According To 401k Statistics 58% Of 401k Participants See Themselves As Savers

Interestingly, the remaining 42% of 401k plan participants think of themselves as investors. Whats more, 72% believe its more important to save now so you could have a comfortable retirement. These attitudes show a changing dynamic towards savings. Hopefully, it will prompt more Americans to choose a retirement plan as soon as possible.

Read Also: When Can You Rollover A 401k Into An Ira

If I Place A Request For An Ira Withdrawal After December 15 Will My Withdrawal Be Processed For The Current Or Next Year For Whatyear Will This Withdrawal Be Reportable

The IRS refers to the date a withdrawal is processed to determine the year to which it is applicable. The amount oftime it takes for an IRA withdrawal request to be processed varies by the withdrawal method selected .

If your IRA withdrawal affects your taxes or is intended to satisfy your minimum required distribution for the current year, make sure that:

- You allow adequate processing time. Submit your online request by December 15thof the current year

- Your brokerage IRA Core account has sufficient funds to cover the withdrawal

- You are not requesting a second brokerage IRA withdrawal on the sameday, or if an earlier request is still pending

- You are not requesting a second IRA withdrawal from the same mutual fund ina mutual fund IRA when there is another request pending for the same mutual fund

If you are requesting a distribution after December 15, please call a Fidelity representative at 800-544-6666 to determine the best wayto process your IRA distribution to satisfy any applicable deadlines.

