How Much Can I Invest In 401k

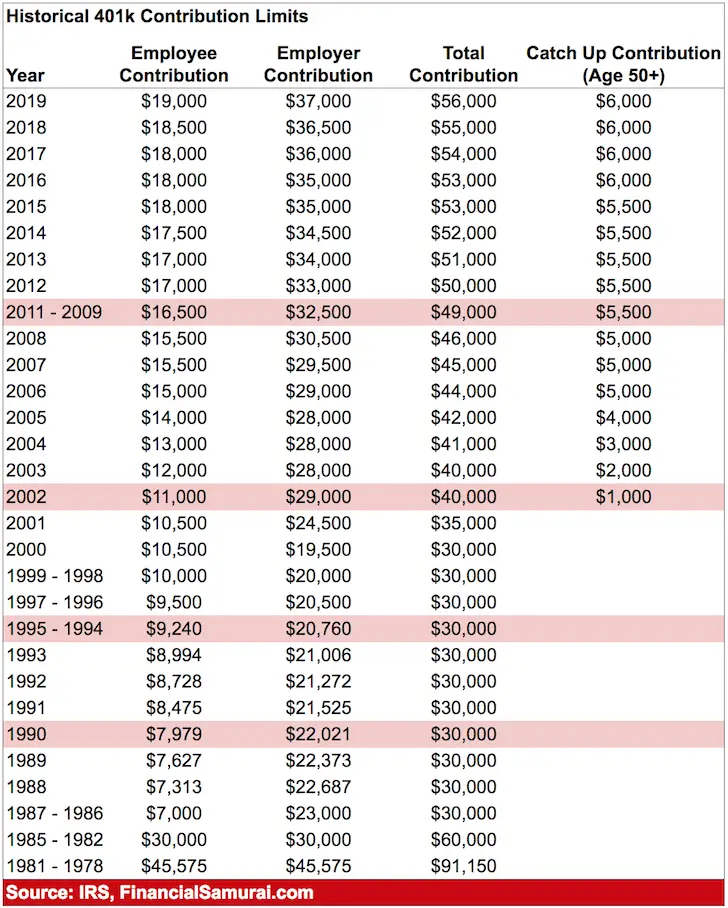

401k plans are a great way to save for retirement, but its important to understand how much you can contribute. The IRS sets annual contribution limits for 401k plans, and these limits can change from year to year.

