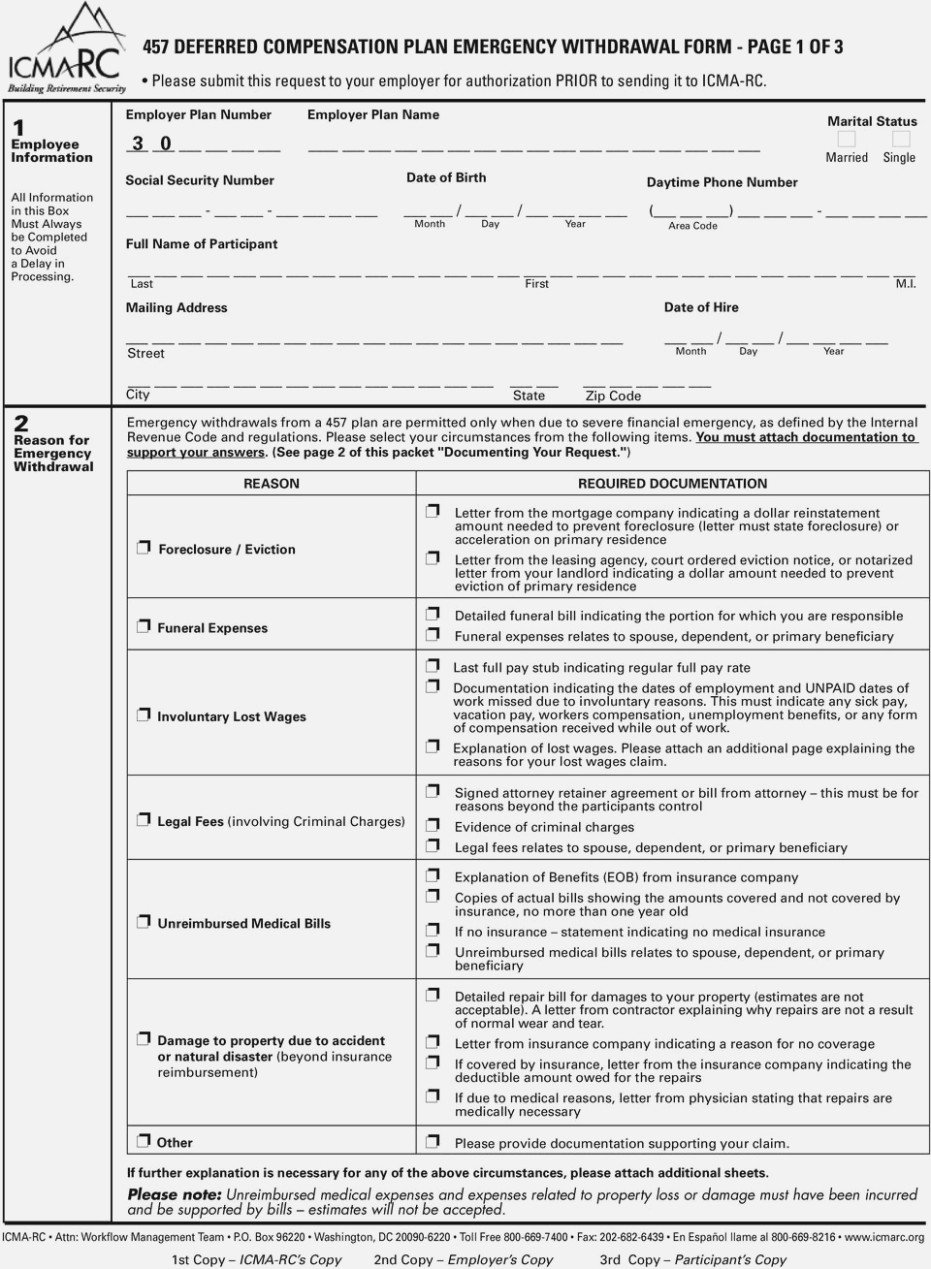

Only use cash distributions as a last resort. That means extreme cases of financial hardship. These hardships may include facing foreclosure, eviction, or repossession. If you have to go this route, only take out funds needed to cover the hardship, plus any taxes and penalties you will owe.

The CARES Act, enacted on March 27, 2020, provided some relief for those who need to make withdrawals from a retirement plan. It lifted penalties for withdrawals made through December 2020 and provides three years to pay back any early withdrawals.