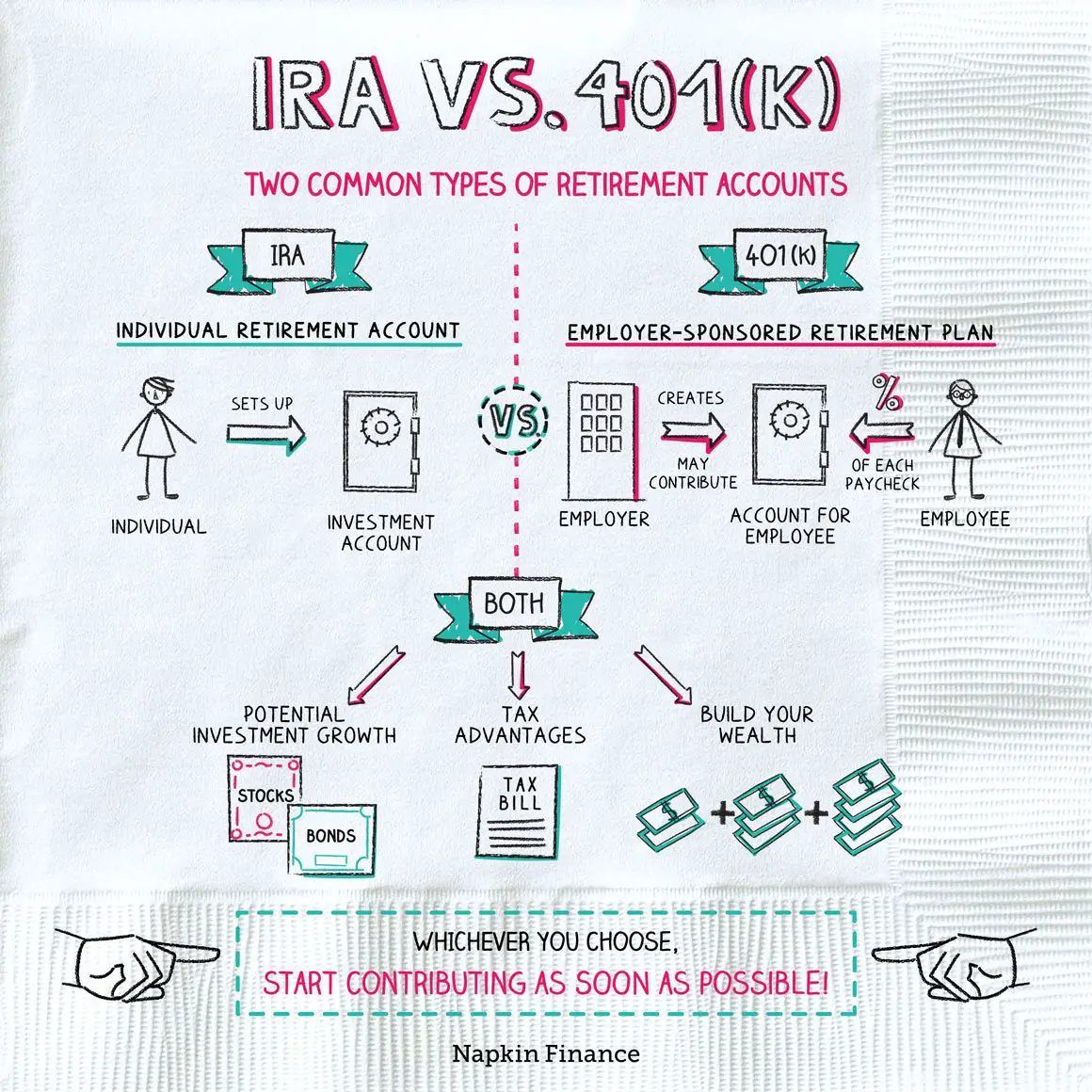

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ . However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA.

Dont Miss: How Can I Take Money Out Of My 401k

Recommended Reading: Is There A Maximum You Can Contribute To A 401k

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Recommended Reading: How Much Can I Withdraw From My 401k

What’s The Maximum I Can Request To Withdraw From My Account

The maximum you can request to withdraw from your account online or by telephone is $100,000 per account. To request a withdrawal greater than $100,000, you must complete a paper form. You can obtain a copy of that form by going to Customer Service > Find a Form, or by contacting a Fidelity representative at 800-544-6666. If you’ve changed your mailing address within the past 15 days, the most you can request to withdraw by check online or by telephone is $10,000.

You May Like: How To Roll Your 401k Into Another Job

The Hardship Withdrawal Option

A hardship withdrawal can be taken without a penalty. For example, taking out money to help with economic hardship, pay college tuition, or fund a down payment for a first home are all withdrawals that are not subject to penalties, though you still will have to pay income tax at your regular tax rate. You may also withdraw up to $5,000 without penalty to deal with a birth or adoption under the terms of the SECURE Act of 2019.

A hardship withdrawal from a participants elective deferral account can only be made if the distribution meets two conditions.

- Its due to an immediate and heavy financial need.

- Its limited to the amount necessary to satisfy that financial need.

In some cases, if you left your employer in or after the year in which you turned 55, you may not be subject to the 10% early withdrawal penalty.

Once you have determined your eligibility and the type of withdrawal, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but once all the paperwork has been submitted, you will receive a check for the requested fundsone hopes without having to pay the 10% penalty.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dont Miss: How Do I Move My 401k To An Ira

Don’t Miss: What Is A 401k For Dummies

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: Can Self Employed Contribute To 401k

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

Most People Have Two Options:

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

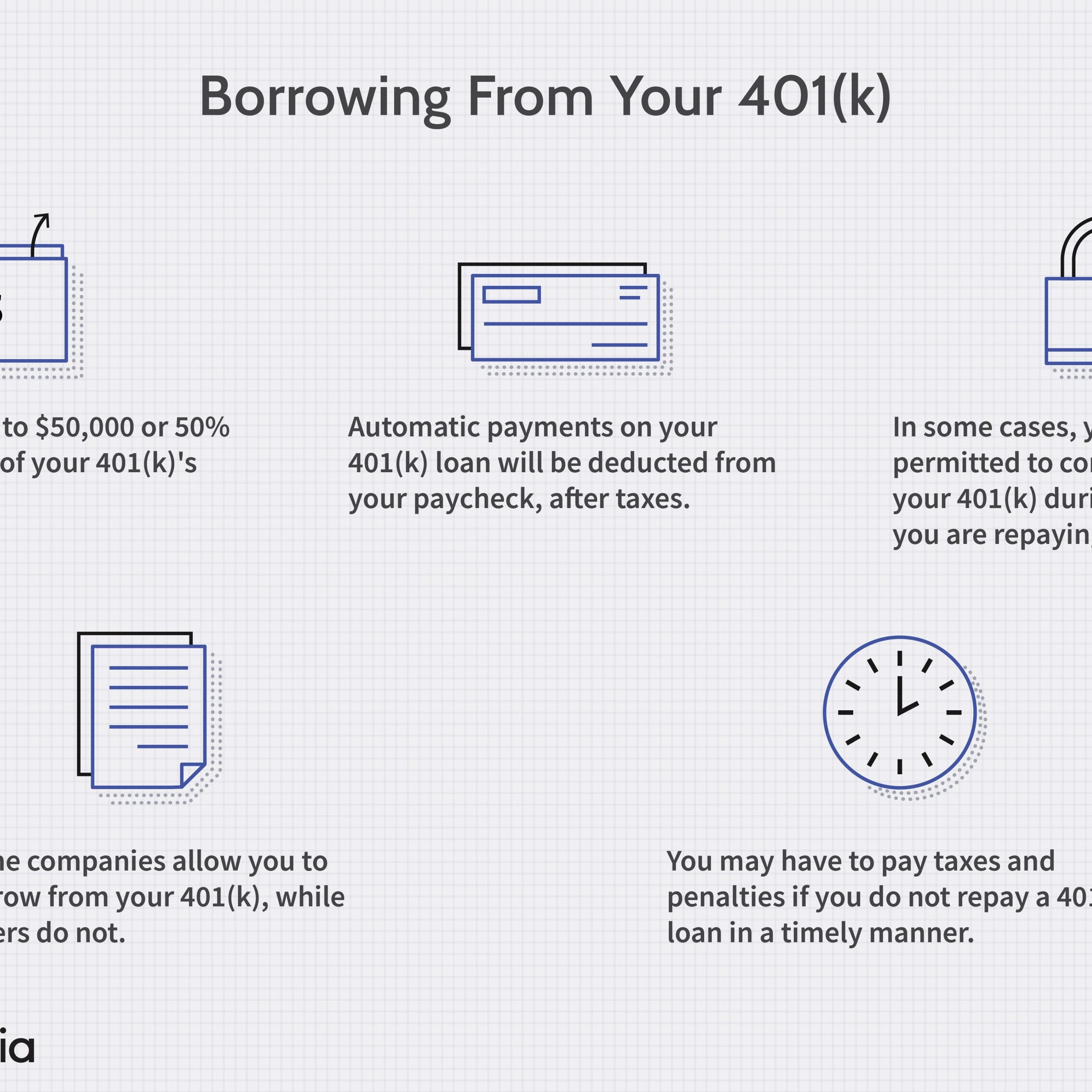

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Don’t Miss: What To Do With Old Employer 401k

Move Money Between Fidelity And Other Accounts

| One to three business days to transfer money between your bank and Fidelity accounts. | Free |

| Same day transfer to wire available money between Fidelity and your bank using the Federal Reserve Wiring System. | Fees may apply |

| One business day to transfer between eligible Fidelity accounts. | Free |

| Three to five weeks to move an account to Fidelity. View Account Transfer Status. | Free2 |

| Contribute to your Fidelity tax-deferred variable annuity by transferring money from your Fidelity mutual fund or brokerage account. | |

| Sign up for Fidelity’s stock option service and instruct Fidelity to exercise your stock options. | Commissions and other fees may apply |

| Addresses and instructions to deposit a check to your account. | Free |

| Addresses and instructions to deposit stock certificates to your brokerage account. | Free |

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Read Also: Can You Convert 401k To Roth 401k

How To Permanently Close A Fidelity Account Online: Step

Ready to close your Fidelity account? You may find that Fidelity no longer meets your needs and its time to close your account. Alternatively, you may find yourself needing to close a Fidelity account on behalf of a loved one who has passed away. Here, well break down the steps you should take to make this happen.