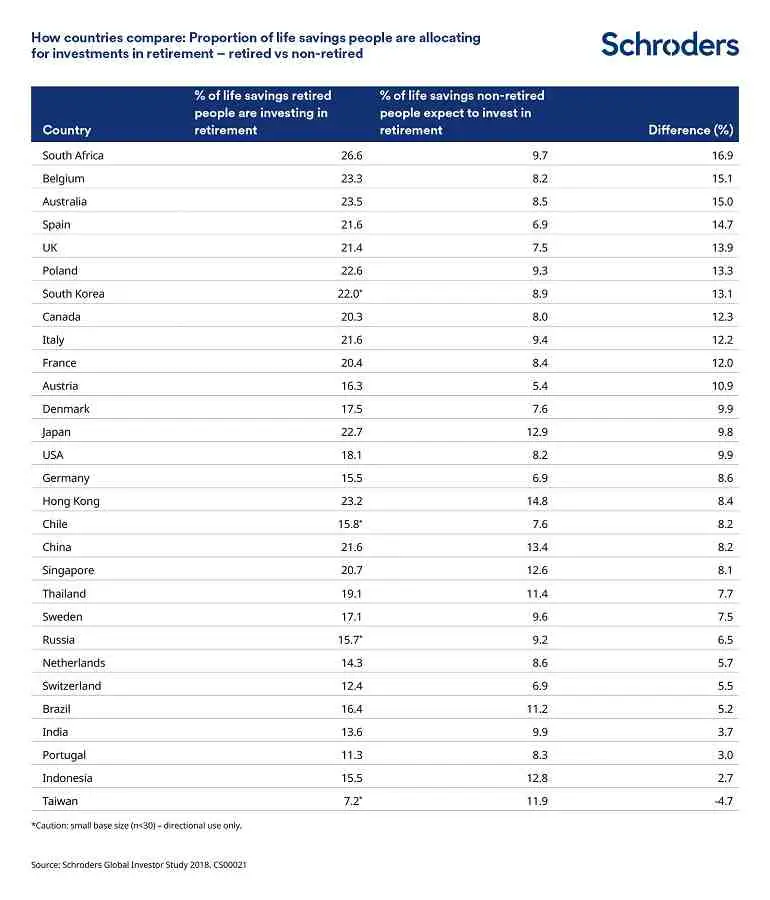

According to most retirement planners, you should put 10% to 15% of your earnings into your 401 each year. Determine the optimum contribution rate by working with a financial adviser.

Read Also: How Do You Know If You Have A 401k Plan

Can I Retire At 66 With 300k

Yes, you can retire at 300k. And if you plan carefully and change your expectations, you can retire early. The three most expensive retirement countries are California, Hawaii and New York.

Can a couple retire on 300k?

Having $ 300,000 when you retire may allow couples to spend $ 48,000 a year on our model, or $ 37,000 after the cost of health care, but that may not be enough for you. Depending on where you live, the cost of health care , and other factors.

How much should a 66 year old retire?

If you want one number to be your retirement nest target, there are guidelines to help you set one. Some advisers recommend saving 12 times your annual salary. Under the law, a 66-year-old person earning $ 100,000 will need $ 1.2 million to retire.

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Also Check: What Should I Do With 401k

Average 401 Balances At 40

You should aim to have at least three times your annual salary saved for retirement by age 40. Workers ages 35 to 44 have an average salary of $59,748, according to the BLS. A worker earning the average salary would want to have around $179,244 saved. Again the average and median 401 balances fall short.

Retirement Isn’t An Age

For most, it’s a financial decision. Workers who delay retirement, for instance, do so because they have to — they simply lack the savings necessary to retire earlier. In fact, a survey from the Bank of Montreal indicates that a quarter of Americans plan to delay retirement because rising costs are forcing them to spend more now and hampering their ability to stash away enough for old age.

On the flip side, retirees who leave the workforce early do so because they can. While most retirees cite health concerns as the main reason for premature retirement, what ultimately enables them to stop working is their financial situation — they’ve saved up enough to sustain the lifestyles they want even in the absence of further income from employment.

But what exactly is “enough”? How much money do you need to retire?

Don’t Miss: How Much Is The Maximum Contribution To 401k

Beyond The 4% Rule: How Much Can You Spend In Retirement

You’ve worked hard to save for retirement, and now you’re ready to turn your savings into a paycheck. But how much can you afford to withdraw from savings and spend? If you spend too much, you risk being left with a shortfall later in retirement. But if you spend too little, you may not enjoy the retirement you envisioned.

One frequently used rule of thumb for retirement spending is known as the 4% rule. It’s relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation. By following this formula, you should have a very high probability of not outliving your money during a 30-year retirement, according to the rule.

For example, let’s say your portfolio at retirement totals let’s say your portfolio at retirement totals $1 million. You would withdraw $40,000 in your first year of retirement. If the cost of living rises 2% that year, you would give yourself a 2% raise the following year, withdrawing $40,800, and so on for the next 30 years.

How Much Super Do I Need To Retire On $100000 A Year

There is a range of calculators available to help you determine how much you will need in super to fund your retirement, but be aware that these do not take into account your individual circumstances: how old you are, your fund of choice, your savings and spending habits. It will also depend on how you intend to draw on your super: as a lump sum or an income? If you have a goal of retiring on a certain amount of money then speak to a professional and ethical financial planner who can help outline what you will need to do to reach that annual figure. You may not need as much as you think.