Distinguishing Account Sources Question:

Thank you for assisting me in opening the three brokerage accounts with Fidelity under your self-directed solo 401k. To recap, I now have the following 3 brokerage accounts at Fidelity:

They all have a zero balance since I just opened them, but they are not labeled accordingly. How do I distinguish them?

Also Check: Can You Lose Your 401k If You Get Fired

What Is The Compensation Plan For Employees With Higher Compensation

There are also additional contribution restrictions for employees that are highly compensated defined by the IRS for a 401k plan.

For an employee that is highly compensated, they meet one of these qualifications:

1. They have 5% ownership of the business sponsoring the plan at any point in the previous year. This 5% includes both individual holdings and that of relatives working for the company.

2. They earn more than the slated annual compensation limit by the IRS. For 2021, we have a limit of $130,000. There can also be a specification that states that the individual must be in the top 20% when it comes to compensation.

To maintain the ERISA directives, employees with higher compensation can make contributions from their salary that is 2% more than normal employees. Since the average employee contributes 5%, employees with higher compensation contribute 7%.

That might be a bit difficult since the limit is based on employees contributions and compensation. Also, when you fail to make contributions in the calendar year, you lose the chance to do so. And you will not know your actual contribution limit until the early part of another year.

It is best to contribute an amount that matches the standard contribution limit and let the administrator decide if it is more than you should contribute. When you do this, the excess will be returned to you, and you will owe income taxes on the entire amount. The principal and the earnings are inclusive.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

You May Like: How To Manage My Own 401k

What Are The Deadlines For Taking Mrds

You may withdraw your annual MRD in one distribution or make withdrawals periodically throughout the year, but the total annual minimum amount must be withdrawn by the deadline of December 31 . Please allow enough time for trades to settle before the final business day of the year.

You generally have until April 1 of the year following the calendar year you turn 70½ to take your first MRD. This is known as your required beginning date, or RBD. In subsequent years, the deadline is December 31. If you turned 70 between July 1st of last year and June 30th of this year, you will be turning 70½ this year and will need to take your first MRD for this year.

Automatic Enrollment Or Making Changes

Enrollment is Automatic for All Employees

Participation in the Supplemental Retirement and Savings Plan is automatic for all employees. You will automatically be enrolled to contribute 3% of your eligible compensation, as defined under the BU Retirement Plan, on a tax-deferred basis and your contribution will be invested in a Vanguard Target Date Fund closest to the year in which you will turn age 65. Your first contribution to the plan will commence in the month following your hire date.

You may change or stop your contribution at any time. You may also change the investment allocation of your contributions at any time.

Automatic Enrollment and BU Matching Contribution After Two Years of Service

Once you have completed two years of service with at least a nine-month assignment at 50% or more of a full-time schedule, you will be eligible to receive the University matching contributions to the Boston University Retirement Plan.

In addition, you will automatically be enrolled in the Supplemental Retirement and Savings Plan to contribute 3% of your eligible compensation as defined under the BU Retirement Plan on a tax-deferred basis if you are not already doing so when you complete two years of service. BU matches your contribution dollar-for-dollar up to 3% of your eligible compensation as defined under the BU Retirement Plan.

You may make the following changes at any time:

Also Check: How Much Employer Contribute To 401k

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, you’ll want to reach out to your provider to determine if moving the assets over “in-kind” or “as is” could be an option for you.

If it is an option, then you’ll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isn’t an option, don’t worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

Transfer The Money To Your New Employer’s 401

If your new employer’s plan allows it, you may transfer your old 401 savings into your new 401 plan.

In Lester’s view, “rolling your old account into your new employer’s 401 plan should be your default unless there’s a good reason not to.”

But you’ll only want to do that if the new plan offers solid, low-cost investments or at the very least, low-cost target date funds.

The benefit of consolidating your retirement savings into one employer-sponsored plan is that it will be easier for you to track and manage the money.

Recommended Reading: How To Pull Out Of 401k

Roll Your Assets Into A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.