Recommended Reading: How To Transfer 401k To Another 401 K

Other Benefits Of A 401

Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like its no big deal, but it actually saves quite a bit of trouble for the employees. As an employee in a 401 plan, you dont have to worry about the complicated rules and regulations that need to be followed, or about making arrangements with the funds in which you invest your moneyyour employer takes care of all of that for you. Thats quite a bit of saved paperwork.

At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, theres probably an option for you.

Tips On Retirement Planning

- We can all use help with our finances, and never more so than when its time to save for retirement. Thats where a financial advisor can offer valuable guidance and insight.

Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Use SmartAssets 401 calculator to get a quick estimate of how much youll have in your 401 by the time you retire.

Don’t Miss: Does Fidelity Offer A Solo 401k

Calculate How Your 401k Balance Compares To Others Your Age

See if youre on track to the retirement you want with this free 401k calculator.

Tip: Get a handle on your money with Personal Capitalsfree financial dashboard. You get a quick overview of your net worth, cash flow, investment allocation, and more. You can also plan for long-term goals like retirement.

How Many People Have $1000000 In Their 401k

Fidelity Investments reports that the number of 401 investors with a net worth of 401 accounts for $ 1 million or more has reached 233,000 by the end of the fourth quarter for 2019, up 16% from the third quarter. of 200,000 and over 1000% from the 2009 estimate of 21,000.1 Joining the ranks of

How many 401k millionaires are there in 2021?

According to Fidelity Investments, one of the largest 401k providers in the United States today, the 401k million figure reached nearly 180,000 in 2021 thanks to the expansion of the bull market.

Read Also: How To Cash In My 401k Early

If You Start At Age 2:

With a 4% rate of return: $843.24 per month

- Annual salary needed if you save 10% of your income: $101,189

- Annual salary needed if you save 15% of your income: $67,459

With a 6% rate of return: $499.64 per month

- Annual salary needed if you save 10% of your income: $59,957

- Annual salary needed if you save 15% of your income: $39,971

With an 8% rate of return: $284.55 per month

- Annual salary needed if you save 10% of your income: $34,146

- Annual salary needed if you save 15% of your income: $22,764

Life Expectancy And Retirement Income

Nobody knows how long they will live. This is one of the most challenging facts about retirement planning: How many years of retirement income will you need? Save too little and you risk spending your savings and relying solely on Social Security income.

Looking at average life expectancy is a good place to start. The Social Security Administrations life expectancy calculator can provide you with a solid estimate, based on your date of birth and gender. Just remember: Average calculations cant take into account your health and lifestylenow or in retirementor family history that could impact your life expectancy, so youll want to consider them in any calculations you do.

You May Like: What Is A Good Percentage To Put In Your 401k

How To Stay On Track

The point of benchmarks isnt to make you feel superior or inadequate. Its to prompt action, coupled with a guidepost to inform those actions, even if that means staying the course. If youre not on track, dont despair. Focus less on the shortfall and more on the incremental steps you can take to rectify the situation:

-

Make sure you are taking advantage of the full company match in your workplace retirement plan.

-

If you can increase your savings rate right away, thats ideal. If not, gradually save more over time.

-

If you have a company retirement plan that enables automatic increases, sign up.

-

If you are struggling to save, many employers offer financial wellness programs or other tools that can help with budgeting and basic finances.

Use these savings benchmarks to get more comfortable with planning for retirement. Then go beyond the rule of thumb to fully understand your potential retirement expenses and income sources. Beyond your savings, think about what you are saving for and how you envision spending your time after years of hard work. After all, thats the reason why you are saving in the first place.

Past performance cannot guarantee future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA’s BrokerCheck.

202204-2128727

Putting It All Together

After you’ve answered the above questions, you have a few options.

The table below shows our calculations, to give you an estimate of a sustainable initial withdrawal rate. Note that the table shows what you’d withdraw from your portfolio thisyear only. You would increase the amount by inflation each year thereafteror ideally, re-review your spending plan based on the performance of your portfolio.

We assume that investors want the highest reasonable withdrawal rate, but not so high that your retirement savings will run short. In the table, we’ve highlighted the maximum and minimum suggested first-year sustainable withdrawal rates based on different time horizons. Then, we matched those time horizons with a general suggested asset allocation mix for that time period. For example, if you are planning on needing retirement withdrawals for 20 years, we suggest a moderately conservative asset allocation and a withdrawal rate between 4.9% and 5.4%.

The table is based on projections using future 10-year projected portfolio returns and volatility, updated annually by Charles Schwab Investment Advisor, Inc. . The same annually updated projected returns are used in retirement saving and spending planning tools and calculators at Schwab.

You May Like: Should You Use 401k To Pay Off Debt

Can I Retire At 62 With $400000 In 401k

Shawn Plummer

CEO, The Annuity Expert

When it comes to retirement planning, there are a lot of factors to consider. How much money do you need to retire? What will your monthly expenses be in retirement? How long will you live? These are all important questions that you need to answer if you want to have a successful retirement. In this guide, we will explore the question of whether or not you can retire at 62 with $400,000 saved in your 401k. We will also offer some retirement planning advice for those who are looking to retire as soon as possible!

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Read Also: Why Cant I Take Out My 401k

What If You Worry You Wont Have Enough

According to OHalloran, most people start thinking in earnest about planning for retirement in their fifties. A first step is to review current expenditure to look for areas to make savings, and put those savings into the super fund.

No matter what, OHalloran believes it is never too late to begin planning for retirement.

There is always something to be done, he says.

In Reeds experience, what most people overlook is the need for different strategies when it comes to saving for retirement versus managing expenses during retirement. He likens it to going up and down a mountain.

The accumulation phase is when youre climbing higher and trying to maximize the amount of savings you have. Risks can lead to higher returns, he says.

To climb down the mountain, you need to minimize those investment risks. You want to slow your withdrawals as you come in to land.

How Confident Do You Want To Be That Your Money Will Last

Think of a confidence level as the percentage of times in which the hypothetical portfolio did not run out of money, based on a variety of assumptions and projections regarding potential future market performance. For example, a 90% confidence level means that, after projecting 1,000 scenarios using varying returns for stocks and bonds, 900 of the hypothetical portfolios were left with money at the end of the designated time periodanywhere from one cent to an amount more than the portfolio started with.

We think aiming for a 75% to 90% confidence level is appropriate for most people, and sets a more comfortable spending limit, if you’re able to remain flexible and adjust if needed. Targeting a 90% confidence level means you will be spending less in retirement, with the trade-off that you are less likely to run out of money. If you regularly revisit your plan and are flexible if conditions change, 75% provides a reasonable confidence level between overspending and underspending.

Read Also: Does Having A 401k Help You Get A Mortgage

Will You Make Changes If Conditions Change

This is the most important issue, and one that trumps all of the issues above. The 4% rule, as we mentioned, is a rigid guideline, which assumes you won’t change spending, change your investments, or make adjustments as conditions change. You aren’t a math formula, and neither is your retirement spending. If you make simple changes during a down market, like lowering your spending on a vacation or reducing or cutting expenses you don’t need, you can increase the likelihood that your money will last.

Save Early And Often In Your 401k By 40

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to help ensure a comfortable retirement. After you have contributed a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

At age 40, you should really have closer to $500,000 or more in your 401k. Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy, but if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

Once you maximize your 401k and save over 50% of your after-tax income for at least 10 years in a row, you will be financially free to do whatever you want.

Take it from me, someone who left the work force at the age of 34 after saving 50%+ for 13 years. Theres not a day that goes by where Im not thankful for working extra hard and making certain financial sacrifices to be free.

Also Check: How To Keep 401k After Leaving A Job